| It is your responsibility to cover the premiums for both Part A (if applicable) and Part B of Medicare. Additionally, you are responsible for paying the monthly premium for your Medicare Supplement plan | Premium Cost | You are required to continue paying the premiums for Medicare Part B and, if applicable, Medicare Part A. Additionally, if you have a Medicare Advantage plan, you may need to pay a monthly premium for that as well. When you receive healthcare services, it is typical to be responsible for copayments, coinsurance, and/or deductibles. |

| You will have higher premiums but generally lower out-of-pocket expenses as you receive healthcare services | Out-of-Pocket Cost | You will have lower or no premiums but may have higher out-of-pocket expenses as you receive healthcare services |

| Medicare Supplement plans do not have network restrictions. You have the freedom to visit any medical facility and healthcare provider in the United States that accepts Medicare | Network | Medicare Advantage plans have a network of providers that you must stay within. However, it's important to note that emergency and urgent care visits are always covered when you are traveling within the United States |

| You have the freedom to select any doctor and hospital that have a contract with Medicare and accept Medicare patients | Doctors & Hospitals | You may need to select healthcare providers from the network of physicians and hospitals associated with the plan |

| You can consult with any specialist without needing a referral from your Primary Care Physician | Specialist Referrals | Before seeing specialists, you may need to obtain referrals |

| Prescription drug coverage is not provided and requires enrollment in a separate Part D Prescription Drug Plan, which entails an additional monthly premium | Prescription Drug

Coverage | Prescription drug coverage is typically included within most Medicare Advantage Plans |

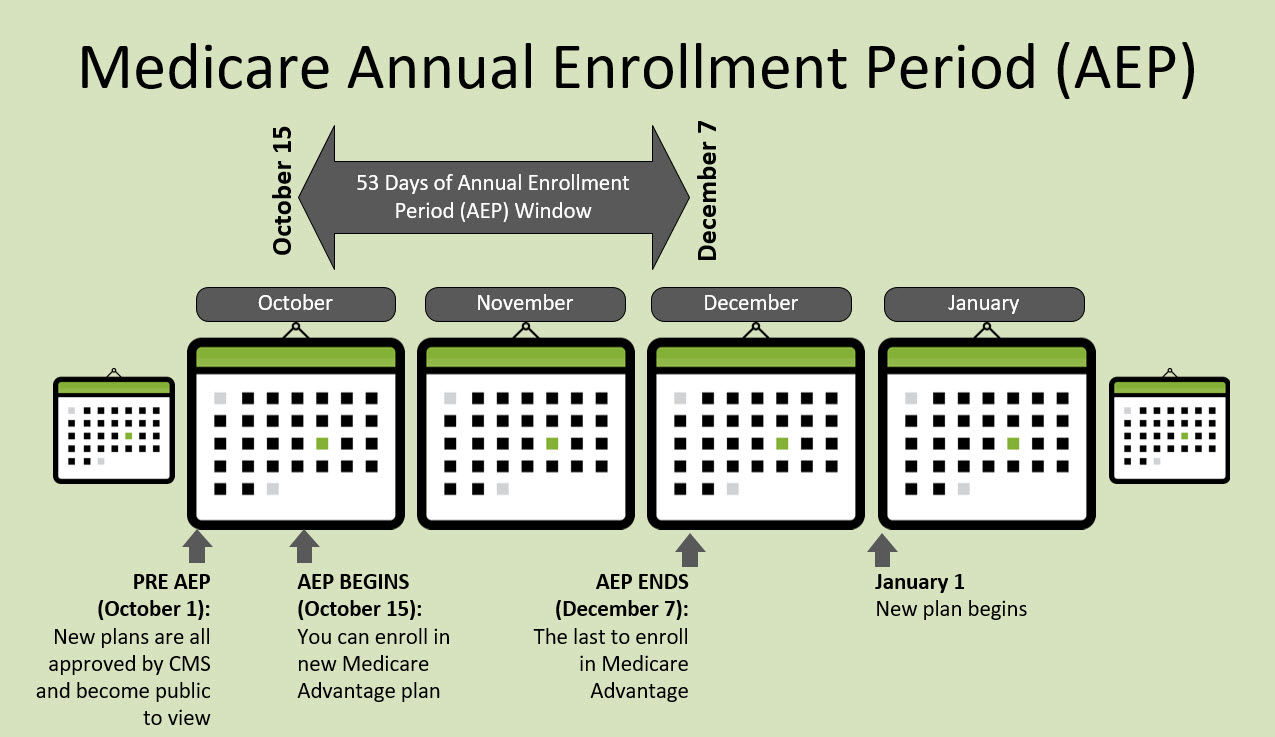

| Open all-year-round | Enrollment Periods | There are specific enrollment periods throughout the year that allow you to enroll or switch plans, such as the Initial Enrollment Period (IEP), Medicare Advantage Open Enrollment Period (MA OEP), and Medicare Annual Enrollment Period (AEP). It's important to note that when it comes to Medicare Advantage plans, there is typically no medical underwriting involved, providing you with more flexibility in selecting and changing plans |

| In general, most Medicare Supplement plans do not have a Maximum-Out-Of-Pocket (MOOP) limit, which means there is no cap on your out-of-pocket expenses. However, it's important to note that plans K and L are exceptions to this rule. These specific Medicare Supplement plans, namely Plan K and Plan L, do have their own set maximum limits on out-of-pocket costs | Out-of-Pocket

Maximums | CMS (Centers for Medicare and Medicaid Services) requires all Medicare Advantage plans to have a Maximum-Out-Of-Pocket (MOOP) limit. This means that there is a cap on the total amount you would need to pay out-of-pocket for covered services within a calendar year. The MOOP limit provides financial protection and helps ensure that beneficiaries do not face excessive costs for their healthcare expenses under Medicare Advantage plans. |

| Medicare Supplement plans generally do not include coverage for dental, vision, or hearing aids. However, some insurance carriers offer additional "buy-up" plans that provide these benefits for an additional premium. These buy-up plans can be added to your Medicare Supplement coverage to provide coverage for dental services, vision care, and hearing aids | Vision, Dental, and

Hearing Services | Medicare Advantage plans often provide coverage for a range of additional benefits beyond what is offered by Original Medicare. These can include benefits such as eye exams, eyeglasses, and corrective lenses for vision care. Dental exams, cleanings, and X-rays may also be covered for dental care |

| Certain Medicare Supplement plans offer extra coverage for medical emergencies during international travel. This additional coverage is not available in all Medicare Supplement plans and may vary depending on the specific plan and insurance provider | Foreign Travel | With most Medicare Advantage plans, coverage for services while traveling abroad is limited, typically only extending to medical emergencies |

| During the 6-month Open Enrollment Period for Medicare Supplement plans, you are guaranteed coverage without any exclusions or waiting periods for pre-existing conditions. This means that you can enroll in a Medicare Supplement plan and receive coverage for all your healthcare needs from the start | Pre-existing conditions | You can enroll in Medicare Advantage plans regardless if you have a pre-existing condition |

| Certain Medicare Supplement plans may include a fitness membership program as an additional benefit. This means that in addition to the standard coverage provided by the Medicare Supplement plan, you may also have access to a fitness membership at participating gyms or fitness centers | Additional Benefits | Certain Medicare Advantage plans may include benefits like fitness and wellness programs, transportation services, home modification/

maintenance services, telehealth and social worker teleservices, and more |