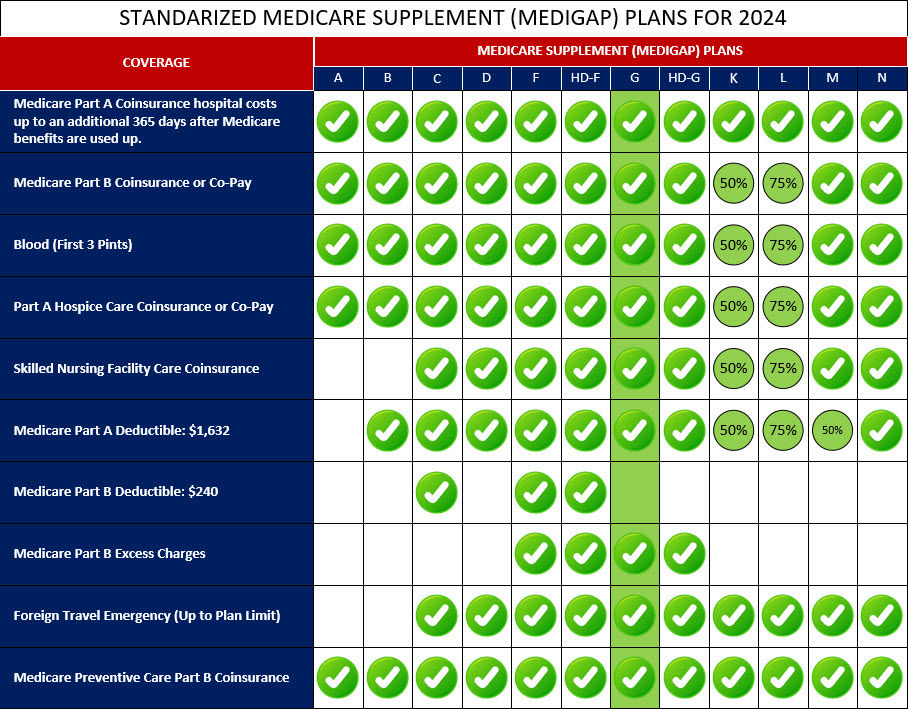

Medigap Plan G is a robust and comprehensive Medicare supplement insurance plan that offers extensive coverage to fill the gaps left by Original Medicare. It is designed to provide financial protection and peace of mind by covering a wide range of medical costs that are not fully covered by Medicare.

With Medigap Plan G, you can benefit from coverage for Medicare Part A coinsurance and hospital costs, which includes expenses incurred during hospital stays and certain skilled nursing facility care. It also covers Medicare Part B coinsurance or copayment, which helps with the costs of outpatient services, medical supplies, and doctor visits. Medigap Plan G includes coverage for blood expenses, ensuring that you have the necessary support for blood transfusions when needed. It also provides coverage for Part A hospice care coinsurance or copayment, offering additional financial assistance during end-of-life care. Additionally, Medigap Plan G covers the coinsurance for skilled nursing facility care, helping to alleviate the financial burden associated with extended stays in a skilled nursing facility.

Medigap Plan G is a popular choice among individuals who desire comprehensive coverage and are willing to pay a slightly higher premium. It offers extensive benefits and helps to minimize out-of-pocket expenses, providing a valuable safety net for your healthcare needs.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan G, which include benefits under Medicare Part A, Medicare Part B, and other areas: