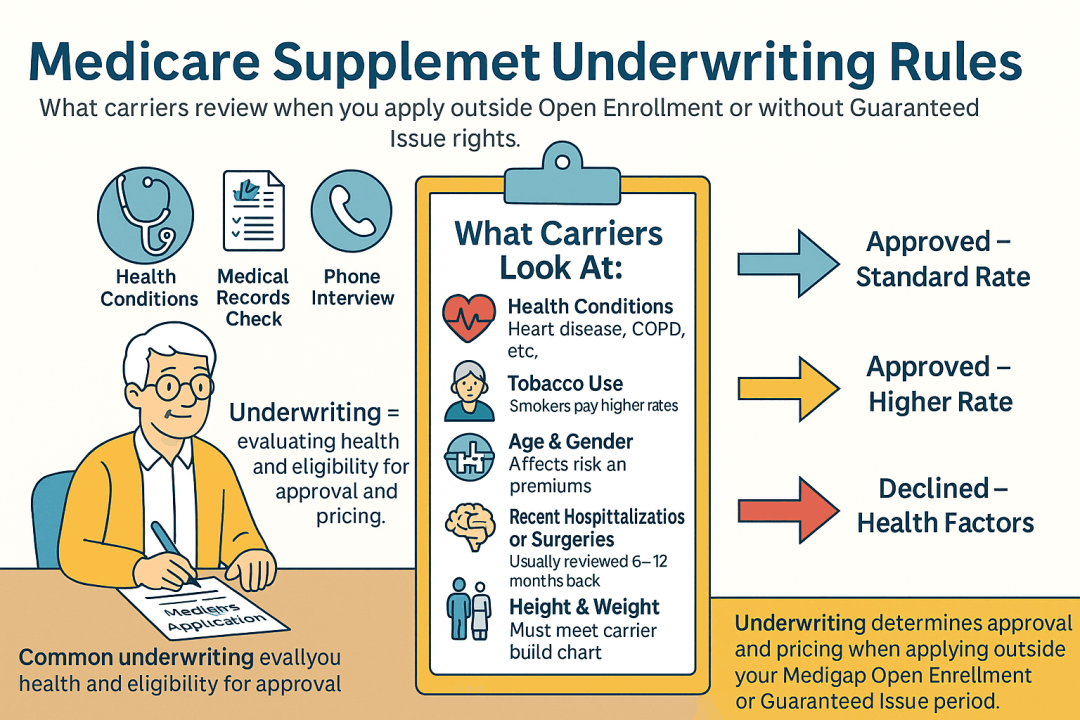

| Underwriting Area | Typical Rule | Common Look-Back | Notes |

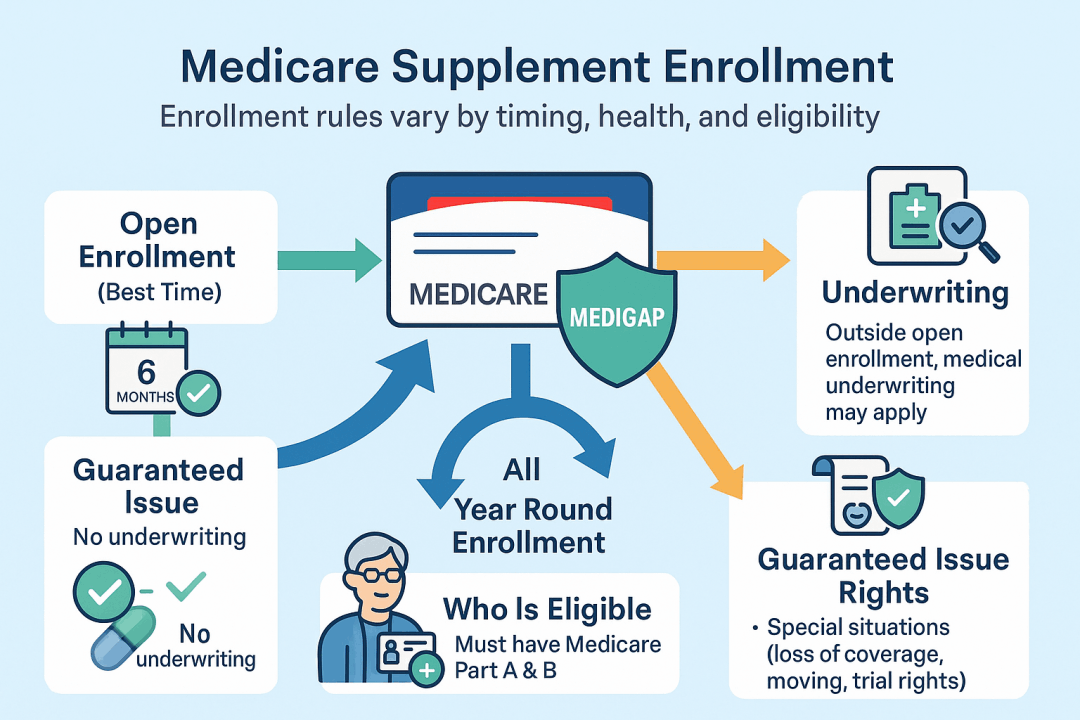

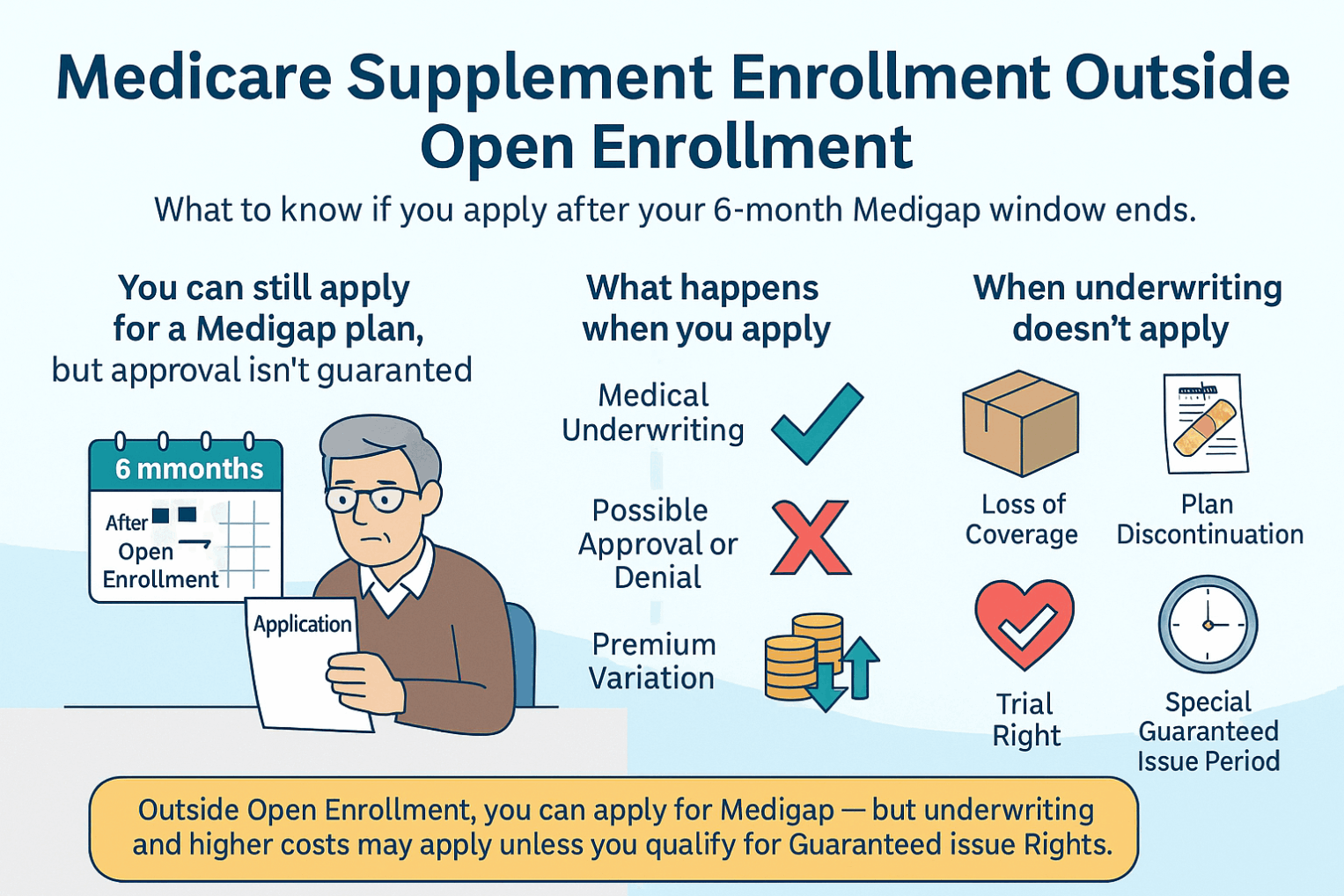

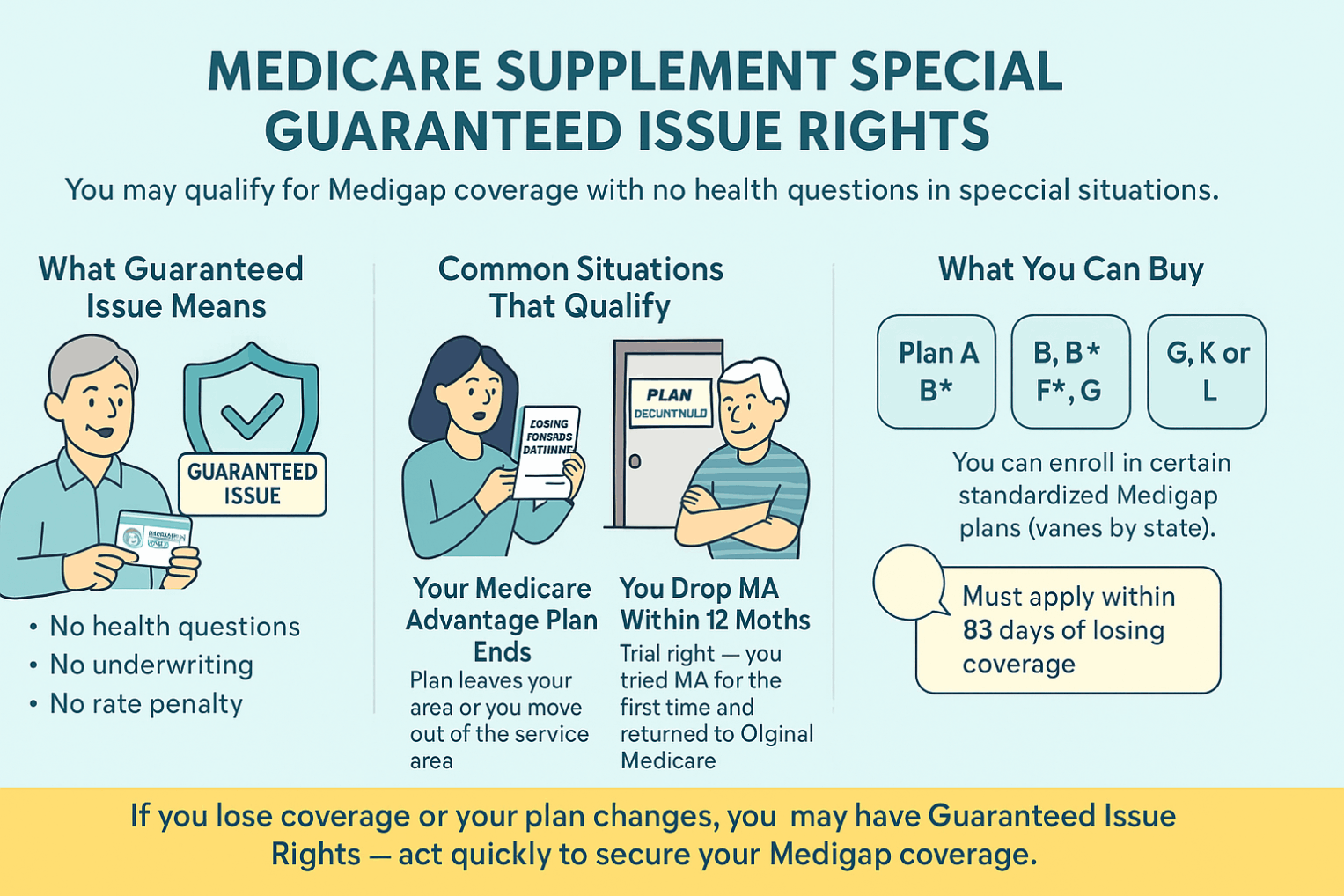

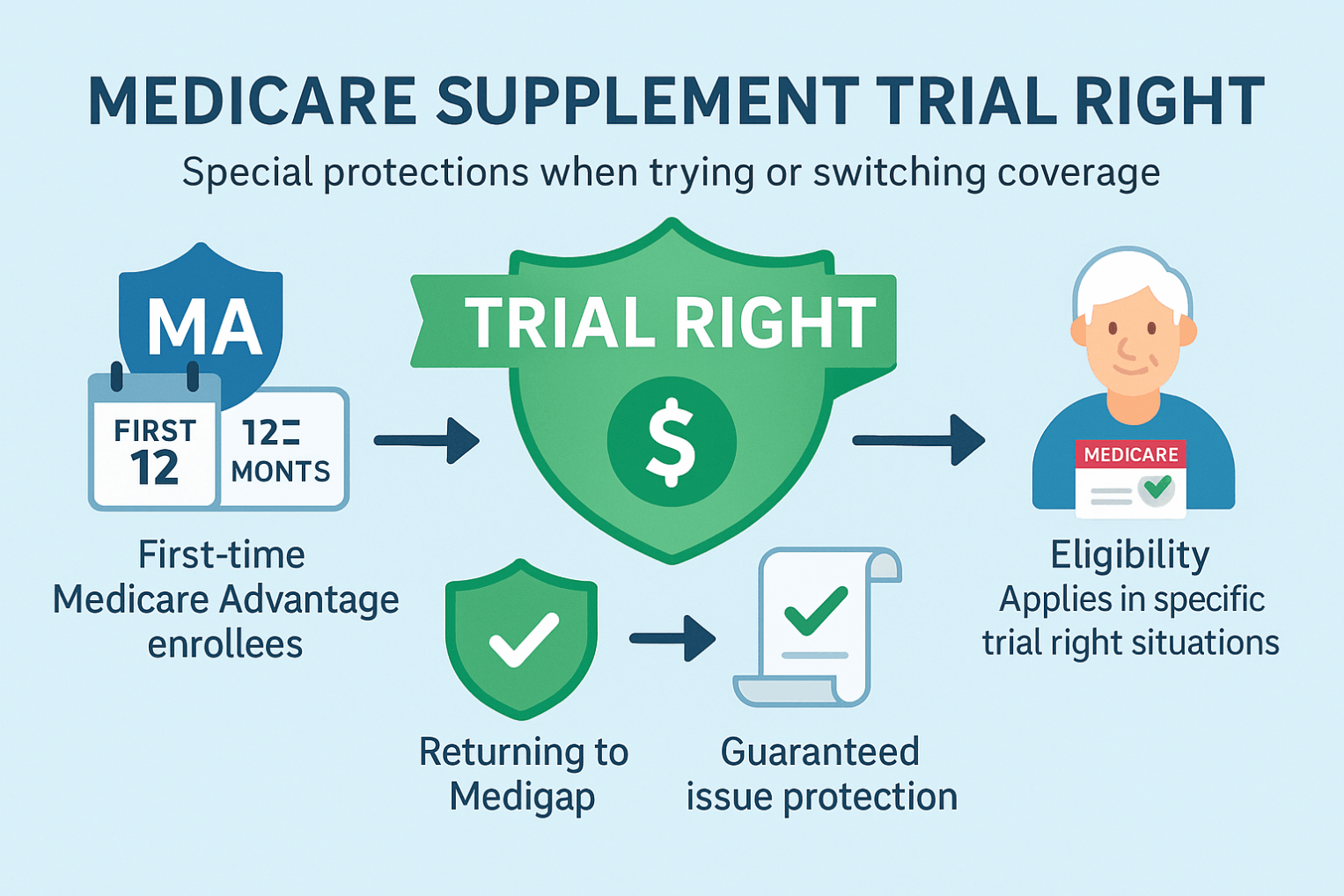

| Eligibility window | If not in Medigap Open Enrollment or no GI right → medical underwriting required | — | OEP/GI generally bypass underwriting. |

| Phone interview | Short health interview often required | Current | Confirms application answers. |

| Rx history check | Carriers review prescription fill history | 12–24 months | Confirms conditions/ stability. |

| MIB/records | May check MIB and request medical records | 12–24 months | Not all carriers use MIB. |

| Height/Weight (BMI) | Must fall within carrier build chart | Current | Outside range → decline or rating. |

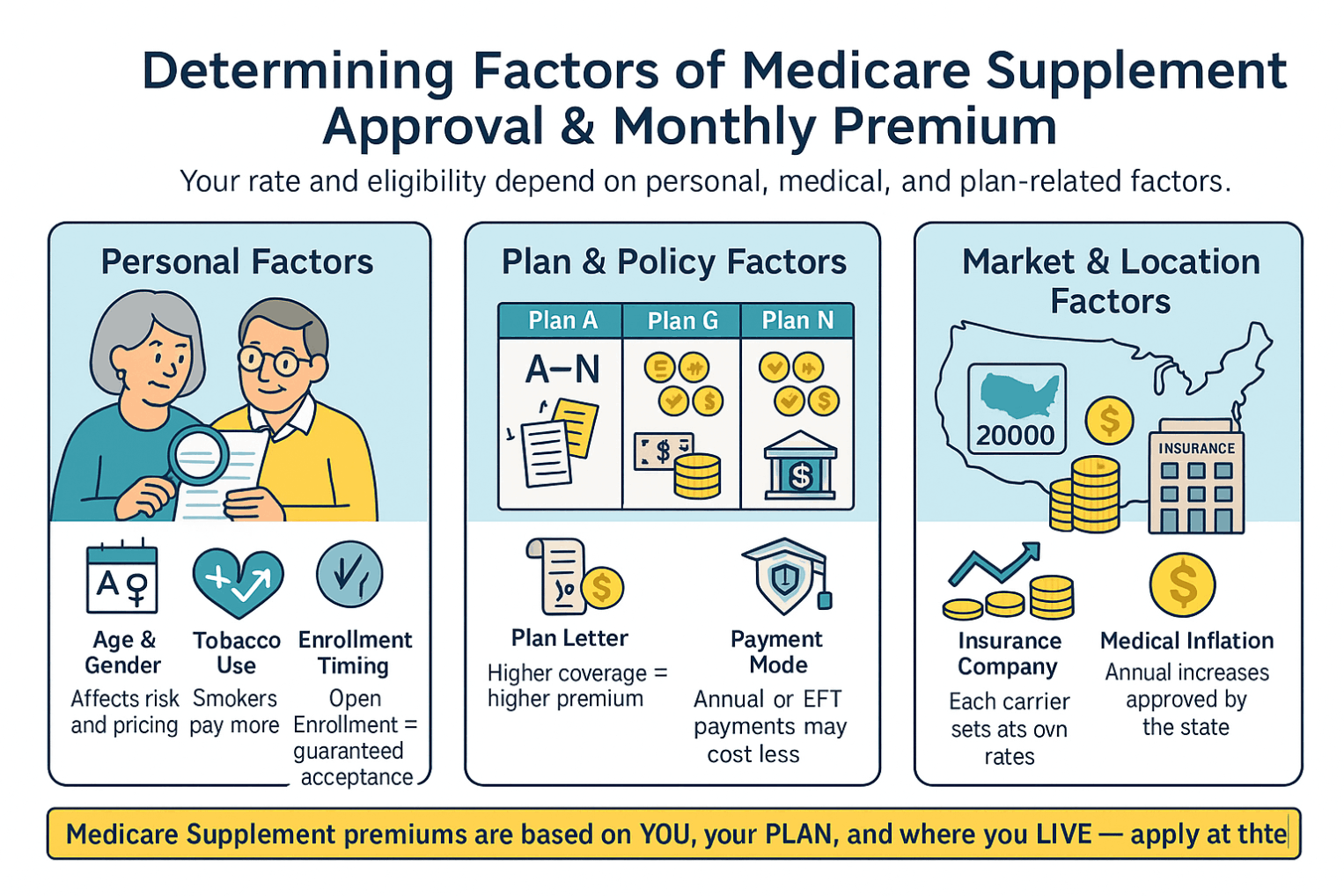

| Tobacco use | Smoker rates higher | 12 months | Some carriers require smoke-free period for best rate. |

| Recent hospitalization/ surgery | Recent inpatient stay/major surgery may decline/postpone | 3–12 months | Elective or pending surgery often postpones. |

| Pending tests/referrals | Undiagnosed symptoms or pending work-ups → postpone | Until resolved | Must have diagnosis/treatment plan. |

| Oxygen use | Current oxygen use usually decline | Current | Includes nocturnal O2 for COPD in many guides. |

| Mobility/ADLs | Wheelchair, ADL assistance, home health, or nursing facility → often decline | Current | Level of assistance matters. |

| Cancer (active/recent) | Active treatment or recent diagnosis often decline | 2–5 years | In remission beyond window may be OK. |

| Cardiac events | Recent MI, stent/bypass, heart failure exacerbation → decline/postpone | 6–24 moths | Stable CAD with meds may pass. |

| CHF (heart failure) | Symptomatic or recent hospitalization → usually decline | 2 years | Controlled, no recent events may pass with some carriers. |

| Stroke/TIA | Recent stroke/TIA → decline/postpone | 2 years | Older events with full recovery may pass. |

| Diabetes | Insulin + complications (neuropathy, retinopathy) → decline with many carriers | 2 years | Oral meds and A1c control may pass. |

| CKD/ESRD | Dialysis/ESRD → usually decline | Current | Earlier CKD stages vary by carrier. |

| Dementia/Alzheimer’s | Usually decline | Current | Cognitive screens may be used. |

| Substance abuse | Active alcohol/drug abuse → decline | 2 years (sustained recovery) | Documentation of recovery may help. |

| Mental health | Severe, unstable, or recent psych hospitalization → decline/postpone | 1–2 years | Stable, well-managed often OK. |

| Sleep apnea | Untreated, severe → postpone/decline | Current | Treated with CPAP and compliant often OK. |

| Auto-declines (varies) | Organ transplant, metastatic cancer, ALS, schizophrenia (varies) → often decline | — | Carrier-specific. |

| State exceptions | Some states have birthday/anniversary rules or continuous access | — | Eases switching without underwriting. |

| Rate classes/discounts | Household/EFT discounts; tobacco surcharge; gender in some states | Current | Community/issue/attained-age rating affects price. |