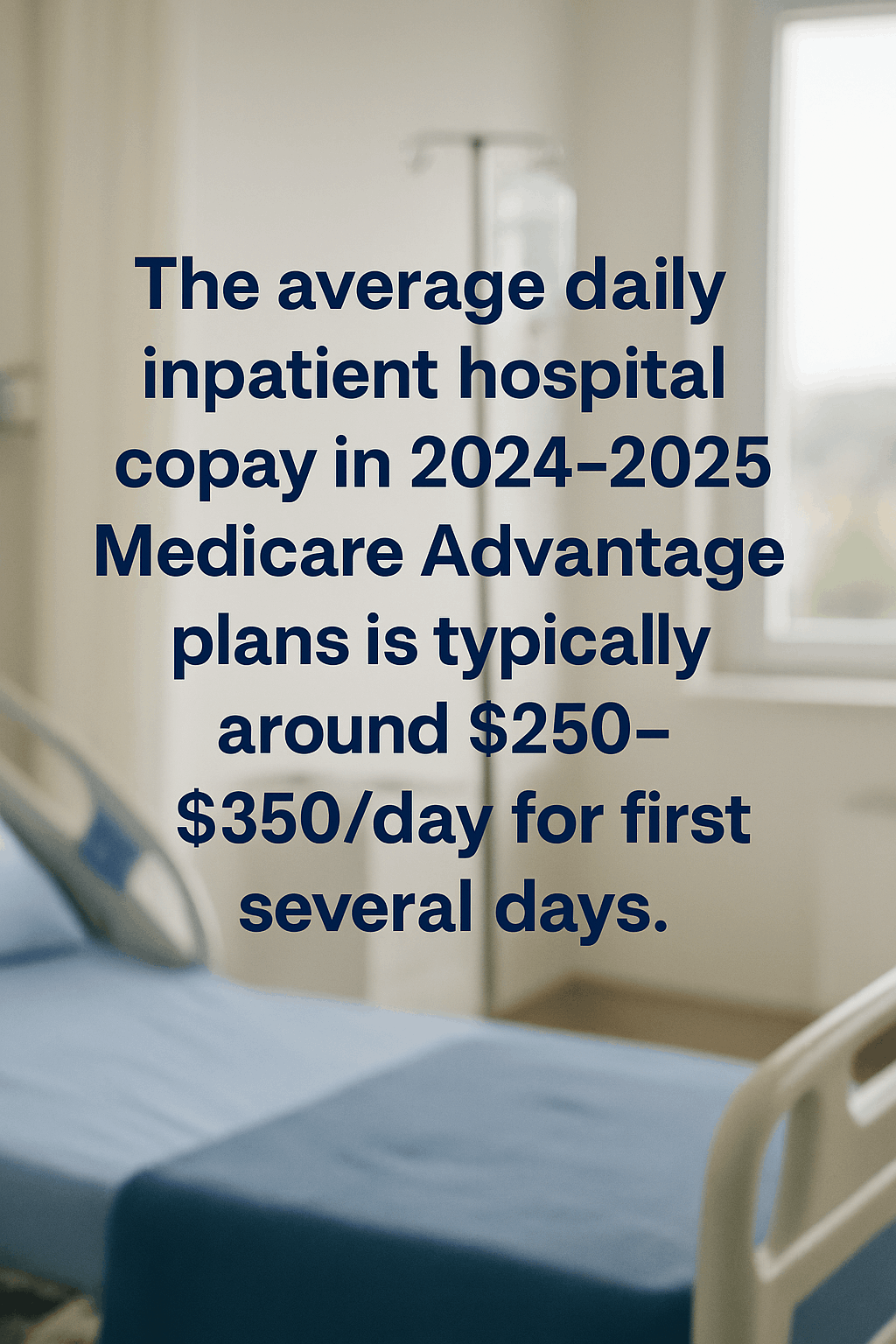

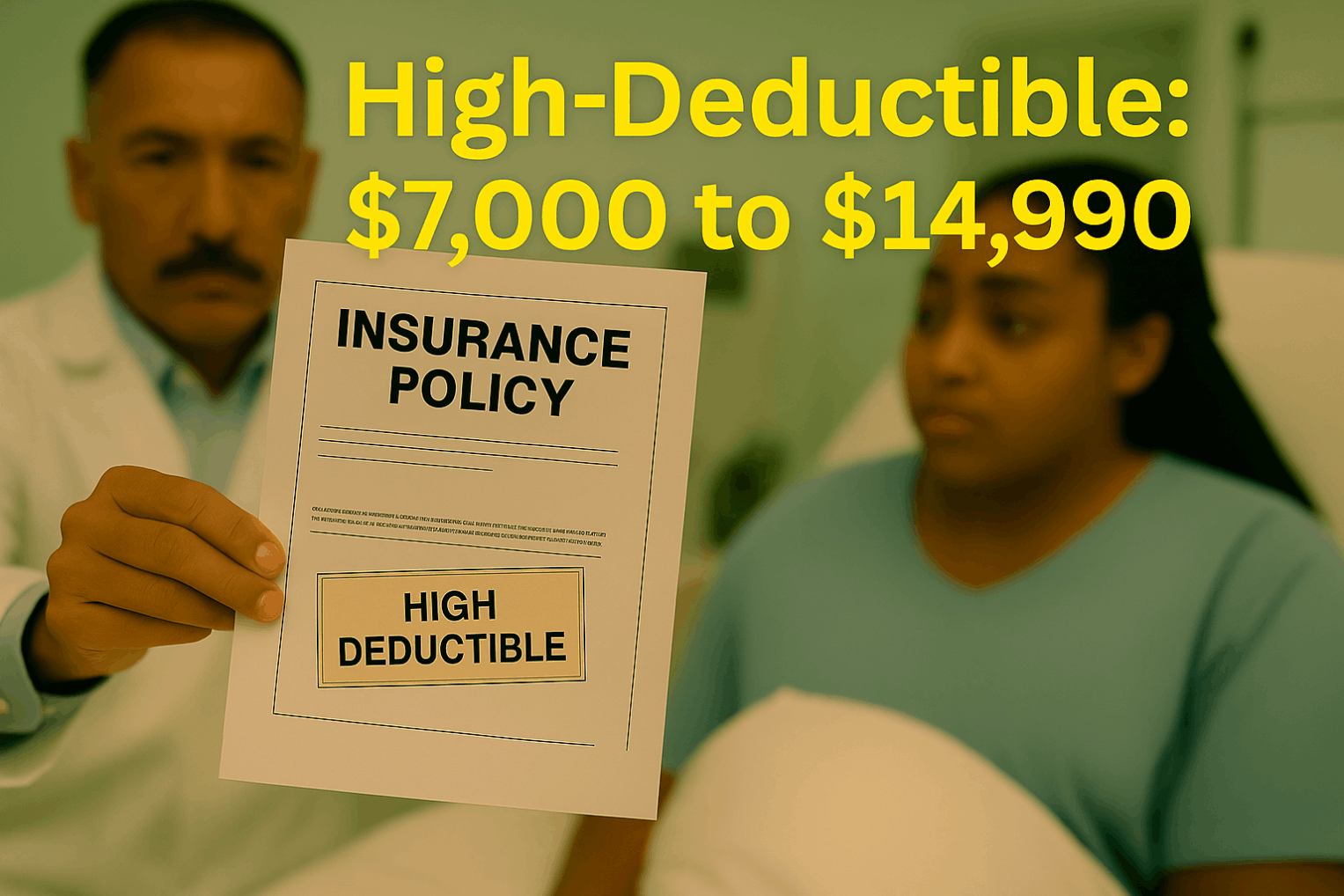

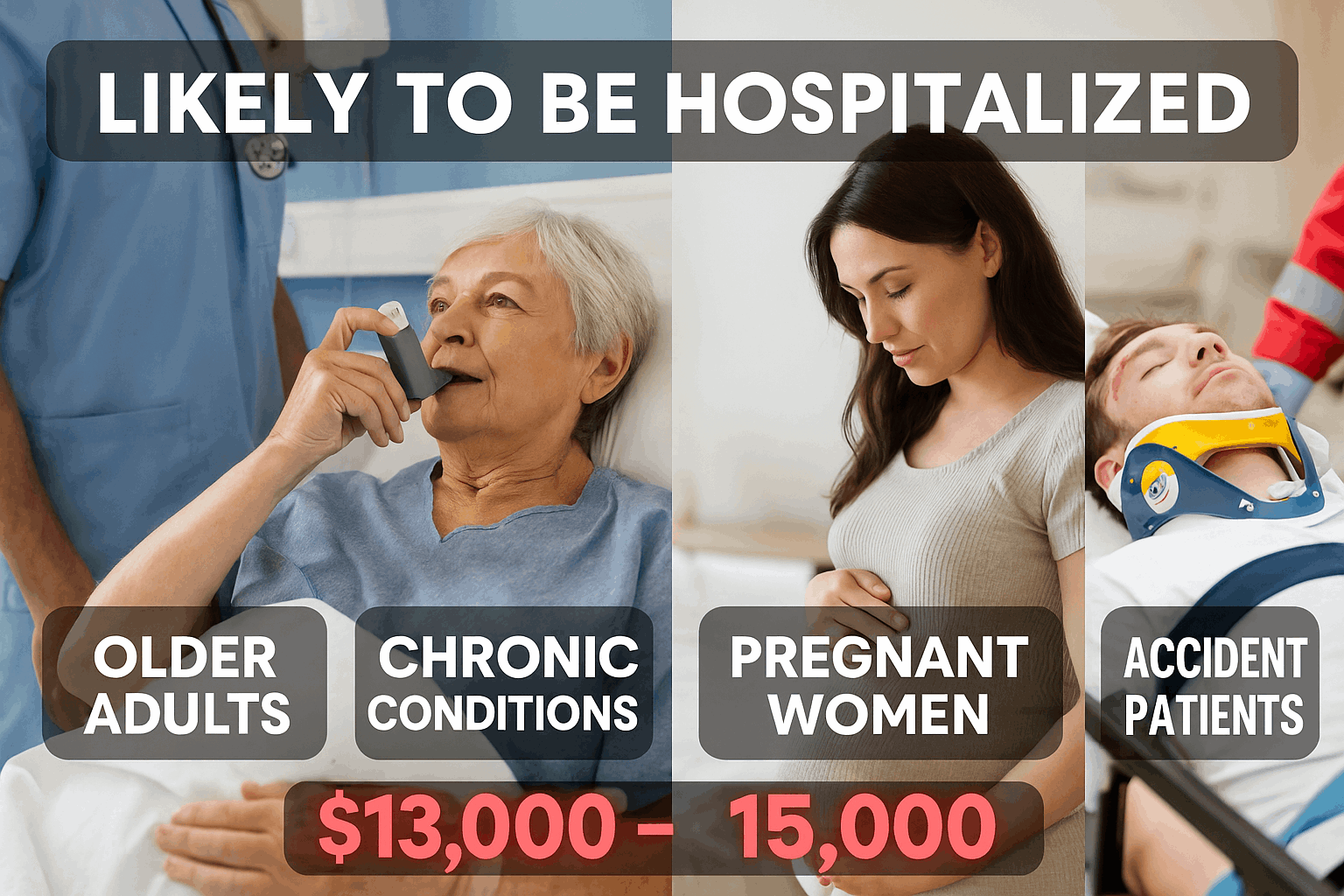

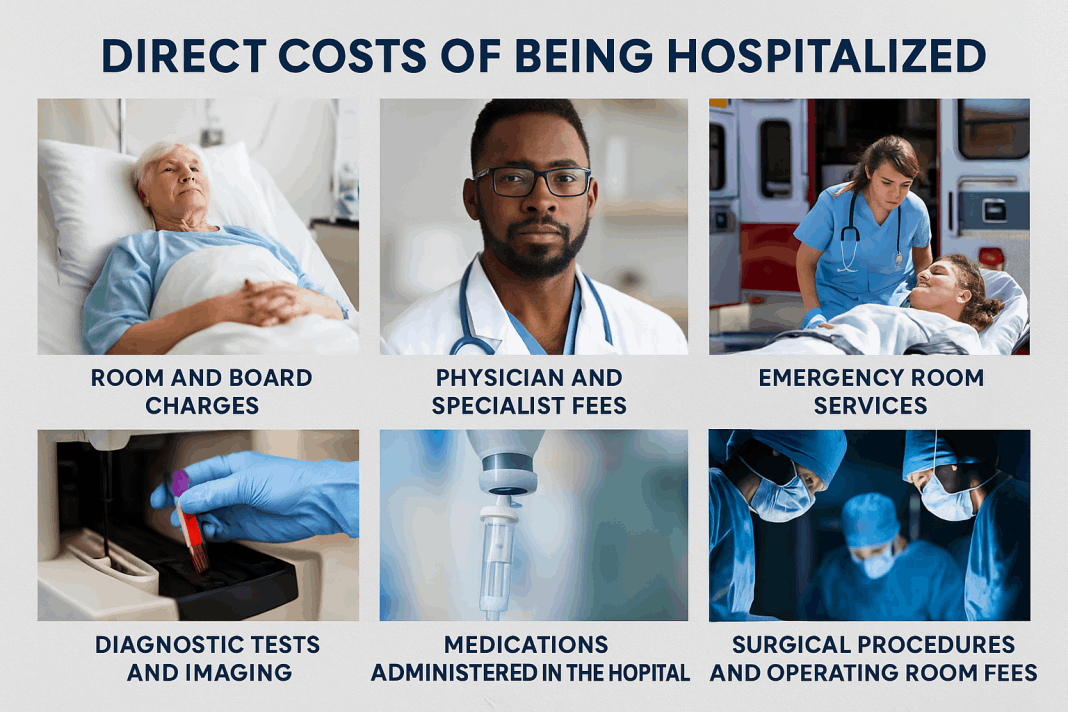

Direct costs of hospitalization are the immediate medical expenses directly tied to treatment and care. Even with insurance, copays, deductibles, and uncovered services can quickly add up, creating a heavy financial burden.

Room and Board Charges – This includes the daily rate for occupying a hospital bed, meals, basic nursing care, and general facility services. Costs are higher for private rooms or specialty units.

