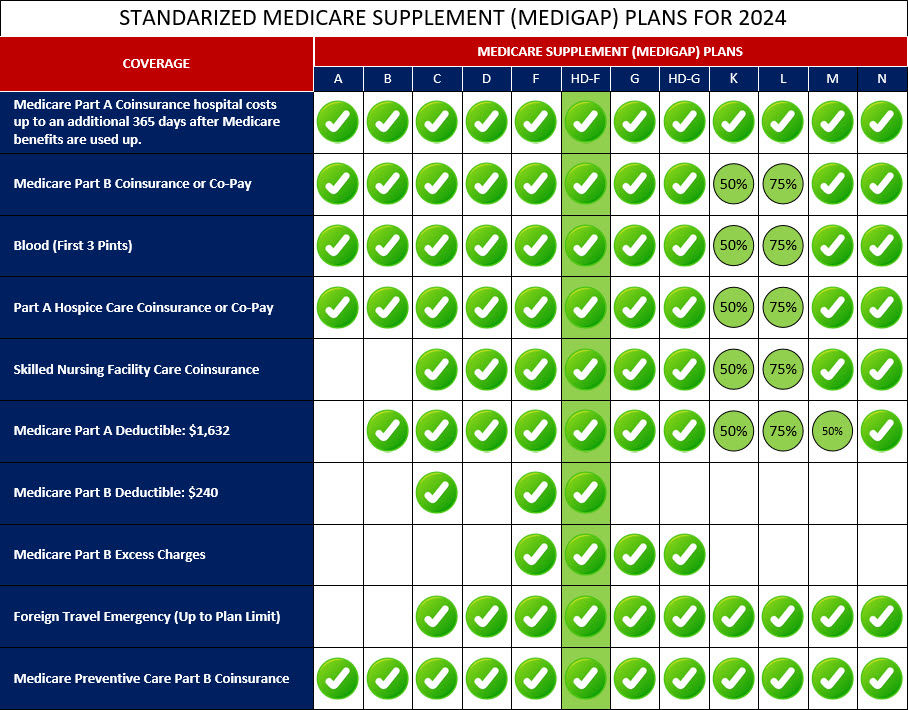

Medigap High Deductible Plan F is a specific variation of Medigap Plan F that has a higher deductible compared to the standard Plan F. This plan is designed for individuals who are looking for lower monthly premiums but are willing to pay a higher deductible before their coverage begins.

With High Deductible Plan F, you will need to pay a certain amount out-of-pocket as a deductible ($2,800 for 2024) before the plan starts covering your Medicare costs. Once you have reached the deductible, the plan will provide coverage for the same benefits as the standard Plan F. The key advantage of High Deductible Plan F is its lower monthly premium compared to the standard Plan F. This can be particularly beneficial for individuals who are generally healthy and do not anticipate frequent medical expenses but still want the comprehensive coverage provided by Plan F when needed.

It's important to note that High Deductible Plan F is also not available for new Medicare beneficiaries who became eligible on or after January 1, 2020. Only those who were eligible for Medicare before this date can enroll in or switch to High Deductible Plan F.

If you choose High Deductible Plan F, it's essential to consider your healthcare needs and financial situation. You will be responsible for paying the deductible amount out-of-pocket before the plan covers your expenses, so make sure you can comfortably afford the deductible before selecting this plan.

Below is a comprehensive list of the covered services provided by Medicare Supplement High-Deductible Plan F, which include benefits under Medicare Part A, Medicare Part B, and other areas: