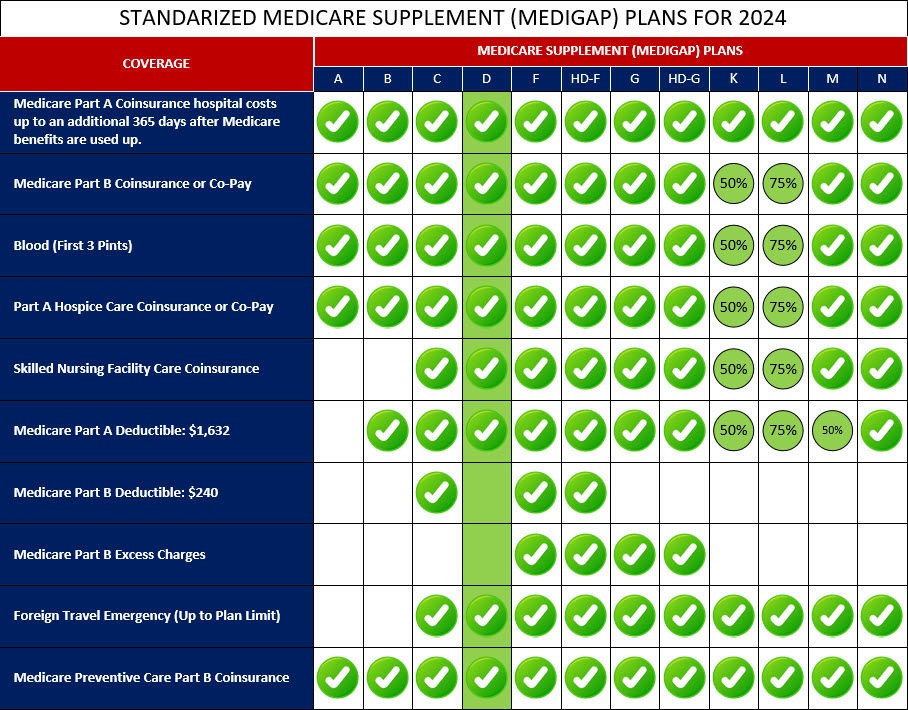

Medigap Plan D is a standardized Medicare Supplement insurance plan that helps cover certain out-of-pocket costs not covered by Original Medicare (Part A and Part B). While it offers comprehensive coverage, it does not cover the Medicare Part B deductible.

Medigap Plan D typically provides coverage for Medicare Part A coinsurance and hospital costs, including an additional 365 days of hospital coverage after Original Medicare benefits are exhausted. It also covers Part B coinsurance or copayments, as well as the first three pints of blood needed for a medical procedure. In addition, Medigap Plan D includes coverage for skilled nursing facility coinsurance and provides coverage for emergency medical care during foreign travel, up to plan limits. However, it does not cover the Medicare Part B deductible or excess charges.

Medigap Plan D may be a suitable option for individuals who are willing to pay the Medicare Part B deductible out of pocket. This plan offers a good balance of coverage and cost savings compared to some other Medigap plans. It's crucial to review and compare the available options based on your individual healthcare needs and budget.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan D, which include benefits under Medicare Part A, Medicare Part B, and other areas: