Medicare FAQs

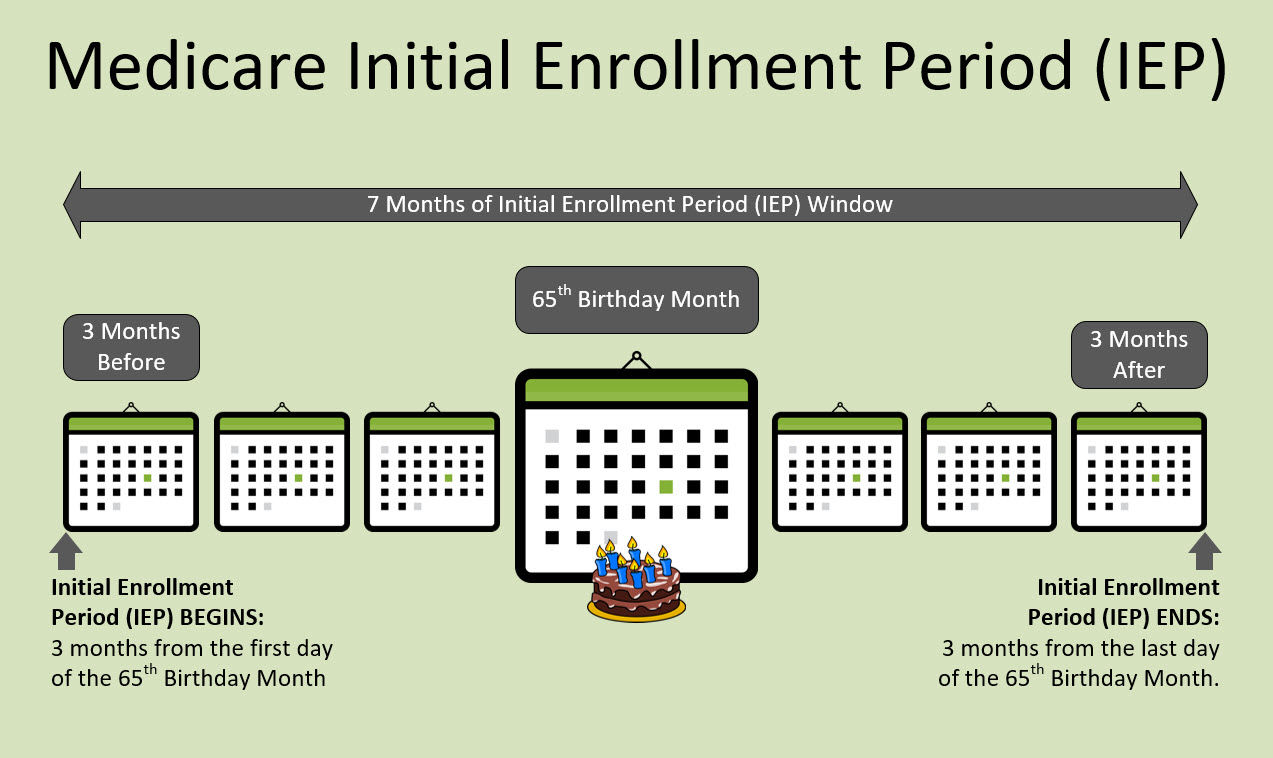

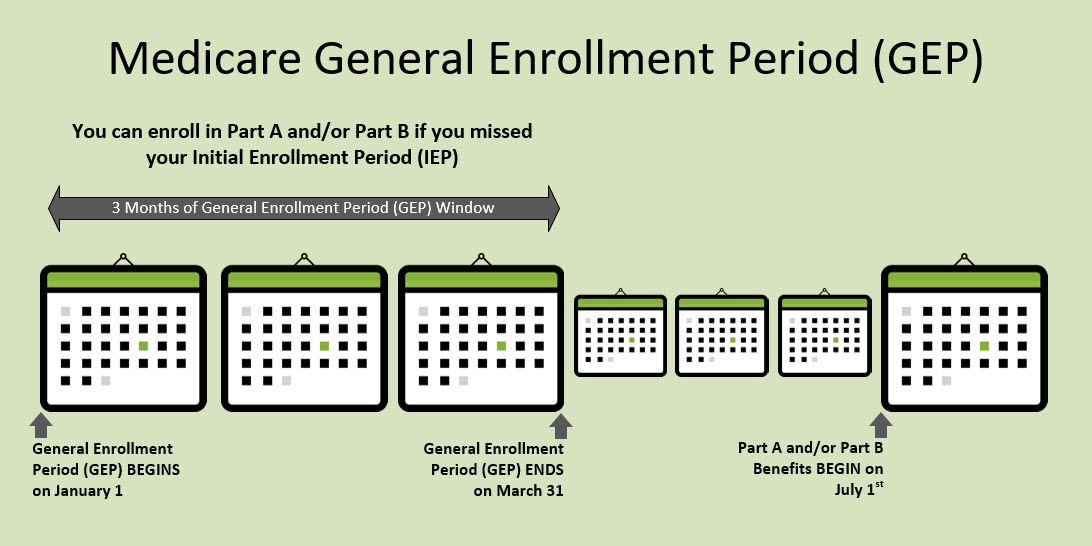

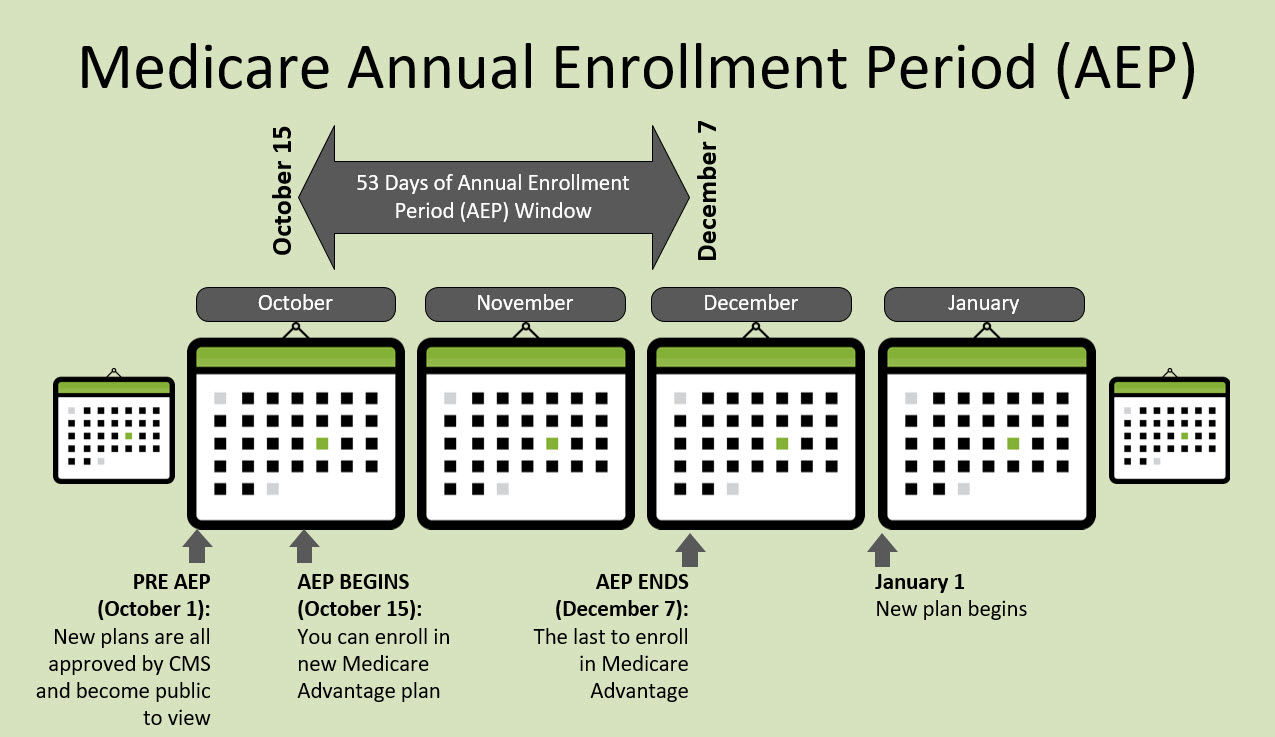

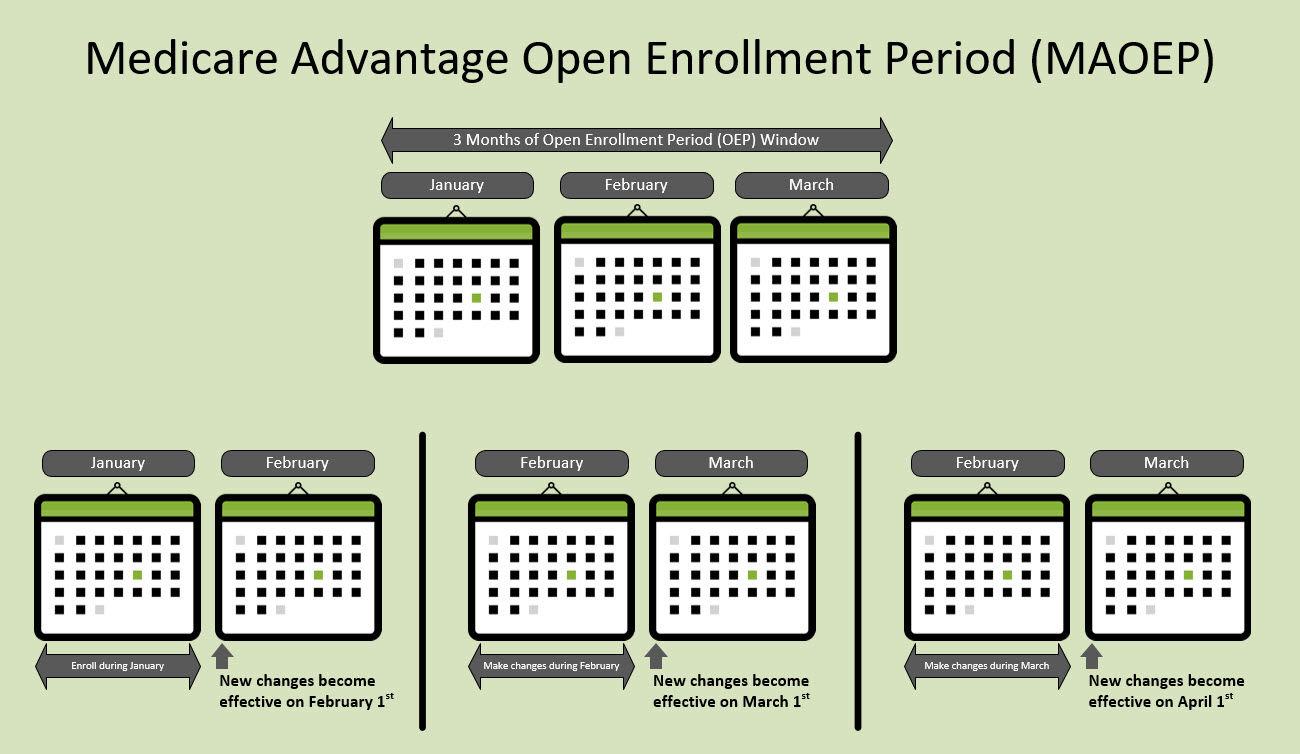

Understanding Medicare can feel overwhelming at first — but it doesn’t have to be. Our Medicare FAQ section provides clear, straightforward answers to the most common questions people have about Medicare eligibility, enrollment periods, plan types, costs, and coverage options. Whether you’re turning 65, already enrolled, or helping a loved one navigate their benefits, this resource is designed to simplify complex rules and help you make confident, informed healthcare decisions. Explore topics such as the difference between Parts A, B, C, and D, when to enroll, how to avoid penalties, and how to review your coverage during Annual Enrollment.