History of Medicare

Medicare was established on July 30, 1965, when President Lyndon B. Johnson signed the Social Security Amendments of 1965 into law during a ceremony at the Truman Library in Independence, Missouri. Former President Harry S. Truman, who had long advocated for national health insurance, was issued the first official Medicare card in honor of his efforts. Medicare was created in response to the growing number of elderly Americans who lacked health insurance and struggled with the rising costs of medical care.

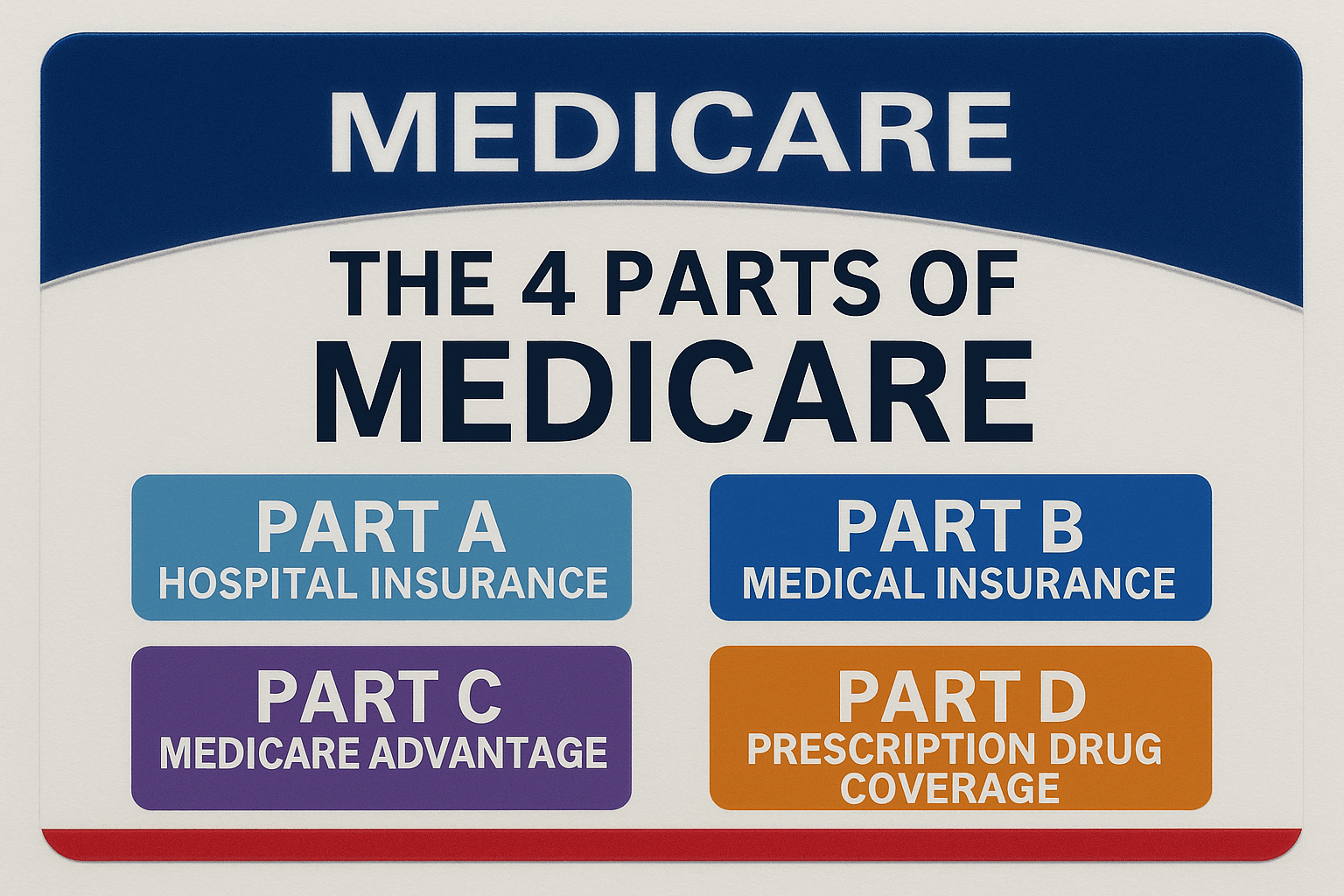

Initially, Medicare consisted of two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). Part A was designed to cover inpatient hospital stays and limited skilled nursing and home health care, while Part B helped pay for physician services, outpatient care, and preventive services.