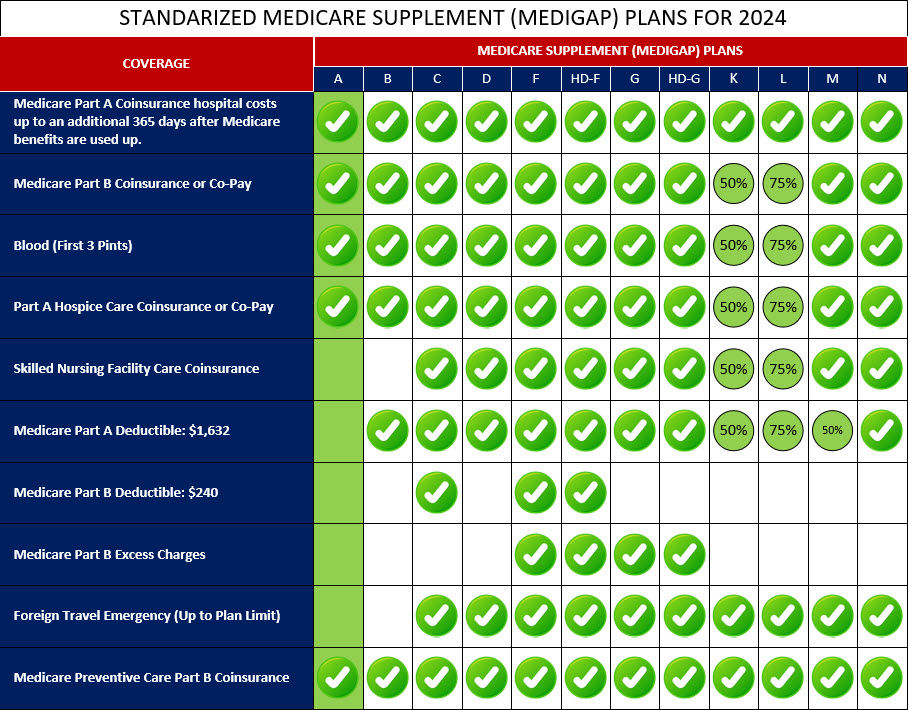

Medigap Plan A is a standardized Medicare Supplement insurance plan that helps fill the gaps in coverage left by Original Medicare (Part A and Part B). It provides a basic set of benefits that are the same across all insurance companies offering Plan A.

Medigap Plan A covers certain costs such as Medicare Part A coinsurance and hospital costs, as well as Part B coinsurance or copayments for medical services. It also covers the first three pints of blood needed for a medical procedure. Medigap Plan A does not cover all the gaps in Original Medicare, such as the Part A and Part B deductibles or excess charges. Additionally, it does not provide coverage for prescription drugs, vision, dental, or other non-Medicare services.

Overall, Medigap Plan A offers basic coverage for essential healthcare expenses, providing individuals with greater financial predictability and peace of mind. It's advisable to compare different Medigap plans to determine which one best meets your specific needs and budget.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan A, which include benefits under Medicare Part A, Medicare Part B, and other areas: