Medigap Plan A Description

Medigap Plan M is a Medicare supplement insurance plan that offers coverage for certain medical costs not covered by Original Medicare. It provides a moderate level of coverage, striking a balance between benefits and out-of-pocket costs.

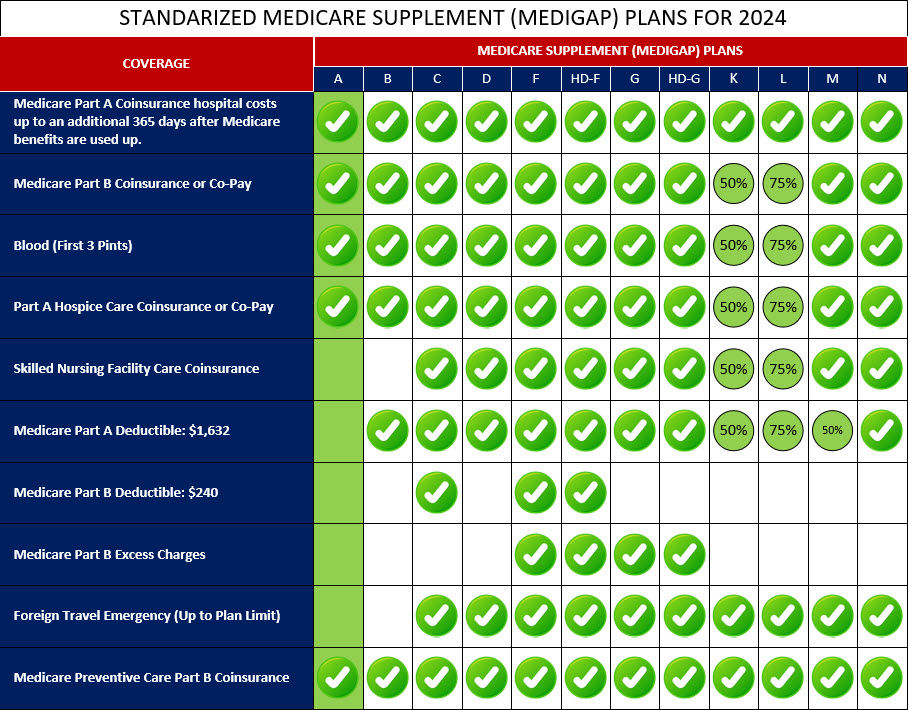

With Medigap Plan M, you can expect coverage for Medicare Part A coinsurance and hospital costs, as well as Medicare Part B coinsurance or copayment. The plan covers 50% of your Part A hospice care coinsurance or copayment, and 50% of skilled nursing facility care coinsurance. However, it does not cover the Part A deductible or excess charges. One unique feature of Medigap Plan M is the inclusion of a cost-sharing arrangement. This means that you will be responsible for paying 50% of the Medicare Part A deductible, which is a set amount you need to pay before Medicare coverage begins.

Medigap Plan M can be a suitable choice if you're looking for a plan with lower premiums compared to some other Medigap plans. However, it's important to evaluate your healthcare needs and budget to determine if this plan aligns with your coverage preferences.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan M, which include benefits under Medicare Part A, Medicare Part B, and other areas: