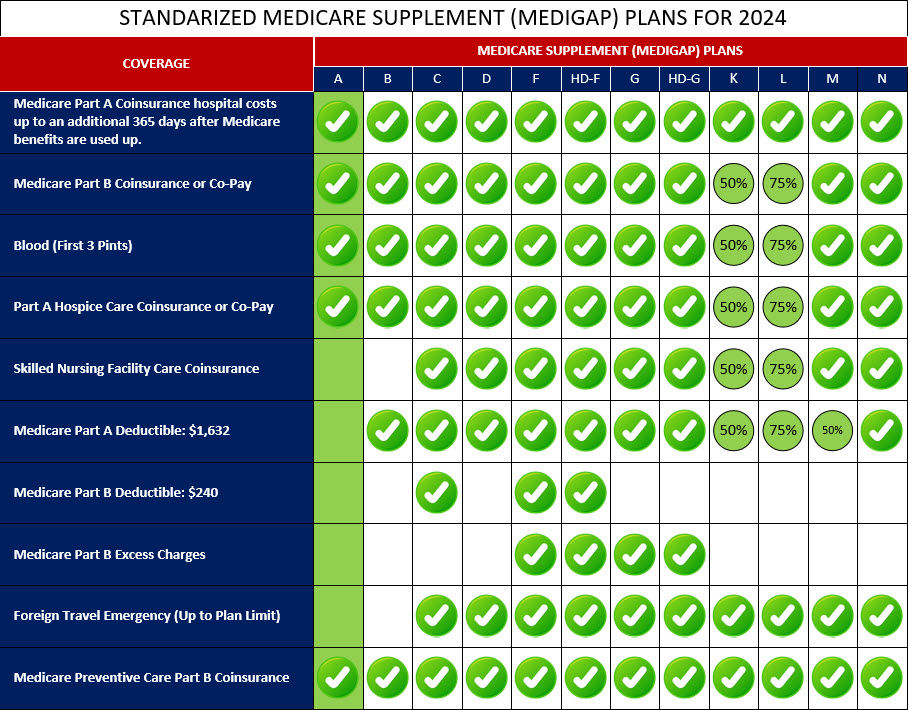

Medigap Plan F is a comprehensive Medicare Supplement insurance plan that offers the most extensive coverage among all the standardized Medigap plans. However, as of 2020, Plan F is no longer available for new Medicare beneficiaries. Only those who were eligible for Medicare before January 1, 2020, can enroll in Plan F.

Medigap Plan F covers all the gaps in Original Medicare, including both Medicare Part A and Part B deductibles, coinsurance, and copayments. This means that beneficiaries with Plan F have little to no out-of-pocket costs for Medicare-approved services. With Medigap Plan F, you can enjoy coverage for hospital costs and coinsurance under Part A, as well as coinsurance or copayments for medical services under Part B. The plan also covers skilled nursing facility coinsurance, excess charges that providers may charge beyond the Medicare-approved amount, and even provides coverage for emergency medical care during foreign travel, up to plan limits.

While Plan F offers comprehensive coverage, it is important to note that it typically has higher premiums compared to other Medigap plans due to its extensive benefits. It is no longer available for new Medicare beneficiaries, but those who were enrolled in Plan F before January 1, 2020, can keep their coverage and enjoy its full benefits.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan F, which include benefits under Medicare Part A, Medicare Part B, and other areas: