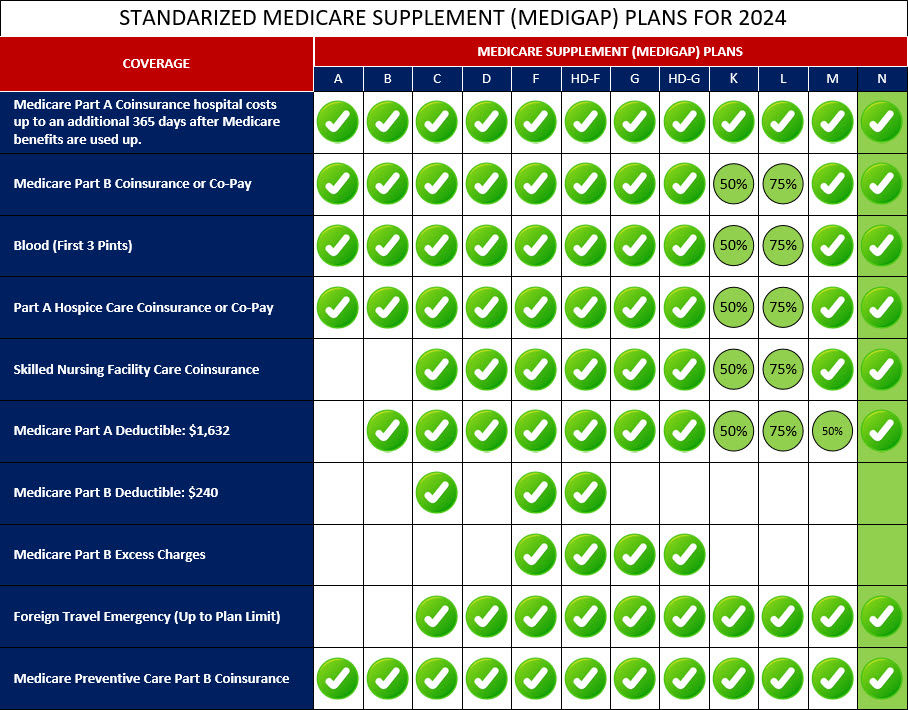

Medigap Plan N is a Medicare supplement insurance plan designed to provide coverage for certain medical expenses not covered by Original Medicare. It offers a balanced combination of benefits and cost-sharing.

With Medigap Plan N, you can expect coverage for Medicare Part A coinsurance and hospital costs, as well as Medicare Part B coinsurance or copayment. The plan covers your Part A deductible and provides coverage for skilled nursing facility care coinsurance. Additionally, it covers emergency care received during foreign travel.

However, it's important to note that Medigap Plan N does have some cost-sharing features. You will be responsible for paying the Medicare Part B deductible, as well as copayments for certain medical services such as visits to the doctor's office or emergency room. These copayments are generally a set amount or percentage of the cost, depending on the specific service.

Medigap Plan N can be a suitable choice if you're looking for a plan that offers comprehensive coverage for hospital stays and other major medical expenses, while also providing some cost-sharing to help keep premiums lower. It's important to evaluate your healthcare needs and budget to determine if this plan meets your specific requirements.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan N, which include benefits under Medicare Part A, Medicare Part B, and other areas: