Accident Insurance

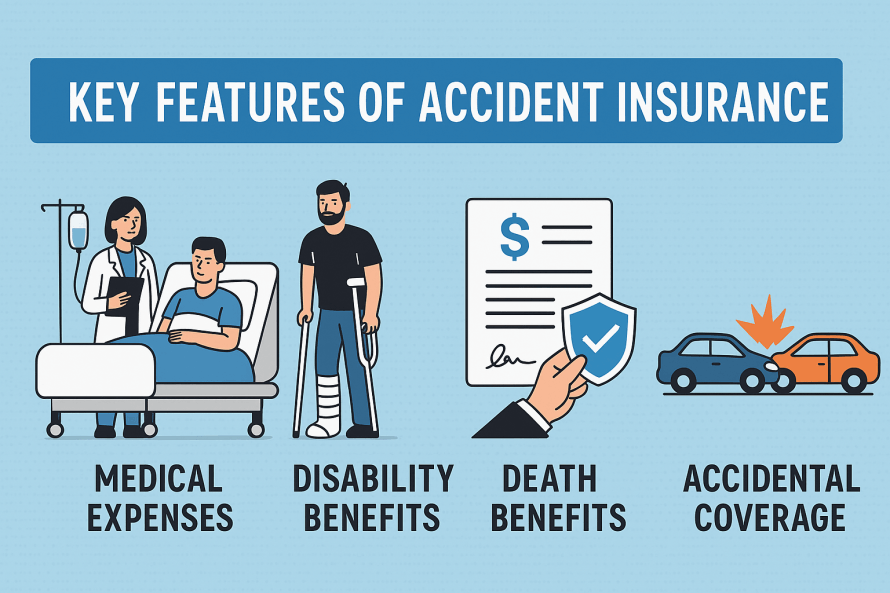

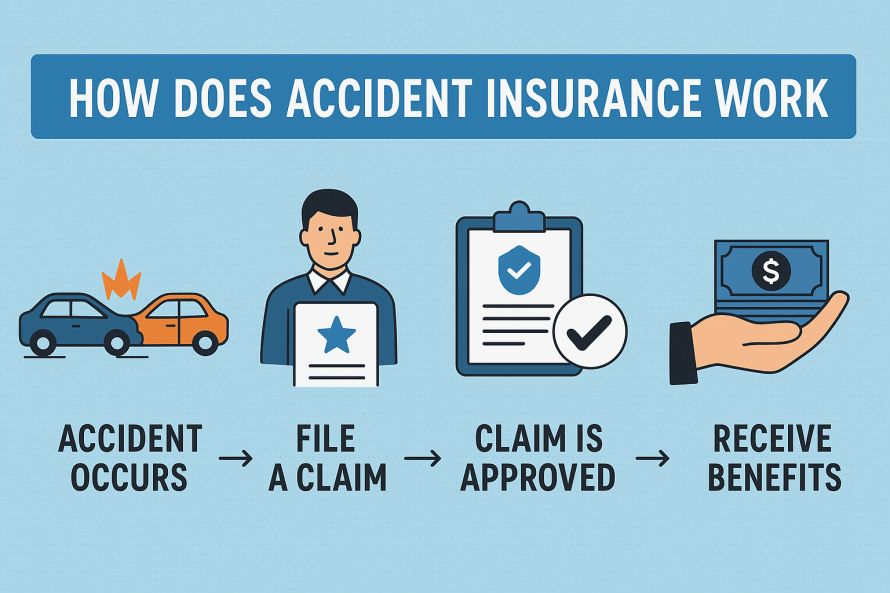

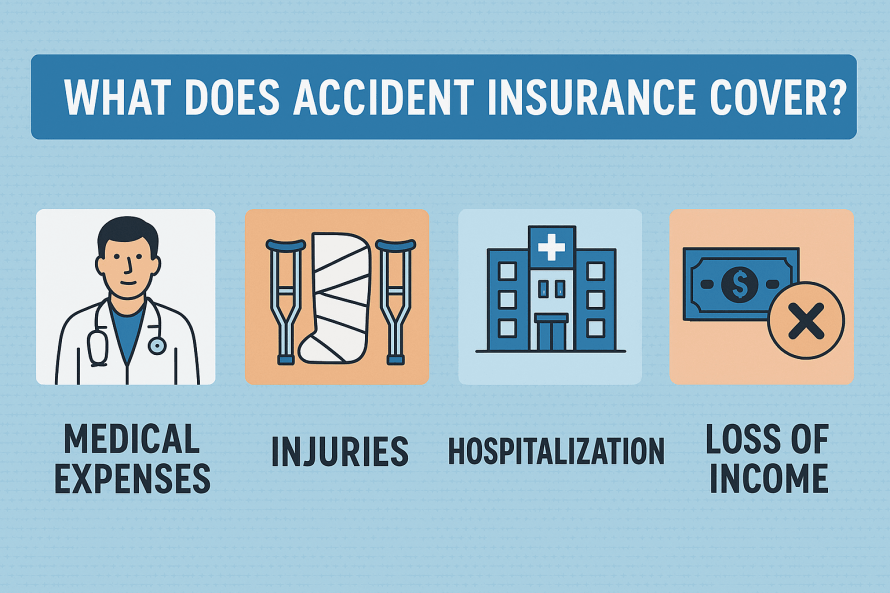

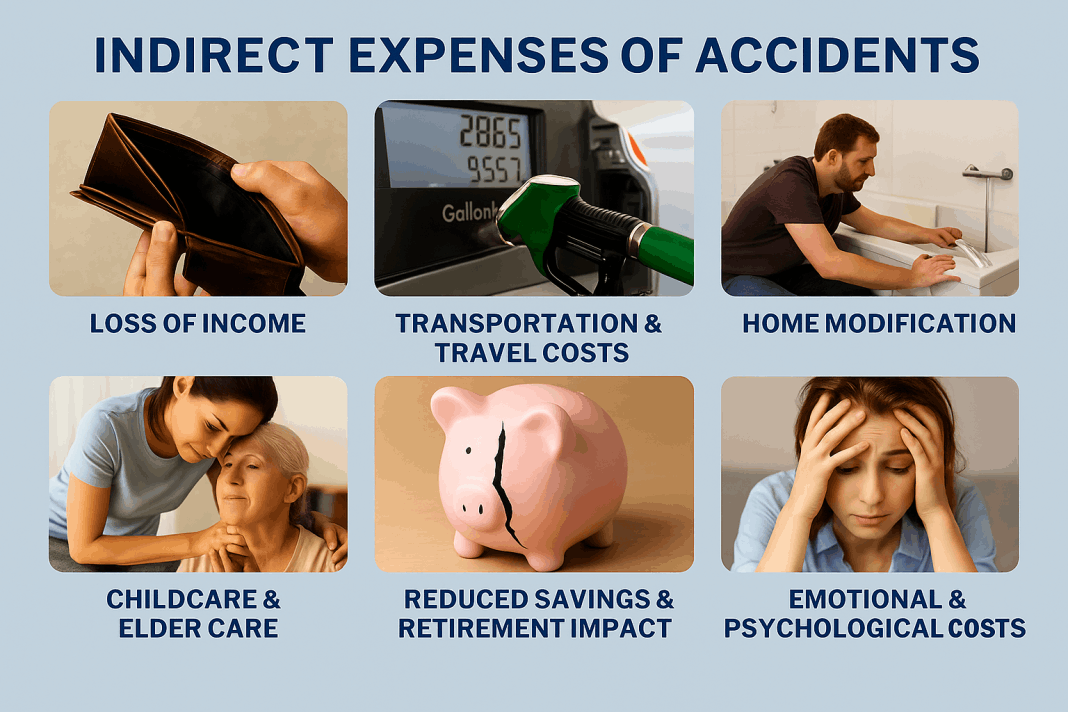

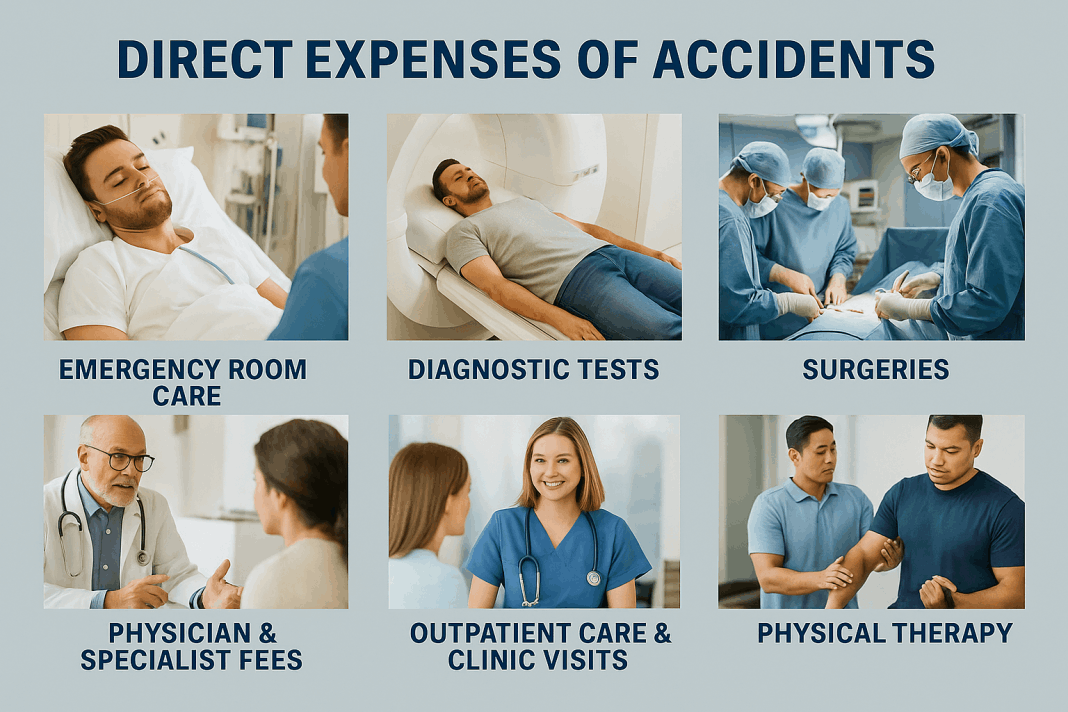

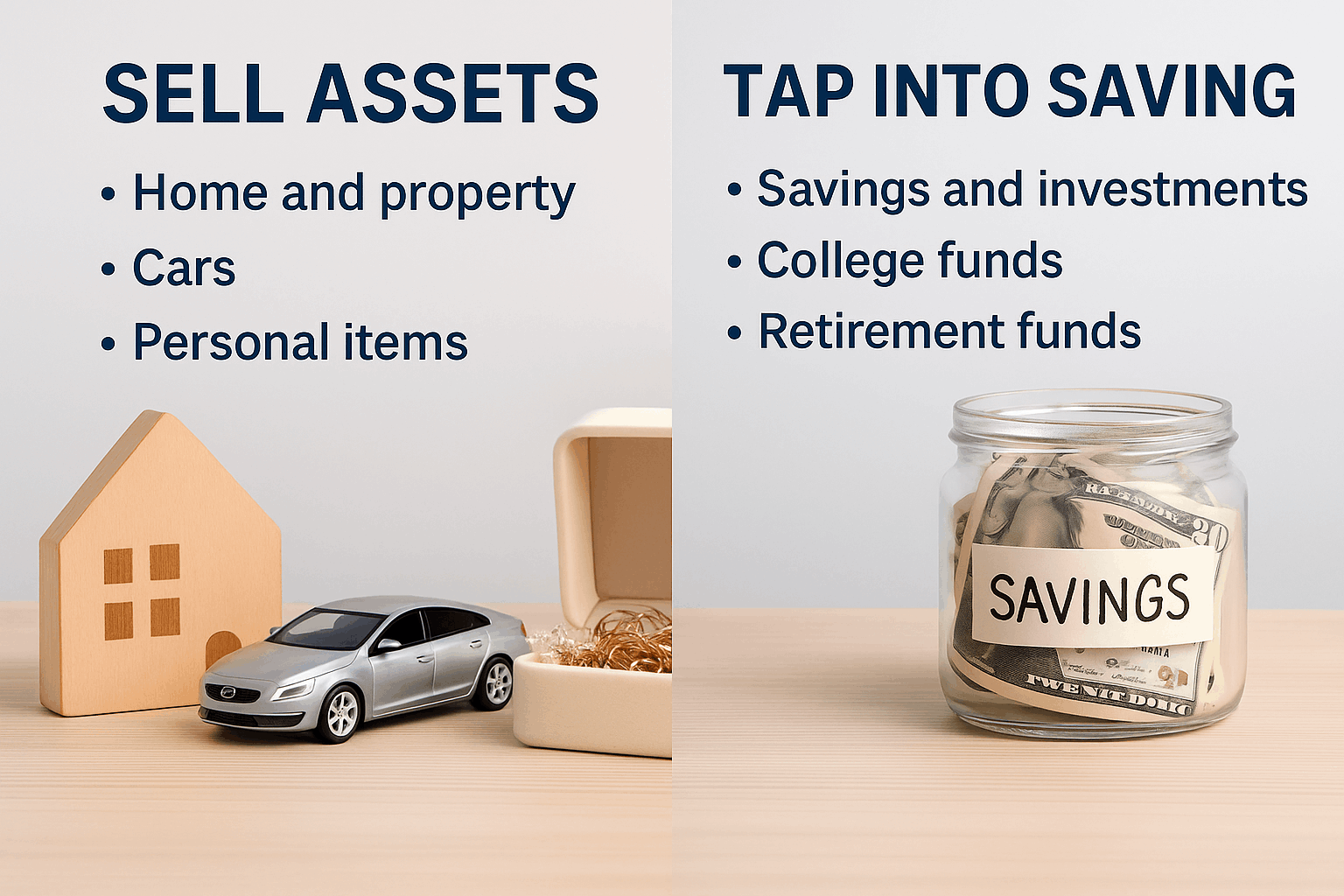

Accident insurance is a supplemental policy that pays you a cash benefit if you’re injured in a covered accident (e.g., fractures, burns, ER visits, ambulance, hospital stays), regardless of what your health insurance pays. Benefits are typically fixed, paid directly to you, and can be used for medical bills or non-medical costs like lost wages, childcare, or transportation. It usually has low monthly premiums, no networks, and fast claim payouts, but it won’t cover illnesses, preexisting conditions, or non-covered activities listed in the policy (e.g., some high-risk sports). It’s most useful for people with high deductibles, active lifestyles, or jobs with higher injury risk.