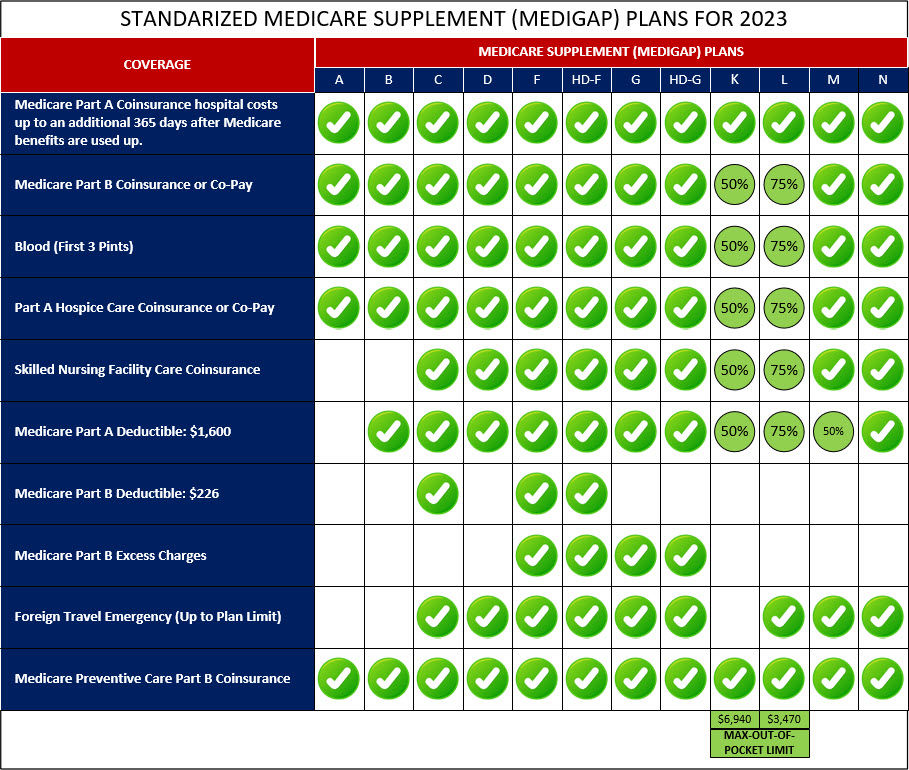

| Medigap plans work alongside Original Medicare (Part A and Part B) and help cover certain out-of-pocket costs such as deductibles, coinsurance, and copayments. The coverage provided by Medigap plans is standardized and depends on the plan type (e.g., Plan A, Plan F, Plan G). However, Medigap plans do not typically include prescription drug coverage | Coverage

| Medicare Advantage plans replace Original Medicare and provide all the benefits of Part A and Part B. These plans often include additional benefits like prescription drug coverage (Part D), dental, vision, hearing, and wellness programs. Medicare Advantage plans vary in coverage and benefits, and the specifics depend on the plan you choose |

| With Medigap plans, you pay a monthly premium in addition to your Part B premium and Part A (if applicable). The premium amount varies depending on the plan and insurance provider. You will also have minimal out-of-pocket costs for Medicare-covered services | Premium Cost

| Medicare Advantage plans have a monthly premium, which may be as low as $0 in some cases. However, you still need to pay your Part B premium and Part A premium (if applicable) |

| You will have minimal out-of-pocket costs for Medicare-covered services | Out-of-Pocket Cost

| Medicare Advantage plans also have cost-sharing in the form of copayments, coinsurance, and deductibles, which vary based on the plan and the services you use |

| With Medigap plans, you can see any healthcare provider that accepts Medicare patients nationwide, as long as they participate in Medicare | Provider Network | Medicare Advantage plans have a network of healthcare providers. You typically need to use doctors and hospitals within the plan's network, although emergency care is covered anywhere in the United States |

| Medigap plans do not require referrals to see specialists, and you have the flexibility to see any specialist who accepts Medicare patients without network restrictions | Referrals and Coordination of Care | Medicare Advantage plans often require you to choose a primary care doctor and obtain referrals to see specialists. This helps coordinate your care and manage healthcare costs |

| Medigap plans do not include prescription drug coverage. If you want prescription drug coverage, you can enroll in a separate Medicare Part D plan | Prescription Drug Coverage | Most Medicare Advantage plans include prescription drug coverage as part of their benefits package (Part D) |

| Medigap plans do not typically offer additional benefits beyond what Original Medicare covers. You can purchase standalone policies for dental, vision, or hearing coverage | Additional Benefits | Medicare Advantage plans often include additional benefits like dental, vision, hearing, fitness programs, and wellness services |

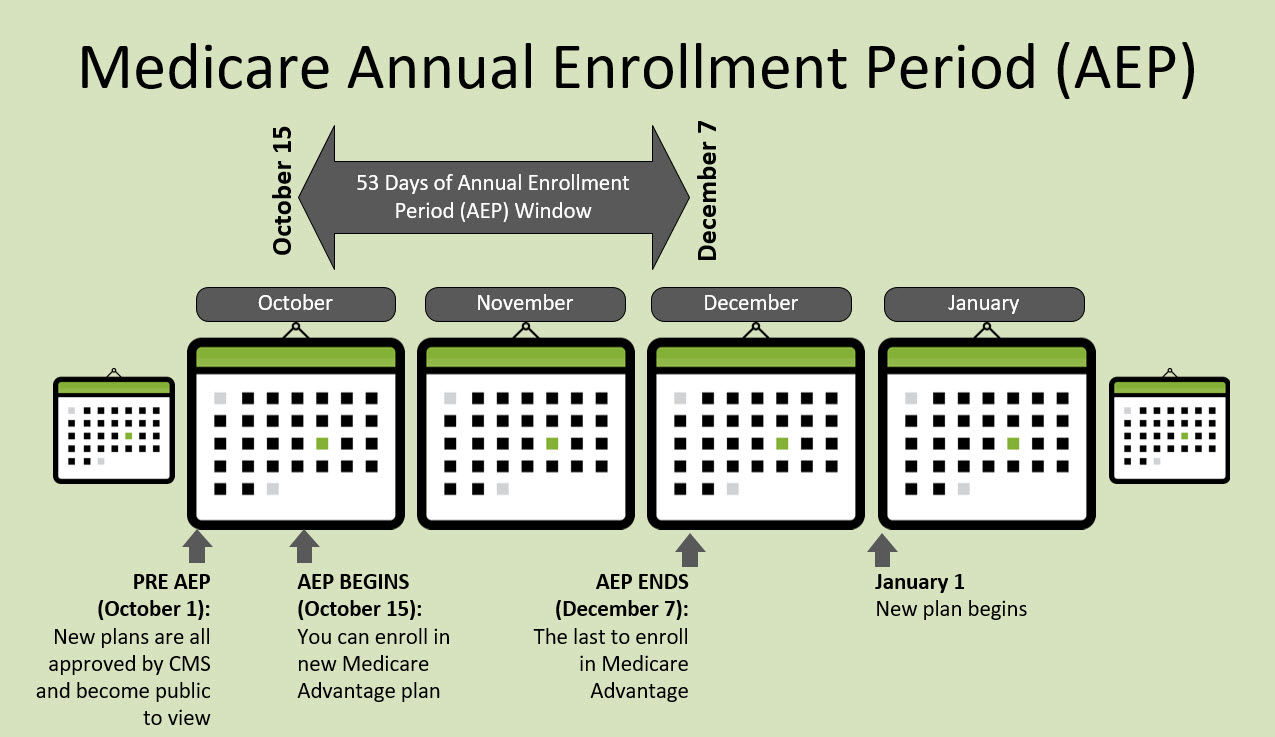

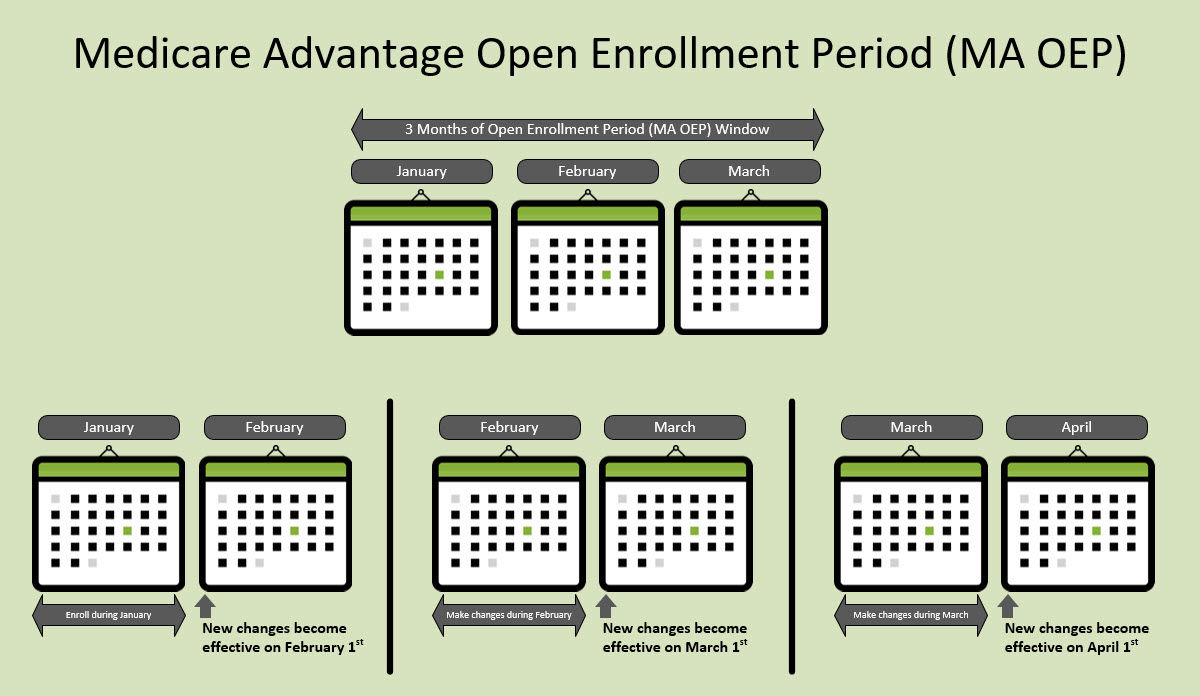

| Open all-year-round | Enrollment | Only allowed to enroll or switch plans during the Initial Enrollment Period (IEP), Medicare Advantage Open Enrollment Period (MA OEP), and Medicare Annual Enrollment Period (AEP) |

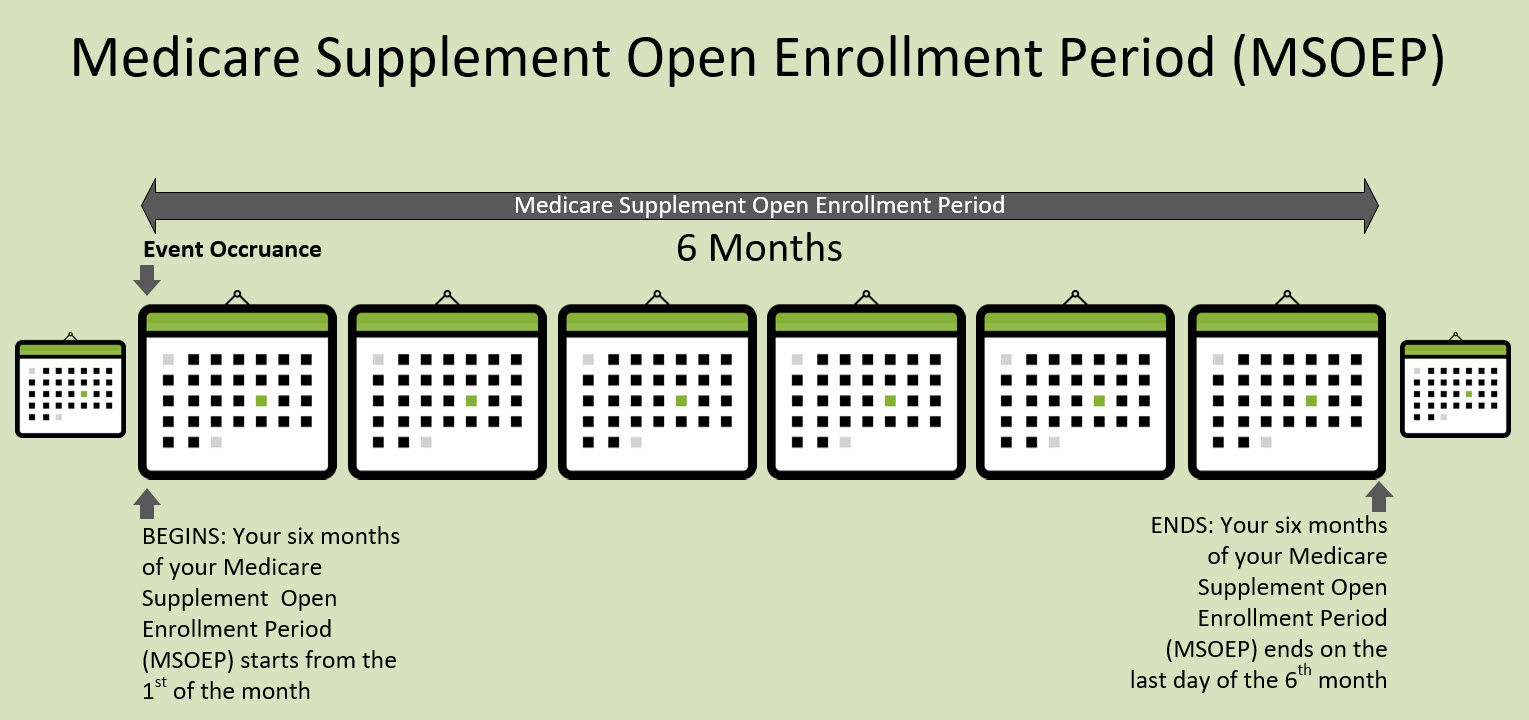

| Usually required outside of Medicare Supplement Open Enrollment Period. However, during the 6-months of Medicare Supplement Open Enrollment Period for plans, underwriting is not required and the policy is Guaranteed Issue | Medical Underwriting | No requirement for underwiring |

| Certain Medicare Supplement plans offer extra coverage for medical emergencies during international travel. This additional coverage is not available in all Medicare Supplement plans and may vary depending on the specific plan and insurance provider | Foreign Travel | With most Medicare Advantage plans, coverage for services while traveling abroad is limited, typically only extending to medical emergencies |