Medicare is a federally-administered health insurance program designed to provide coverage for individuals who meet certain eligibility criteria. It primarily caters to people aged 65 and older, individuals with specific disabilities, and those with permanent kidney failure who require dialysis or a transplant. The program consists of two main parts: Part A, commonly referred to as hospital insurance, and Part B, known as medical insurance.

Medicare Part A, established in 1965, provides healthcare coverage for U.S. citizens aged 65 and above. It is one part of the Original Medicare program, along with Medicare Part B. In 1966, Medicare Part A became effective, extending coverage to over 19 million Americans. Its main focus is on inpatient hospital services like hospital stays, medications given when hospitalized, basic hospital meals, in-hospital lab services, home healthcare, skilled nursing home, and hospice care.

Medicare Part B, established in 1965 as part of the Original Medicare program, Medicare Part B is specifically designed to cater to individuals aged 65 and above. It operates alongside Medicare Part A, which primarily covers hospital services. Part B focuses on delivering outpatient medical services to beneficiaries, encompassing various forms of care, such as outpatient medical services like doctor's visits, emergency and urgent care visits, medications given at doctor's office, lab services, durable medical equipment, outpatient surgical procedures, ambulance services, diagnostic radiology, radiation and chemotherapy, some immunizations, and diagnostic procedure. Part B also covers preventive care including flu shots, colonoscopies, mammograms and more.

No, Medicare coverage works similarly to Group Health Insurance, where you are responsible for deductibles, copays, and coinsurance when you receive medical services.

A deductible is the amount you must pay each year before Medicare starts paying its portion of your medical cost. Both Medicare Part A (Hospital Insurance) and Part B (doctor services) have deductibles. Medicare Part A has a deductible of $1,632 for 2024 for each benefit period and Medicare Part B has a deductible of $240 for 2024.

Coinsurance is a percentage of your medical bill that you have to pay after you meet your deductible. For Medicare Part B, Medicare pays 80% of the bill and leaves you with 20% for you to pay. You will continue to pay your 20% share until the end of the year and there is no cap on how much you pay.

Original Medicare does not provide coverage for prescription drugs. However, there are certain circumstances where Medicare may cover medications administered during inpatient stays at hospitals or outpatient visits to doctors' offices. Examples of drugs that Medicare may cover include immunosuppressive drugs for transplant patients and oral anti-cancer drugs.

To qualify for Medicare, you must be:

To initiate the application process for Medicare, you can get in touch with the Social Security Administration. There are multiple options available for submitting your application, such as online filing, phone assistance, or visiting a nearby Social Security Administration Office in person. Additionally, if you are also interested in applying for Social Security Income (SSI) benefits, you can do so simultaneously.

Applying for Medicare online is a simple and efficient process. To get started, you'll need to create a secure online account on the Social Security Administration website and log in to complete your application.

To apply for both Social Security Income (SSI) benefits and Medicare simultaneously, please visit the following link:

https://www.ssa.gov/benefits/retirement/apply.html

If you only wish to apply for Medicare, please visit this link:

https://www.ssa.gov/benefits/medicare

Once you've submitted your application, the Social Security Administration will process it accordingly.

If you have any questions or need assistance, please don't hesitate to contact us. We have experience helping numerous individuals navigate through this process successfully.

You may contact Medicare Social Security at (800) 772-1213 (for TTY users, the number is (800) 325-0778. You will speak to a live Social Security representative and you let them know that you wish to apply for Medicare and/or Social Security Income (SSI). If you have Railroad Retirement, you can contact the U.S. Railroad Retirement Board at (877) 772-5772 and they can help you do the same.

Visiting your local Social Security Administration (SSA) office might be convenient for some people if the office is close to your residence or work place. You can search for the nearest Social Security Administration (SSA) office online on the https://secure.ssa.gov/ICON/main.jsp. You will meet with an Social Security representative and they can assist to apply for Medicare and/or Social Security Income (SSI)

If you currently receive Social Security Income (SSI), Railroad Retirement, or disability benefits, Medicare Part A and Part B will be automatically assigned to you. Your Medicare identification card, commonly known as the RED, WHITE, AND BLUE card, will be mailed to you approximately three months before you reach the age of 65. This period of enrollment is referred to as your Initial Enrollment Period (IEP). During this time, you have the opportunity to choose between Medicare Advantage (Part C) or Medicare Prescription Drug Plans (Part D) to enhance your coverage. If you decide to decline Part B coverage, it is crucial to inform the Social Security Administration of your decision to opt out. Subsequently, you will receive a new Medicare ID card indicating that you are exclusively enrolled in Medicare Part A.

If you have employer-sponsored group insurance that provides creditable coverage, you have the option to delay enrolling in Original Medicare (Parts A & B) beyond the age of 65. However, it is common for most individuals to choose to enroll in Part A because it does not have a premium and can serve as secondary coverage alongside their group insurance.

If you have chosen to delay enrollment in Part A but later decide to apply for it, you will have a Special Enrollment Period (SEP) of eight months to do so. This allows you a specific window of time to enroll in Part A without facing any penalties or late enrollment fees.

Certainly! You have the option to enroll in Original Medicare even if you previously delayed enrolling. You may qualify for a Special Enrollment Period (SEP) based on certain circumstances. If you had group health insurance through your employer or your spouse's employer while working, you may not have to pay the Late Enrollment Penalty for Part B.

If you have been receiving Social Security Disability Insurance (SSDI) or Railroad Retirement Board (RRB) disability benefits for 24 months, you will be automatically enrolled in Medicare Parts A and B. This will be your Initial Enrollment Period (IEP). You will receive your Medicare ID card in the mail about three months before your coverage starts. You can then choose Medicare Advantage or Prescription Drug Plans: Once enrolled in Medicare Parts A and B, you have the option to enroll in a Medicare Advantage plan (Part C) or a Medicare Prescription Drug Plan (Part D) to enhance your coverage.

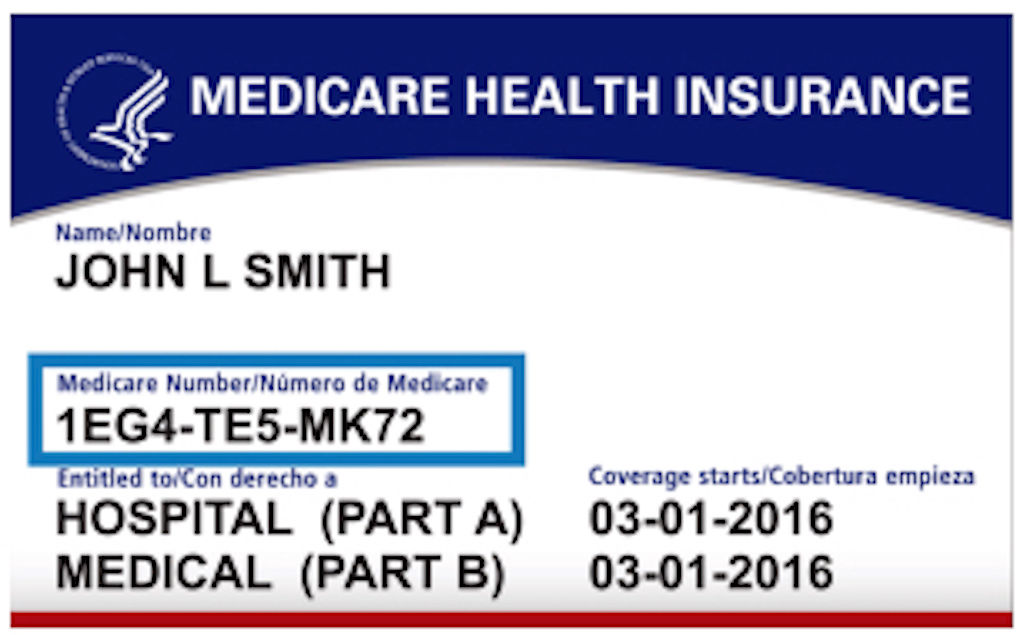

The Medicare ID Card is an official document issued by the government to every Medicare recipient in the United States. It contains essential details pertaining to your Medicare coverage. The card includes your full legal name, a unique Medicare number comprising 11 alphanumeric digits, as well as two dates indicating the initiation of your Part A and Part B coverage.

In the past, Medicare cards used to display the individual's Social Security Number as their Medicare number. However, in order to enhance security and protect beneficiaries from potential identity theft, Medicare took the initiative to eliminate the Social Security Number from the Medicare card. This change serves to safeguard personal information and reduce the risk of unauthorized access to sensitive data.

The Income-Related Monthly Adjusted Amount (IRMAA) may apply to individuals with higher incomes, resulting in an additional premium for Medicare Part B. The table provided below illustrates the impact of your income on your 2024 Part B Monthly Premium:

| File individual tax

return | File joint tax return | File married &

separate tax return | You pay (in 2024) |

| $103,000 or less | $206,000 or less | $103,000 or less | $174.70 |

| above $103,000 up

to $129,000 | above $206,000 up to

$258,000 | not applicable | $244.60 |

| above $129,000 up

to $161,000 | above $258,000 up to

$322,000 | not applicable | $394.40 |

| above $161,000 up

to $193,000 | above $322,000 up to

$386,000 | not applicable | $428.60 |

| above $193,000 and

less than $500,000 | above $386,000 and

less than $750,000 | above $103,000 and

less than $397,000 | $527.50 |

| $500,000 or above | $750,000 or above | $397,000 or above | $560.50 |

Failure to enroll in Medicare Part B when you are first eligible can result in a late enrollment penalty. The penalty increases your monthly premium by 10% for each 12-month period that you could have had Part B but did not enroll. For instance, if you went without Part B for 14 months, you would face a 10% penalty. If the period extends to 26 months, the penalty would be 20%. Suppose you go without Part B for 2 years. In 2023, the standard Part B premium is $164.90. As a result, your monthly premium would be $197.88, which is $32.98 higher than the standard premium due to the 20% penalty. It's important to note that the Part B late enrollment penalty remains in effect for life. You can use the form below to calculate your Part B Late Enrollment Penalty.

Your Part B Late Enrollment Penalty (US$):

This is the dollar amount you will have to pay every month

in addition to the monthly premium of the Medicare Part B!

Medicare Part C, or Medicare Advantage, provides comprehensive coverage that includes all the services offered by Original Medicare (Parts A and B). These plans are administered by private insurance companies under contract with the federal government to deliver Medicare benefits. Some Medicare Advantage plans also include prescription drug coverage (Part D). Alongside the coverage provided by Original Medicare, Medicare Advantage plans offer additional benefits such as dental, vision, hearing care, transportation services, and much more. Some plans may even offer over-the-counter benefits and access to fitness memberships.

Medicare Advantage (MA) plans are not a substitute for Original Medicare, but rather an alternative way to receive your Medicare benefits. To enroll and stay enrolled in a Medicare Advantage plan, you must already be enrolled in both Medicare Part A and Part B.

When you choose to enroll in a Medicare Advantage plan, you are essentially agreeing to receive your Medicare Part A and Part B benefits through a private insurance company that offers the plan. This means that the Medicare Advantage plan becomes your primary source of coverage, and you will no longer receive your Medicare benefits directly from Original Medicare.

Medicare Advantage plans are required to provide at least the same level of coverage as Original Medicare, which includes hospitalization (Part A) and medical services (Part B). However, Medicare Advantage plans may have their own unique rules, costs, and coverage limitations that differ from Original Medicare.

With a Medicare Advantage plan, you will typically pay copayments or coinsurance for the healthcare services you receive, instead of the deductibles, copayments, and coinsurance associated with Original Medicare. Additionally, Medicare Advantage plans may have their own network of healthcare providers that you are required to use in order to receive covered services.

Before enrolling in a Medicare Advantage plan, it's crucial to thoroughly review the plan's terms, fee schedule, provider networks, and rules. This will help you understand the costs, coverage, and provider options available to you under the plan. Consulting with a Medicare advisor or representative can also provide valuable guidance and help you make an informed decision about your healthcare coverage.

The table below summarizes the main differences between Original Medicare and Medicare Advantage:

| Original Medicare | Versus | Medicare Advantage |

|---|---|---|

| Original Medicare provides coverage for hospital services (Part A) and medical services (Part B). It includes inpatient hospital stays, doctor visits, preventive care, and some medical equipment. However, it does not cover prescription drugs, dental, vision, or hearing care. | Coverage | Medicare Advantage plans provide all the coverage of Original Medicare (Part A and Part B) and often include additional benefits such as prescription drug coverage (Part D), dental, vision, hearing, and wellness programs. Medicare Advantage plans are offered by private insurance companies approved by Medicare. |

| With Original Medicare, you generally pay a monthly premium for Part B and Part A (if applicable) | Premium Cost | Medicare Advantage plans usually have a monthly premium in addition to the Part B premium and Part A (if applicable). Some Medicare Advantage plans have a $0 premium |

| Part A and Part B deductibles, coinsurance, and copayments for services | Out-of-Pocket Cost | You are required to utilize healthcare providers within your local and regional network. In the case of a PPO, you have the option to seek services outside of the network, but it may result in additional costs or fees |

| No limit | Maximum-Out-of-Pocket (MOOP) | The out-of-pocket costs, such as deductibles, copayments, and coinsurance, vary depending on the specific plan |

| You can visit any healthcare provider that accepts Medicare patients. There are no network restrictions, giving you a wide choice of doctors, hospitals, and specialists nationwide | Provider Network | Medicare Advantage plans have a network of healthcare providers. You typically need to use doctors and hospitals within the plan's network, although emergency care is covered anywhere in the United States |

| Under Original Medicare, you have the freedom to see any specialist or receive medical services without referrals | Coordination of Care | Medicare Advantage plans often require you to choose a primary care doctor and obtain referrals to see specialists. This can help coordinate your healthcare and manage your overall care |

| Original Medicare does not include prescription drug coverage. To obtain prescription drug coverage, you can enroll in a separate Medicare Part D plan | Prescription Drug Coverage | Most Medicare Advantage plans include prescription drug coverage (Part D) as part of their benefits package |

| Original Medicare does not cover additional benefits like dental, vision, or hearing care | Additional Benefits | Medicare Advantage plans often offer additional benefits such as dental, vision, hearing, fitness programs, and wellness services |

Medicare Advantage plans come in different types of programs including Health Maintenance Organization (HMO), Health Maintenance Organization-Point of Service (HMO-POS), and Preferred Provider Organization (PPO), Private Fee-for-Service plans (PFFS), and Medicare Medical Savings Account (MSA). The table below outlines the main differences between HMO, HMO-POS and PPO plans:

| HMO | HMO-POS | PPO | |

|---|---|---|---|

| Is there provider network? | Generally have a network of doctors, hospitals, and other healthcare providers that you must use to receive coverage | Similar to HMO plans but may offer some out-of-network coverage, typically at a higher cost | Offer more flexibility in choosing healthcare providers, allowing you to receive care both in-network and out-of-network |

| Do I need a Primary Care Provider? | Typically require you to choose a primary care physician (PCP) who will coordinate your care and provide referrals to specialists | Typically require you to choose a primary care physician (PCP) who will coordinate your care and provide referrals to specialists | You are not required to choose a primary care physician (PCP) |

| Do I need referral to see specialist? | Most HMO plans require referrals for specialist visits | You may be able to see out-of-network providers, but it usually requires a referral from your PCP | Generally, you don't need a referral to see a specialist |

| Are Out-of-Network services covered? | Out-of-network services are typically not covered, except for emergency care or urgent care in certain situations | Out-of-network services may have higher copayments or coinsurance compared to in-network services | Monthly premiums and out-of-pocket costs are typically higher compared to HMO plans |

Yes, that's correct! Medicare Advantage Only plans are specifically designed for individuals who have creditable prescription drug coverage from other sources, such as the Veterans Affairs (VA), Tri-Care, or certain unions. These plans provide all the benefits and coverage of traditional Medicare Advantage plans but without the inclusion of prescription drug coverage (Part D).

Medicare Advantage Only plans often have low or even $0 monthly premiums, making them an affordable choice for beneficiaries who already have prescription drug coverage and do not require additional Part D coverage. These plans offer the same basic benefits as Original Medicare, including hospital (Part A) and medical (Part B) coverage.

In addition to the standard Medicare benefits, Medicare Advantage Only plans may also offer additional benefits such as enhanced dental coverage, vision benefits, hearing aid coverage, and higher allowances for over-the-counter items. The specific benefits and coverage can vary depending on the plan and insurance company.

If you have creditable prescription drug coverage and are considering a Medicare Advantage Only plan, it's important to carefully review the plan details, including the network of providers, additional benefits, and costs. Comparing different plans and consulting with a Medicare advisor can help you choose the plan that best fits your healthcare needs and preferences.

Special Needs Plans (SNPs) are a specific type of Medicare Advantage plan that is designed to provide coordinated care to beneficiaries with specific needs or situations. SNPs are tailored to address the unique healthcare needs of certain individuals, such as those with chronic illnesses, disabilities, or who reside in certain institutional settings.

SNPs operate with a network of healthcare providers, which can be structured as a Health Maintenance Organization (HMO), Health Maintenance Organization-Point of Service (HMO-POS), or a Preferred Provider Organization (PPO), depending on the specific SNP.

There are three different Special Needs Plans (SNPs) as described below:

In general, all individuals who are enrolled in both Parts A and B of Original Medicare are eligible to enroll in Medicare Advantage plans.

To enroll in any type of Special Needs Plans (SNPs), individuals must be enrolled in both Parts A and B of Original Medicare in addition to the following requirements for each Special Needs Plan:

For most individuals, to enroll in, disenroll from, or change Medicare Advantage plans you must do so during certain enrollment periods. Based on specific timing and special circumstances, the following enrollment periods provide opportunities to enroll, disenroll, or change Medicare Advantage plans:

Upon becoming eligible for Medicaid, whether it's partial or full coverage, you will gain access to a special enrollment period known as the Change in Medicaid Status Special Enrollment Period (SEP). This SEP allows you to enroll in a Dual Eligible Special Needs Plan (D-SNP). The Change in Medicaid Status SEP begins in the month when you receive notification of your Medicaid status change and lasts for a duration of three months. If you decide to enroll in a Medicare Advantage plan, it will become effective on the first day of the following month.

Similarly, if you lose your eligibility for Medicaid, you will also have the same Change in Medicaid Status Special Enrollment Period (SEP) to enroll in a Medicare Advantage plan, whether with or without prescription drug coverage.

Furthermore, there exists a continuous open enrollment period for making changes to Dual Eligible Special Needs Plans (D-SNPs) and enrolling in a different D-SNP, known as the Medicaid Special Enrollment Period (SEP). Alternatively, you have the option to discontinue your D-SNP coverage altogether, return to Original Medicare, and select a stand-alone Prescription Drug Plan (PDP). This provides you with the flexibility to enroll, disenroll, or switch D-SNPs during specific periods throughout the year. The available opportunities for enrollment are as follows:

If you decide to enroll in a D-SNP in any given quarter, your plan will become effective on the first day of the following month. For instance, if you enroll in January, your plan will start on February 1st. If you wish to make another change, you will need to wait until the second quarter of the year. Apart from the first three quarters, there is an additional enrollment opportunity during the Annual Enrollment Period (AEP) when all Medicare recipients can make changes. During this period, if you enroll in a new plan, it will begin on January 1st.

In order to be eligible for enrollment in a Chronic Special Needs Plan (C-SNP), you must have a qualified chronic medical condition. When enrolling in a C-SNP, you will utilize the Chronic Condition Special Needs Plan (C-SNP) Special Enrollment Period (SEP). This SEP begins in the month when you were diagnosed with the chronic condition and remains open until you enroll in the available C-SNP plan in your area. The effective date of your C-SNP plan will be the first day of the subsequent month.

If, at a later point, you no longer meet the qualifications for the chronic condition, you will need to disenroll from the C-SNP plan. You can then choose to enroll in a Medicare Advantage plan with or without prescription drug coverage or revert back to Original Medicare and enroll in a Prescription Drug Plan. To facilitate this change, you will have a special enrollment period (SEP) known as the Losing Chronic Condition Status Change Special Enrollment Period (SEP). This SEP begins in the month when you lost your chronic medical condition and extends for a period of three months. Your new plan will become effective on the first day of the following month.

To meet the eligibility criteria for enrollment in an Institutional Special Needs Plan (I-SNP), you need to be residing in an approved health institution. When you decide to enroll in an I-SNP, you will make use of the Institutional Special Needs Plans (I-SNPs) Special Enrollment Period (SEP). This SEP starts in the month when you are admitted to the institution and extends for two months following your discharge. The effective date of your I-SNP plan will be the first day of the following month.

The monthly expenses for Medicare Advantage plans can differ based on factors such as the chosen plan, location, and the coverage provided. Certain Medicare Advantage plans involve premiums, which are monthly charges added to your Medicare Part B premium. It's worth noting that not all Medicare Advantage plans have premiums, and some plans even offer premiums as low as $0. In the Metro Detroit area, the monthly premium costs for Medicare Advantage plans in 2024 typically range from $0 to $300.

If you already have Part B and/or Part D penalties when you enroll in Medicare Advantage, the penalties will generally still apply. Medicare Advantage plans are required to provide at least the same level of coverage as Original Medicare (which includes Part A and Part B), and many Medicare Advantage plans also include prescription drug coverage (Part D). However, enrolling in a Medicare Advantage plan does not automatically waive any penalties you may have incurred for late enrollment in Part B or Part D. These penalties are typically based on the number of months you were eligible for Part B or Part D but did not enroll. It is important to consult with the Social Security Administration or Medicare to understand your specific situation and any potential penalties you may owe.

Medicare Advantage Plans with Prescription Drugs offer coverage for retail and mail-order prescription medications similar to standalone Prescription Drug Plans (Part D). In the case of Part C plans, a collaboration between insurance carriers and CMS is necessary to determine the specific plan details, including the covered drugs, which are listed in the Drug Formulary. These plans often utilize a structure called Drug Tiers, which indicate the cost-sharing responsibilities for different medications. Additionally, Part C plans may have Pharmacy Networks, which involve insurance carriers partnering with specific pharmacies to provide lower costs for prescriptions. For comprehensive information, please refer to the Prescription Drug Plans (Part D) FAQ's for specific details.

Insurance companies are paid by Medicare for your health risks. The monthly Part B premium you pay is used to pay Medicare Advantage to insure you. For this reason, you must continue to be enrolled in Parts A and B of Medicare while you are enrolled in a Medicare Advantage program. It is also why some Medicare Advantage plans have a monthly premium of $0 as Medicare pays on your behalf.

Choosing the right Medicare Advantage plan can indeed be a complex task, especially when transitioning from a non-Medicare plan. It's important to consider various factors such as premium costs, network coverage, access to healthcare, copays, deductibles, Maximum-Out-Of-Pocket limits, prescription coverage, and other individual concerns.

Meeting with an experienced Medicare Advisor can be immensely helpful during this process. They can guide you through the ABCs of Medicare, explaining the differences between your current plan and the world of Medicare. Their expertise can ensure that you have a clear understanding of the options available to you and help you make an informed decision.

A transparent approach is crucial, and a reliable Medicare Advisor will provide you with unbiased information and recommendations. They will carefully consider your specific needs and preferences, taking into account factors like affordability, preferred doctors and hospitals, desired freedom in accessing healthcare, and any other concerns you may have.

During the consultation, the Medicare Advisor will discuss the pros and cons of viable options, giving you a comprehensive understanding of each plan's benefits and potential drawbacks. They will work closely with you to find the right Medicare Advantage plan that meets your requirements.

Additionally, a trustworthy Medicare Advisor will assist you with the enrollment process, ensuring that all necessary paperwork is completed accurately and efficiently. They will also continue to provide ongoing support and service throughout your enrollment period, maintaining a strong relationship with you.

Here are some potential pros and cons to consider when evaluating Medicare Advantage:

Medicare Part D, also known as the prescription drug plan (PDP), was established in 2006 as a component of Medicare to provide coverage for retail or mail-order prescriptions. These Part D plans are overseen by the Centers for Medicare & Medicaid Services (CMS) but are offered by private insurance companies.

Part D Prescription Drug Plans provide coverage for retail and mail-order prescription drugs. For Part D plans, collaboration between insurance carriers and CMS is required to determine the specific details of the plan, including the drugs covered, also known as the Drug Formulary list. These plans typically have a structure called Drug Tiers, which outline the cost you will be responsible for paying for different medications. Additionally, Part D plans may have Pharmacy Networks, which means that the insurance carrier has contracted with specific pharmacies to offer you lower costs for your prescriptions.

A formulary refers to a comprehensive list of generic and brand-name prescription drugs covered by your Part D Prescription Drug Plan (PDP). Insurance companies regularly create or update this list to include a wide range of effective medications at affordable costs for beneficiaries. It's important to note that the insurance company will only provide coverage for medications that are included in their formulary.

Based on the cost of medications, insurance carriers categorize prescription drugs into different tiers. Typically, a Part D plan consists of five tiers, which help determine the amount you will need to pay at the pharmacy for each medication.

Part D Prescription Drug Plans (PDPs) utilize a formulary list that organizes medications into five distinct categories, known as Drug Tiers. These tiers are determined based on the type and cost of the drugs, and they are as follows:

The Drug Tiers in the Part D formulary list provide a framework for determining the coverage and cost-sharing requirements for each medication. It's important to review the formulary list of your specific Part D plan to understand how different drugs are categorized and what expenses you may incur for each tier.

Part D Prescription Drug Plans (PDPs) often establish contracts with retail or mail-order pharmacies, which are referred to as Preferred Pharmacy Networks. These networks enable beneficiaries to access lower cost-sharing options for their medications. Pharmacies outside of the Preferred Pharmacy Network are referred to as non-preferred, standard, or out-of-network pharmacies. The primary advantage of using a Preferred Pharmacy is that you may have lower copayments and coinsurance for your drugs compared to standard pharmacies.

To enroll in a Medicare Part D Prescription Drug Plan (PDP), it is necessary to already be enrolled in Medicare Part A and/or Part B. Additionally, you must reside in the service area where the specific Part D plan is being offered. Your zip code plays a crucial role in determining whether the Part D plan is available in your area.

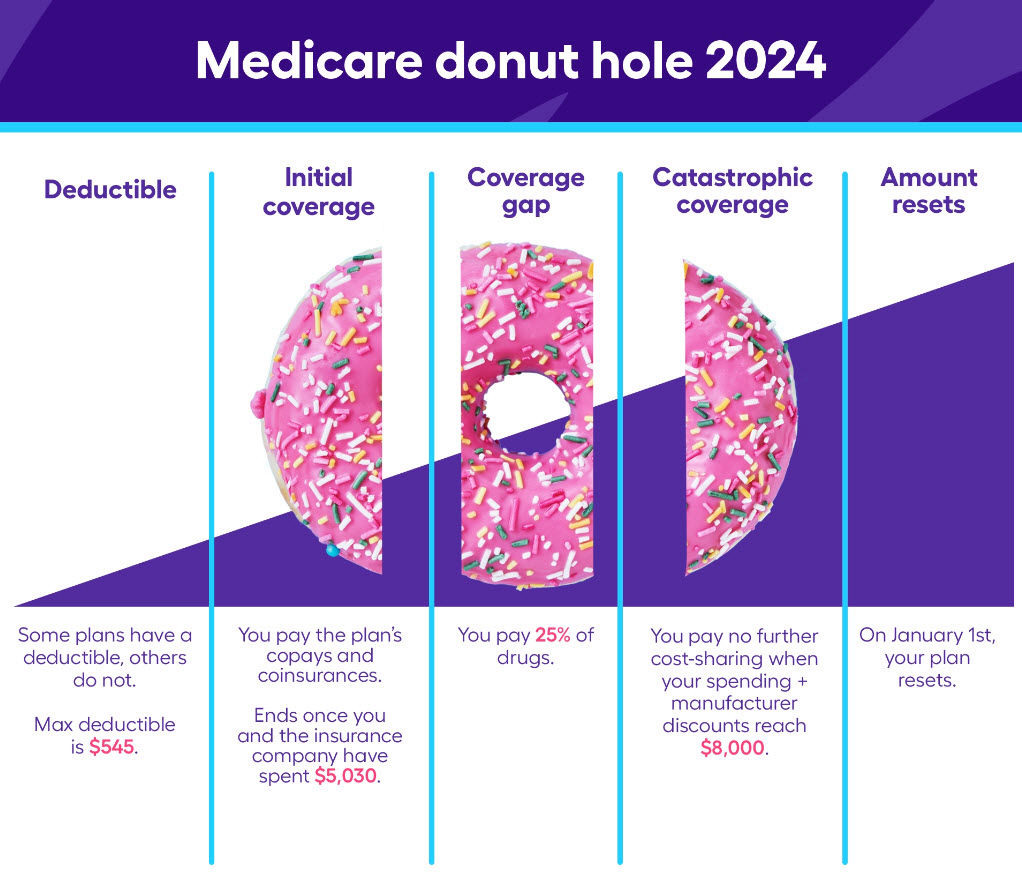

Part D cost-sharing involves the division of prescription drug costs between Medicare Part D beneficiaries and the program itself. When enrolled in a Medicare Part D prescription drug plan or a Medicare Advantage plan with prescription drug coverage, beneficiaries are responsible for certain out-of-pocket expenses related to their medications. These costs encompass various phases, including:

It's important to note that these stages and cost-sharing details may vary depending on the specific Part D plan chosen. Beneficiaries should review the information provided by their chosen plan or consult the official Medicare resources for the most accurate and up-to-date information.

The Medicare Part D Coverage Gap Phase, also known as the "Donut Hole," is the stage that follows the Initial Coverage Phase in Part D coverage. You enter the "Donut Hole" once your total drug costs, including what you and your plan have paid for your drugs, reach a certain threshold. In 2024, this threshold is set at $5,030.

Once you enter the "Donut Hole," you are responsible for a percentage of the cost of your drugs. For generic and brand-name drugs, this percentage is 25%. During this stage, the drug manufacturer covers 70% of the cost, while the Part D plan covers only 5%.

You will remain in the "Donut Hole" until the total amount you and your plan have paid for drugs reaches $8,800. Once this threshold is met, you exit the "Donut Hole" and transition to the Catastrophic Stage.

It's important to note that the amounts and thresholds mentioned may vary from year to year, as they are determined by Medicare. It's advisable to review your specific plan's details, including the Summary of Benefits or Evidence of Coverage, to understand the exact thresholds and cost-sharing percentages applicable to your Part D plan.

During the Coverage Gap Phase, some generic drugs may be available at a discounted rate, thanks to agreements between Medicare and drug manufacturers. This discount is taken into account when calculating your out-of-pocket costs and the total amount applied toward exiting the Coverage Gap.

The Catastrophic Stage, which follows the Coverage Gap Phase, involves a significant reduction in your out-of-pocket costs for covered drugs. Once you reach the Catastrophic Stage, you will only pay $0 for the remainder of the calendar year.

True Out-of-Pocket (TrOOP) refers to the expenses that are counted toward reaching the maximum out-of-pocket threshold in the Part D Prescription Drug Plan (PDP). These expenses include:

It's important to note that not all expenses are counted towards your TrOOP. For example, premiums, pharmacy dispensing fees, or expenses for drugs that are not covered by your plan are not included in TrOOP calculations.

Once your TrOOP expenses reach the annual out-of-pocket threshold set by Medicare (in 2024, $8,000), you will exit the Coverage Gap Stage and enter the Catastrophic Drug Coverage Stage. In the Catastrophic Stage, your out-of-pocket costs for covered prescription drugs will be significantly reduced for the remainder of the calendar year.

The monthly expenses for Prescription Drug Plans (PDPs) can differ based on factors such as the chosen plan, location, and the prescription coverage provided. In the Metro Detroit area, the monthly premium costs for Medicare Advantage plans in 2024 typically range from $3 to $113.

The Income-Related Monthly Adjusted Amount (IRMAA) may apply to individuals with higher incomes, resulting in an additional premium for Prescription Drug Plans (PDPs) or Medicare Part D. The table provided below illustrates the impact of your income on your 2023 Part D Monthly Premium:

| File individual tax

return | File joint tax return | File married &

separate tax return | You pay (in 2024) |

| $103,000 or less | $206,000 or less | $103,000 or less | Your plan

premium |

| above $103,000 up

to $129,000 | above $206,000 up to

$258,000 | not applicable | $12.90 + your

plan premium |

| above $129,000 up

to $161,000 | above $258,000 up to

$322,000 | not applicable | $33.30 + your

plan premium |

| above $161,000 up

to $193,000 | above $322,000 up to

$386,000 | not applicable | $53.80 + your

plan premium |

| above $193,000 and

less than $500,000 | above $386,000 and

less than $750,000 | above $103,000 and

less than $397,000 | $74.20 + your

plan premium |

| $500,000 or above | $750,000 or above | $397,000 or above | $81.00 + your

plan premium |

The Medicare Part D late enrollment penalty is a fee that can be permanently added to an individual's monthly payment for Part D, which is Medicare's prescription drug coverage. If an individual delays enrolling in Medicare Part D or any other creditable coverage for prescription drugs for a period of 63 days or more after their Initial Enrollment Period, they may be subject to this late enrollment penalty.

The Part D Late Enrollment Penalty is determined by CMS through a mathematical formula. This penalty is computed by multiplying the number of months you were eligible for Part D but did not enroll by the national average cost of a Part D plan for the specific year you decide to enroll. The resulting amount is then multiplied by 1%. The national base beneficiary premium for Part D in 2023 is $34.70.

For instance, if you missed enrolling in Part D for 35 months and choose to enroll in May 2024, your Part D Late Enrollment Penalty would be calculated as follows:

Penalty = Number of months missed to enroll x Average cost of a Part D plan x 1%

Penalty = 35 x $34.70 x 0.01 = $12.15

It's important to note that the Part D late enrollment penalty remains in effect for life. You can use the form below to calculate your Part D Late Enrollment Penalty.

Your Part D Late Enrollment Penalty (US$):

This additional monthly amount is the dollar figure

that you will be required to pay on top of the premium

for the Medicare Part D Prescription Drug Plan

that you select to enroll in.

Extra Help, or Low-Income Subsidy (LIS), is a government initiative designed to assist individuals in paying for their Part D prescription drug costs if they meet the eligibility criteria. Any Medicare beneficiaries can apply for Extra Help through the Social Security Administration (SSA) office, either online, by phone, or by visiting a local SSA office.

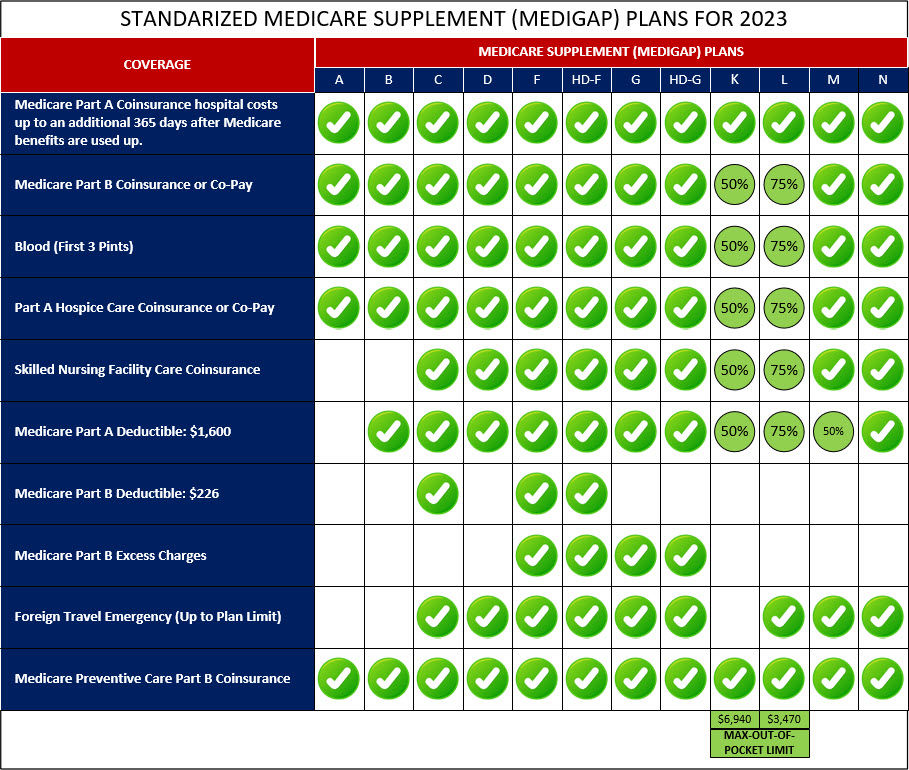

Medicare Supplement, also known as Medigap, is a type of private health insurance policy that helps cover the gaps (or "gaps in coverage") in Original Medicare (Medicare Part A and Part B). If you only have Original Medicare, both Parts A and B have cost-sharing like deductibles, copays and coinsurance that you are responsible to pay when you use the services.

Private insurance companies offer and sell Medicare Supplement plans. These plans provide varying levels of coverage for beneficiaries. All the benefits provided by Medicare Supplement plans are approved by Medicare and are standardized across different insurance carriers. This means that regardless of the insurance company you choose, the benefits offered by each plan are the same. There are 12 different Medicare Supplement plans and each plan has a letter designation (A, B, C, D, F, High-Deductible F, G, High-Deductible G, K, L, M, and N)

The popularity of Medicare Supplement plans, also known as Medigap plans, can vary depending on factors like location and individual preferences.

Plan G has gained popularity as a viable alternative to Plan F. It offers similar coverage, except for the Part B deductible which beneficiaries must pay out-of-pocket before Plan G coverage starts. Many individuals opt for Plan G because it provides comprehensive coverage and potentially lower premiums compared to Plan F.

Another popular choice is Plan N, which offers comprehensive coverage with some cost-sharing. While it covers most Medicare expenses, beneficiaries are responsible for small copayments for doctor's visits and emergency room visits. Plan N typically has lower premiums when compared to Plans F and G.

It's important to consider your specific needs and circumstances when selecting a Medicare Supplement plan, as preferences can vary. It's recommended to compare the coverage and costs of different plans available in your area before making a decision.

None of the 12 Medicare Supplement plans provide coverage for several services, including but not limited to prescription drugs, dental care, vision care, hearing aids, transportation, and over-the-counter benefits.

Selecting the appropriate Medicare Supplement plan involves considering various factors such as coverage level, out-of-pocket costs, and monthly premium. It's also crucial to evaluate your current health condition and future health projections, although predicting the future can be challenging. However, many Medicare beneficiaries are opting for Plan G and Plan N due to their favorable combination of service coverage, low out-of-pocket expenses, and affordable monthly premiums. To receive personalized guidance in choosing the Medicare Supplement plan that best suits your health needs, we invite you to schedule an appointment with us. Our team will help navigate the options and assist you in making an informed decision.

