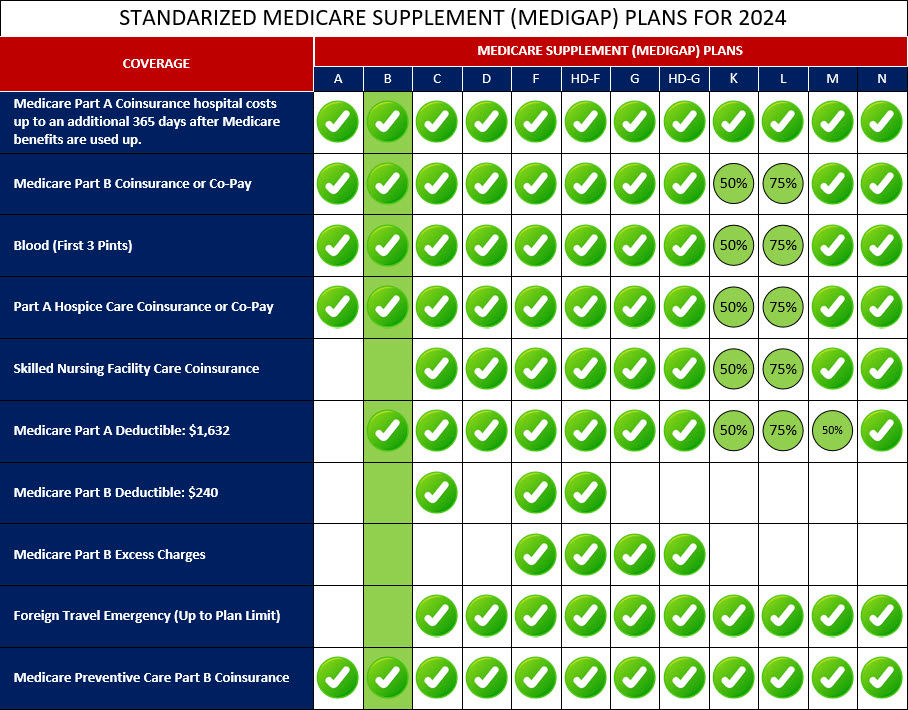

Medigap Plan B is a standardized Medicare Supplement insurance plan that works alongside Original Medicare (Part A and Part B) to help cover certain out-of-pocket costs.

Medigap Plan B provides a comprehensive set of benefits that include coverage for Medicare Part A coinsurance and hospital costs, as well as Part B coinsurance or copayments for medical services. It also covers the first three pints of blood needed for a medical procedure. While Medigap Plan B offers coverage for these expenses, it does not cover the Part A and Part B deductibles, excess charges, or any additional charges beyond the Medicare-approved amounts. It also does not provide coverage for prescription drugs, vision, dental, or other non-Medicare services.

Individuals who choose Medigap Plan B can benefit from greater financial protection and peace of mind, knowing that a portion of their Medicare out-of-pocket costs will be covered. It's important to evaluate your healthcare needs and compare different Medigap plans to find the one that best fits your specific requirements and budget.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan B, which include benefits under Medicare Part B, Medicare Part B, and other areas: