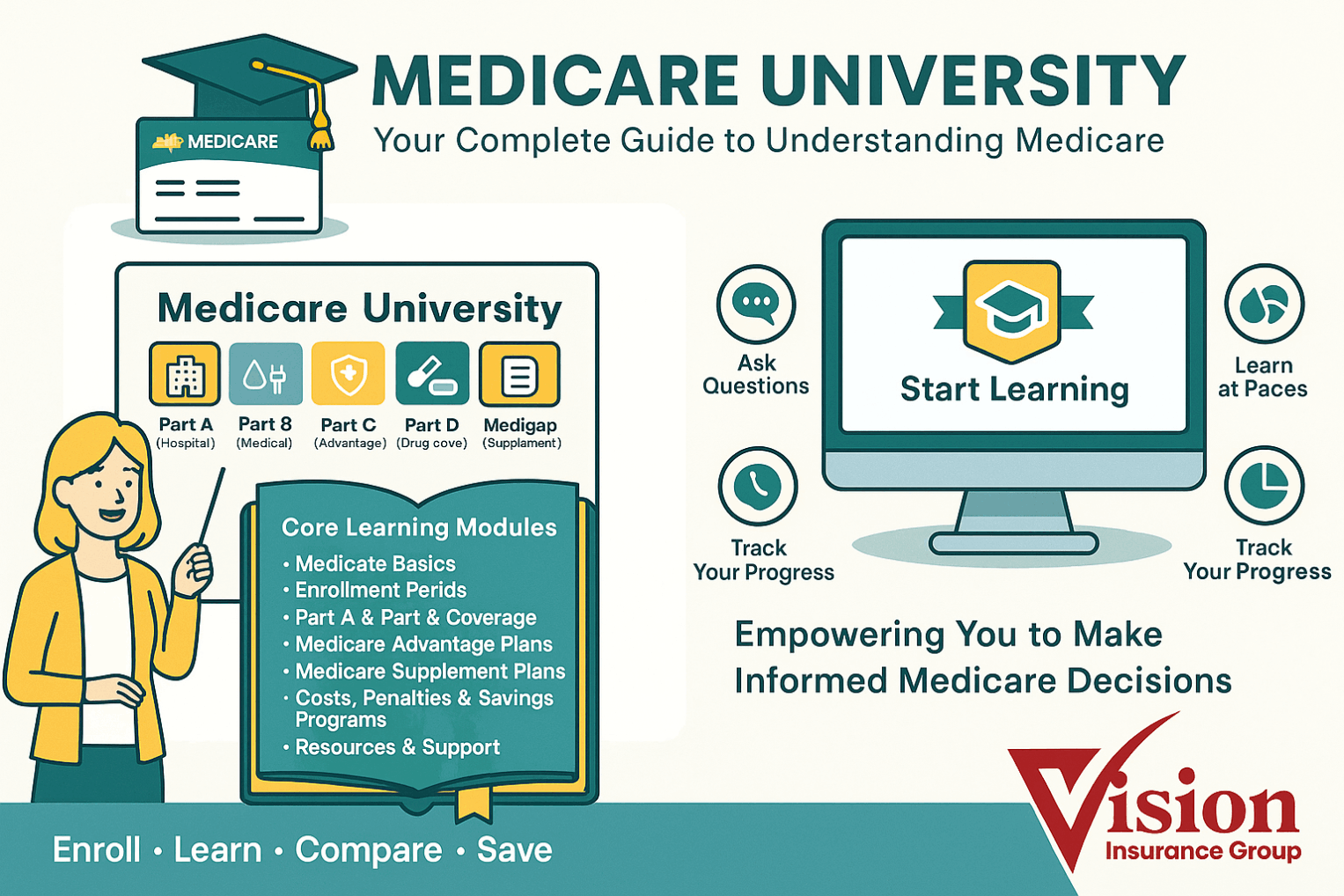

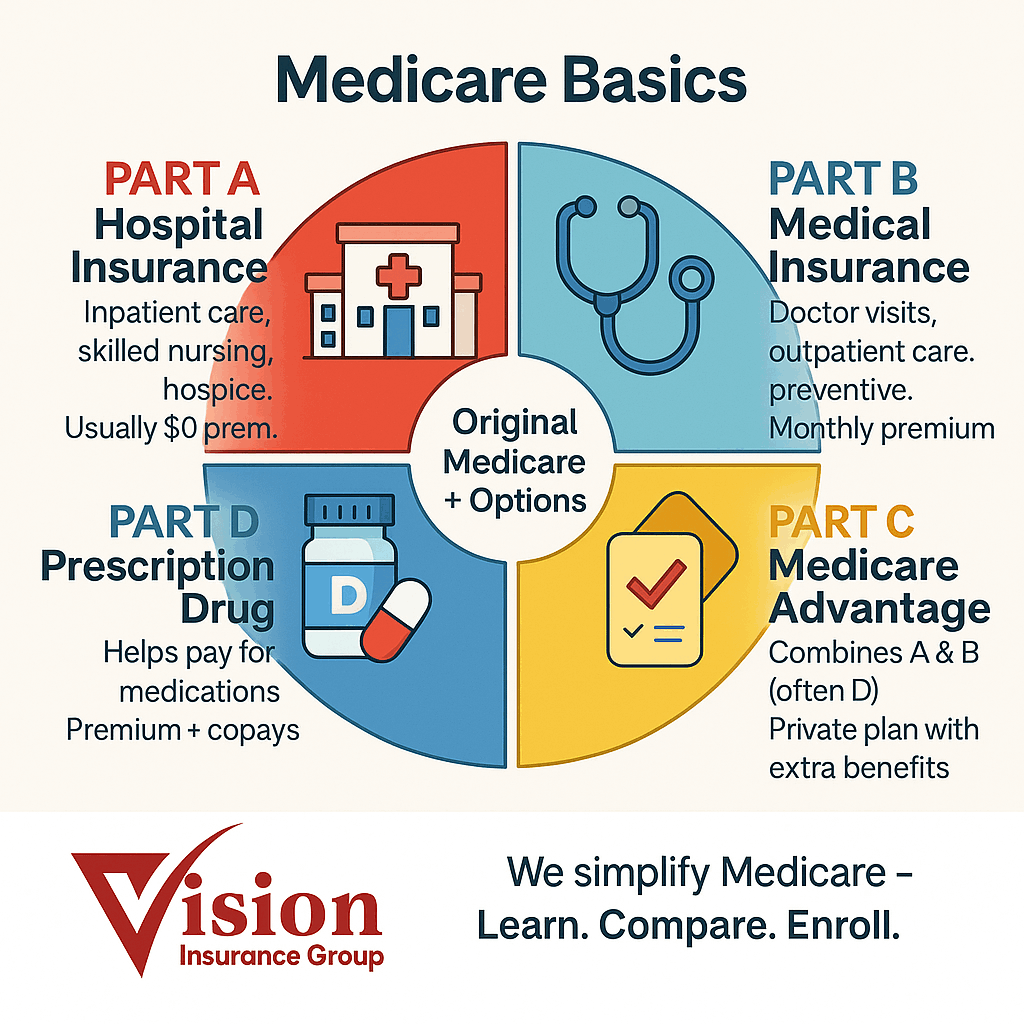

The 4 Parts of Medicare (A, B, C, and D)

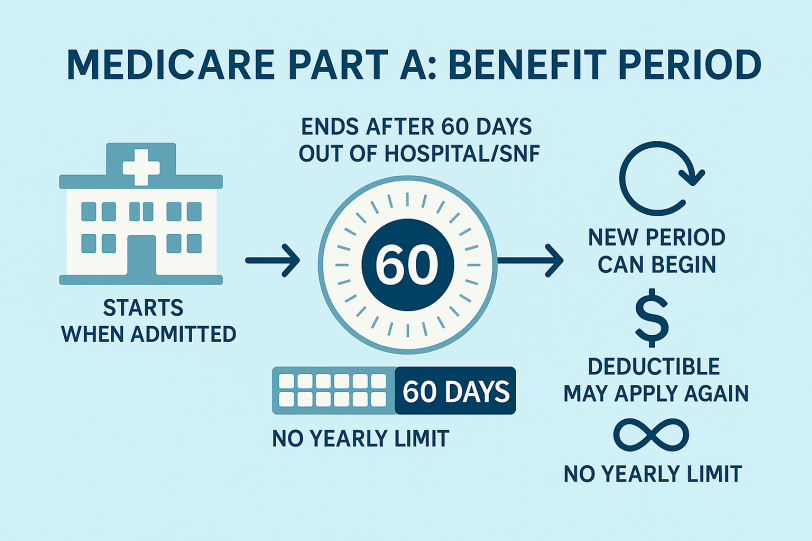

Medicare has four parts: Part A (Hospital Insurance) covers inpatient hospital care, skilled nursing after a qualifying stay, hospice, and some home health—often with a $0 premium if you’ve paid Medicare taxes long enough. Part B (Medical Insurance) covers doctor visits, outpatient services and procedures, preventive care, labs, and durable medical equipment; it has a monthly premium and cost-sharing, and higher-income enrollees may owe IRMAA. Part C (Medicare Advantage) is a private, all-in-one alternative that bundles A and B (often Part D too) and can include extras like dental, vision, and hearing, but typically uses provider networks and sets an annual out-of-pocket maximum. Part D (Prescription Drugs Plan) adds prescription drug coverage through stand-alone plans or within Advantage plans, with costs based on the plan, drug tiers, and pharmacy—and penalties can apply if you delay without creditable coverage.