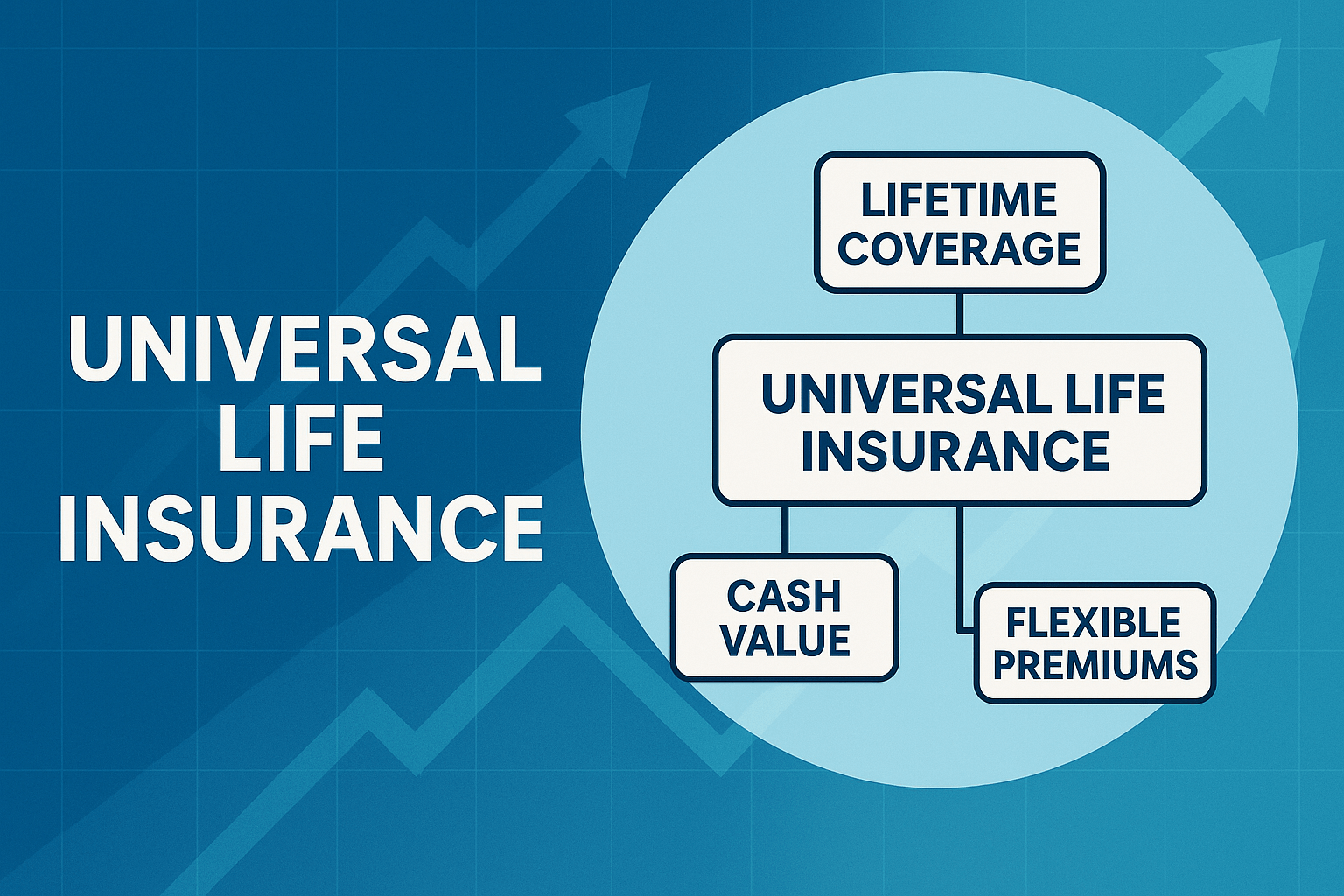

Universal Life Insurance

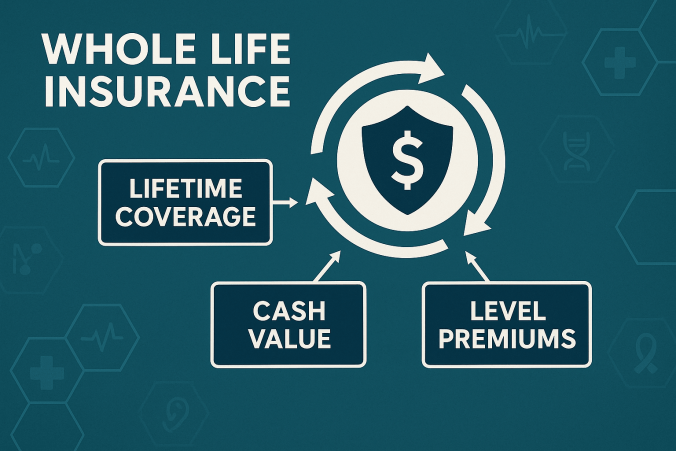

Universal life insurance is a type of permanent life insurance that offers both lifetime coverage and flexible financial features. Like whole life insurance, it includes a death benefit that is paid to beneficiaries upon the policyholder’s passing, as well as a cash value component that grows on a tax-deferred basis. However, what sets universal life apart is its flexibility — policyholders can adjust their premium payments and death benefit amounts (within certain limits) to fit changing financial needs. The cash value earns interest based on market rates set by the insurer, and funds from this account can be used to cover premiums if the accumulated value is sufficient. This makes universal life a blend of protection and adaptable financial planning, ideal for those who want lifetime coverage but also the ability to respond to life’s changes. It is often used for wealth transfer, estate planning, or supplementing retirement income, while giving policyholders more control over how their policy evolves over time.