Medicare Part B (Medicare Insurance)

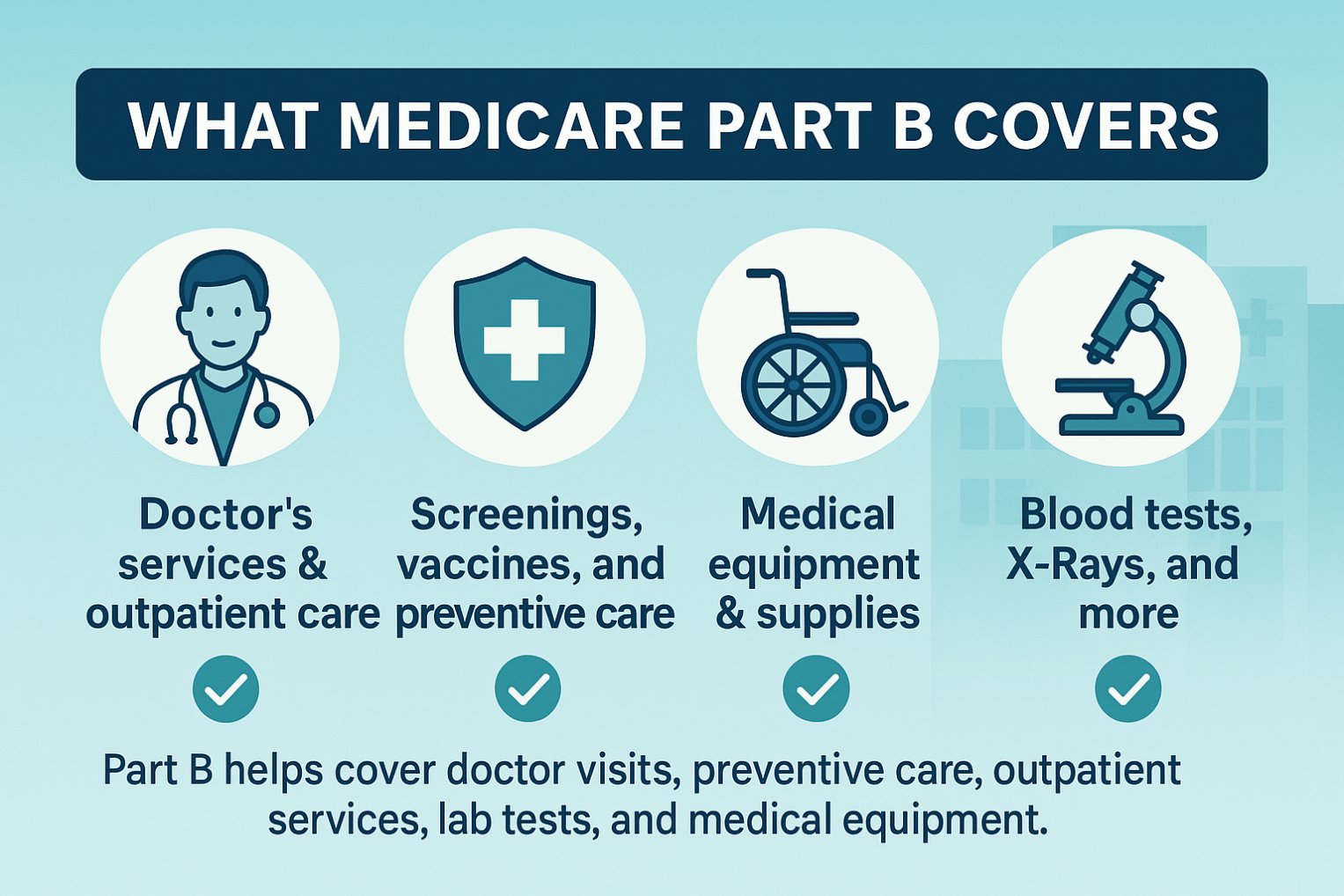

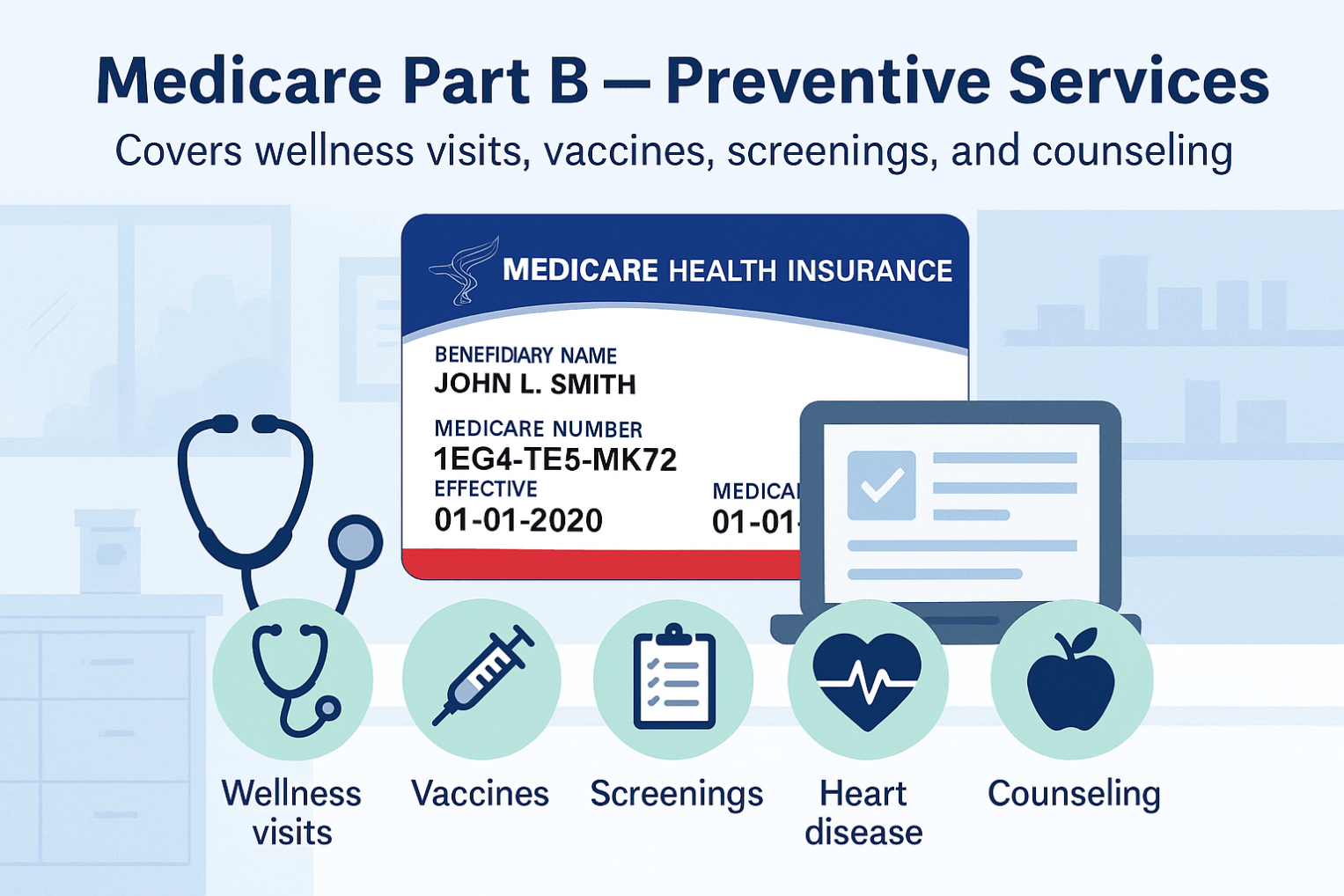

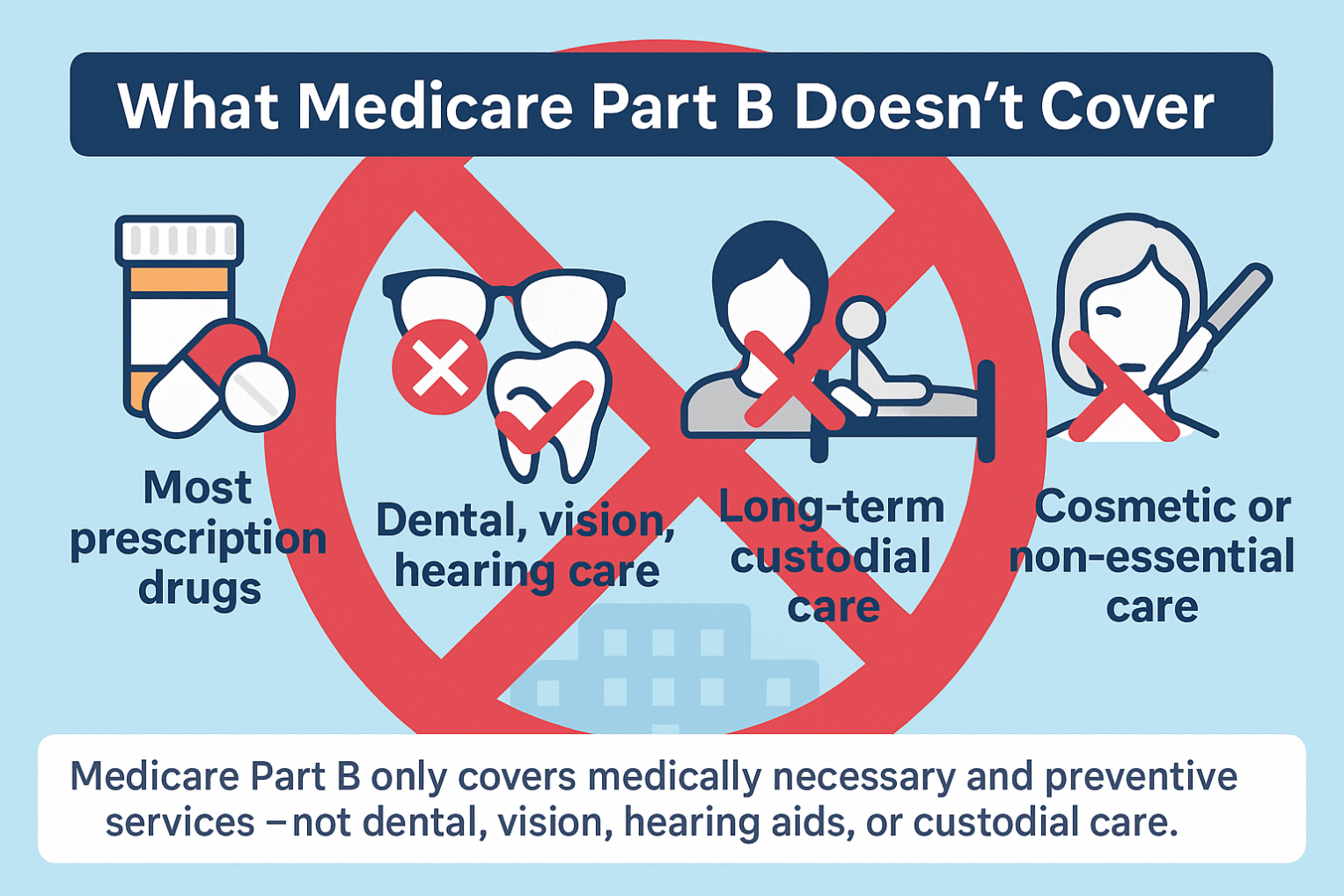

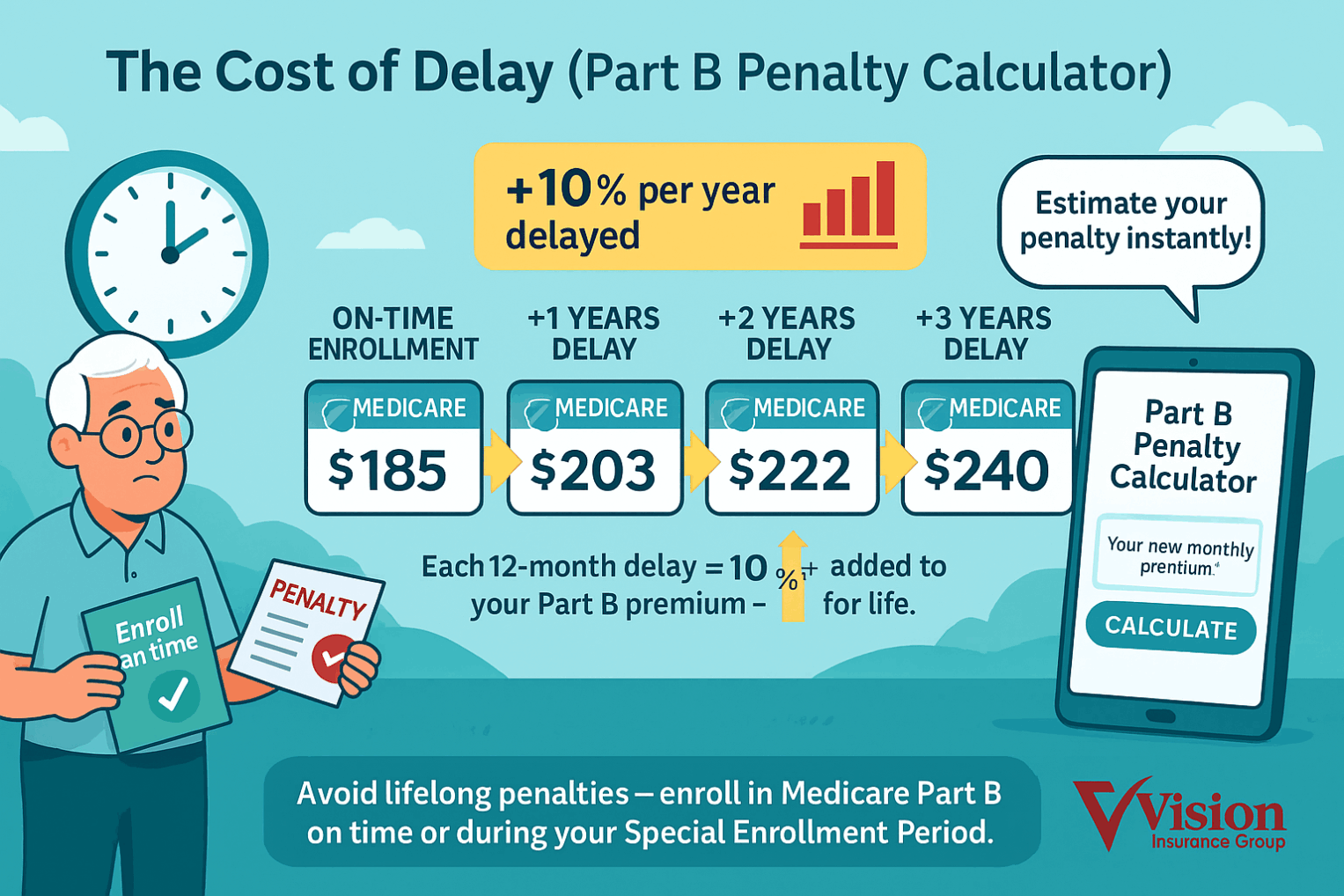

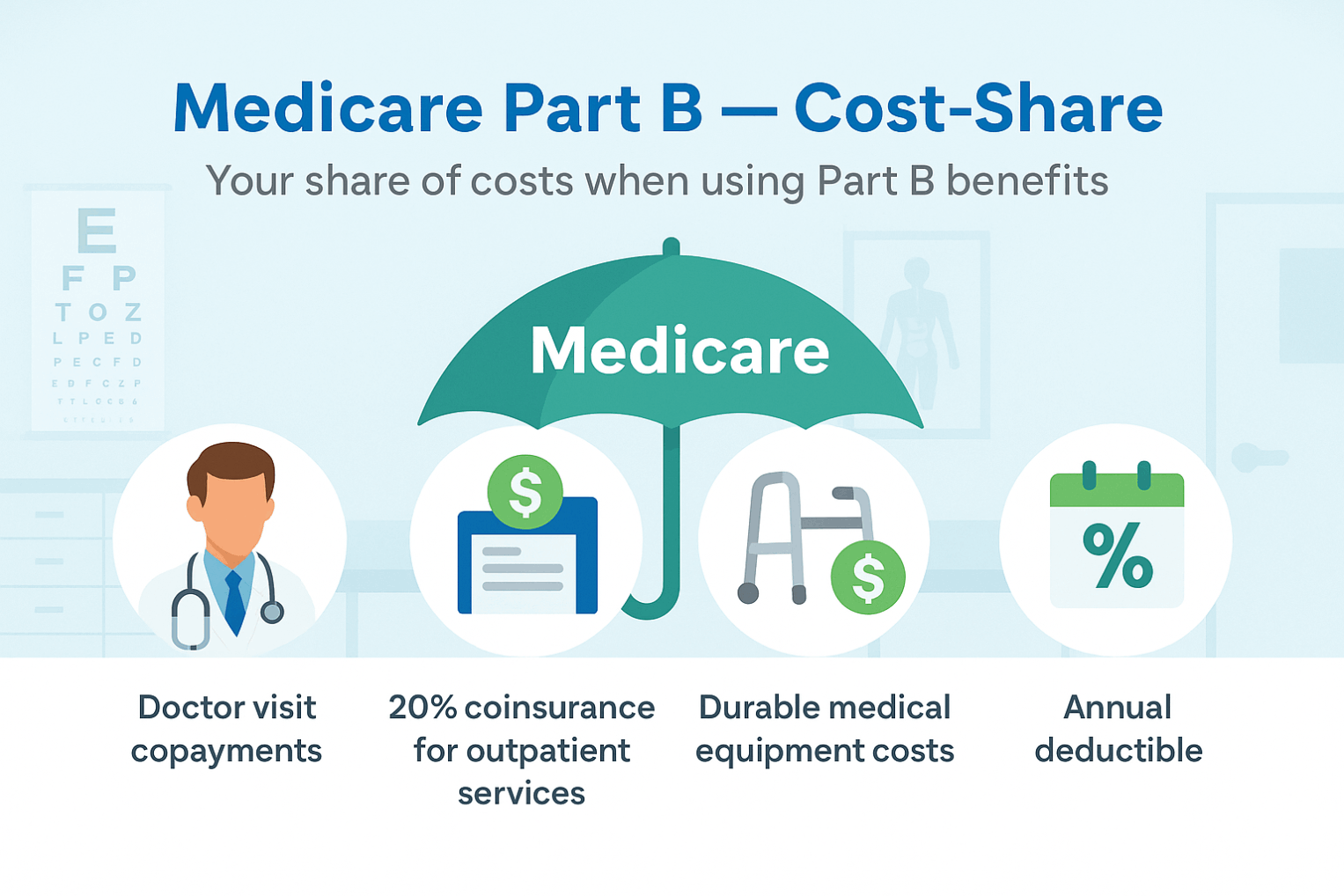

