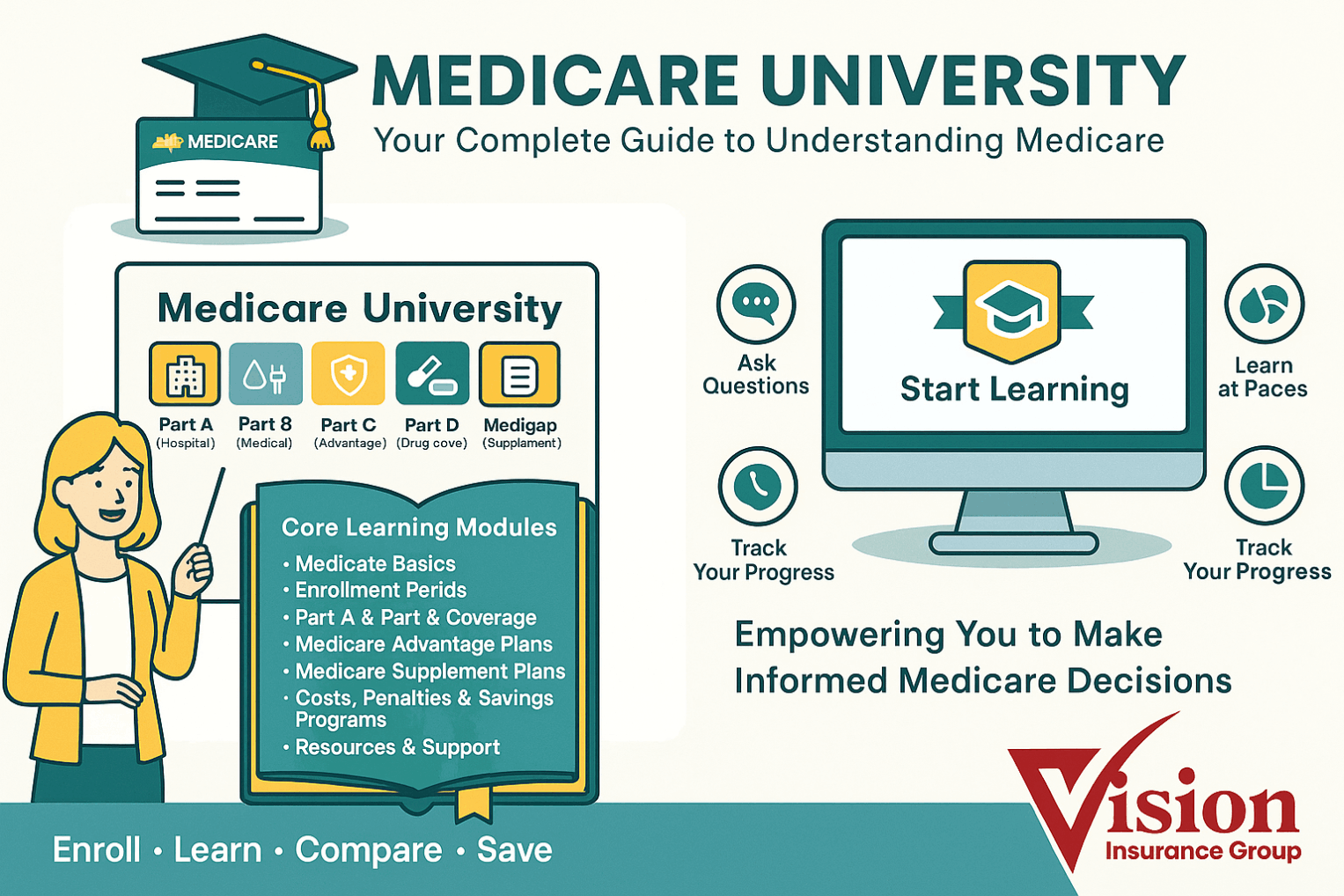

Medicare Part A (Hospital Insurance)

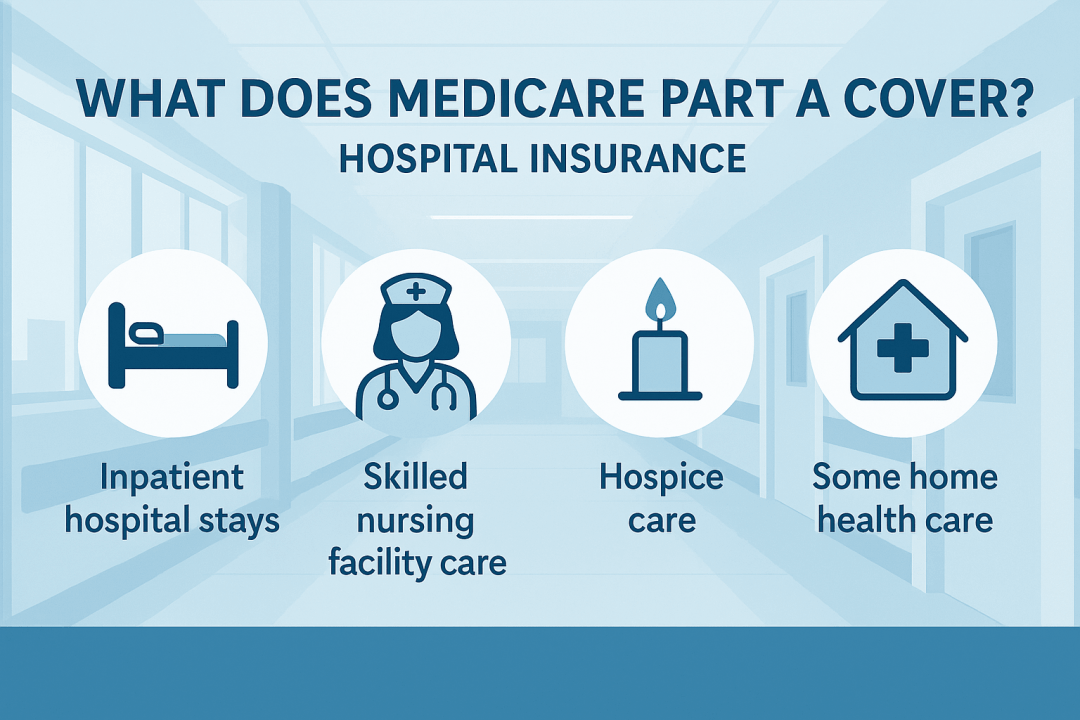

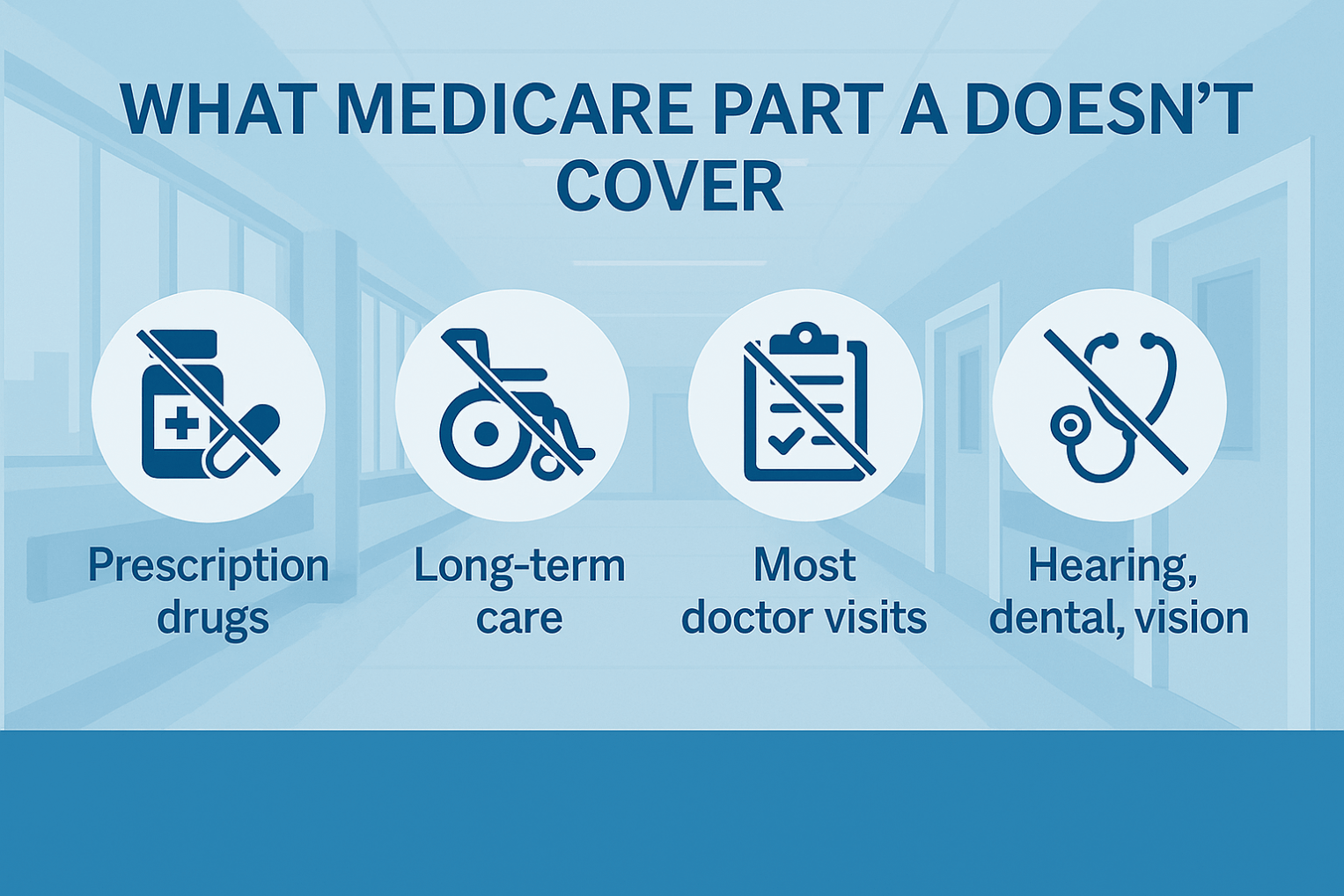

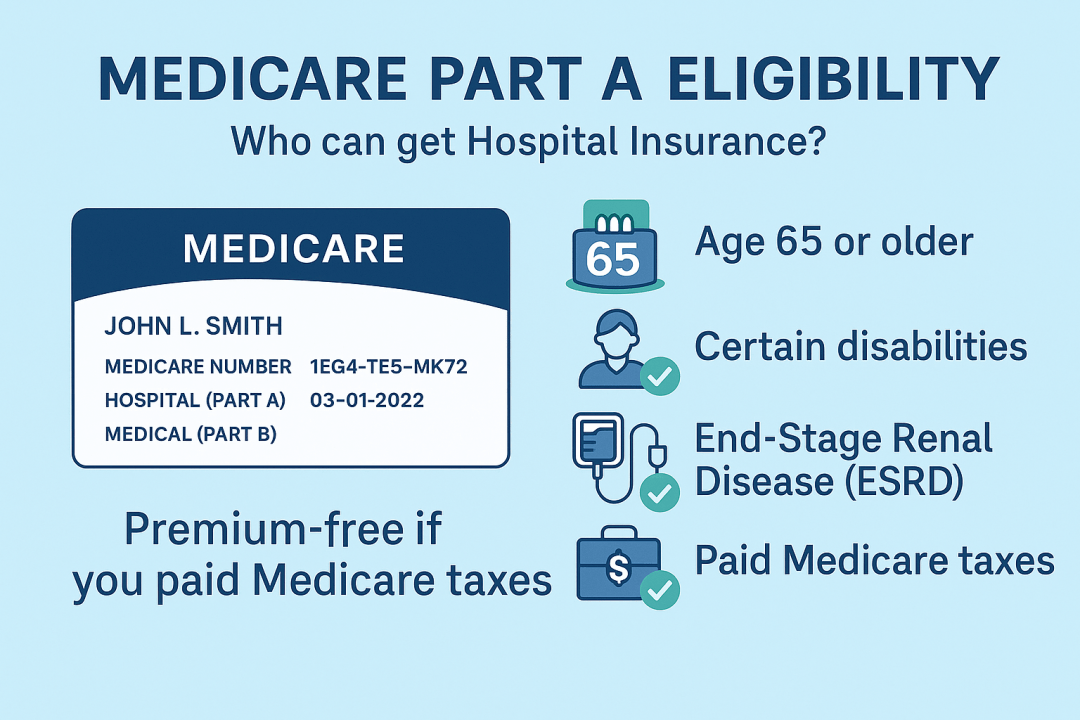

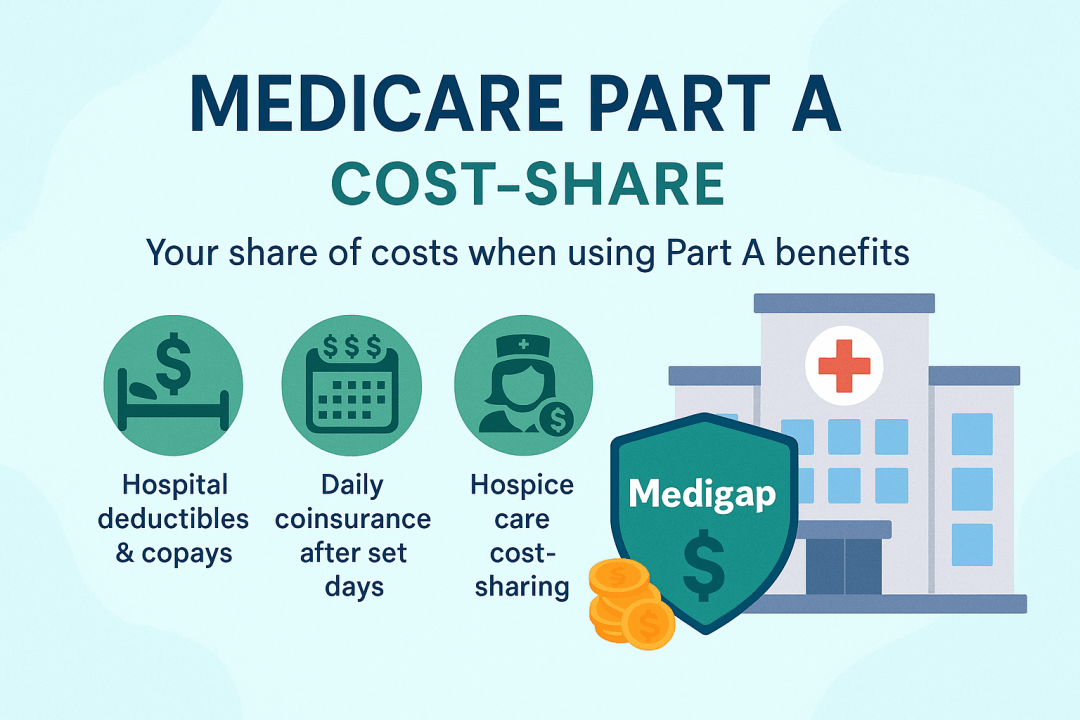