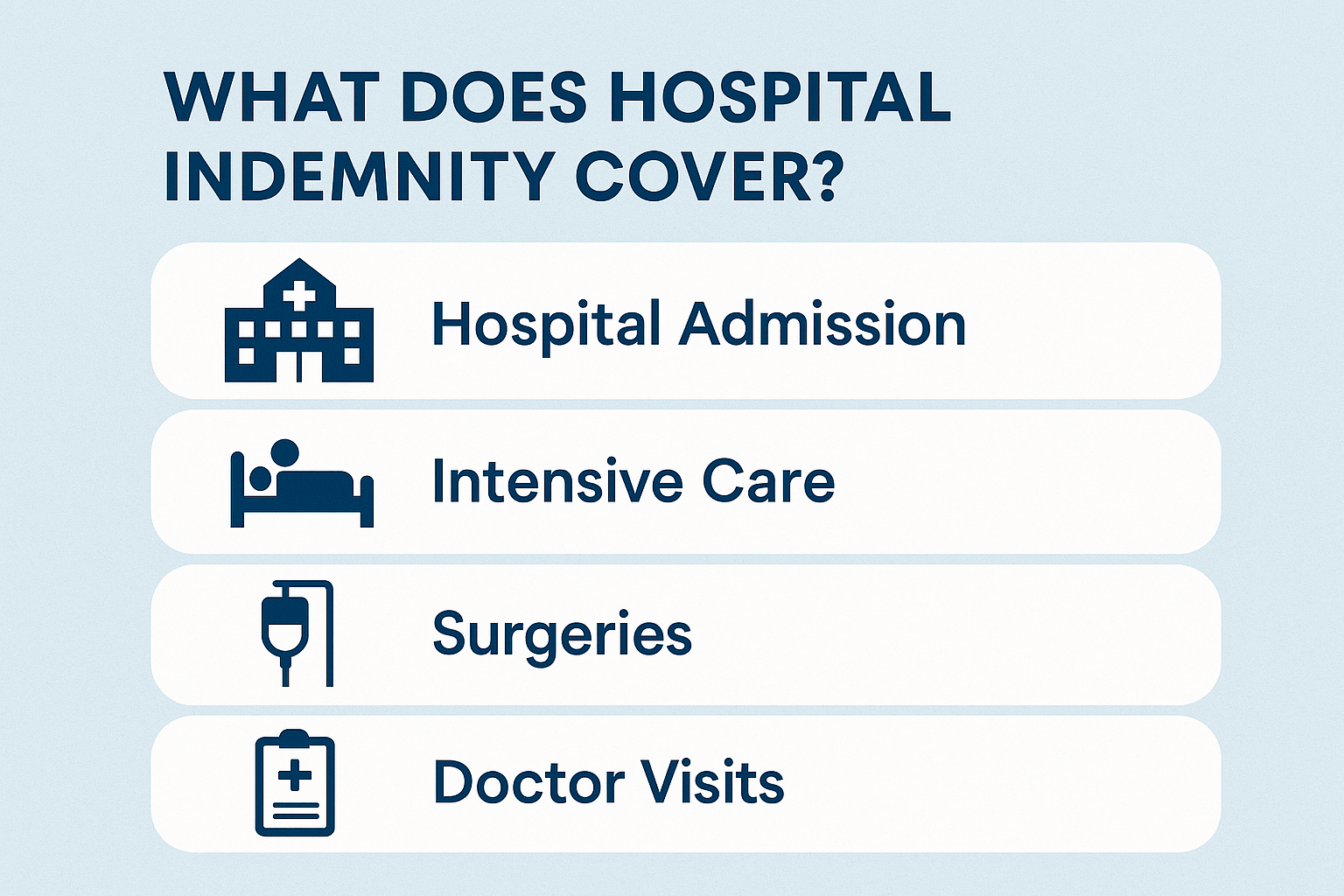

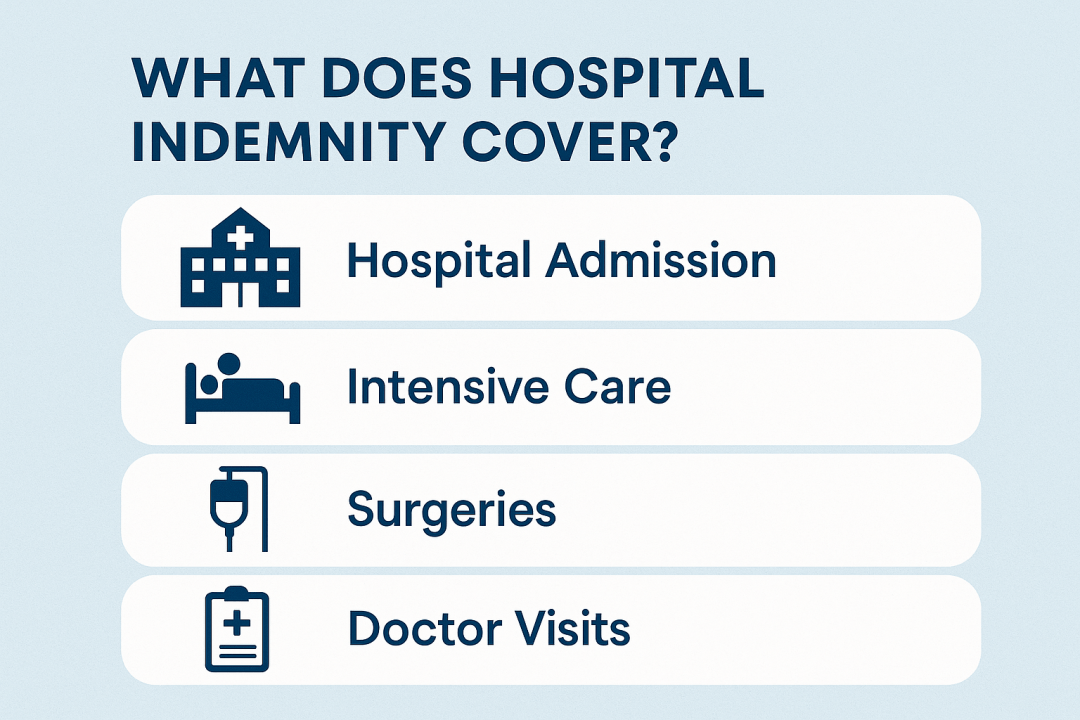

Physician and Specialist Fees – Hospital stays often involve multiple providers—primary doctors, surgeons, anesthesiologists, and consulting specialists—each billing separately for their services.

Emergency Room Services – If the patient is admitted through the ER, charges apply for emergency evaluation, stabilization, and initial testing before being transferred to a hospital unit.

Diagnostic Tests and Imaging – Lab work, blood tests, X-rays, ultrasounds, CT scans, MRIs, and other diagnostics are billed separately and can quickly add up, especially for complex cases.

Medications Administered in the Hospital – Drugs provided in-house (such as IV antibiotics, chemotherapy, insulin, or pain management) are billed at hospital rates, which are often higher than retail pharmacy costs.

Surgical Procedures and Operating Room Fees – If surgery is required, patients face charges for the operating room, anesthesia, surgical team, and post-operative recovery services.

Medical Supplies and Equipment – This includes all items used during care—IV tubing, catheters, oxygen, wound dressings, monitoring devices, and disposable supplies.

Intensive Care Unit (ICU) Charges – Stays in specialized units like ICU or CCU (cardiac care) are far more expensive due to the advanced technology, specialized staff, and 24/7 monitoring involved.