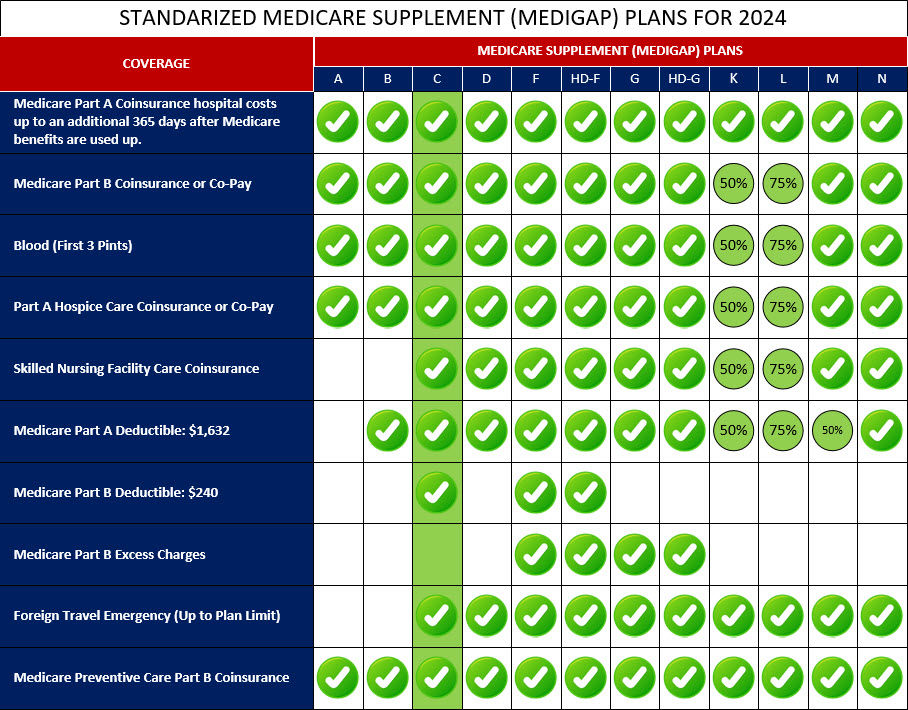

Medigap Plan C was a standardized Medicare Supplement insurance plan that provided a comprehensive set of benefits to help cover out-of-pocket costs not covered by Original Medicare (Part A and Part B). This plan typically included coverage for Medicare Part A coinsurance and hospital costs, Part B coinsurance or copayments, and the first three pints of blood needed for a medical procedure.

In addition to these basic benefits, Medigap Plan C also offered coverage for the Medicare Part A deductible, skilled nursing facility coinsurance, and even coverage for emergency medical care during foreign travel. However, it did not include coverage for the Medicare Part B deductible or excess charges.

It's important to note that while Medigap Plan C provided comprehensive coverage, it was discontinued for new enrollees after January 1, 2020. This change was due to the Medicare Access and CHIP Reauthorization Act (MACRA), which eliminated Medigap plans that covered the Part B deductible for newly eligible beneficiaries.

If you are considering a Medigap plan, we recommend exploring other available plans such as Medigap Plan G or Plan N, which may offer similar coverage options. It's always best to review and compare the available plans to find the one that best suits your healthcare needs and budget.

Below is a comprehensive list of the covered services provided by Medicare Supplement Plan C, which include benefits under Medicare Part A, Medicare Part B, and other areas: