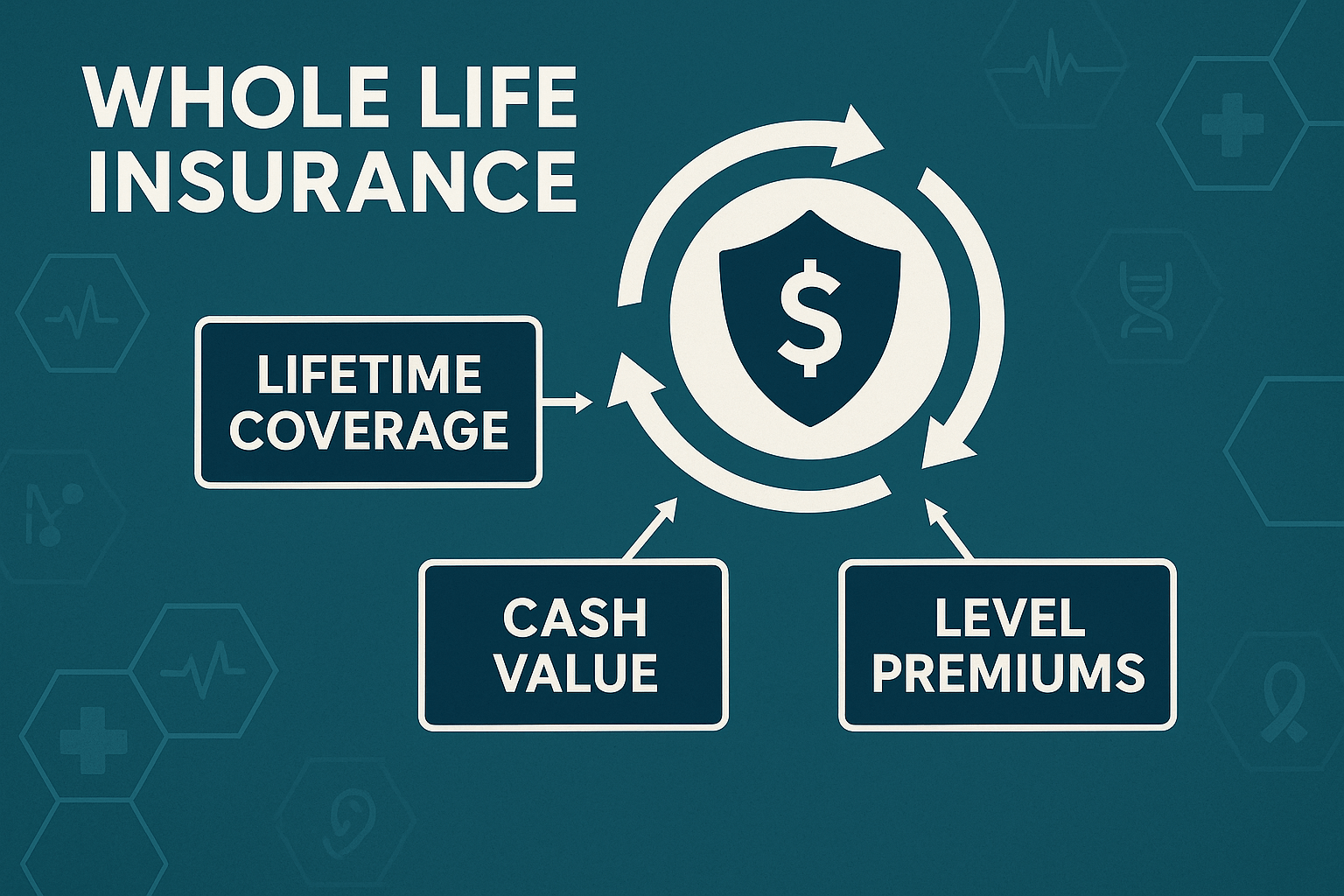

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the insured’s entire lifetime, as long as premiums are paid. Unlike term life insurance, which covers a set period, whole life insurance never expires and includes a guaranteed death benefit for beneficiaries. One of its key features is a cash value component, which grows over time at a fixed, tax-deferred rate set by the insurer. Policyholders can borrow against or withdraw from this cash value, making it a financial tool as well as a protection plan. Premiums are typically higher than those of term life insurance but remain level for the life of the policy. Whole life insurance is often chosen for long-term financial planning, estate preservation, or leaving a legacy, since it combines lifetime protection with a stable savings component. It can also help cover final expenses, supplement retirement income, or provide funds for emergencies, offering both security and predictable growth.