Cancer Insurance

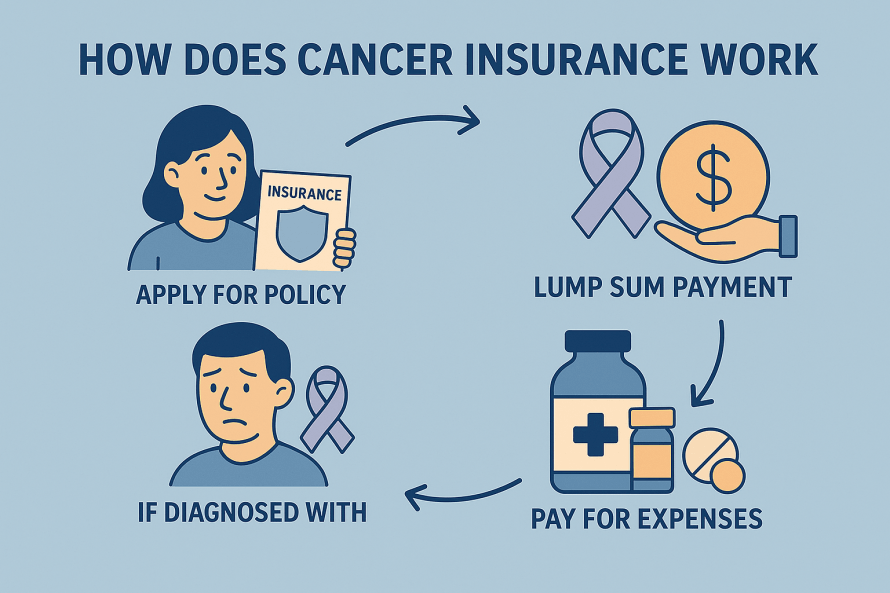

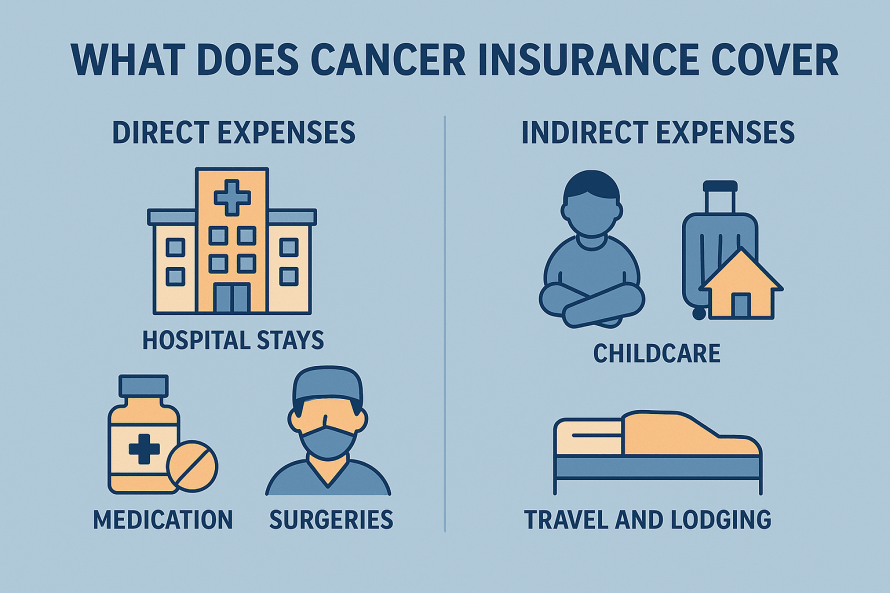

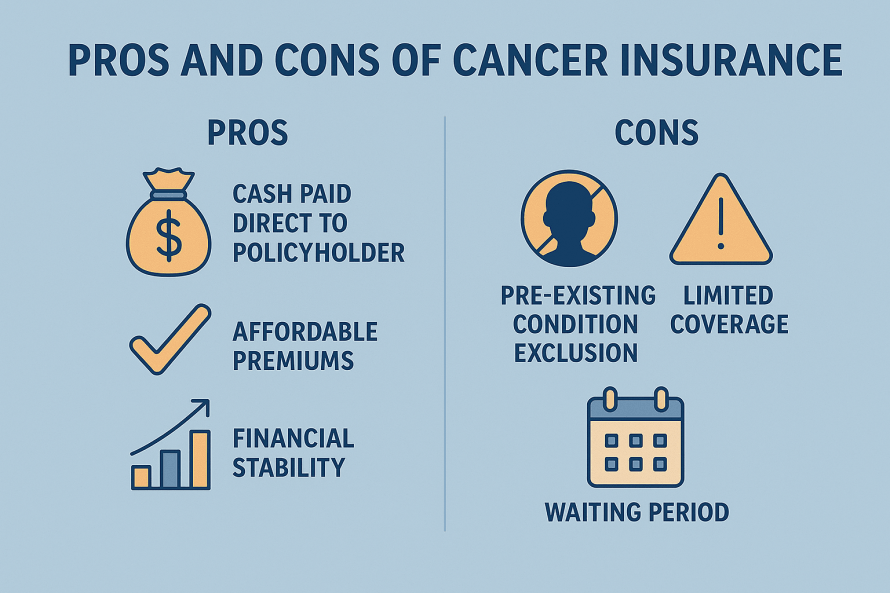

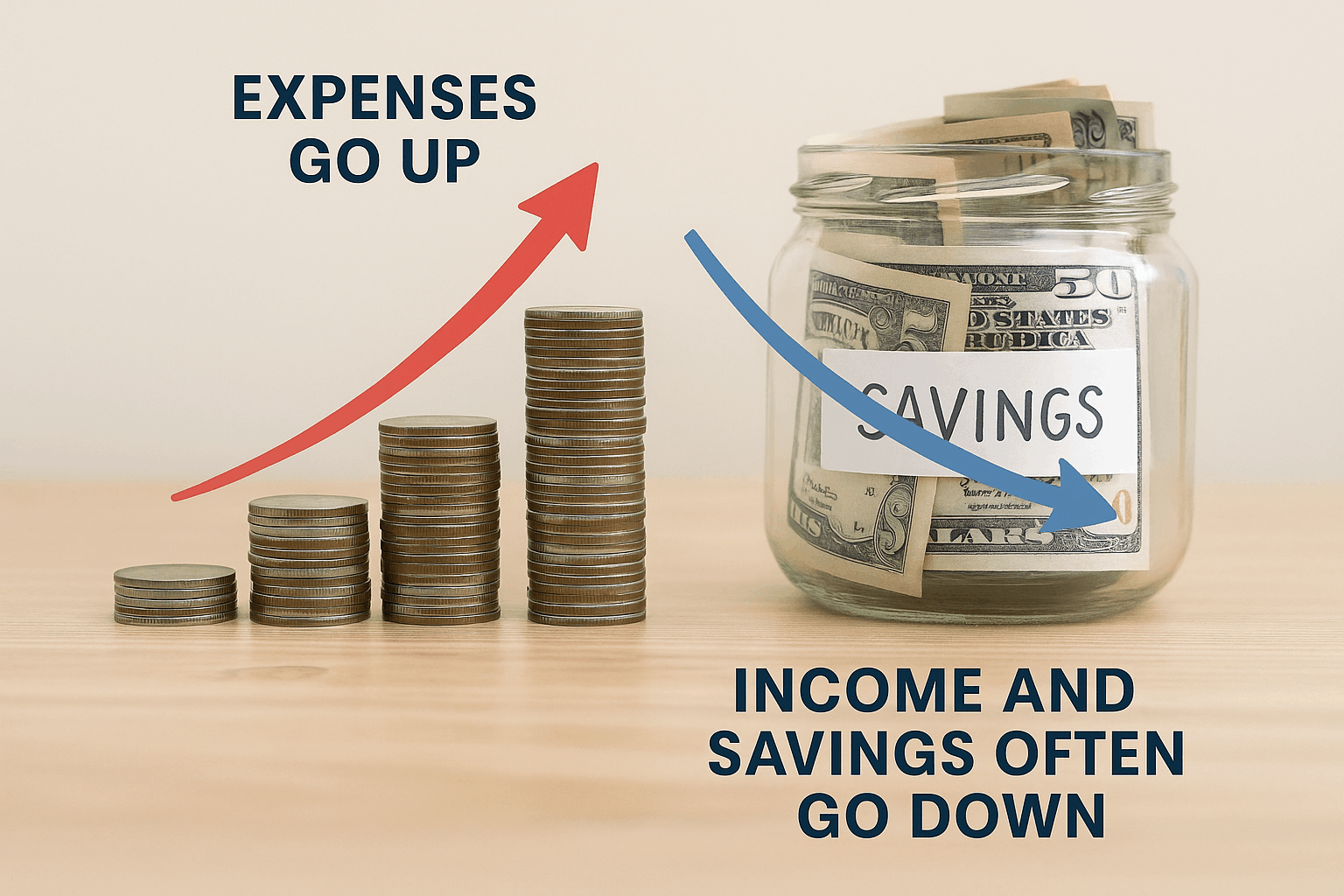

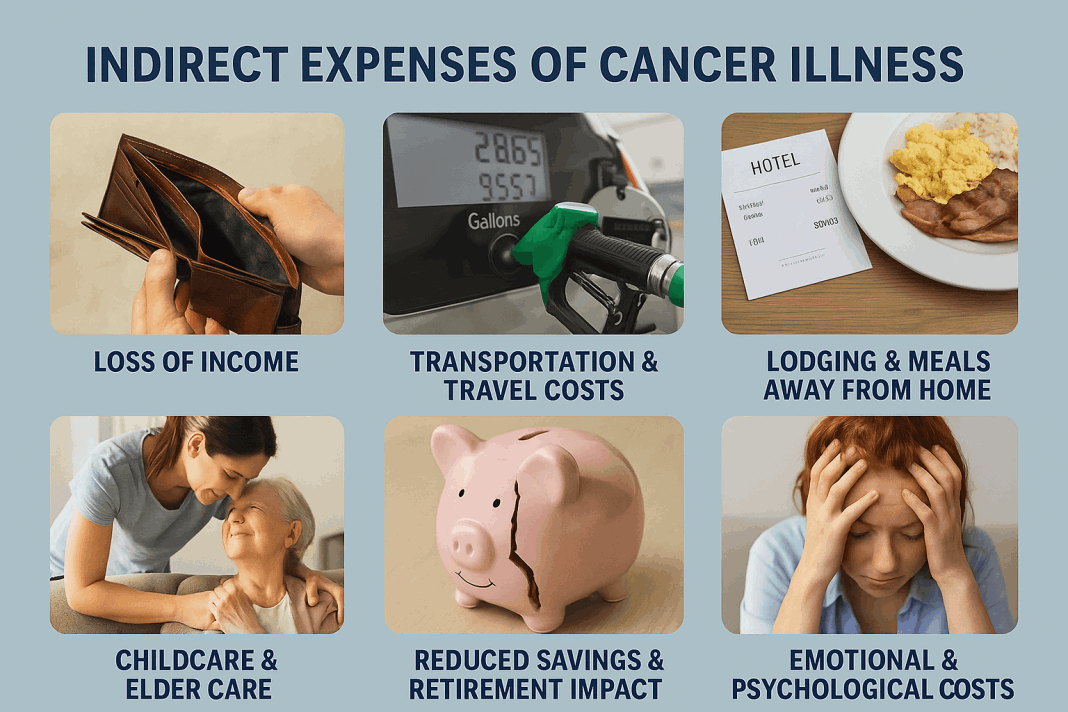

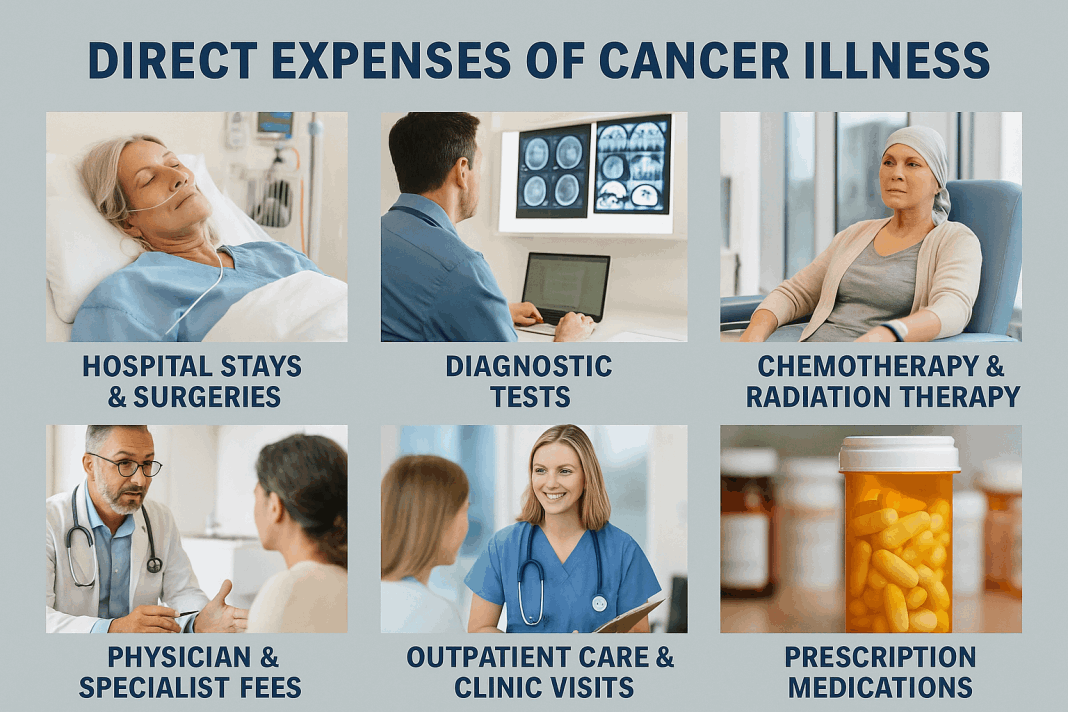

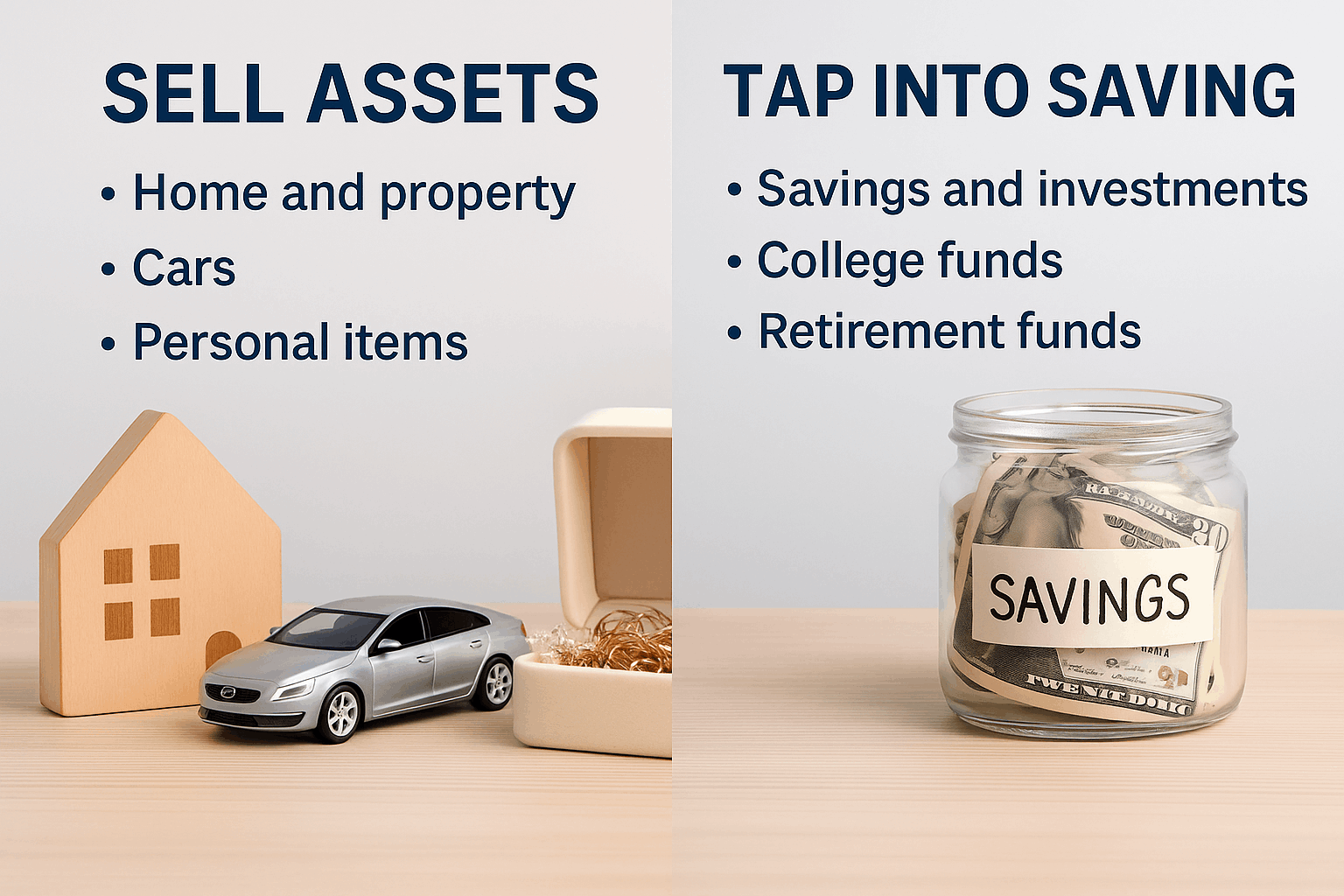

Cancer insurance is a supplemental health insurance plan that provides financial protection if you are diagnosed with cancer. Unlike standard health insurance, which may leave you with high out-of-pocket expenses, cancer insurance offers cash benefits that can be used for medical costs such as treatments, hospital stays, and medications, as well as non-medical expenses like travel, childcare, or household bills.

This flexibility allows individuals and families to focus on recovery without the added stress of unexpected financial burdens. It is especially valuable for those with high-deductible health plans or a family history of cancer, giving peace of mind and support during a challenging time.