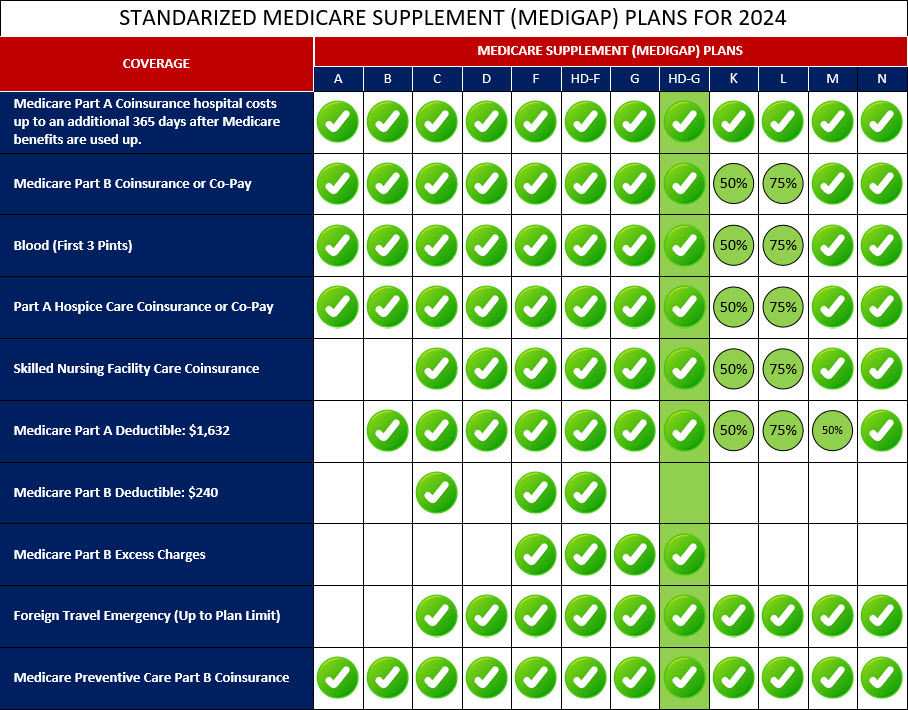

Medigap High-Deductible Plan G is a Medicare supplement insurance plan that offers coverage for various medical expenses, similar to other Medigap plans. However, it has a higher deductible compared to other plans.

With Medigap High-Deductible Plan G, you are responsible for paying a higher deductible amount out of pocket ($2,800 for 2024) before the plan begins covering your healthcare costs. Once you meet the deductible, the plan provides coverage for Medicare Part A coinsurance and hospital costs, Medicare Part B coinsurance or copayment, blood expenses, Part A hospice care coinsurance or copayment, skilled nursing facility care coinsurance, and more. This plan is designed for individuals who are willing to take on a higher initial cost in exchange for lower monthly premiums. It can be a suitable option if you are generally healthy and don't anticipate needing extensive medical care throughout the year.

It's important to carefully consider your healthcare needs and budget before choosing Medigap High-Deductible Plan G. Understanding the higher deductible requirement and evaluating your expected medical expenses will help you determine if this plan aligns with your healthcare coverage goals.

Below is a comprehensive list of the covered services provided by Medicare Supplement High-Deductible Plan G, which include benefits under Medicare Part A, Medicare Part B, and other areas: