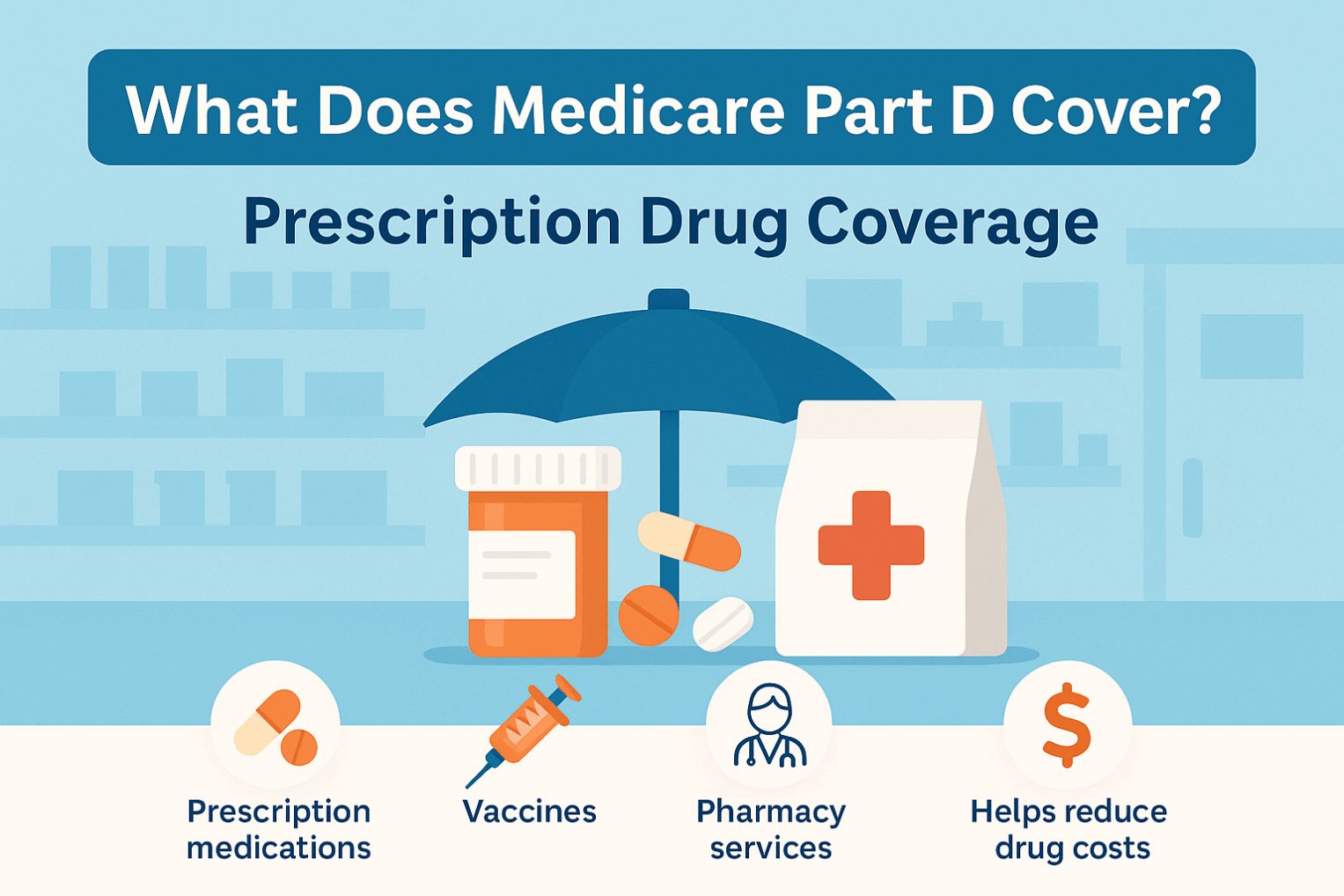

Medicare Part D (Prescription Drug Plans)

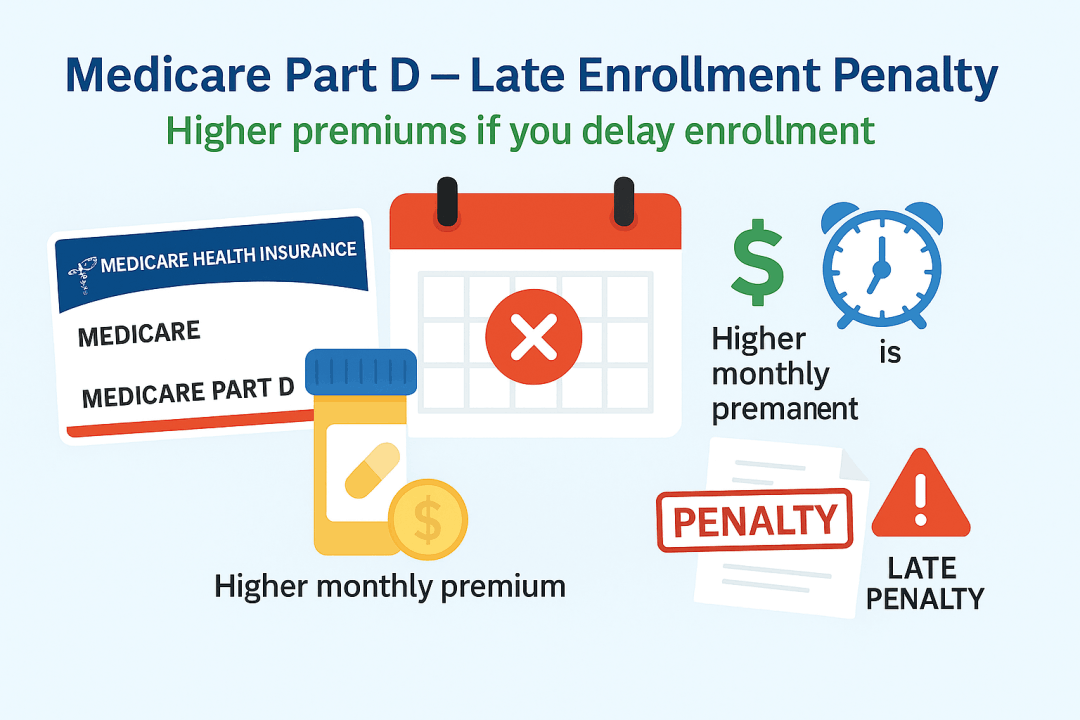

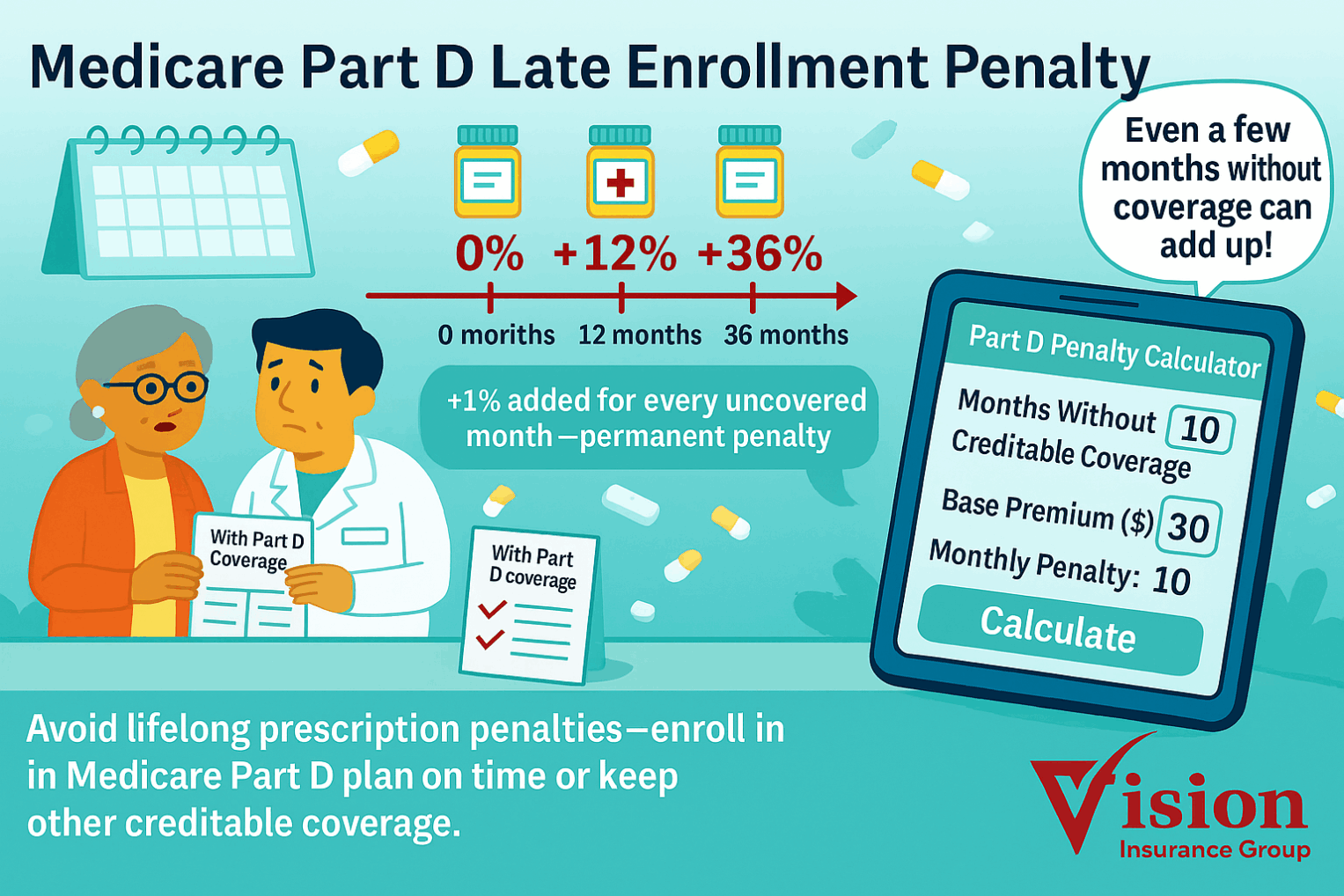

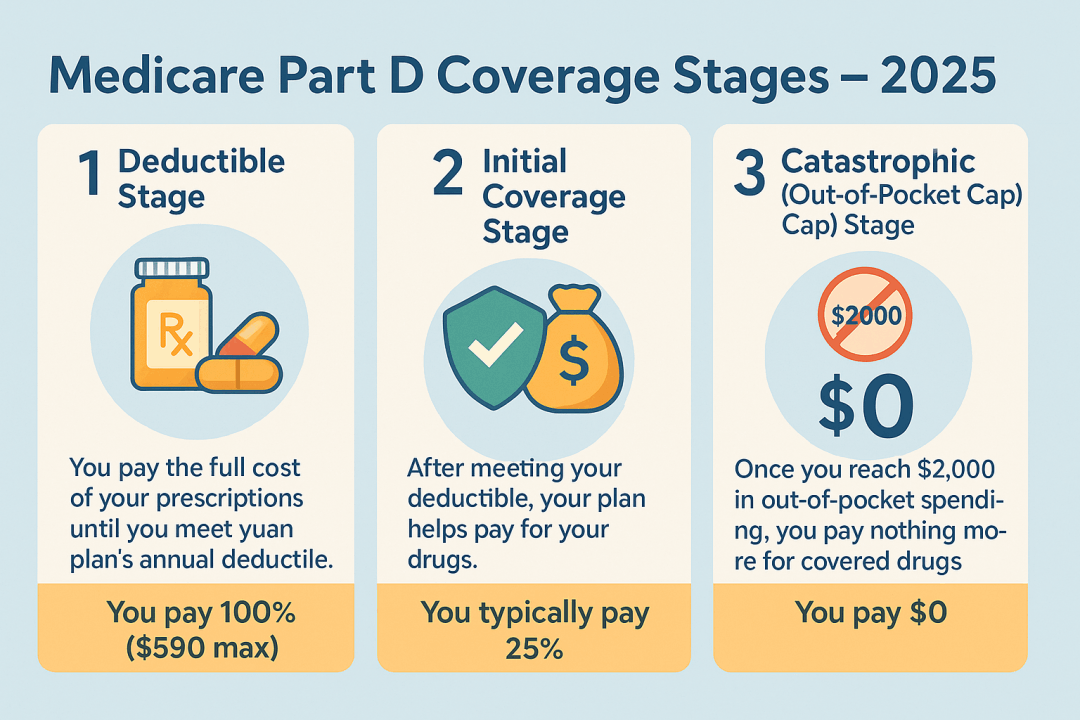

Medicare Part D provides prescription drug coverage to help lower the cost of medications. It is optional, but highly recommended because late enrollment can result in lifetime penalties if you go without “creditable” drug coverage.

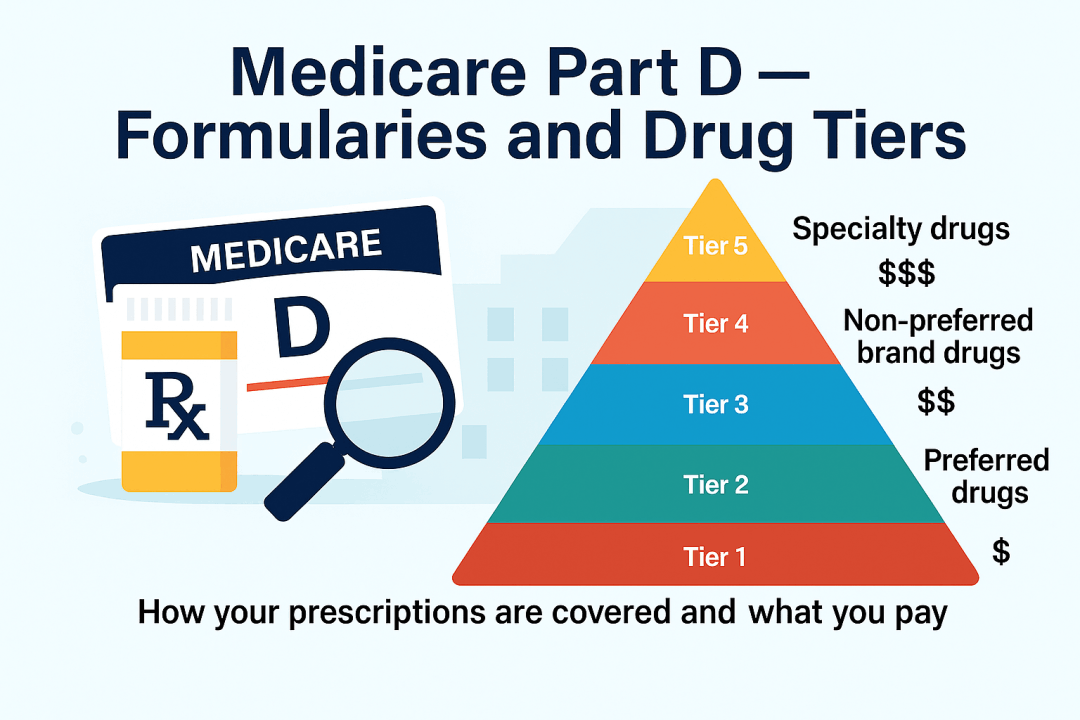

Part D is administered by private insurance companies that contract with the Centers for Medicare & Medicaid Services (CMS).

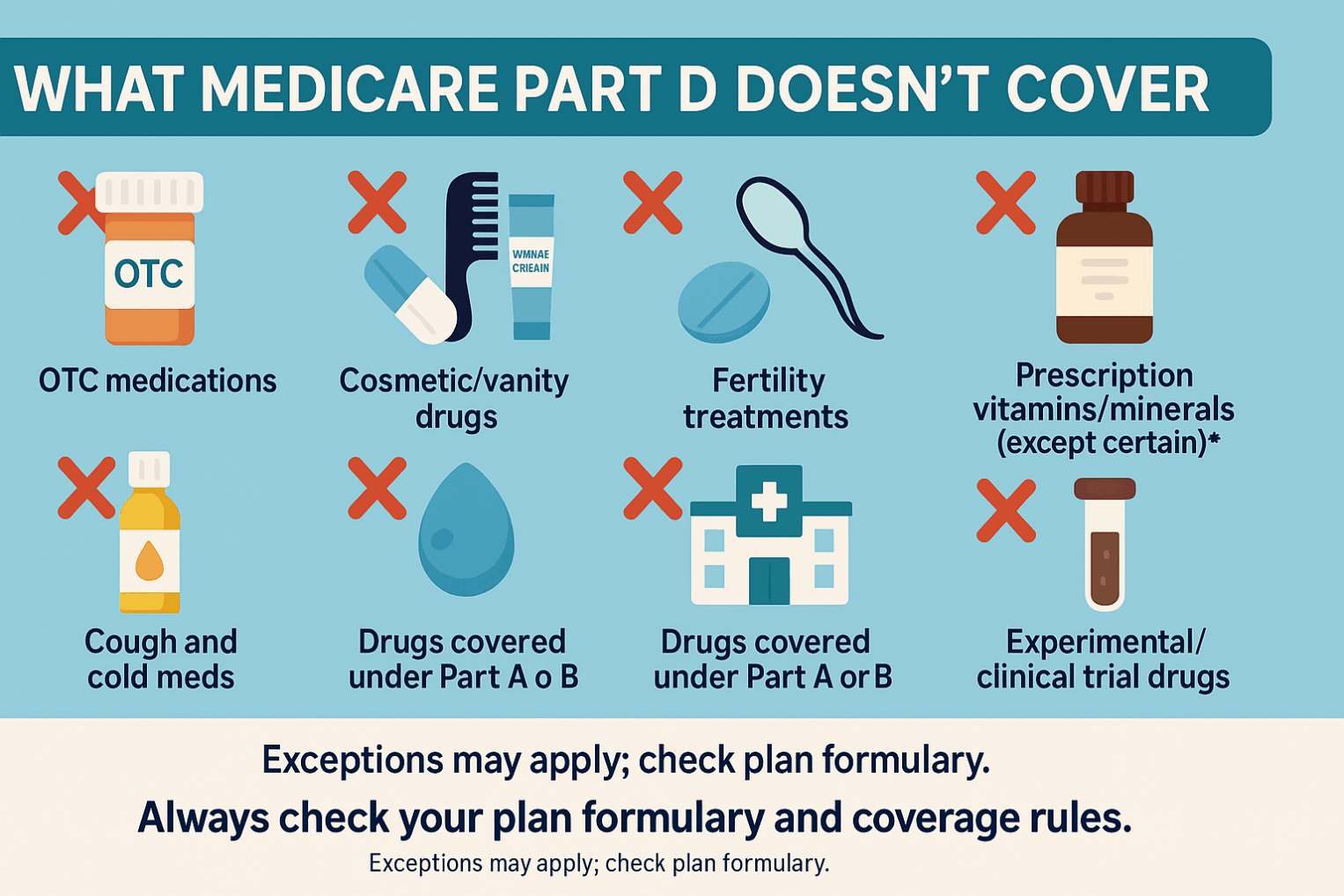

You can get Part D in one of two ways:

- Stand-alone Prescription Drug Plan (PDP): Works with Original Medicare (Parts A & B).

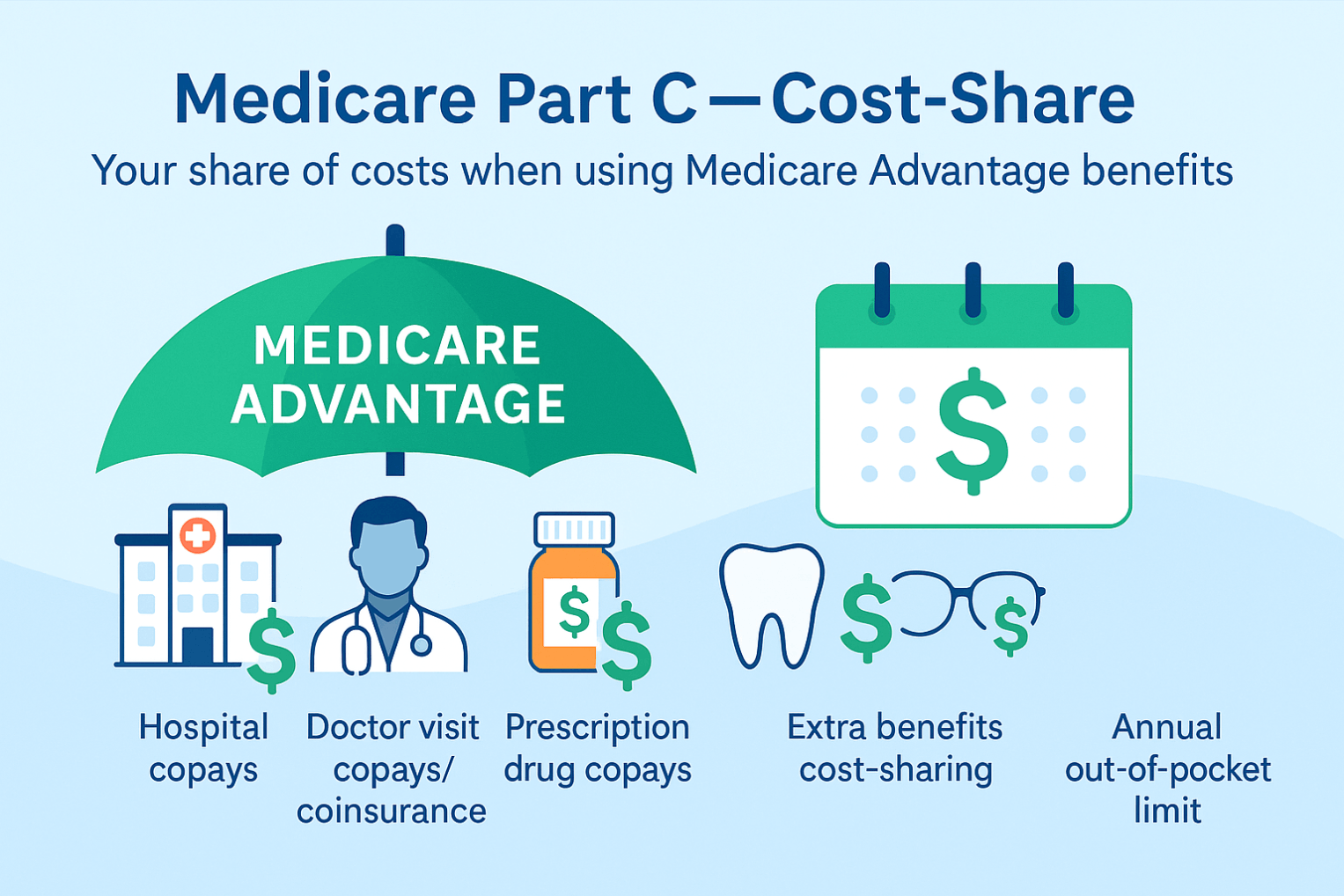

- Medicare Advantage Prescription Drug Plan (MAPD): Combines Part C + Part D benefits in one plan.

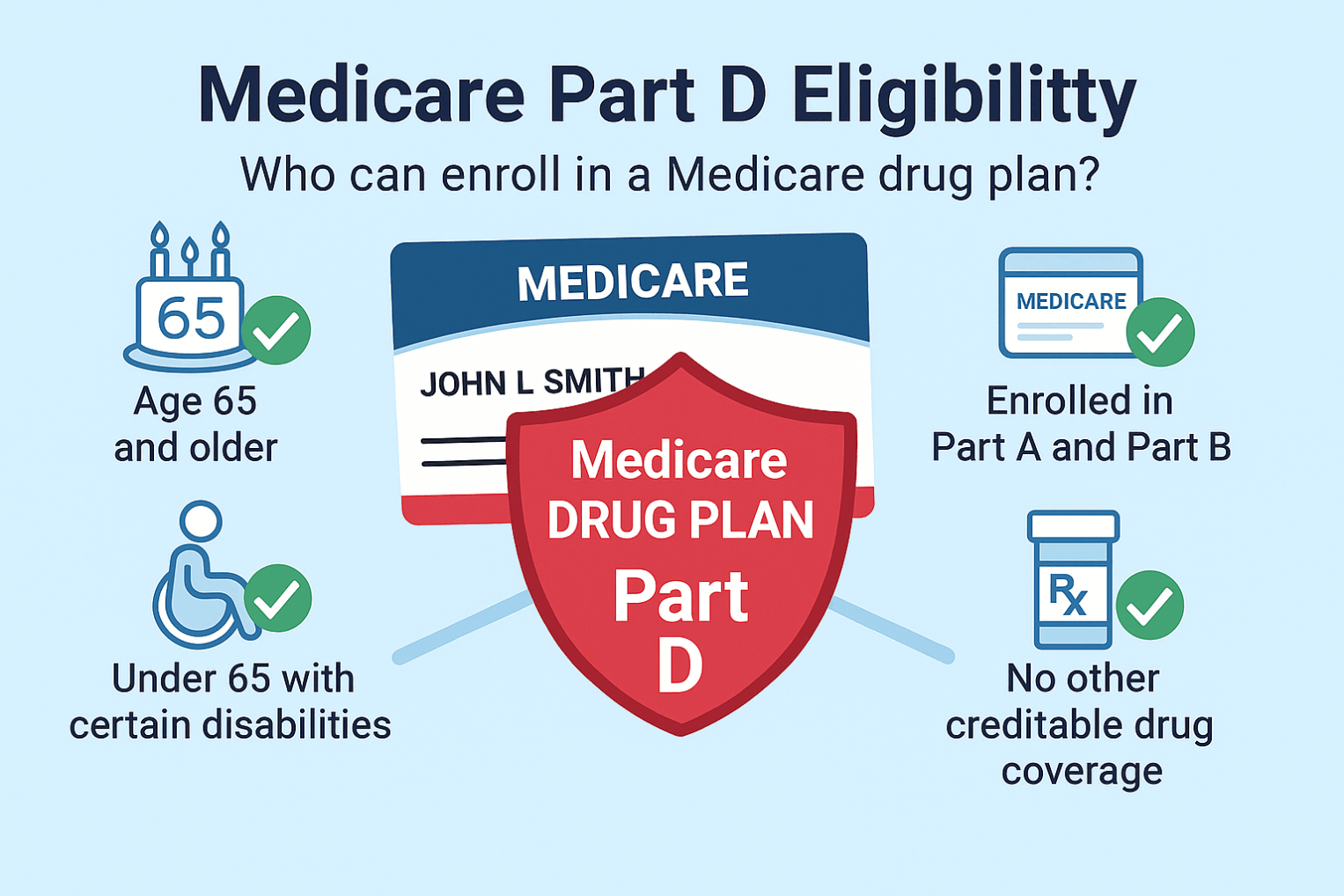

You must be enrolled in both Parts A and B to join a Part C plan, and you continue to pay your Part B premium (plus any additional premium the plan charges).