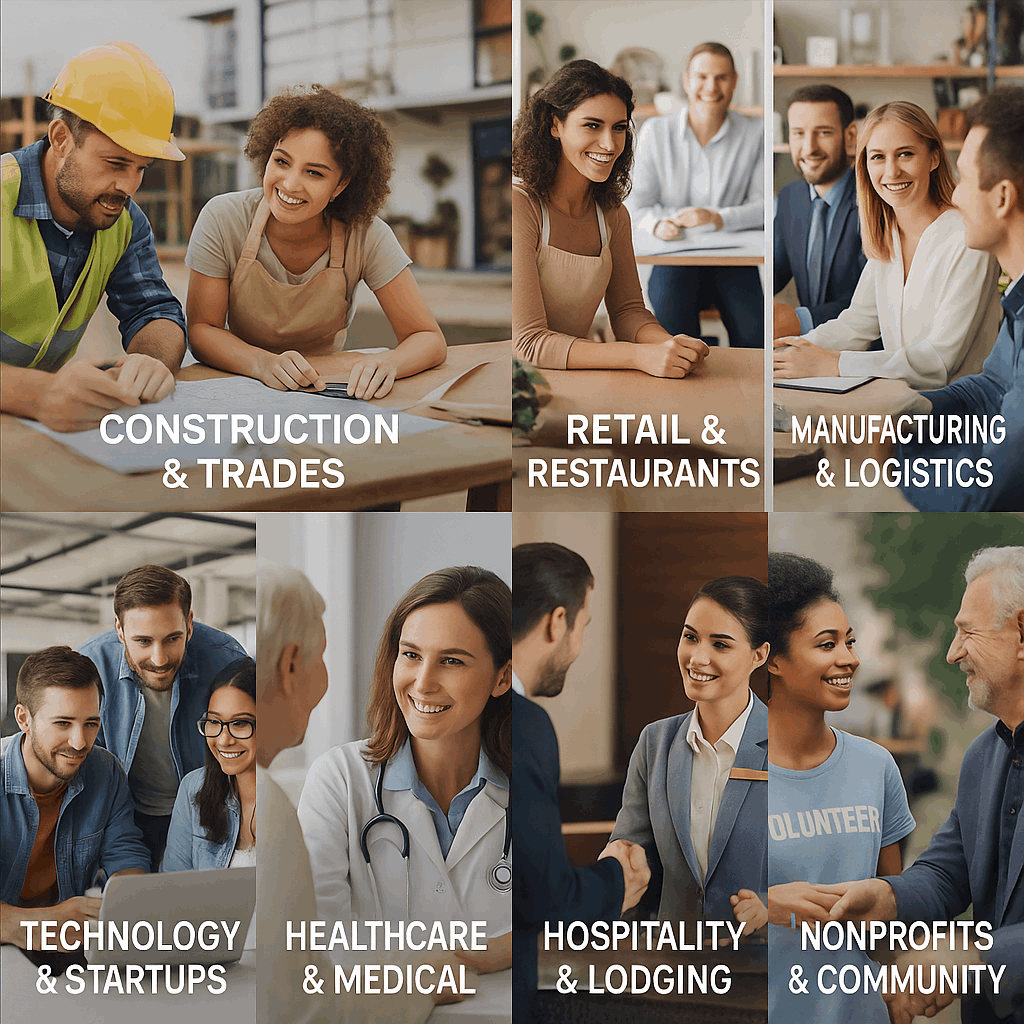

At Vision Insurance Group, we understand that no two businesses are alike. Every industry faces its own set of risks, regulations, and day-to-day challenges. That’s why we partner with organizations across a wide range of sectors, delivering tailored coverage that protects what matters most while ensuring compliance and peace of mind.

Here are the types of businesses we proudly serve:

Construction & Trades

From general contractors to specialty subcontractors, we help protect against job-site accidents, equipment losses, and liability exposures. Coverage often includes General Liability, Workers’ Compensation, Builders Risk, Commercial Auto, and Surety Bonds to keep projects moving forward.

Retail & Restaurants

Brick-and-mortar shops, boutiques, and dining establishments face risks from customer slip-and-falls, theft, property damage, and employee injuries. We provide Business Owner’s Policies, Liquor Liability, Food Spoilage, and Cyber Protection for point-of-sale systems.

Professional Services

Consultants, accountants, attorneys, IT providers, and healthcare professionals rely on trust. We help safeguard reputations with Professional Liability (Errors & Omissions), Cyber Insurance, General Liability, and tailored Property Insurance.

Manufacturing & Logistics

Manufacturers, warehouses, distributors, and logistics companies face unique risks in production, supply chain, and delivery. Coverage includes Product Liability, Commercial Property, Inland Marine, Equipment Breakdown, and Cargo/Transit Insurance.

Technology & Startups

Emerging businesses face evolving risks: data breaches, investor lawsuits, intellectual property claims. We help with Tech E&O, Cyber Liability, D&O (Directors & Officers), Employment Practices Liability, and scalable coverage as you grow.

Healthcare & Medical Practices

From physician offices to clinics and wellness centers, healthcare businesses need specialized protection against malpractice claims, HIPAA breaches, and employee risks. Our solutions include Malpractice Coverage, Cyber, Property, and Workers’ Comp.

Hospitality & Lodging

Hotels, motels, and event venues face risks tied to guest safety, property damage, and liquor liability. We build programs that include General Liability, Commercial Property, Business Interruption, and Umbrella Coverage.

Nonprofits & Community Organizations

Nonprofits serve their communities and need protection for staff, volunteers, donors, and facilities. We offer affordable policies including General Liability, D&O, Abuse & Molestation Coverage, and Special Event Insurance.

Small Businesses & Startups

Even the smallest company needs protection. We offer affordable packages for family-owned shops, solopreneurs, and startups that combine General Liability, Property, and Workers’ Comp, with scalable options as the business grows.