The cost of ACA (Affordable Care Act) Marketplace plans in 2025 varies significantly based on your age, location, household size, and income level—especially due to eligibility for subsidies and cost-sharing reductions. Here's a breakdown:

💵 Average Monthly Premiums (2026)

- Silver plans for a 40-year-old average approximately $621/month before subsidies.

- Bronze plans average around $380–$495/month.

- Gold plans average about $510–$676/month.

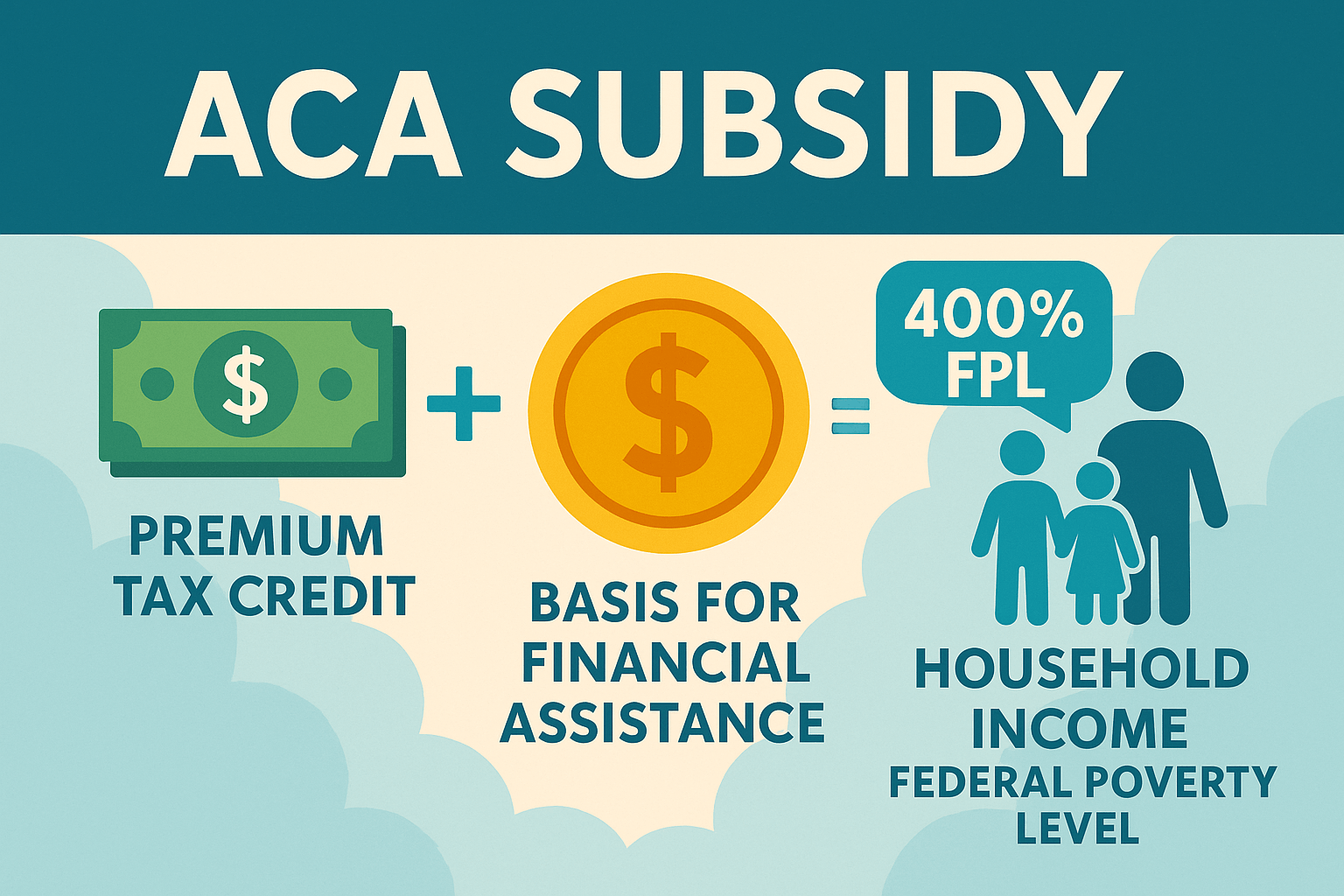

Most enrollees qualify for premium tax credits, reducing actual costs—over 4 in 5 pay just $10/month or less

🏛️ Premium Assistance & Key Savings

- The Premium Tax Credit (PTC) limits what you pay for the benchmark Silver plan to between 0% and 8.5% of household income, depending on your income relative to the Federal Poverty Level (FPL).

- Cost-Sharing Reductions (CSRs) are available for individuals with incomes up to about 250% of FPL, often leading to deductibles as low as $90 when enrolled in a CSR-eligible Silver plan.

📊 Out-of-Pocket Maximum:

The most you’ll pay in a year before your plan covers 100% of costs. ACA caps this (e.g., ~$10,600 for individuals and ~$21,000 for families in 2026).

💳 Annual Deductibles:

The amount you pay out-of-pocket before your insurance begins paying.

🩺 Average Annual Deductibles (2026):

- Silver plan deductibles are around $5,304 more.

- Bronze plan deductibles may reach up to $9,000.

Copayments and Coinsurance:

Shared costs for specific services or prescriptions after your deductible is met.