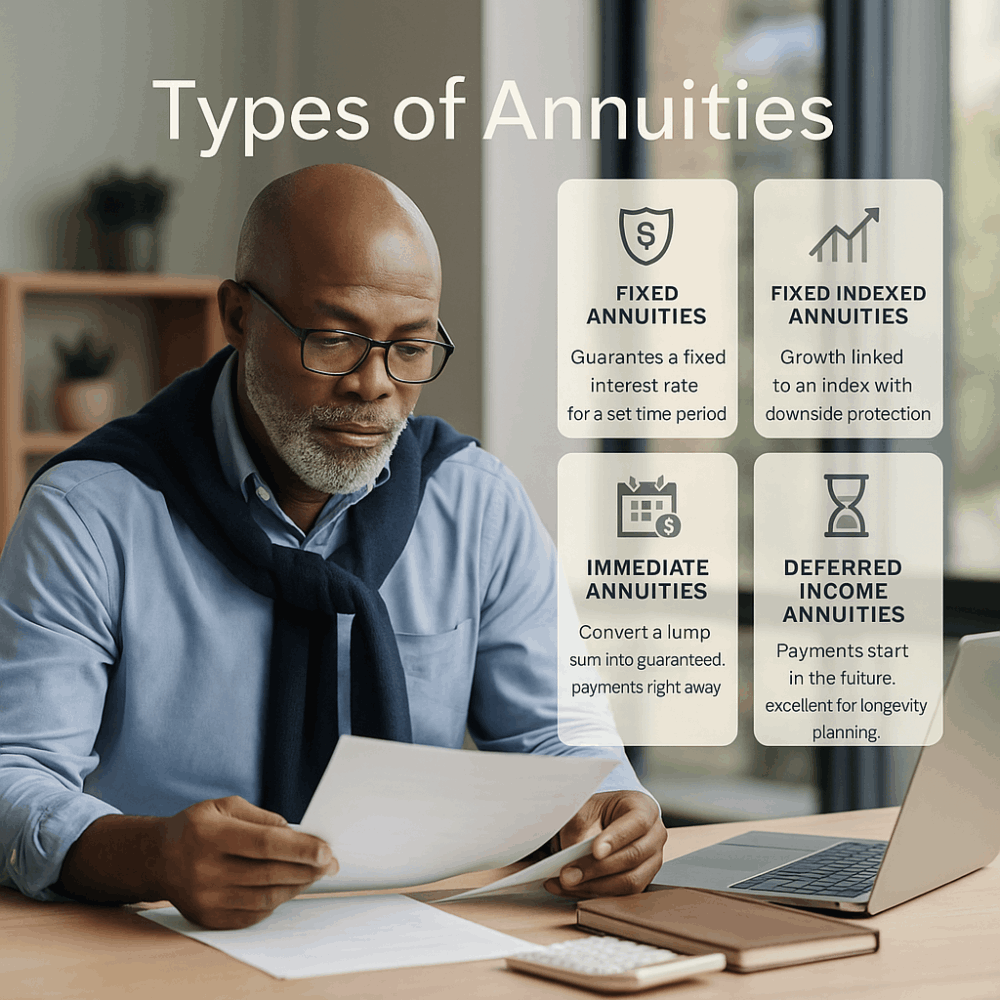

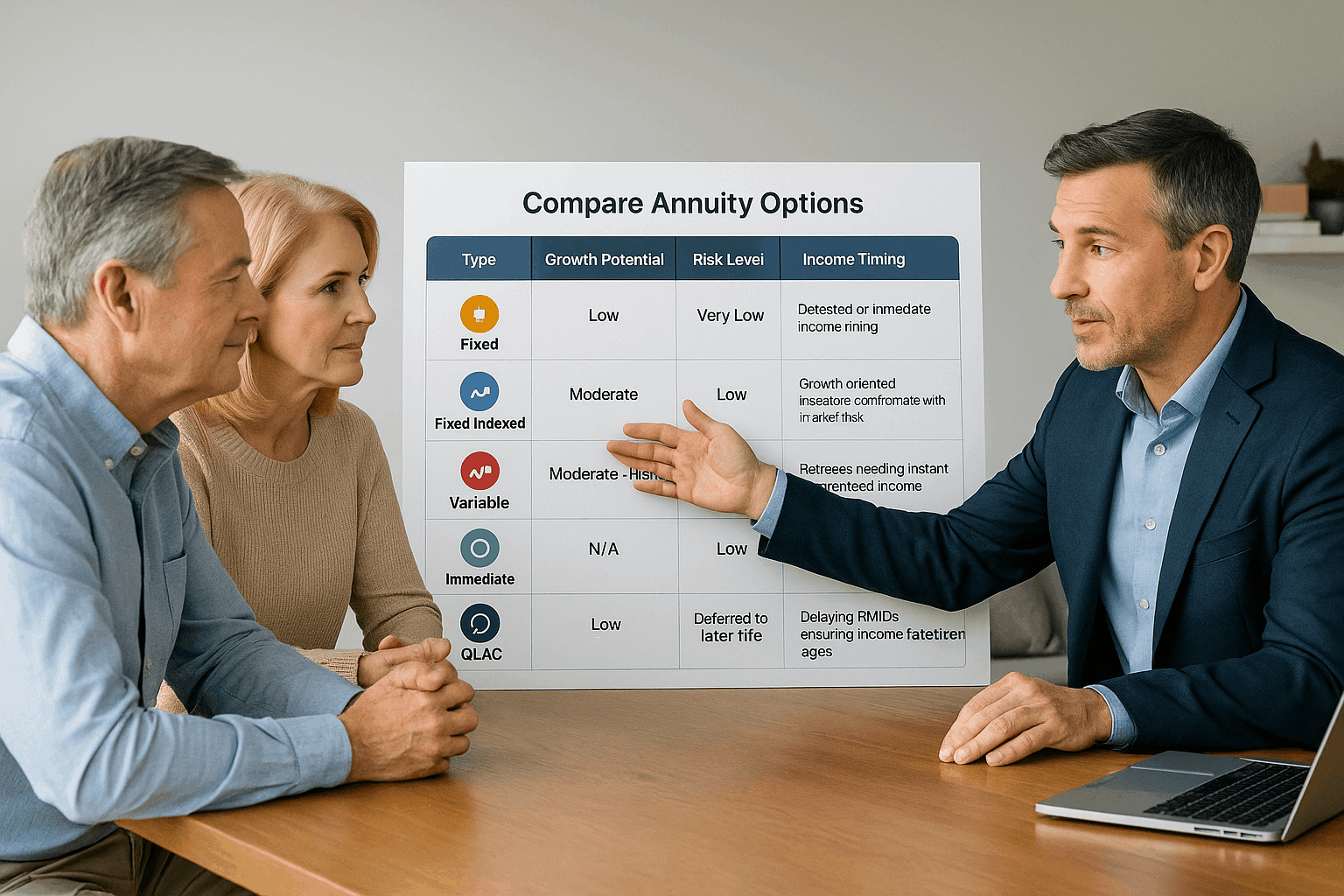

Annuities

Planning for retirement isn’t just about saving—it’s about ensuring those savings last as long as you do. Annuities provide a reliable stream of income that continues for life, helping you cover essential expenses no matter how long you live. With the security of guaranteed payments, you can enjoy retirement with greater peace of mind, knowing your financial future is protected against market downturns, inflation, and the risk of outliving your assets.