Supplemental Insurance

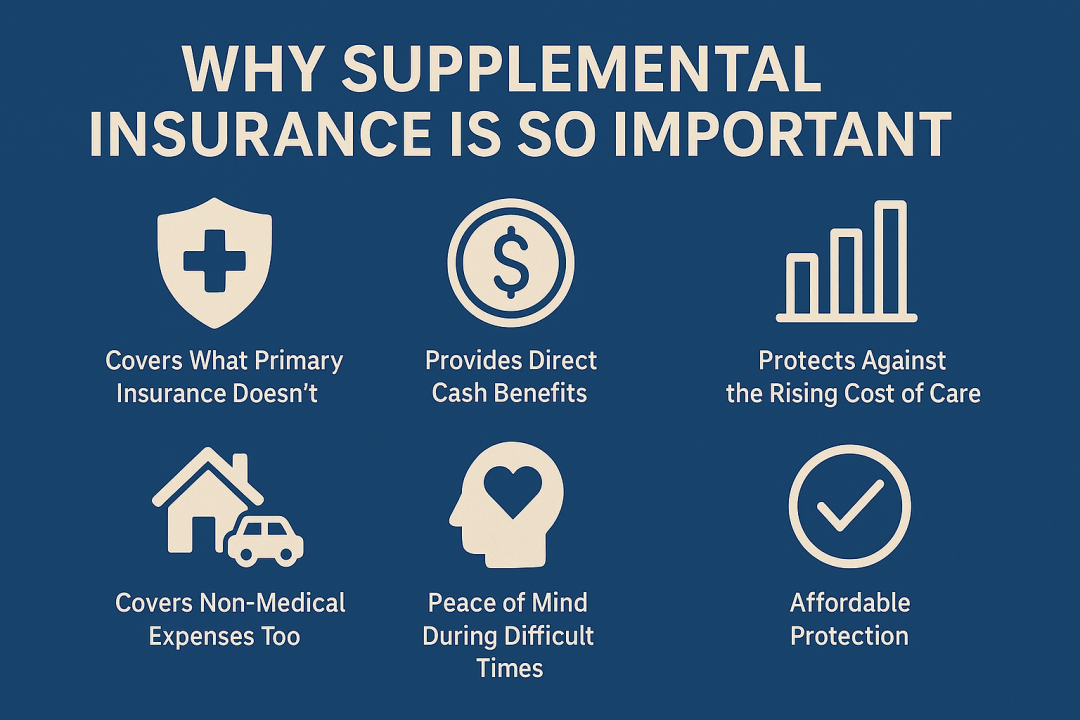

Supplemental insurance is additional coverage that works alongside your primary health or life insurance to provide extra financial protection. Unlike standard health plans that may leave you with deductibles, copays, or uncovered services, supplemental policies help fill these gaps by paying benefits directly to you. This money can be used for medical bills, travel costs, lost income, or everyday expenses while you recover.

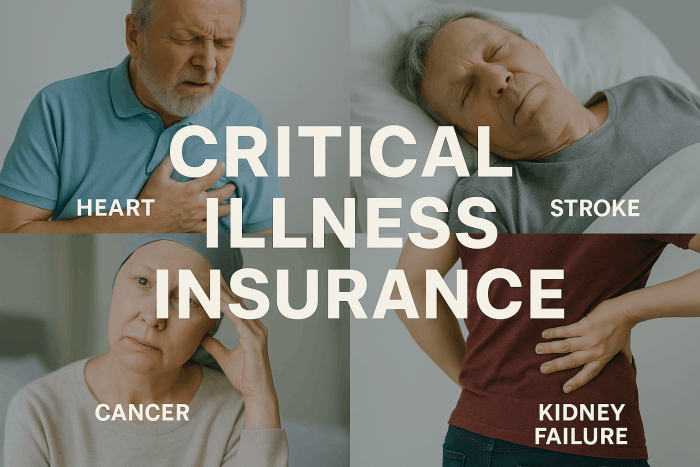

Common types include accident insurance, hospital indemnity, critical illness, cancer coverage, and dental, vision, and hearing plans. By adding this layer of protection, supplemental insurance gives individuals and families peace of mind and greater financial security when unexpected health events occur.