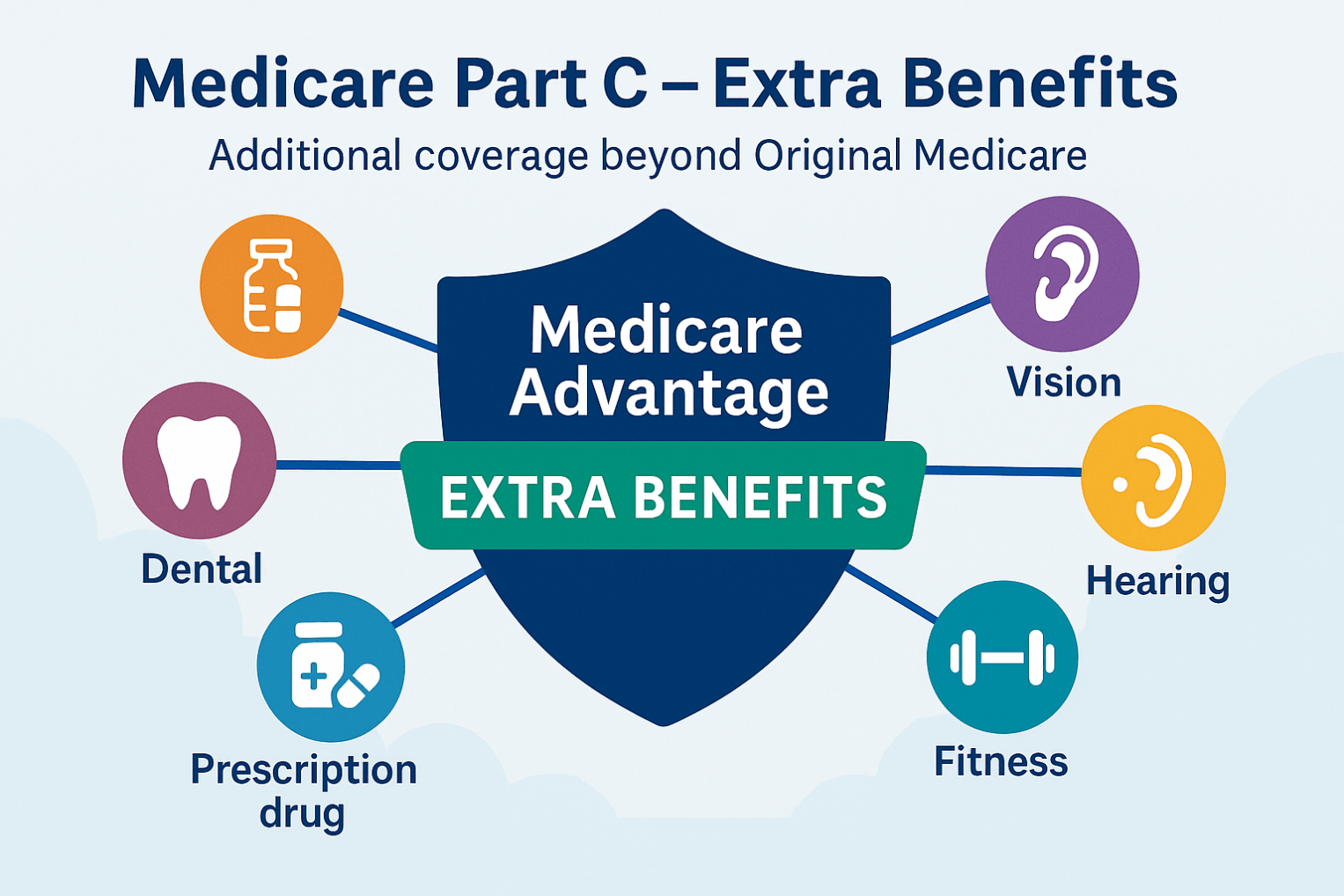

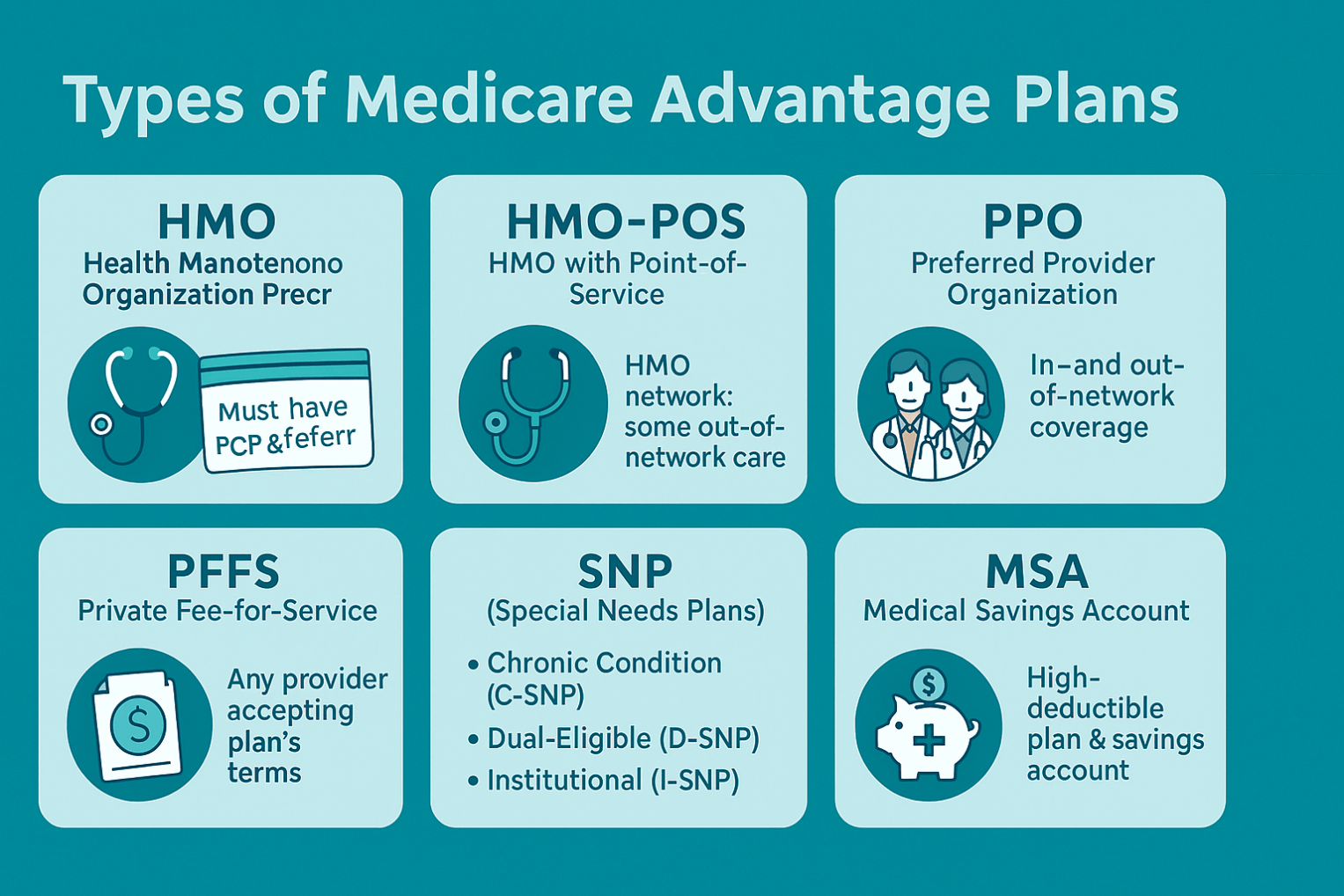

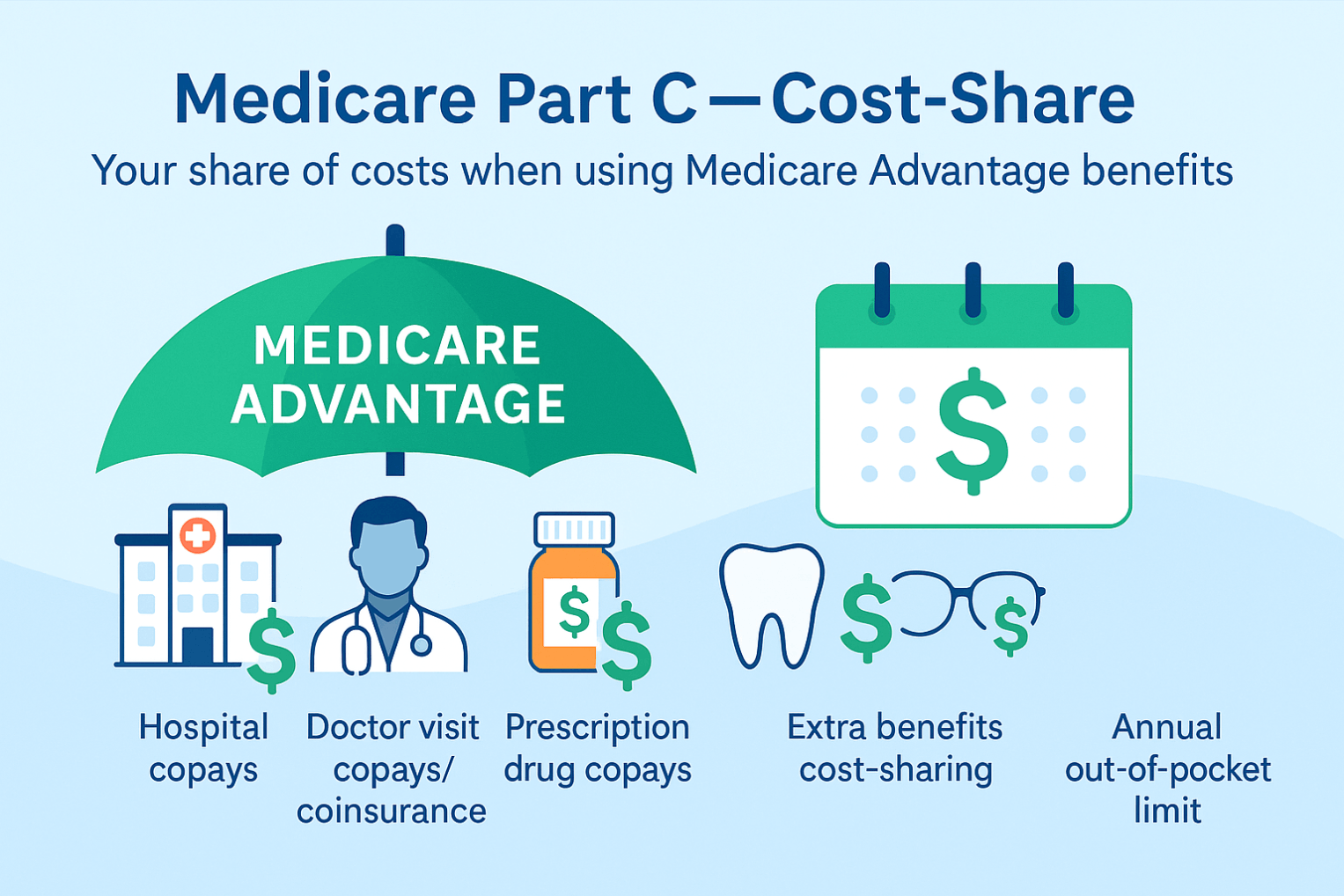

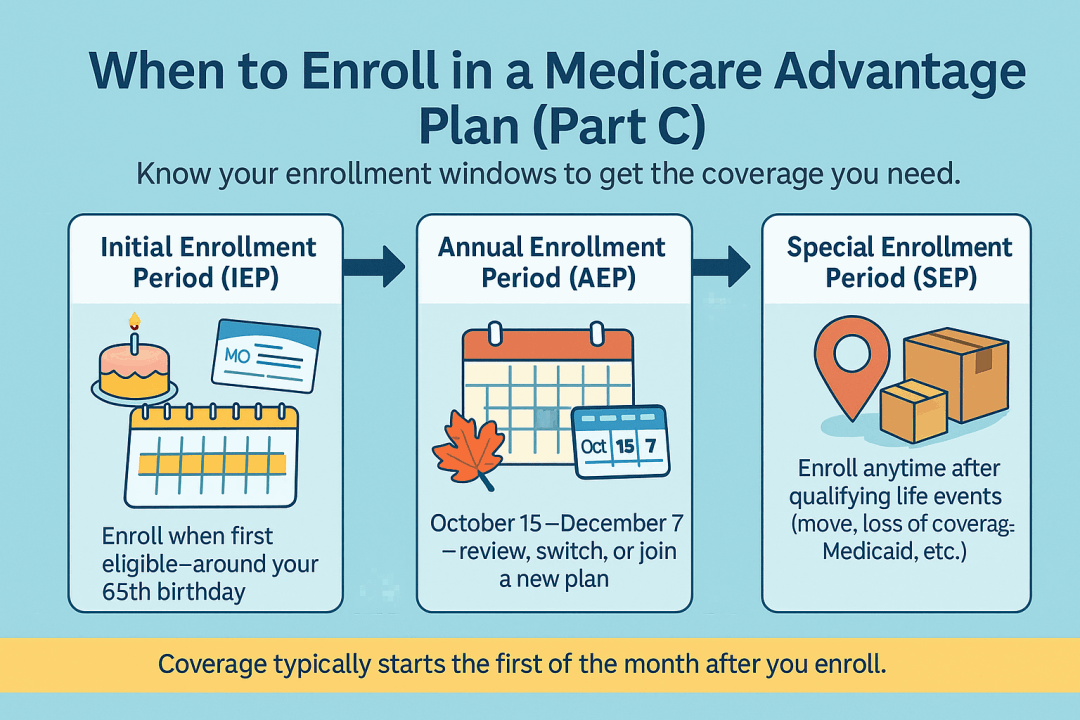

Medicare Part C (Medicare Advantage)

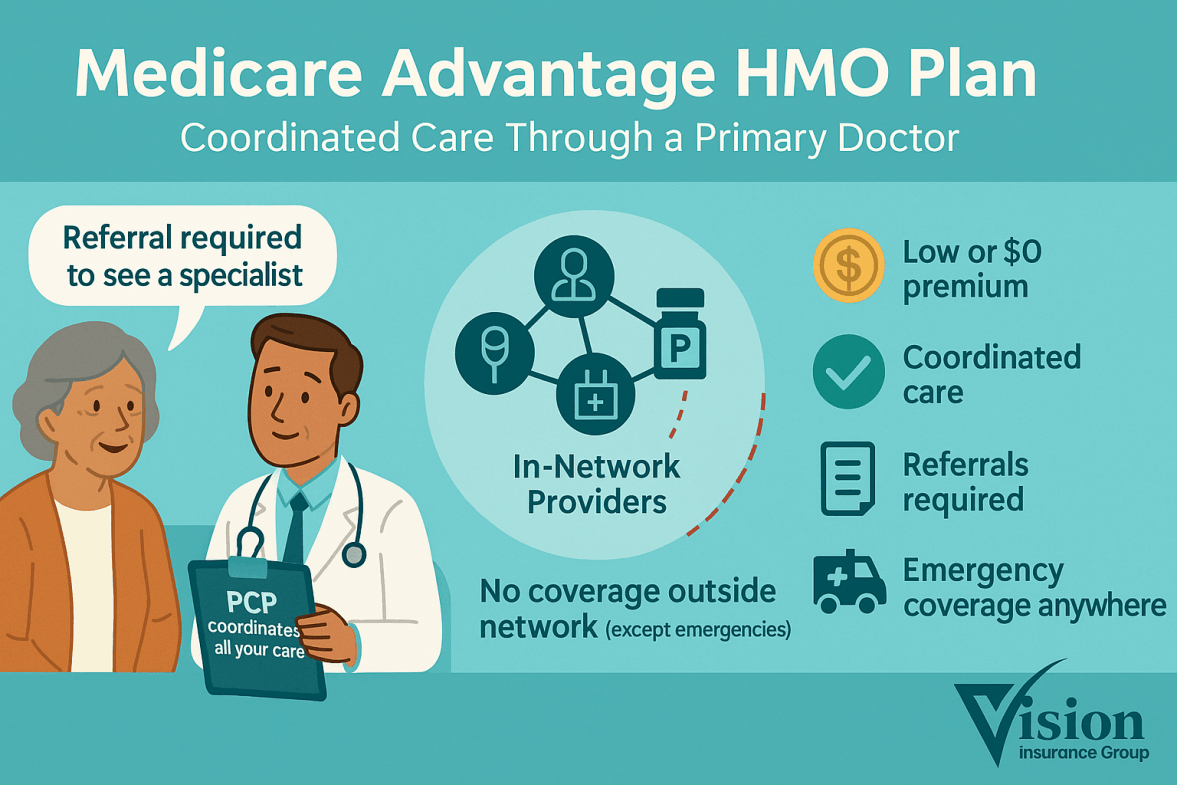

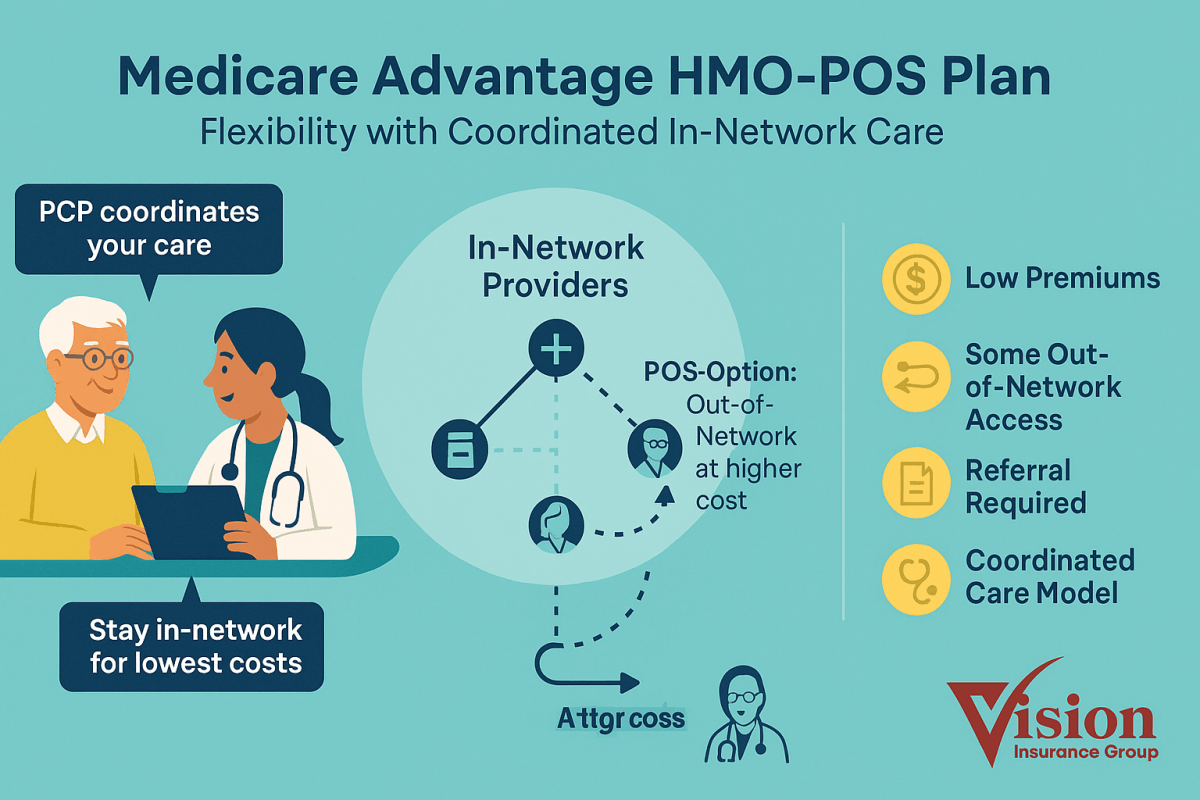

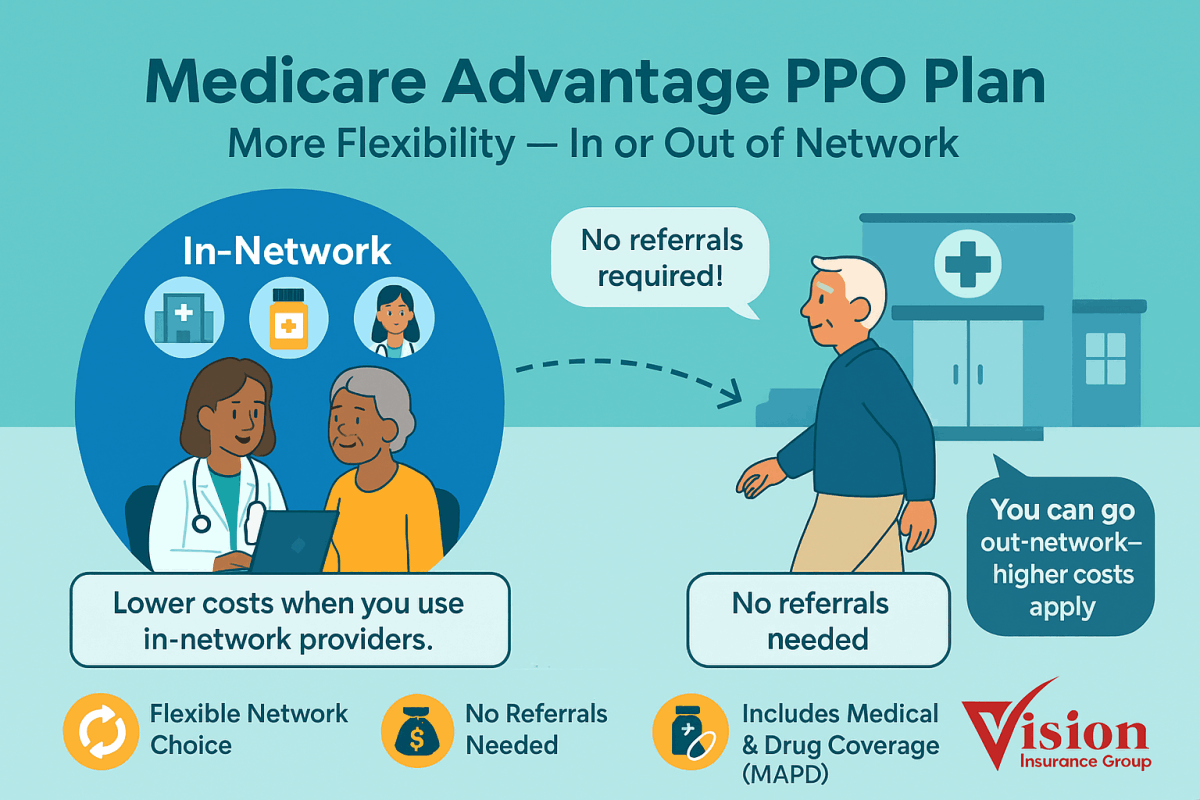

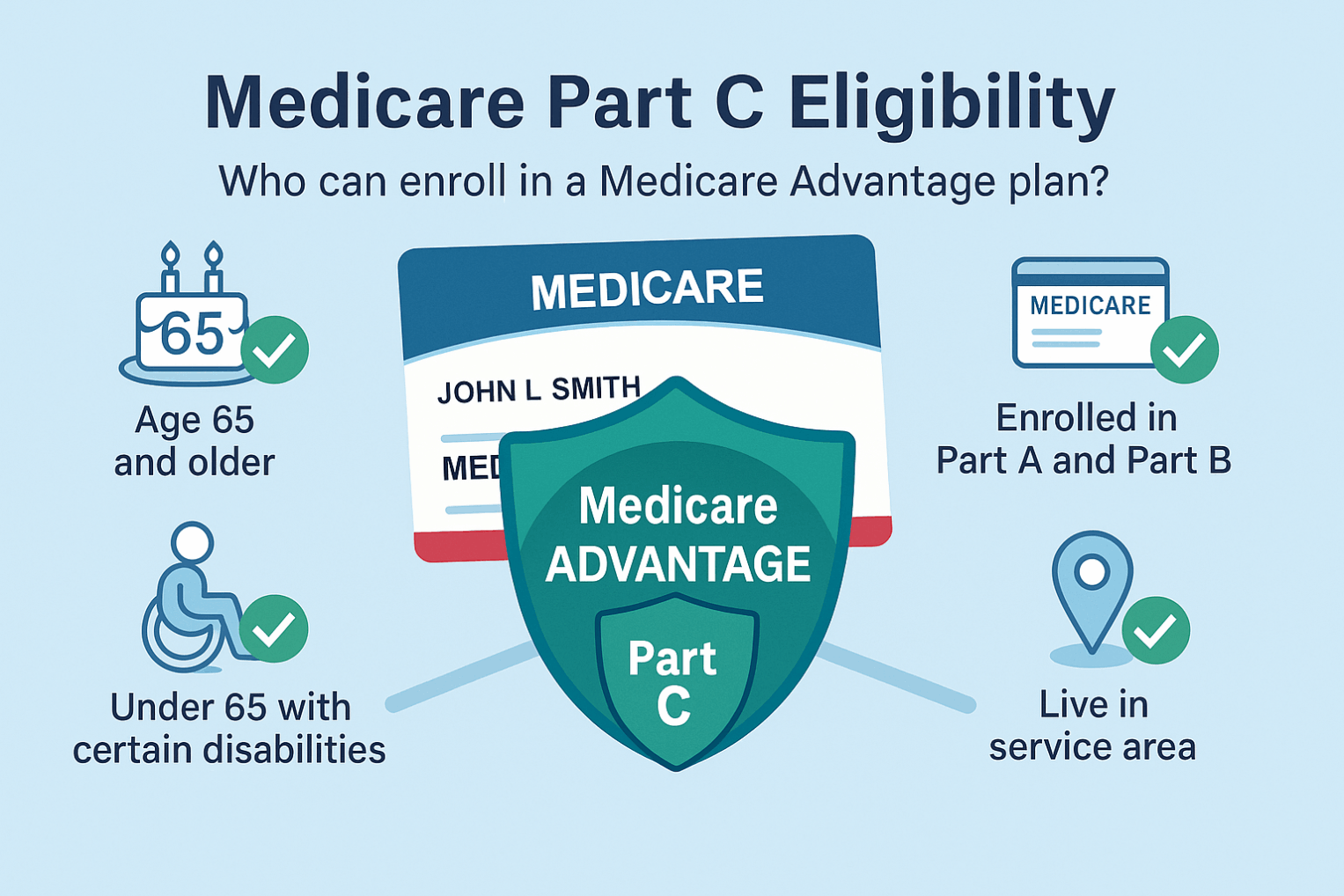

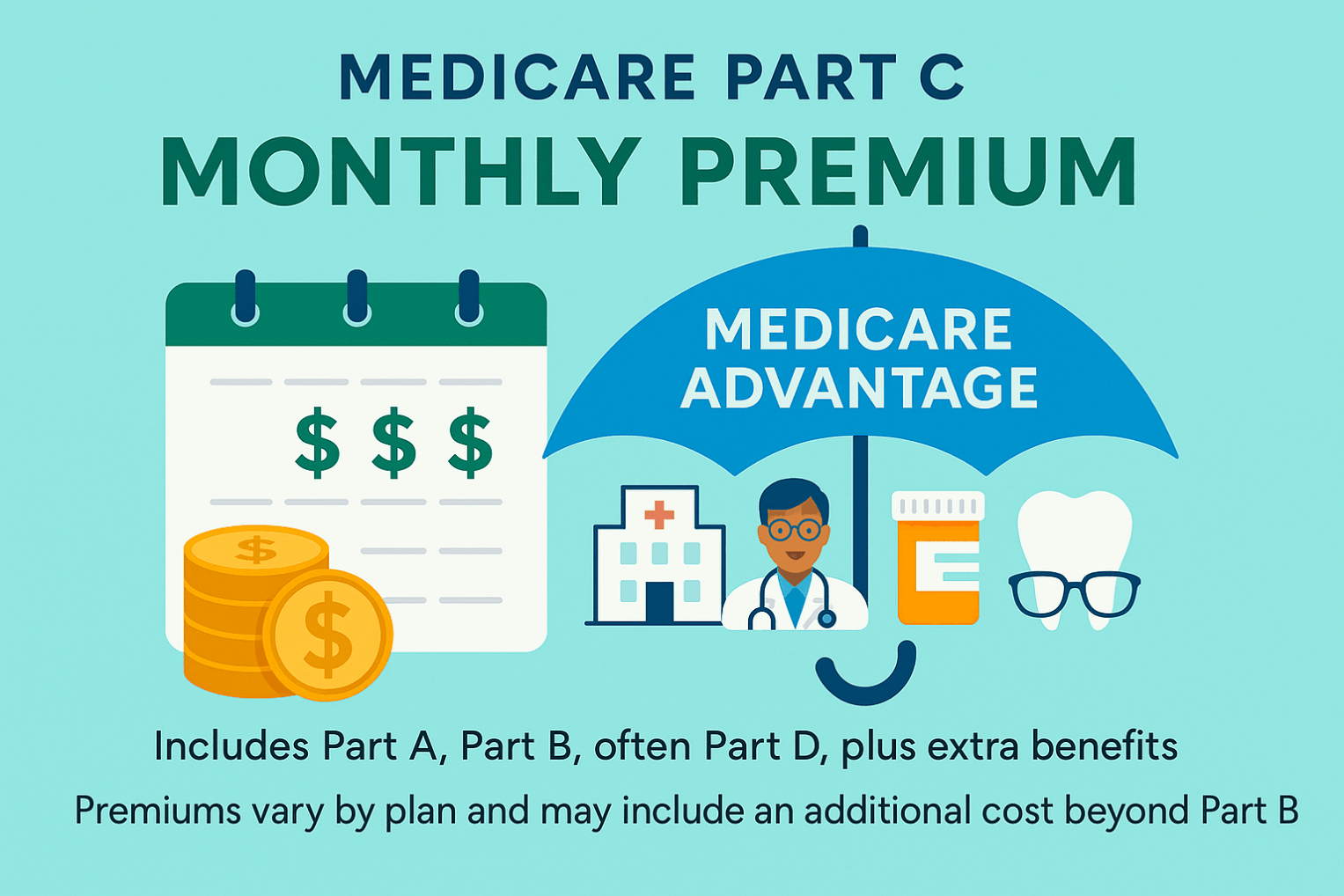

Medicare Part C, also known as Medicare Advantage (MA), is an alternative way to receive your Medicare benefits. It combines Part A (Hospital Insurance) and Part B (Medical Insurance) into one comprehensive plan offered by private insurance companies approved by the Centers for Medicare & Medicaid Services (CMS).

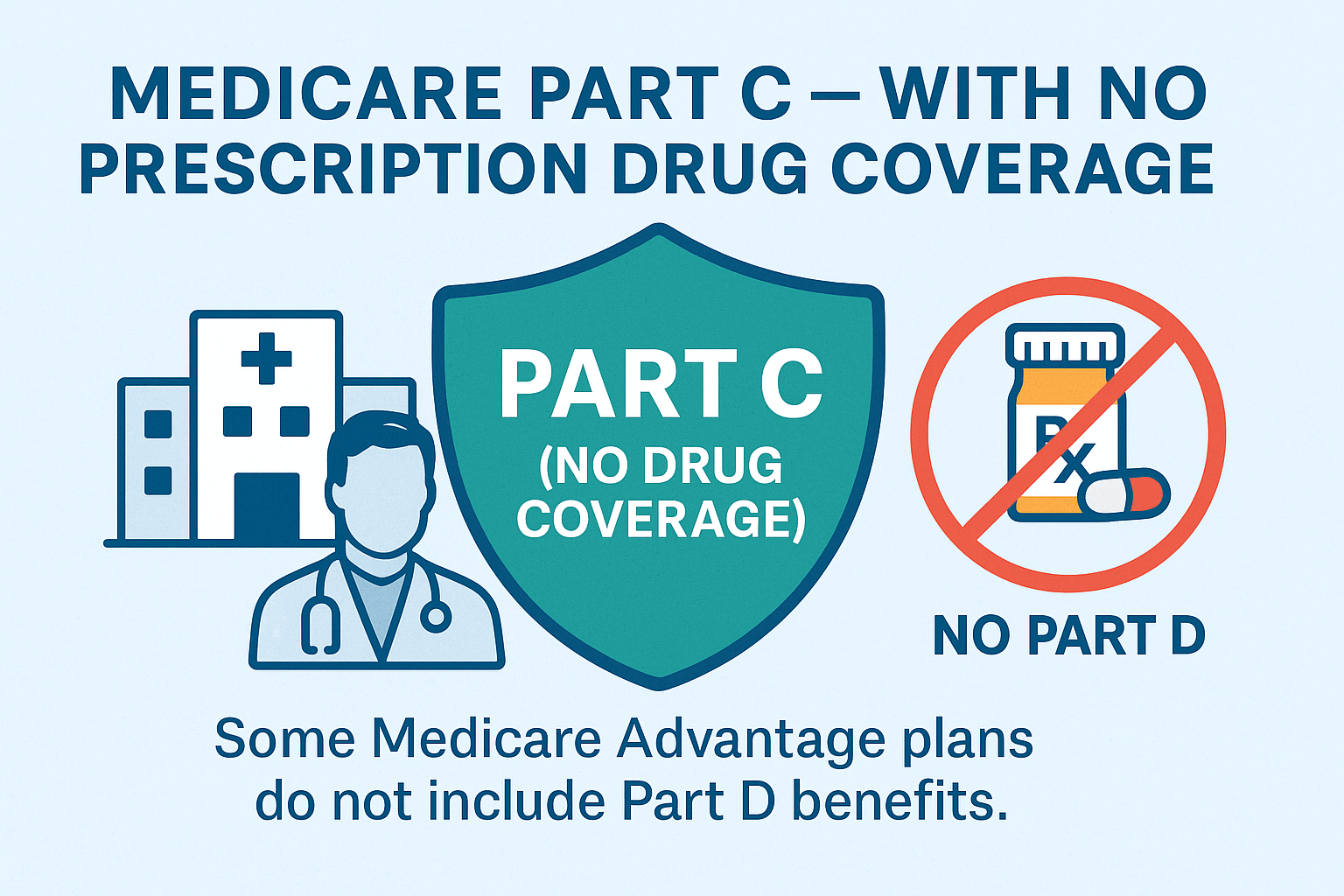

Most Medicare Advantage plans also include:

- Part D (Prescription Drug Coverage).

- Extra benefits such as dental, vision, hearing, transportation, fitness, and over-the-counter allowances.

You must be enrolled in both Parts A and B to join a Part C plan, and you continue to pay your Part B premium (plus any additional premium the plan charges).