Here are some potential pros and cons to consider when evaluating Medicare Supplement:

To qualify for Medicare Supplement, there are typically specific criteria that must be fulfilled including:

Enrollment in a Medicare Supplement plan, also known as Medigap, is available during specific periods. These enrollment periods include:

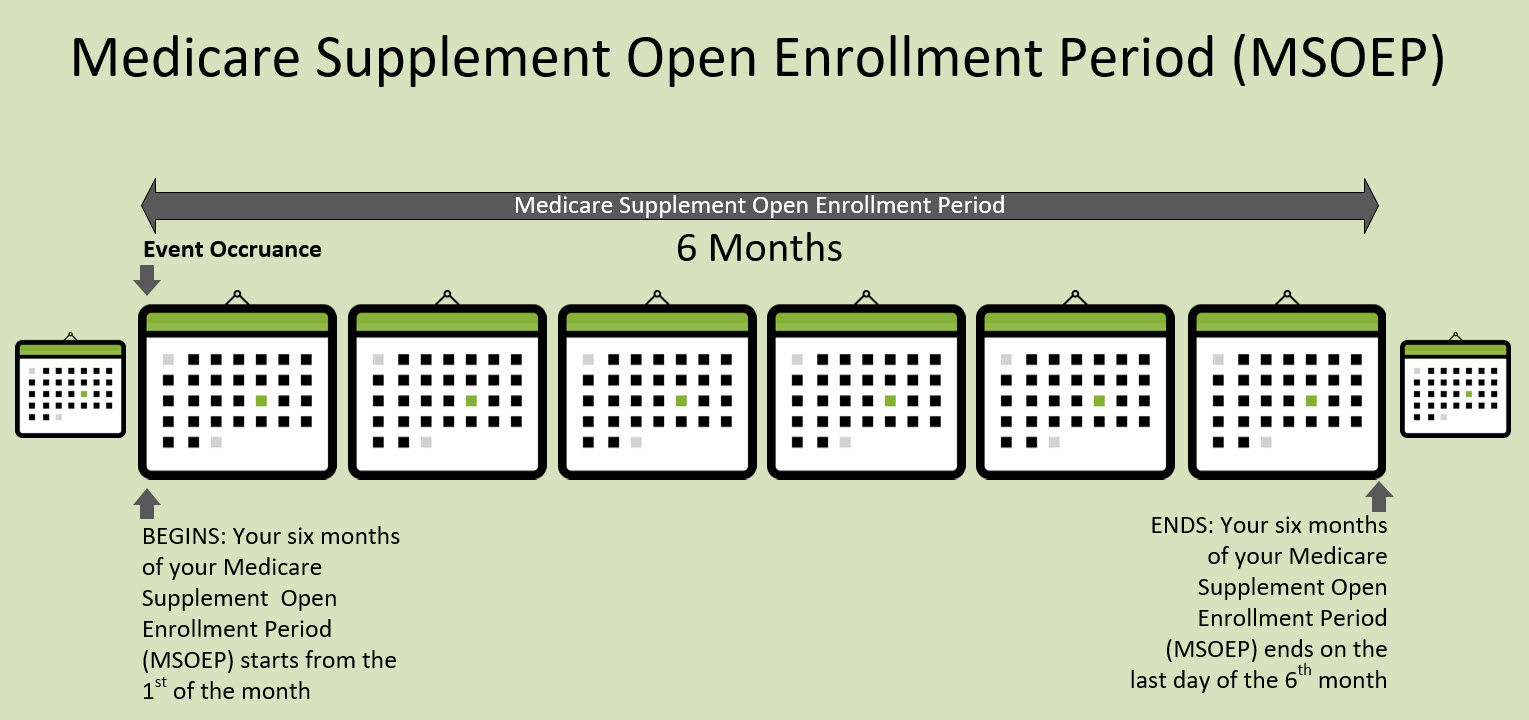

Medicare Supplement Open Enrollment Period (MS OEP): The MS OEP is the most advantageous time to enroll in a Medicare Supplement plan. It begins on the first day of the month when you are 65 years old or older and enrolled in Medicare Part B. Lasting for six months, this period ensures guaranteed issue, meaning insurance companies cannot deny you coverage or charge higher premiums based on your health condition. You are eligible for any Medicare Supplement plan offered in your area during this period.

Special Enrollment Periods (Guaranteed Issue Rights): Certain situations grant you guaranteed issue rights outside of the Medigap Open Enrollment Period. For instance, if you lose your existing health coverage (e.g., employer-sponsored coverage), your existing Medigap plan is involuntarily terminated, or you decide to leave a Medicare Advantage plan within the first year of enrollment. During these special enrollment periods, insurance companies must offer you a Medicare Supplement plan without medical underwriting.

Annual Enrollment Period (AEP): The AEP takes place from October 15 to December 7 each year. It is important to note that the AEP is specifically for making changes to your Medicare Part D prescription drug coverage or Medicare Advantage plan. It does not apply to enrolling in or changing Medicare Supplement plans.

Medicare Advantage Open Enrollment Period (MA OEP): The MA OEP occurs from January 1 to March 31 each year. During this period, individuals already enrolled in a Medicare Advantage plan have the option to switch back to Original Medicare. While you can shop and apply for a Medicare Supplement plan during this period, you will be subject to medical underwriting. Additionally, this period allows for the addition of a stand-alone Prescription Drug Plan (Part D).

You have the flexibility to change your Medicare Supplement plan throughout the year. There are various reasons why individuals choose to switch from one Medicare Supplement plan to another, including:

It's important to note that when switching Medicare Supplement plans outside of the Medigap Open Enrollment Period or without guaranteed issue rights, you may need to go through medical underwriting. Insurance companies can consider your health status and may impose restrictions or deny coverage based on pre-existing conditions. Additionally, it's recommended to compare different plans, review the coverage details, and consider the potential impact on your premiums and benefits before making a decision to switch Medicare Supplement plans.

Medicare Supplement underwriting involves insurance companies evaluating an applicant's health and other factors to determine their eligibility and the premium rates for a Medigap policy. This process helps insurers decide if they will offer coverage and how much it will cost based on the individual's health status. Ultimately, underwriting determines whether an applicant can enroll in a Medicare Supplement plan and the monthly premium they will pay.

As of January 1, 2020, individuals who are new to Medicare are not able to enroll in Medicare Supplement Plan C, Plan F, or High-Deductible Plan F. This change was made as part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

However, if you were eligible for Medicare before January 1, 2020, and already had either Plan C, Plan F, or High-Deductible Plan F, you may be able to keep your existing plan or switch to another Medicare Supplement plan that is available in your area.

If you already have Medicare Supplement Plan C, Plan F, or High-Deductible Plan F prior to January 1, 2020, you can generally keep your plan. The changes made under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) do not affect individuals who were enrolled in these plans before that date.

You have the option to continue with your current Medicare Supplement plan or make changes if desired. You can switch to a different Medicare Supplement plan that is available in your area or explore other options based on your healthcare needs and preferences.

It's important to note that while Plan C, Plan F, and High-Deductible Plan F are no longer available for new Medicare beneficiaries after January 1, 2020, existing policyholders can maintain their coverage and receive the benefits offered by their chosen plan.

The table below summarizes the main differences between Medicare Supplement and Medicare Advantage:

| Medicare Supplement Plan | Versus | Medicare Advantage

Plan |

|---|---|---|

| Medigap plans work alongside Original Medicare (Part A and Part B) and help cover certain out-of-pocket costs such as deductibles, coinsurance, and copayments. The coverage provided by Medigap plans is standardized and depends on the plan type (e.g., Plan A, Plan F, Plan G). However, Medigap plans do not typically include prescription drug coverage | Coverage | Medicare Advantage plans replace Original Medicare and provide all the benefits of Part A and Part B. These plans often include additional benefits like prescription drug coverage (Part D), dental, vision, hearing, and wellness programs. Medicare Advantage plans vary in coverage and benefits, and the specifics depend on the plan you choose |

| With Medigap plans, you pay a monthly premium in addition to your Part B premium and Part A (if applicable). The premium amount varies depending on the plan and insurance provider. You will also have minimal out-of-pocket costs for Medicare-covered services | Premium Cost | Medicare Advantage plans have a monthly premium, which may be as low as $0 in some cases. However, you still need to pay your Part B premium and Part A premium (if applicable) |

| You will have minimal out-of-pocket costs for Medicare-covered services | Out-of-Pocket Cost | Medicare Advantage plans also have cost-sharing in the form of copayments, coinsurance, and deductibles, which vary based on the plan and the services you use |

| With Medigap plans, you can see any healthcare provider that accepts Medicare patients nationwide, as long as they participate in Medicare | Provider Network | Medicare Advantage plans have a network of healthcare providers. You typically need to use doctors and hospitals within the plan's network, although emergency care is covered anywhere in the United States |

| Medigap plans do not require referrals to see specialists, and you have the flexibility to see any specialist who accepts Medicare patients without network restrictions | Referrals and Coordination of Care | Medicare Advantage plans often require you to choose a primary care doctor and obtain referrals to see specialists. This helps coordinate your care and manage healthcare costs |

| Medigap plans do not include prescription drug coverage. If you want prescription drug coverage, you can enroll in a separate Medicare Part D plan | Prescription Drug Coverage | Most Medicare Advantage plans include prescription drug coverage as part of their benefits package (Part D) |

| Medigap plans do not typically offer additional benefits beyond what Original Medicare covers. You can purchase standalone policies for dental, vision, or hearing coverage | Additional Benefits | Medicare Advantage plans often include additional benefits like dental, vision, hearing, fitness programs, and wellness services |

| Open all-year-round | Enrollment | Only allowed to enroll or switch plans during the Initial Enrollment Period (IEP), Medicare Advantage Open Enrollment Period (MA OEP), and Medicare Annual Enrollment Period (AEP) |

| Usually required outside of Medicare Supplement Open Enrollment Period. However, during the 6-months of Medicare Supplement Open Enrollment Period for plans, underwriting is not required and the policy is Guaranteed Issue | Medical Underwriting | No requirement for underwiring |

| Certain Medicare Supplement plans offer extra coverage for medical emergencies during international travel. This additional coverage is not available in all Medicare Supplement plans and may vary depending on the specific plan and insurance provider | Foreign Travel | With most Medicare Advantage plans, coverage for services while traveling abroad is limited, typically only extending to medical emergencies |

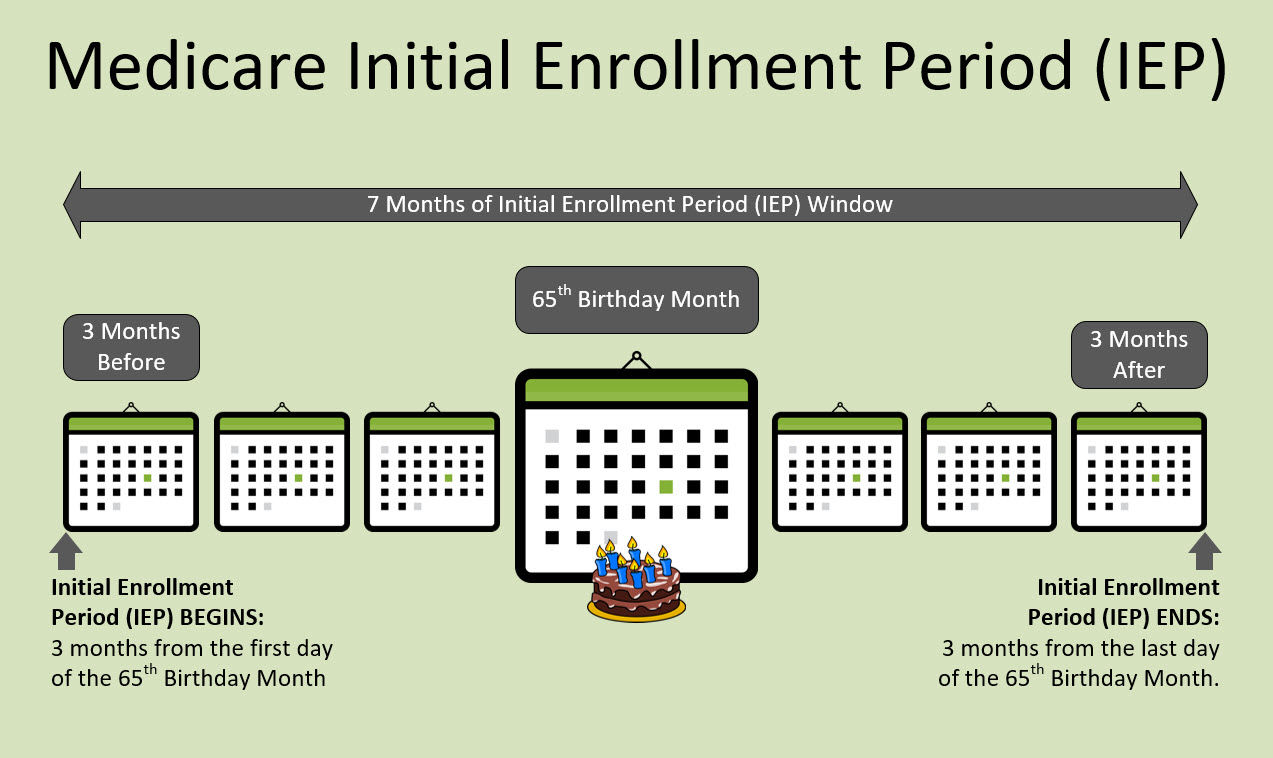

The Initial Enrollment Period (IEP) is a 7-month period during which you can enroll in Medicare for the first time. It starts 3 months before the month of your 65th birthday, includes the month of your 65th birthday, and continues for 3 months after your birthday month. This gives you a total of 7 months to sign up for Medicare.

During your Initial Enrollment Period, you have the opportunity to enroll in Medicare Part A (hospital insurance) and/or Part B (medical insurance). It's important to note that if you don't sign up for Part B during your Initial Enrollment Period and you don't have other creditable coverage, you may face a late enrollment penalty and have to pay a higher premium for Part B when you do decide to enroll.

It's recommended to be aware of your Initial Enrollment Period and make sure to take action within this timeframe to avoid any potential penalties or gaps in your coverage. If you have any questions or need assistance with enrolling in Medicare during your Initial Enrollment Period, you can reach out to the Social Security Administration or visit the official Medicare website for guidance.

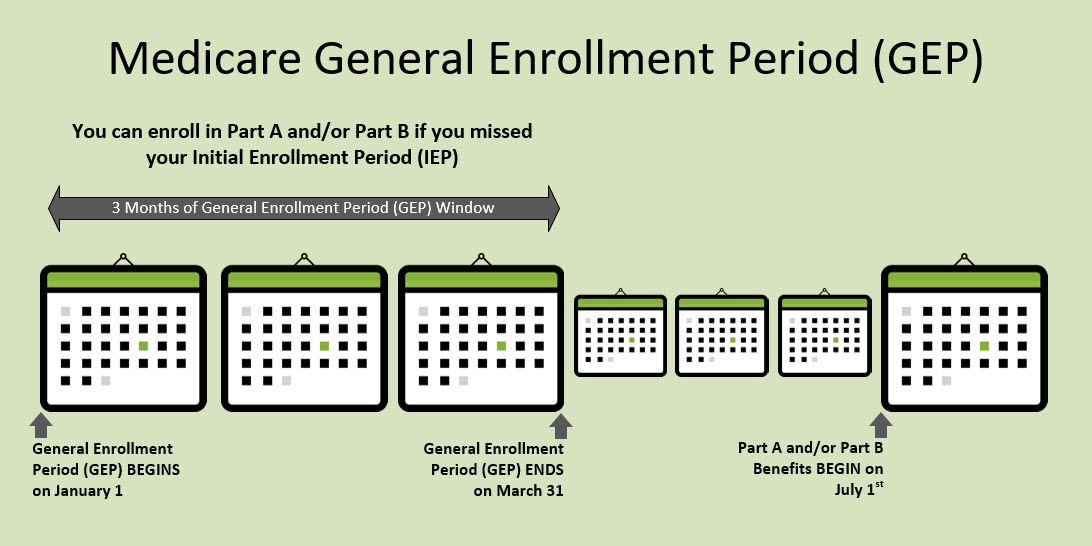

The General Enrollment Period (GEP) is indeed an enrollment period that allows individuals who missed their initial enrollment in Medicare Part A and/or Part B to enroll. It runs from January 1st to March 31st of each year. However, the effective date of coverage for those who enroll during the General Enrollment Period is different.

If you enroll in Medicare Part A and/or Part B during the General Enrollment Period, your coverage will begin on July 1st of the same year. It means there will be a waiting period before your coverage becomes effective. During this waiting period, you may not have coverage for any medical expenses.

It's important to note that enrolling during the General Enrollment Period may also result in a late enrollment penalty, especially if you delayed enrolling in Part B without having creditable coverage (coverage that's considered as good as Medicare) for the period you were eligible.

To avoid any gaps in coverage or potential penalties, it's generally recommended to enroll in Medicare during your Initial Enrollment Period (IEP) or take advantage of any applicable Special Enrollment Periods (SEPs) if you qualify.

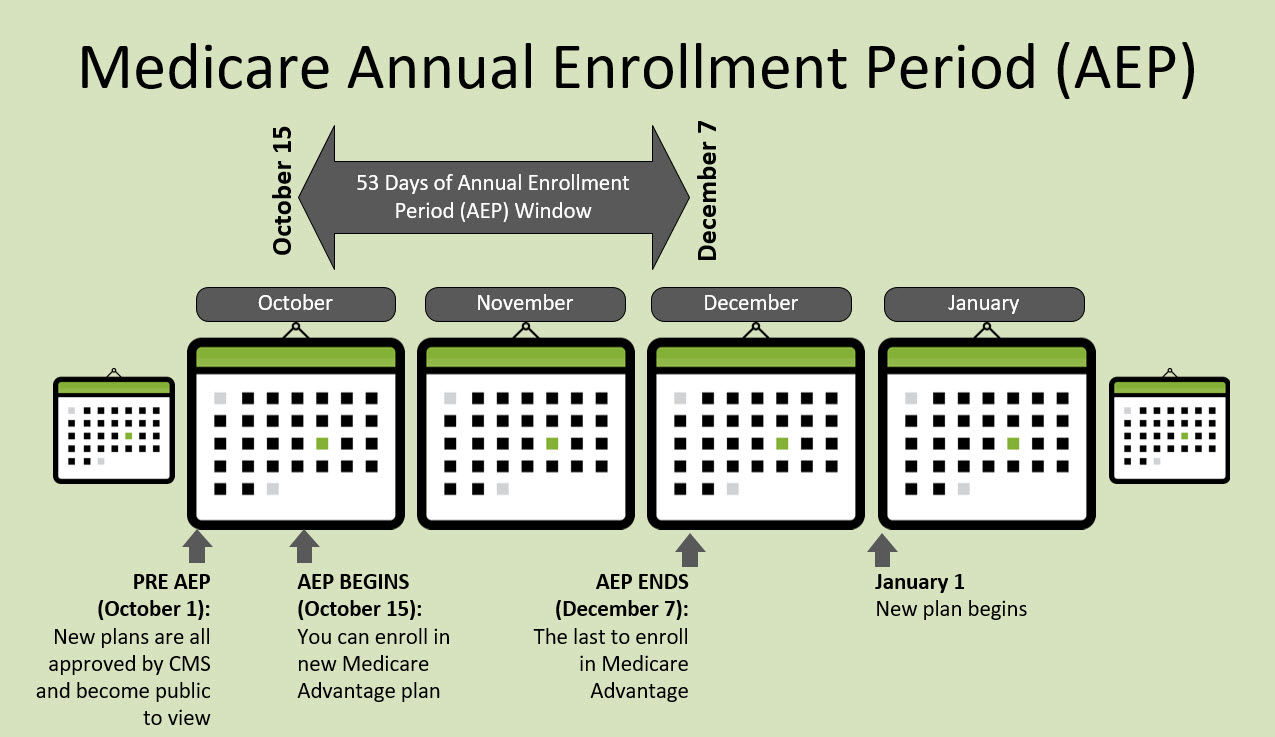

The Annual Enrollment Period (AEP) takes place annually from October 15th to December 7th. During this time, there are several options available for Medicare beneficiaries:

The AEP provides an opportunity for Medicare beneficiaries to review and make changes to their Medicare coverage to ensure it aligns with their healthcare needs and preferences.

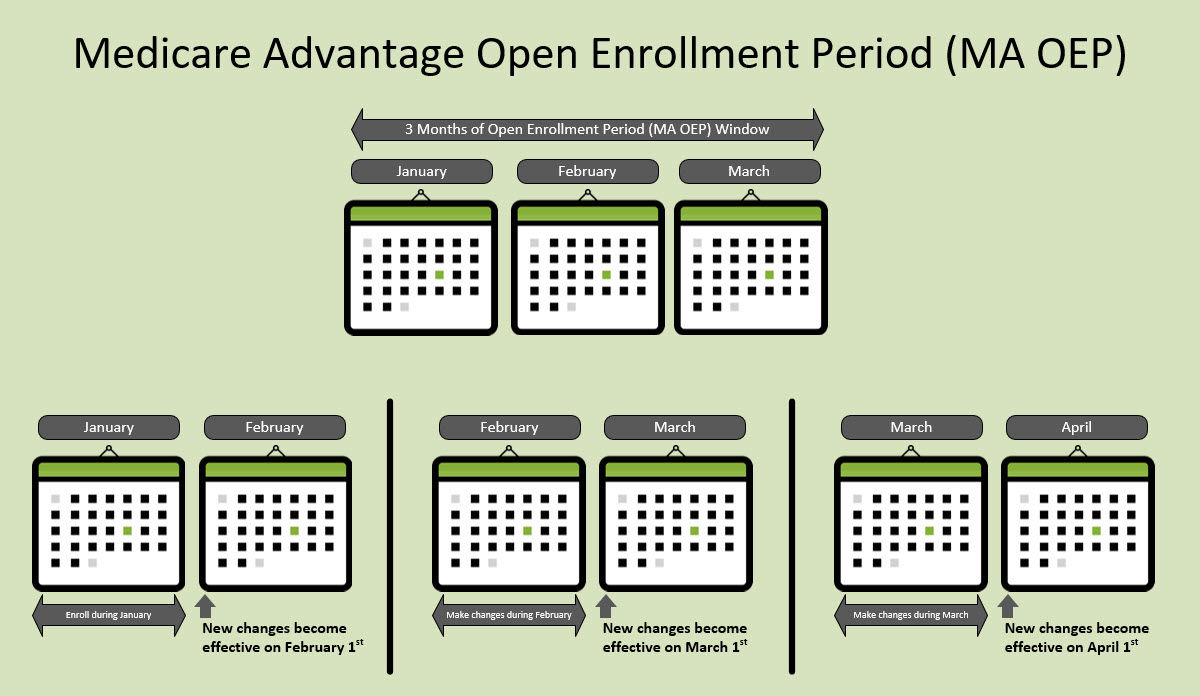

The Medicare Advantage Open Enrollment Period (MA OEP) takes place from January 1st to March 31st each year. During this period, you have the opportunity to make one change to your Medicare Advantage plan if you are currently enrolled in one.

If you are eligible, you can use the MA OEP to make the following changes:

Additionally, during the MA OEP, you can also enroll in a Part D Prescription Drug Plan (PDP) to add prescription drug coverage to your Original Medicare, and you can choose to add a Medicare Supplement (Medigap) plan to enhance your coverage.

It's important to note that any changes made during the MA OEP will take effect on the 1st day of the following month. For example, if you disenroll from your current Medicare Advantage plan and enroll in a new one in February, your new plan will become effective on March 1st.

Make sure to carefully review your options and consider your healthcare needs before making any changes during the MA OEP. Consulting with a Medicare advisor or counselor can provide valuable guidance to help you navigate the process and make informed decisions about your coverage.

The Medicare Supplement Open Enrollment Period (MS OEP) is a designated timeframe in which Medicare beneficiaries have a guaranteed opportunity to enroll in a Medicare Supplement plan. This enrollment period spans six months and commences when any of the following events occur:

During the MS OEP, insurance companies are obligated to accept your application for a Medicare Supplement plan without the ability to deny you coverage or impose higher premiums based on your health conditions. It is crucial to make the most of this enrollment period to secure the necessary coverage for your healthcare needs.

The Special Enrollment Period (SEP) is a specific period outside of the Initial Enrollment Period (IEP) when you have the opportunity to make changes to your Medicare plans. This period is triggered by certain qualifying circumstances or life events that may affect your Medicare coverage needs.

For Part C, also known as Medicare Advantage, the Special Enrollment Period can be triggered by several circumstances, including:

These are just a few examples of the circumstances that may trigger a Special Enrollment Period for Medicare Advantage plans. It's important to review the specific eligibility criteria and timeframes associated with each SEP and make changes within the designated period to ensure uninterrupted coverage and access to the desired plan.

Request your a call or consultation with a benefits consultant

Submit your question to our Medicare benefits consultants

Call, text, fax,

or email us

Find answers to

your questions

Find answers to

your questions

Navigate through

our website