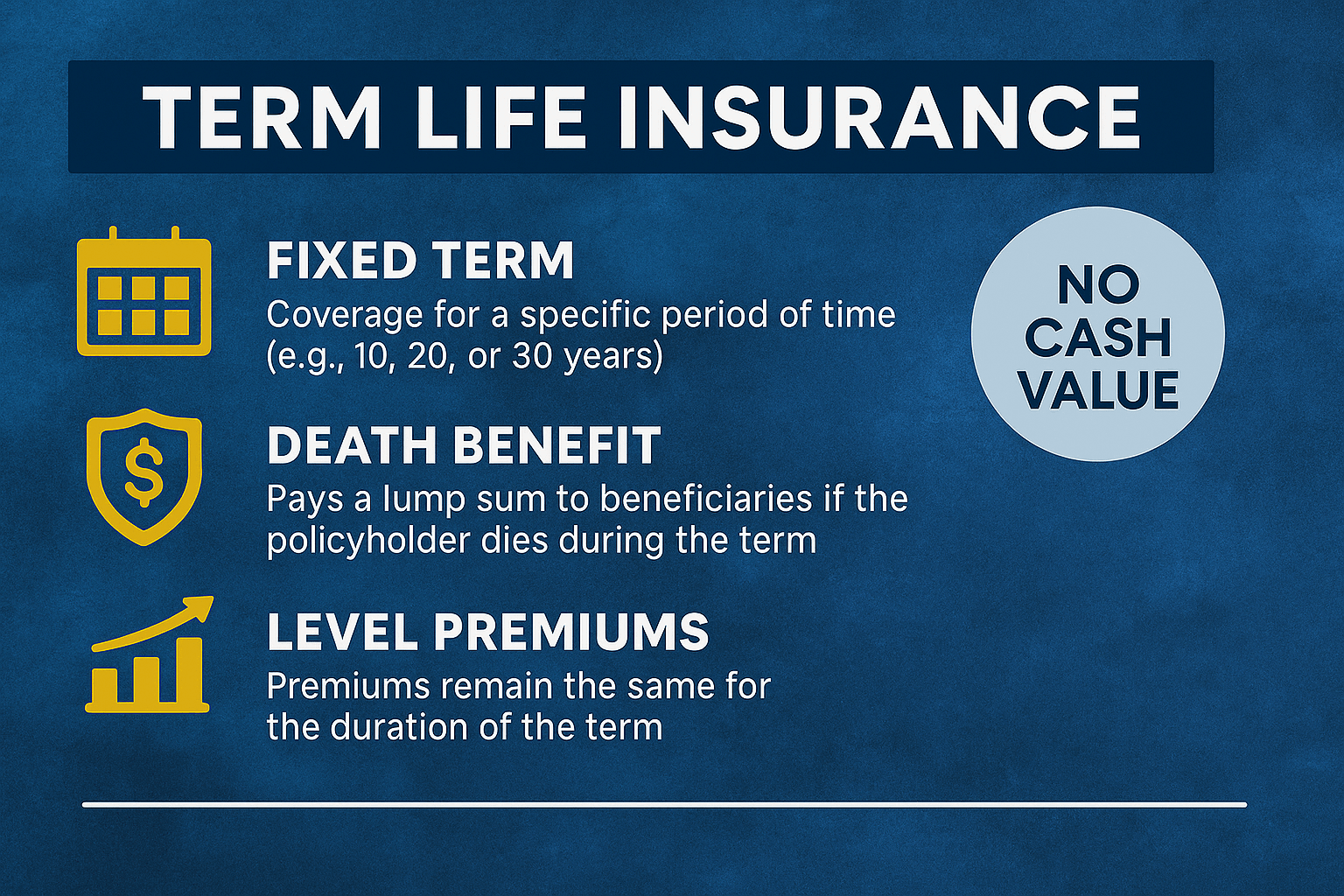

Term-Life Insurance

Term life insurance is straightforward, temporary coverage that pays a death benefit to your beneficiaries if you die during a set period—typically 10, 15, 20, or 30 years. It has no cash value and is usually the lowest-cost way to buy a large amount of protection, making it ideal for covering time-bound needs like a mortgage, income replacement while kids are dependent, or other debts. Premiums are fixed for the term you choose; if the term ends and you’re still living, the policy simply expires (though many policies can be renewed at higher rates or converted to permanent insurance within certain time limits). In short, term life maximizes affordable protection for a defined window, without the savings component of permanent policies.