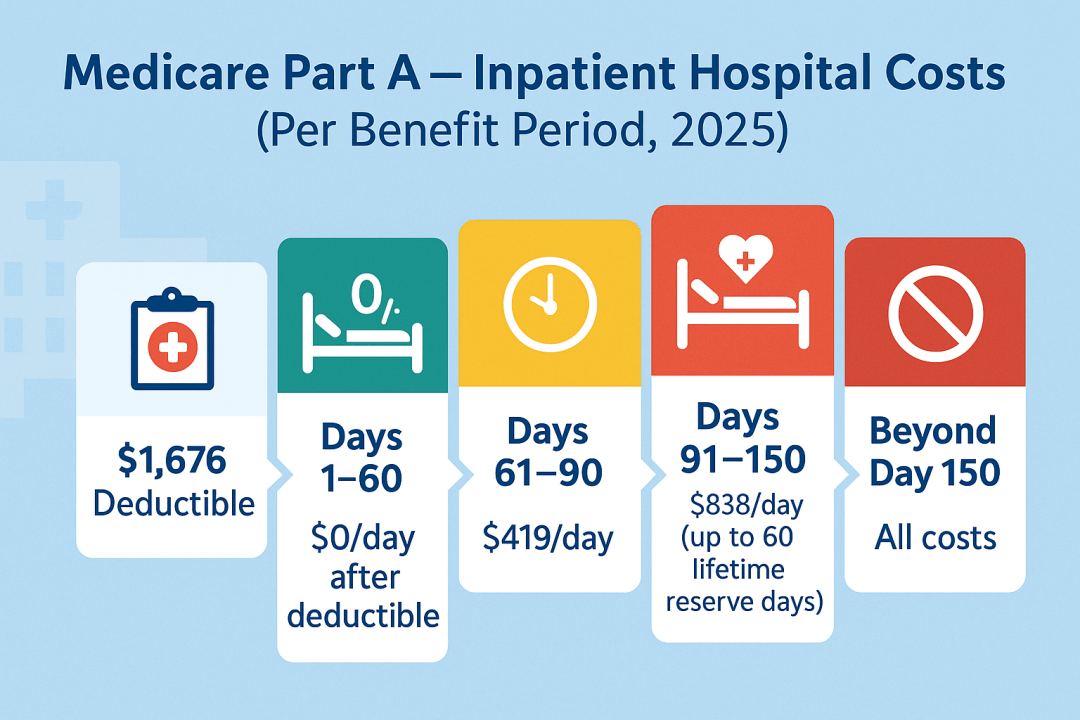

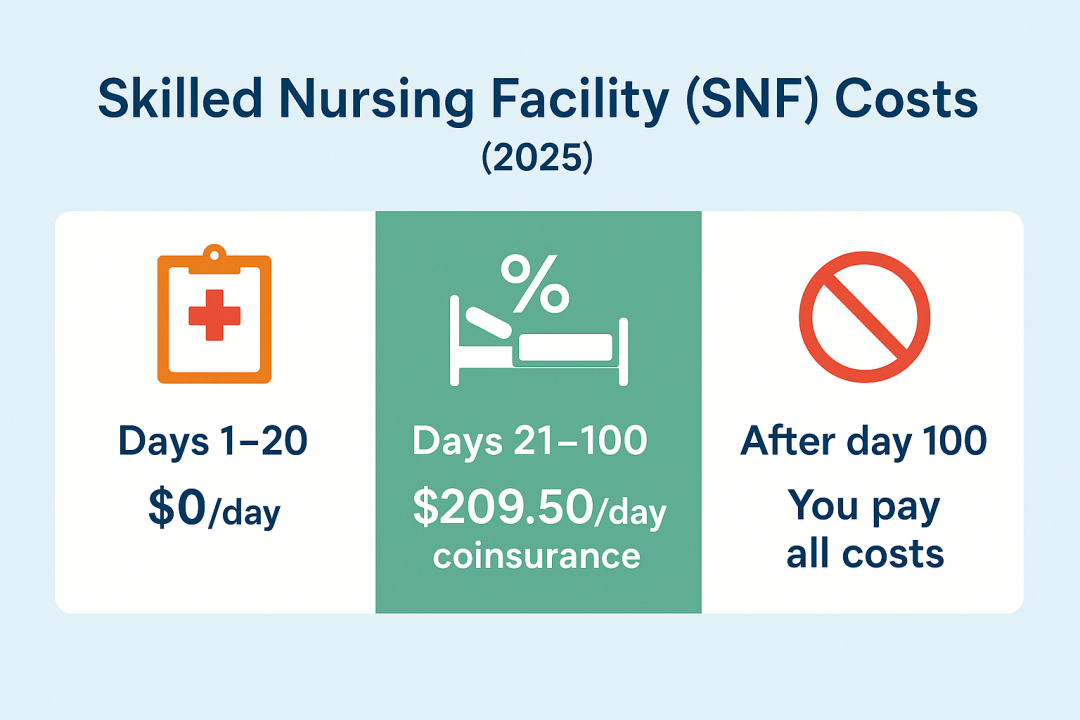

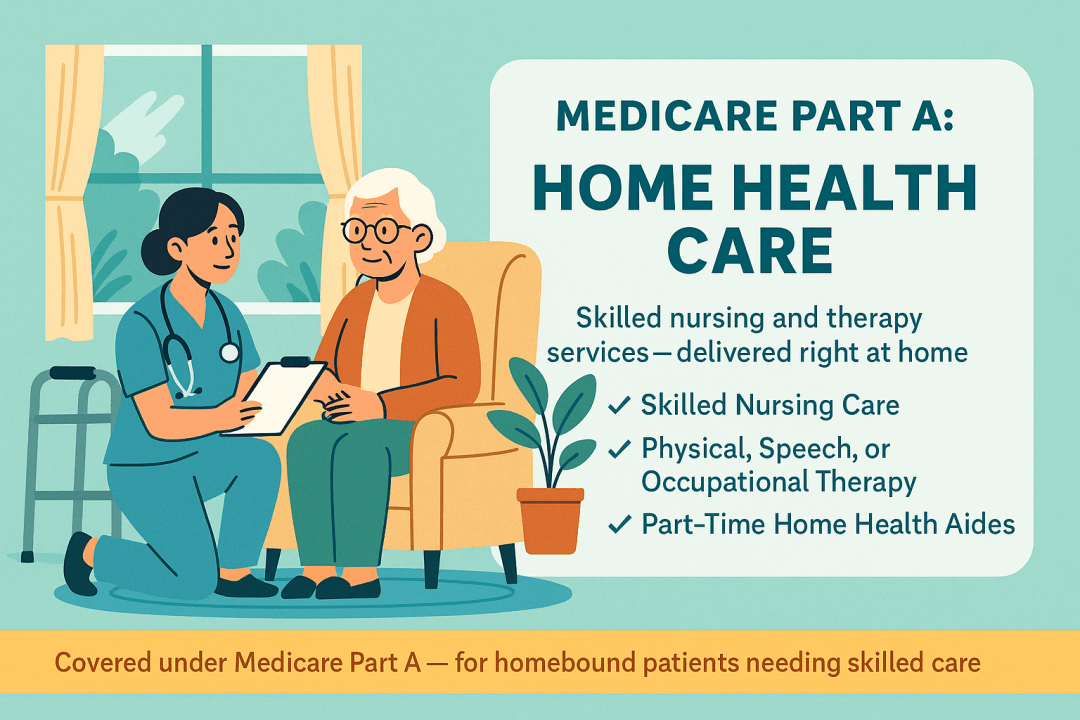

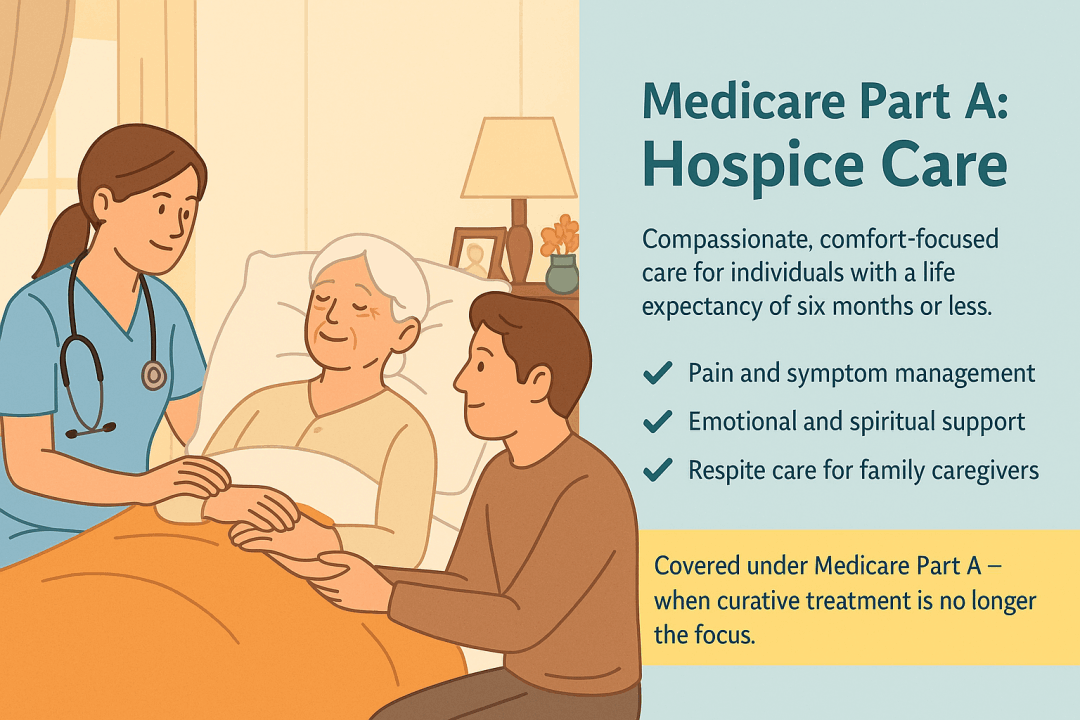

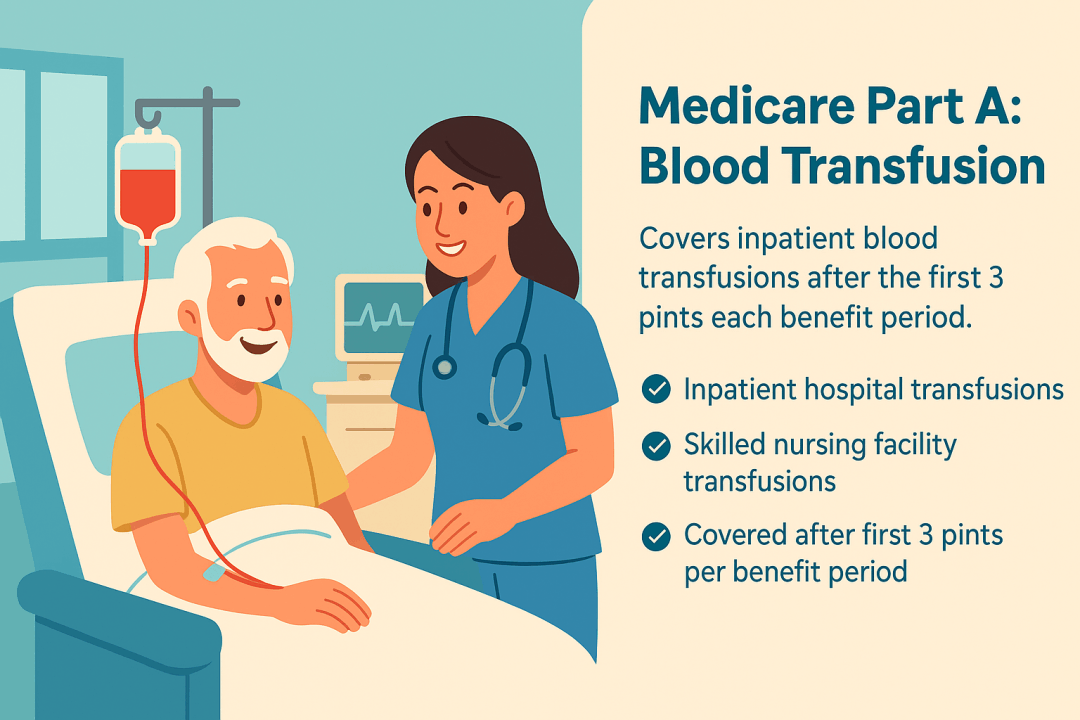

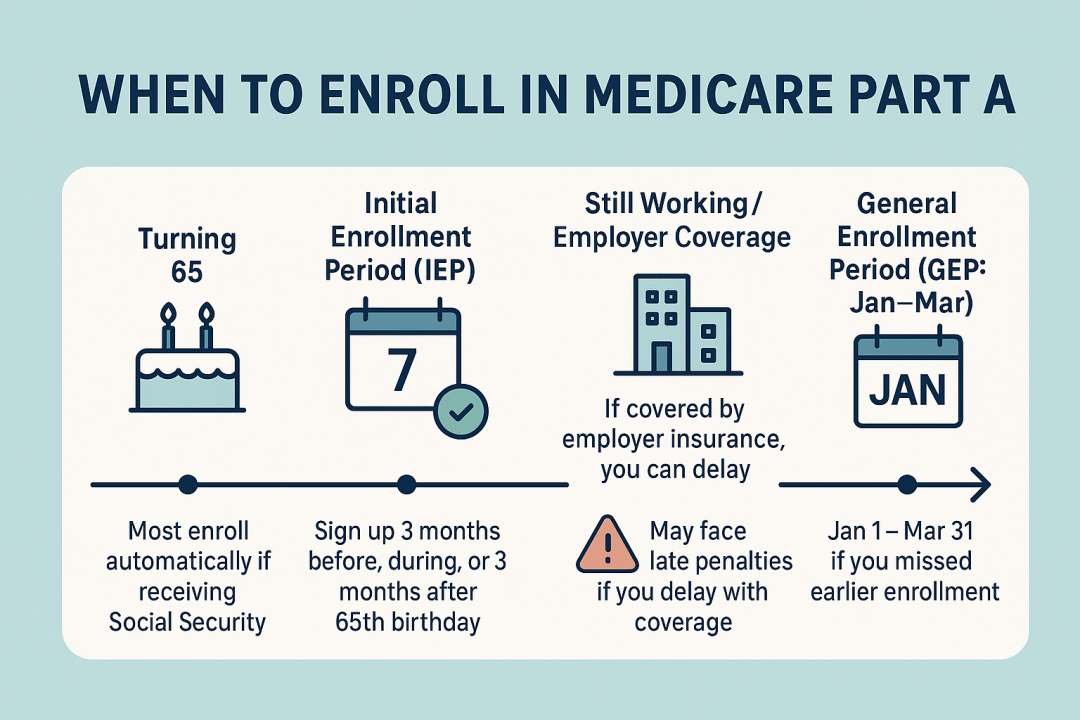

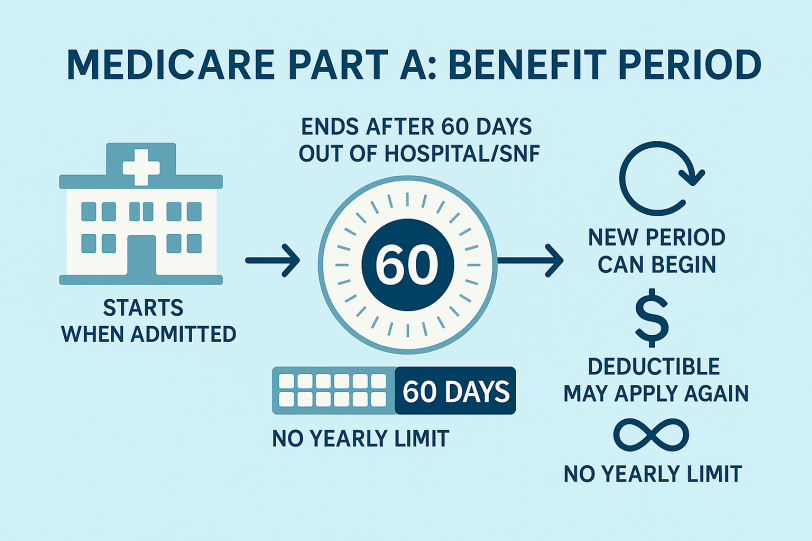

Medicare Part A is hospital insurance that helps pay for inpatient hospital care, skilled nursing facility care after a qualifying hospital stay, hospice, limited home health, and inpatient blood. Most people get it premium-free if they (or a spouse) paid Medicare taxes for about 10 years; otherwise a monthly premium applies. You pay a deductible per benefit period and daily coinsurance after certain day limits. You’re generally eligible at 65+ or earlier with certain disabilities or End Stage Renal Disease (ESRD).