Life Insurance

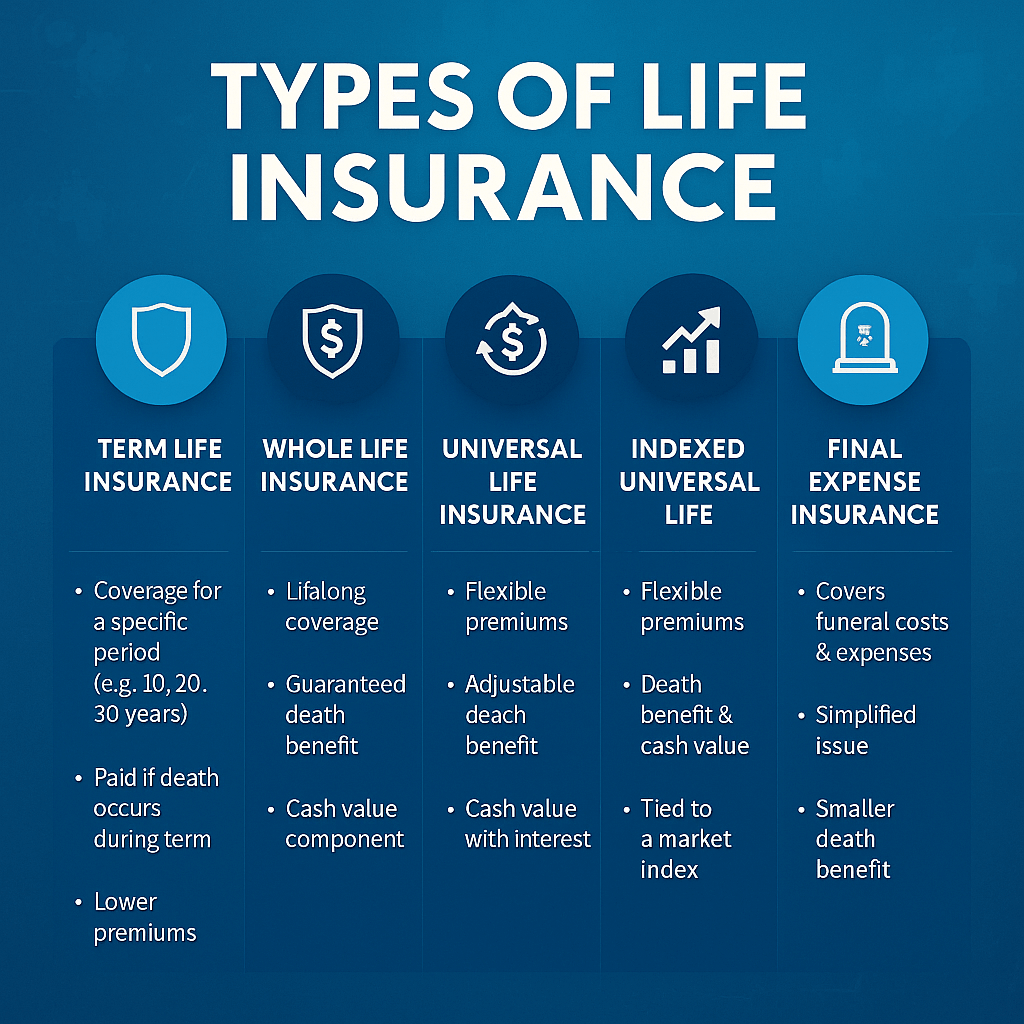

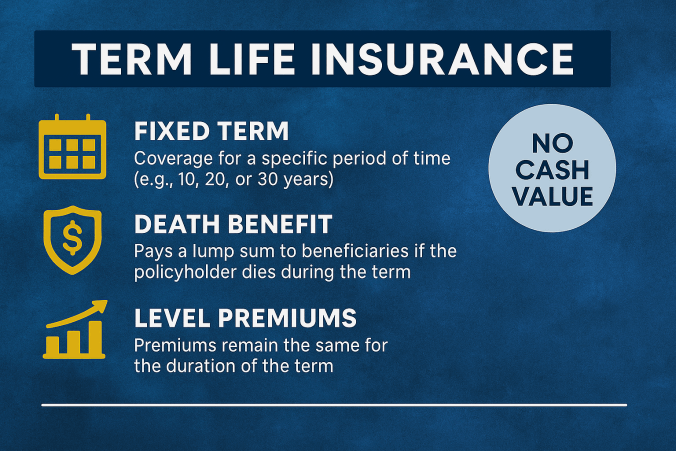

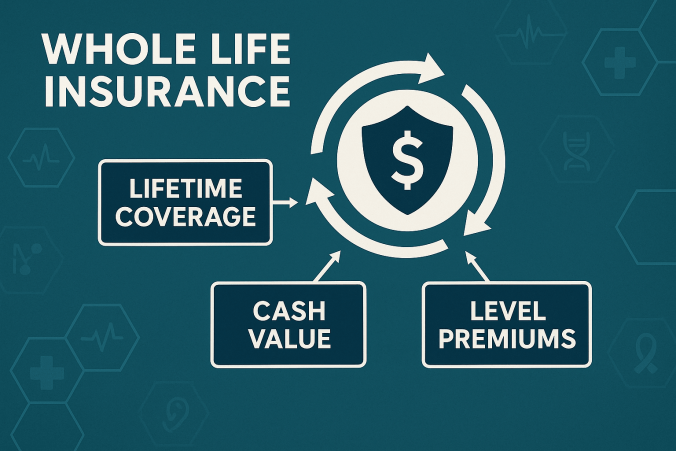

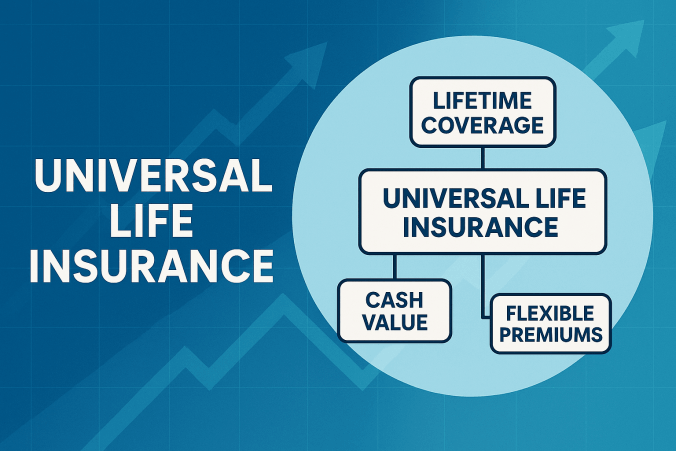

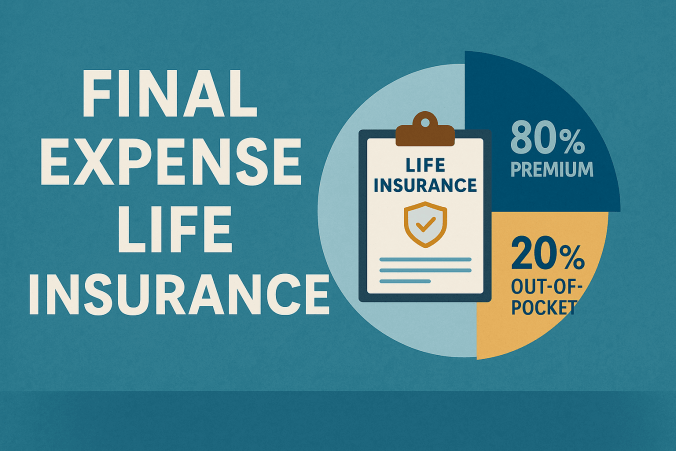

Life insurance is a financial contract between an individual (the policyholder) and an insurance company, designed to provide a monetary benefit to designated beneficiaries upon the insured’s death. In exchange for regular premium payments, the insurer guarantees a payout—called the death benefit—that can help loved ones cover expenses such as funeral costs, outstanding debts, daily living needs, and future financial goals like education. There are different types of life insurance, including term life, whole life, universal life, indexed universal life, and final expense, each offering unique features related to coverage length, premium structure, and cash value accumulation. Beyond the financial protection it provides, life insurance offers peace of mind, ensuring that dependents and loved ones are financially supported in the event of the policyholder’s passing.