01

Special Needs Plans membership is limited to beneficiaries who have specific chronic illnesses, beneficiaries who are admitted to certain medical institutions or circumstances such as being eligible for both Medicare and Medicaid

Medicare Part C is Medicare Advantage plans. MA plans that include prescription drugs coverage are Medicare Advantage with Prescription Drugs (MAPD). On the other hand, MA plans that don't include prescription drugs coverage are are called MA only plans. MA only plans are good fit for Medicare beneficiaries who have drugs benefits from different sources such as Veterans Affairs, Tricare for Life, or other sources. MA and MAPD plans can be either an HMO, HMO-POS, or PPO.

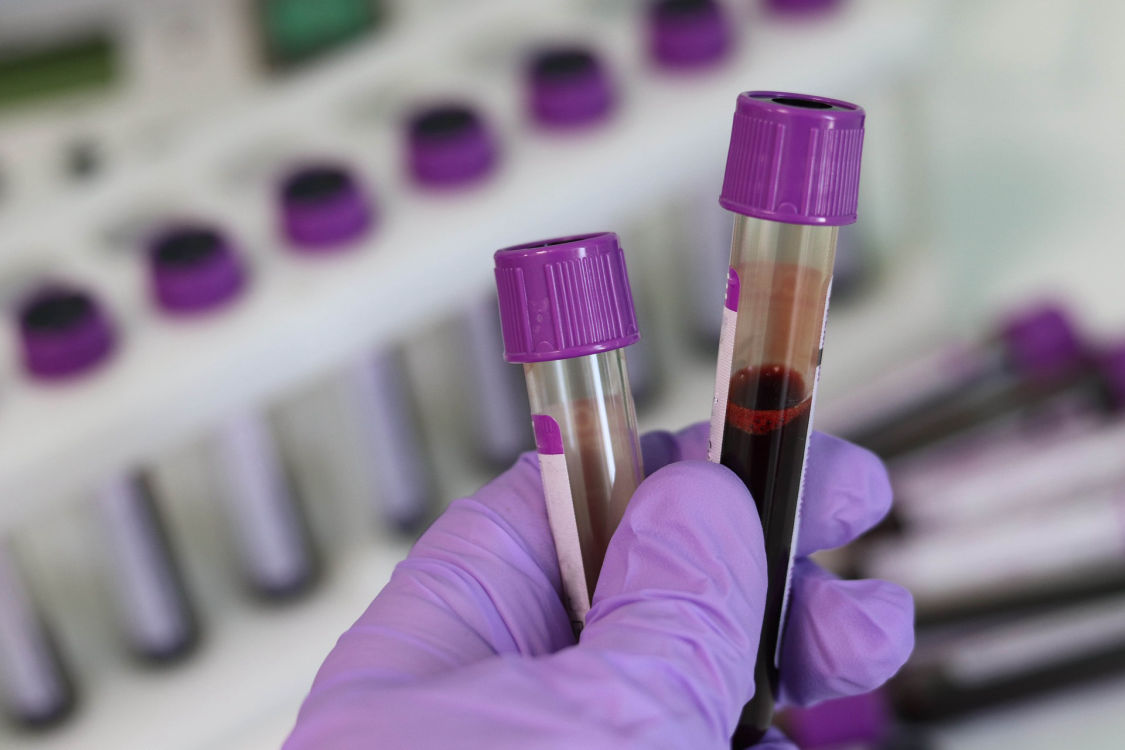

You will pay copays for many routine services like doctor’s visits, lab-work, ambulance, surgeries, hospital stays, urgent care and more. All MA plans have a Maximum-Out-of-Pocket (MOOP) limiting your annual health cost.

Medicare Part C covers all services covered all services offered by Original Medicare (Parts A and B). It will cover all hospital and inpatient services and all medical outpatient services. When you enroll in a Medicare Advantage plan, your insurance carrier will take over your health and it becomes your primary insurance. This is all possible because Medicare pays the insurance company to manage and coordinate your health.

When you have a Medicare Advantage, you will pay set copays by your plan instead of deductibles (for Part A is $1,600 and Part B is $226 for 2023) and the 20% coinsurance for Part B.

