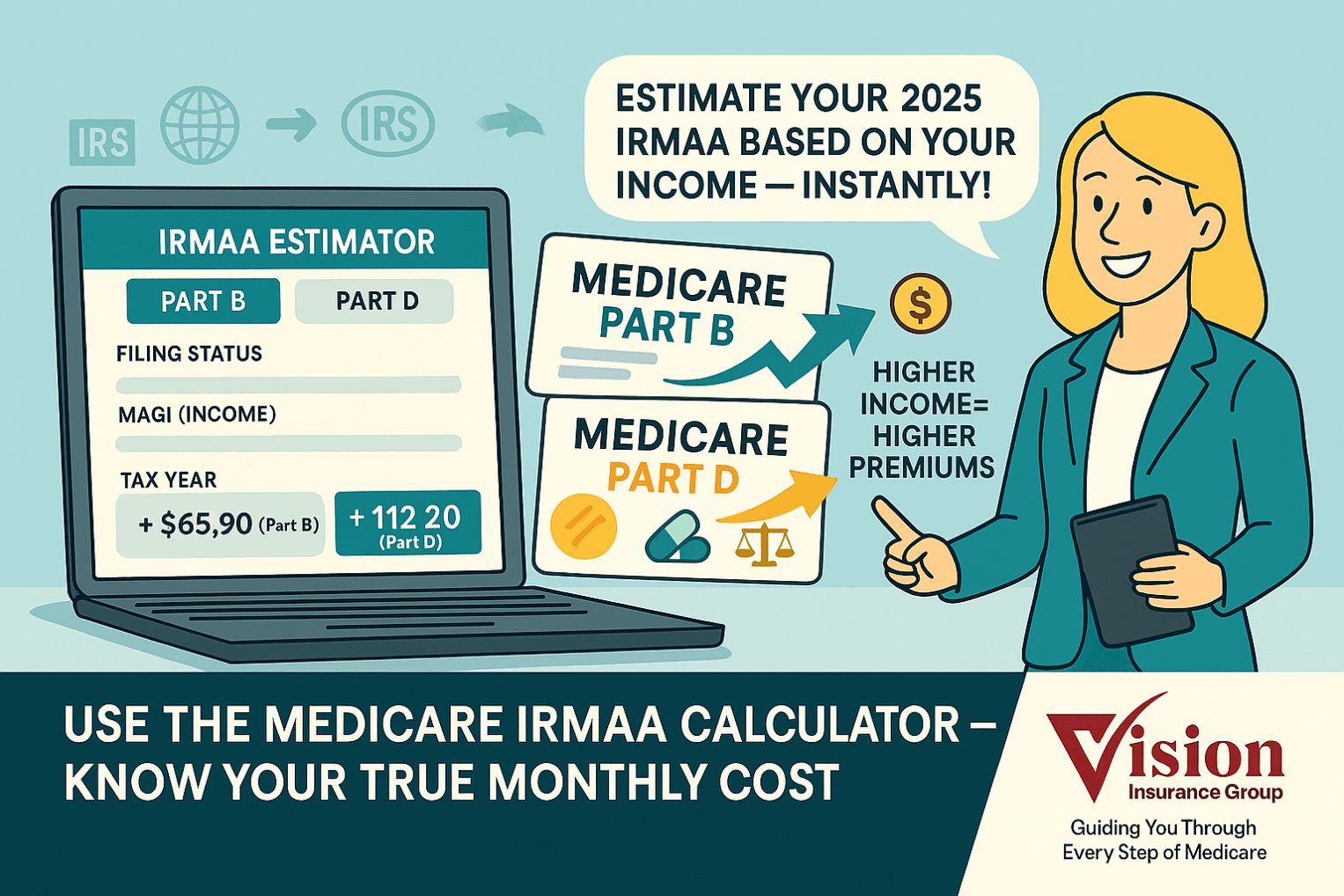

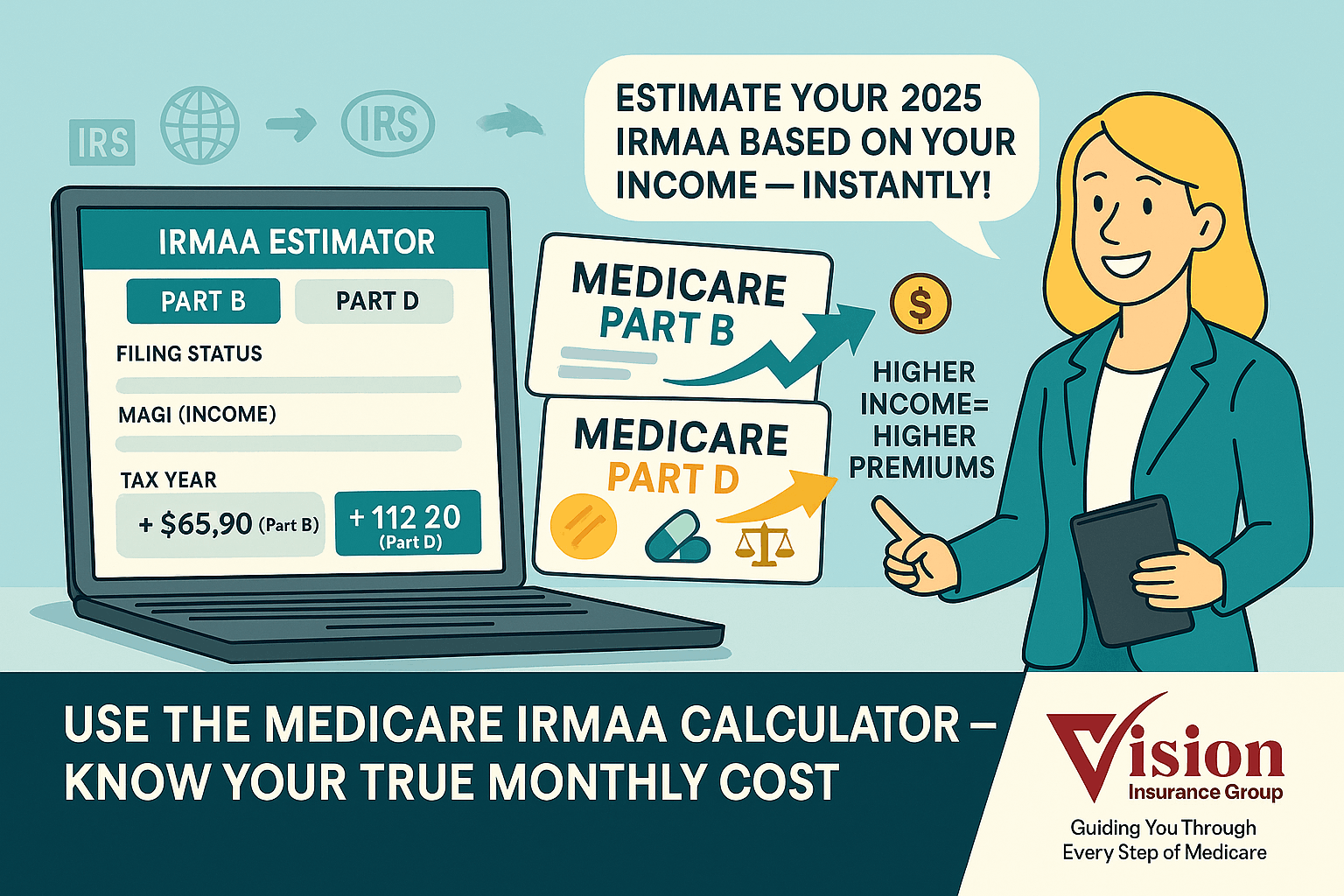

Income-Related Monthly Adjustment Amount (IRMAA)

IRMAA (Income-Related Monthly Adjustment Amount) is a surcharge added to your Medicare premiums if your modified adjusted gross income (MAGI) from two years prior exceeds set thresholds (e.g., 2025 uses your 2023 tax return). It’s calculated by Social Security and applied in tiers, on top of your standard premiums: for Part B, the IRMAA is added to your monthly Part B premium; for Part D, the IRMAA is a separate amount paid to Medicare (not your drug plan) in addition to your plan’s premium. IRMAA is typically in effect for the entire calendar year and is re-evaluated annually when new IRS data arrives. If your income has dropped due to a qualifying life-changing event (retirement, marriage/divorce, loss of pension, etc.), or you file an amended return, you can ask Social Security for a new determination (Form SSA-44) to reduce or remove IRMAA mid-year going forward. Note: people who qualify for Extra Help don’t pay the Part D IRMAA, but Part B IRMAA can still apply.