How does Medicare Part D Work?

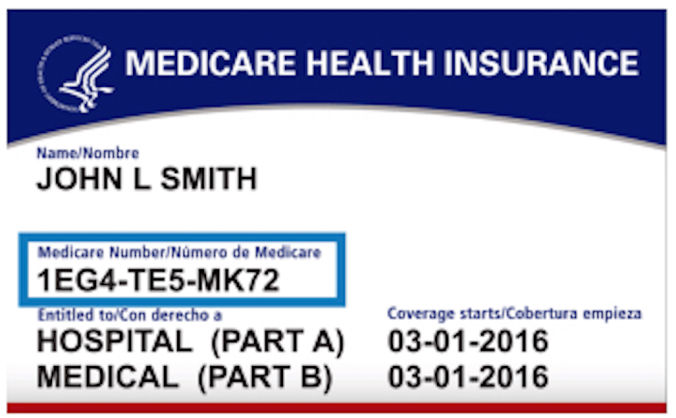

Medicare Part D, or prescription drug plan (PDP), was created in 2006 Medicare Part D and it is the part of Medicare that provides you with retail or mail-order prescription coverage.

Part D plans are monitored by CMS but sold by private insurance companies. You can only enroll or disenroll in Part during certain enrollment periods. Although enrollment is voluntary, the federal government penalizes those Medicare beneficiaries who do not enroll in Part D.

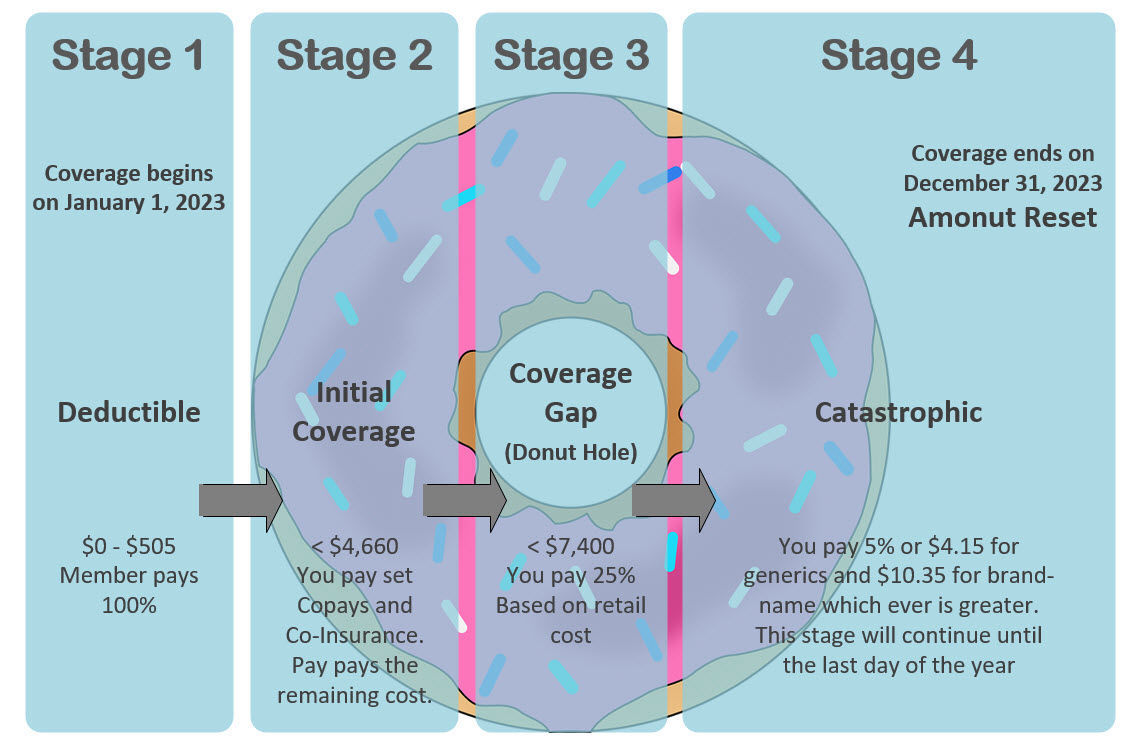

Part D plans have monthly premiums that range from as low as $7 and as high as $120 per month. Most Part D plans have an annual deductible that you may have to pay before the plan covering the cost of your prescription drugs. After your deductible is met, you will have copays and co-insurance when you get your prescriptions.