Part C Medicare Advantage plans are annually reviewed and approved by Medicare before they become available to view every year on October 1st. Every plan has a Summary of Benefits which lists all various medical services and their copays. As an example, the Summary of Benefits would list the copay for specialist doctor visit is $35 per visit. Another example would be for hospital stay daily copay of $250 per day for the first 5 days. Just as a comparison, if you only had Original Medicare and you had to stay one night in the hospital, you would be paying the Part A deductible of $1,556 if you stay one night or 5 nights.

The Summary of Benefits also list other real important cost information of your plan like annual medical and drug deductibles and most importantly your Maximum-Out-Of-Pocket (MOOP). The MOOP is the total sum of all Part A and B covered services that you pay for including deductibles (if any), copays, and coinsurance. Note that the MOOP does not include Rx copays, deductible and coinsurance. After you meet that MOOP, the plan pays 100% for all medical services till the end of the calendar year.

Medicare Advantage Plans come in different programs. Those programs are Health Maintenance Organization (HMO), Health Maintenance Organization-Point of Service (HMO-POS), Preferred Provider Organization (PPO), and Private Fee For Service (PFFS) plans

HMO stands for Health Maintenance Organization. Members of HMO plans must go to network providers to get medical care and services. That doesn't mean they can't ever see a doctor who's outside the HMO network. But, unless it's an emergency, the member may have to pay the whole cost for their medical care.

HMO-POS stands for Health Maintenance Organization with a point-of-service option. This is one type of Medicare Advantage plan. An HMO-POS plan has features of an HMO plan. One is a defined list of providers, often referred to as a network, that members must use for care and services.

PPO stands for preferred provider organization. Just like an HMO, or health maintenance organization, a PPO plan offers a network of healthcare providers you can use for your medical care. These providers have agreed to provide care to the plan members at a certain rate.

Special Needs Plans (SNPs) are a type of Medicare Advantage plan that provides coordinated care to beneficiaries with specific needs or situation. Special Needs Plans will have a network, usually either a Health Maintenance Organization (HMO), Health Maintenance Organization-Point of Service (HMO-POS) or a Preferred Provider Organization (PPO).

Here is how Medicare Advantage Special Needs Plans work:

Special Needs Plans membership is limited to beneficiaries who have specific chronic illnesses, beneficiaries who are admitted to certain medical institutions or circumstances such as being eligible for both Medicare and Medicaid

Special Needs Plans tailor their plan benefits, network and drug formulary to meet the needs of individuals according to the type of the Special Needs Plans

All Special Needs Plans include all of the same services as Original Medicare Parts A and B

All Special Needs Plans include a built-in Part D drug plan

All Special Needs Plans are Medicare Advantage plans approved by Medicare and run by private insurance companies

You must get all medical and hospital services, and prescription drug coverage services through that Special Needs Plan

Medicare SNPs can help you manage your different services and providers. They can make it easier for you to follow your doctor’s orders related to diet and prescription drug use

Medicare SNPs for people with both Medicare and Medicaid may also help people get help from the community and coordinate many Medicare and Medicaid services

All Special Needs Plans are either HMO or PPO plans and therefore you will have to get healthcare services from the plan's network

The Medicare SNP will still cover emergency or urgently needed care, even if you’re out of the plan’s service area.

Special Needs Plans may have a monthly premium in addition to the monthly Part B premium

Special Needs Plans may have cost-sharing such as deductibles, copays and coinsurance

Those Medicare Advantage Plans are designed for those beneficiaries who are qualified for both Medicare and Medicaid.

Those Medicare Advantage SNP plans are specifically designed to provide healthcare and support for those Medicare beneficiaries who are with certain chronic illness.

Those Medicare Advantage SNP plans are specifically designed for those who are living in certain institution such as nursing homes, assisted living center, and more.

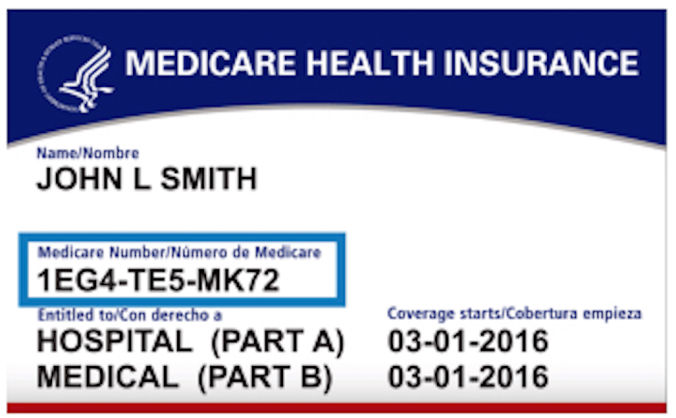

Anyone who is enrolled in both parts of Original Medicare (Parts A and B) is eligible for Medicare Part C. Prior to 2021, there was a single condition that prevented beneficiaries from enrolling in Medicare Advantage plans and that was if they have a medical condition called End Stage Renal Disease (ESRD) or kidney failure. The requirements to enroll are really simple and they are as follows:

You must be enrolled in both Medicare Part A and B and continue to pay your Part B premium. If you stop paying Part B monthly premium, you be automatically disenrolled from the Medicare Advantage plan.

You must live in the service are where the Medicare Advantage plan is offered. Your zip code is used to determine if you are eligible if you can enroll in the plan.

You can only enroll in or disenroll from Medicare Advantage plan during allowed enrollment period. Refer to the Medicare Advantage Enrollment and Disenrollment section for more detail.

At minimum, Medicare Part C plans must cover all services covered by Original Medicare (Parts A and B). It may also cover other extra benefits like dental, hearing, vision, and much more.

* with Medicare Advantage Drug Plans (MAPD) only. Prescriptions drugs are not available with Medicare Advantage (MA) only plans

Anyone who is enrolled in both parts of Original Medicare (Parts A and B) is eligible for Medicare Part C. Prior to 2021, there was a single condition that prevented beneficiaries from enrolling in Medicare Advantage plans and that was if they have a medical condition called End Stage Renal Disease (ESRD) or kidney failure. The requirements to enroll are really simple and they are as follows:

Many people are misled that their Medicare Part B monthly premium will go away once they are enrolled in a Medicare Advantage. That's simply not true unless you qualify for assistance through Medicaid in your state. To keep your Medicare Advantage plan active and in effect, you must continue to pay for your Part B premium which is $164.90 per month for 2023.

There are tens of Medicare Advantage plans offered in your service area with monthly premium ranging from $0 to $250. You must pay the monthly plan premium to keep it active. You can pay pay your monthly premium through automatic withdrawal from your Social Security Income or Railroad Retirement Income, or setting up monthly Electronic Fund Transfer (EFT). You can also pay by check or call customer service to pay over the phone. It is important to pay in a timely manner as you could be disenrolled from the plan if you don't pay. You will be with out benefits and you won't be able to enroll again until the next Annual Enrollment Period.

To enroll in, disenroll from, or change Medicare Advantage plans you must do so during certain enrollment periods. Each enrollment period has its own qualification criterion on what changes you can make to your current healthcare plan. Listed below are the most popular enrollment periods that beneficiaries use to enroll, disenroll, or change Medicare Advantage plans.

You can enroll in a Medicare Advantage Plan when you turn 65 and first become eligible for Medicare Part B.

You can enroll in new Medicare Advantage, change your Medicare Advantage, or disenroll from you current one.

This period is only for those who are enrolled in a Medicare Advantage. You can change your Medicare Advantage or you can disenroll and go back to Original Medicare.

In addition to Part B monthly premium, and the Medicare Advantage monthly premium, you are responsible for some cost-sharing like deductibles, coinsurance, and copays when using services covered under the Medicare Advantage plan. Refer to the Summary of Benefits for details.

Before the plan start paying for any medical services, you have meet your deductibles (if any). HMO plans usually no dedcutibles but HMO-POS and PPO plans may have some deductibles when you go out-of-network for medical services.

Some plans may have some deductibles for before the plan start paying for any medical services, you have meet your deductibles (if any). HMO plans usually no dedcutibles but HMO-POS and PPO plans may have some deductibles when you go out-of-network for medical services.

Some medical services like chemotherapy, dialysis, and durable medical equipment have 20% coinsurance that you will have to pay for.

Yes. Few plans available offered in your service area do not offer prescription drug coverage. Those plans are called Medicare Advantage (MA) Only plans. Similarly to the traditional Medicare Advantage with prescription drug coverage, the monthly premium for those types of plans are as low as $0.

Now, you might ask why are those types of plans exist? Well, some Medicare beneficiaries do not really need prescription drug coverage because they have creditable prescription drugs coverage from somewhere like the Veterans Affairs (VA), Tri-Care, unions, etc.

Other group of Medicare beneficiaries who might be a great fit for Medicare Advantage (MA) only plans are those who have high Part D Late Enrollment Penalty. That's because MA Only plans do not have Part D Prescription Drugs coverage embedded in it, and therefore Medicare will not charge you the Part D Late Enrollment Penalty because you don't have Part D coverage.

Medicare Advantage (MA) only plans tend to offer more extra benefits than traditional Medicare Advantage plans. Some of these benefits might be Part B Premium Giveback, higher dental, vision, hearing aid, and Over-The-Counter limits.

There are tens or perhaps hundreds of Medicare Advantage plans in your service area and choosing the right one for you is quite an intricate task. Meeting with a Medicare Advisor can make the process less complicated and fairly straight forward. Our philosophy is to be unbiased when it comes to choosing the insurance carrier and the plan. Our promise is to place you in the plan that provide you the maximum in term of health benefits and cost.

We understand that transitioning from non-Medicare plan whether it is employer group plan, Affordable Care Act (ACA) plan into Medicare can be very cumbersome! Therefore, meeting with an experienced Medicare Advisor, we will explain to you the ABCs of Medicare, the differences between the plan you currently have and the new world of Medicare. Everything will be transparent and we will suggest the right Medicare plan for you.

We will take into consideration the premium cost you can afford, if your doctors and hospital are in network, freedom of accessing healthcare, copays, deductible, Maximum-Out-Of-Pocket, prescription cost, and any other matter that concern you. We will look at all factors and discuss the pros and cons of all viable options. We will complete the enrollment process with and we will continue to sustain a great relationship and provide full service to you while you use the plan.

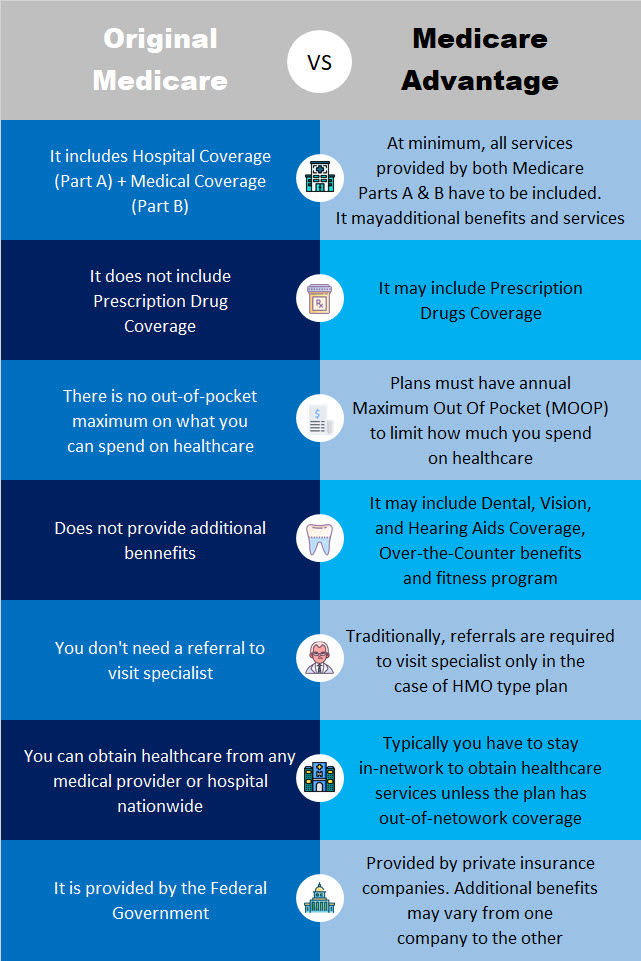

Original Medicare only includes Part A and Part B. Unlike Medicare Advantage, Original Medicare does not have an Maximum-Out-Of-Pocket (MOOP) . Medicare Advantage plans have limitations on where you can go to get healthcare while with Original Medicare, you can use any healthcare provider to obtain healthcare.

The chart below reveals the major differences between Original Medicare and Medicare Advantage Plans. These differences can affect your healthcare cost, healthcare access restrictions, extra benefits and more.

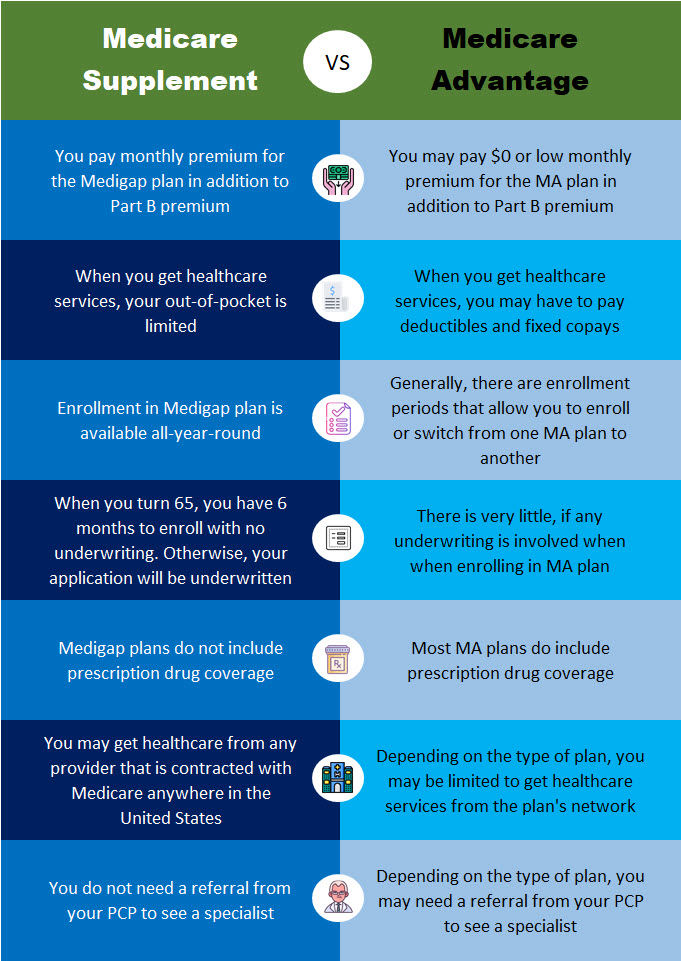

The chart below reveals the major differences between Medicare Supplement and Medicare Advantage Plans. These differences can affect your healthcare cost, healthcare access restrictions, extra benefits and more.

Yes! Part C Medicare Advantage does not replace your Medicare Part B. In order to stay enrolled in your Part C plan, you must remain enrolled in both Medicare Parts A and B and must continue to pay your Part B premium. If you drop either Part A or B, you will automatically be disenrolled from your Medicare Advantage plan.

Insurance companies are paid by Medicare to take on your medical risk. The monthly Part B premium you pay goes towards paying that Advantage company to insure you. This is why you must continue to be enrolled in both Medicare Parts A and B while you are enrolled in a Medicare Advantage plan. It is also the reason why some Medicare Advantage plans have $0 monthly premium because Medicare is paying on your behalf. Once you are enrolled in a Medicare Advantage, the plan is responsible to pay for

medical services.

No. Medicare Advantage does not replace Original Medicare. In fact, to remain enrolled in Medicare Advantage, you must be enrolled in both Parts A and B. When you sign up for Medicare Advantage, you are agreeing to accept the terms, fee schedule, networks, and all the rules of your plan. You will no longer pay the Original Medicare Parts A and B deductibles, copays, and coinsurance of Original Medicare Parts A and B.