Final Expense Life Insurance

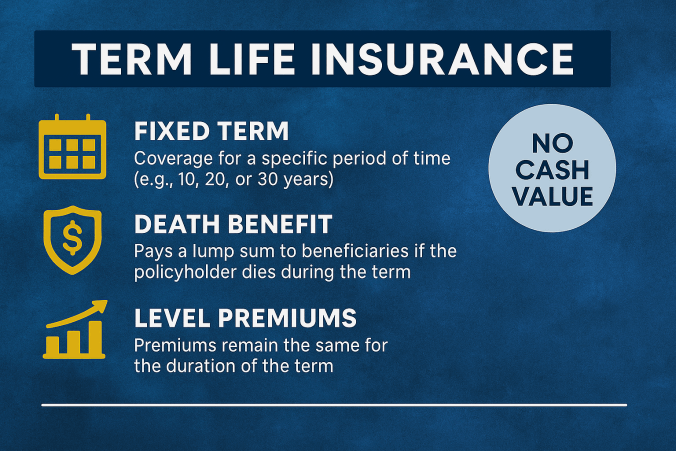

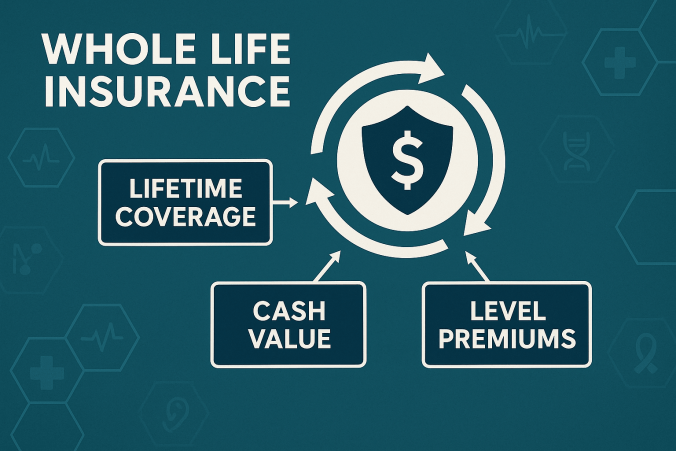

Final Expense Life Insurance is a small, typically whole-life policy designed to cover end-of-life costs—think funeral and burial/cremation expenses, medical bills, and small debts—so loved ones aren’t left with the tab. Coverage amounts are modest (often $5,000–$25,000), premiums stay level, and the policy generally builds a small cash value. It’s usually simplified issue, meaning health questions but no medical exam in many cases, and approval can be easier for older adults or those with health conditions compared with traditional life insurance. Beneficiaries receive the tax-free death benefit to use as needed.