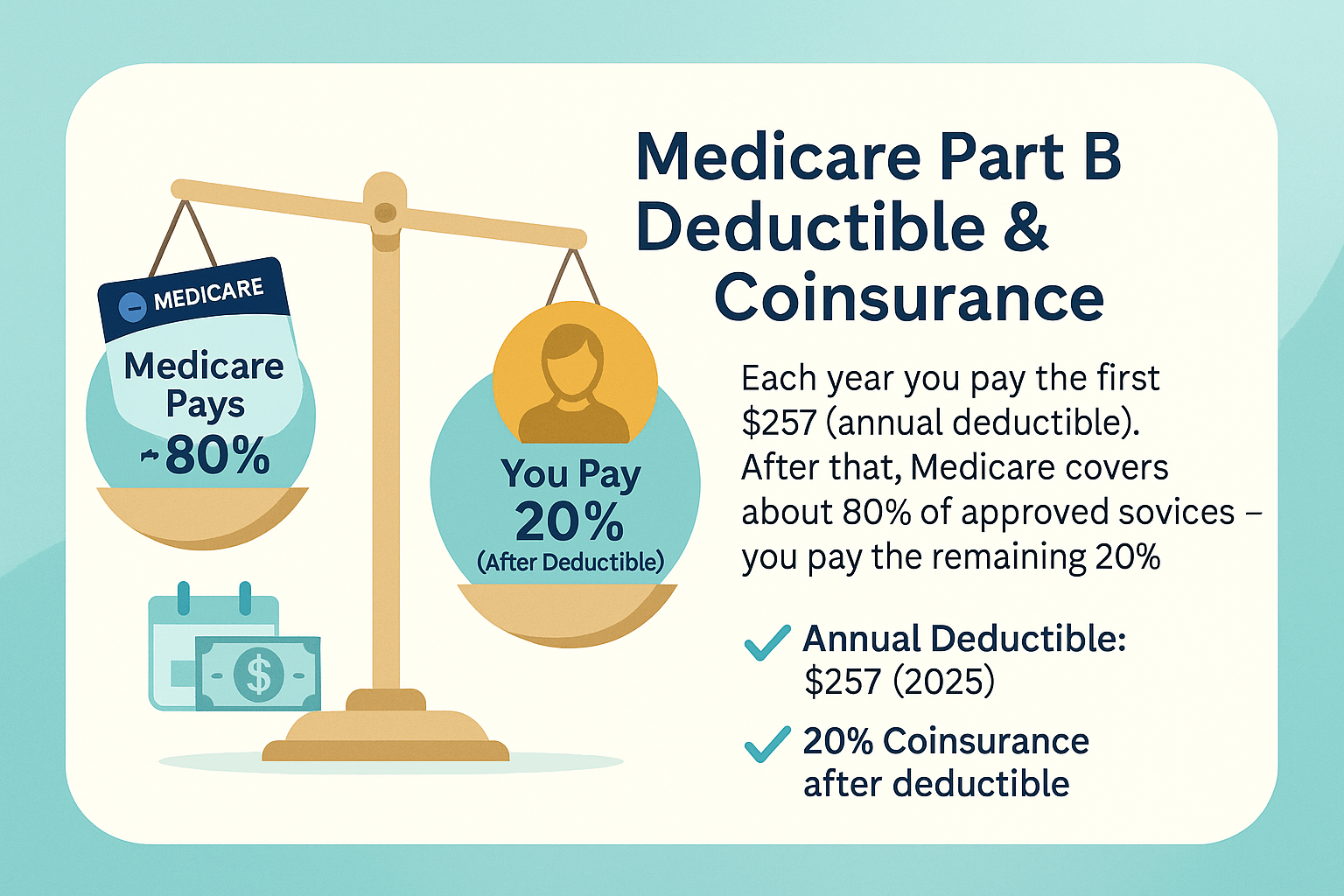

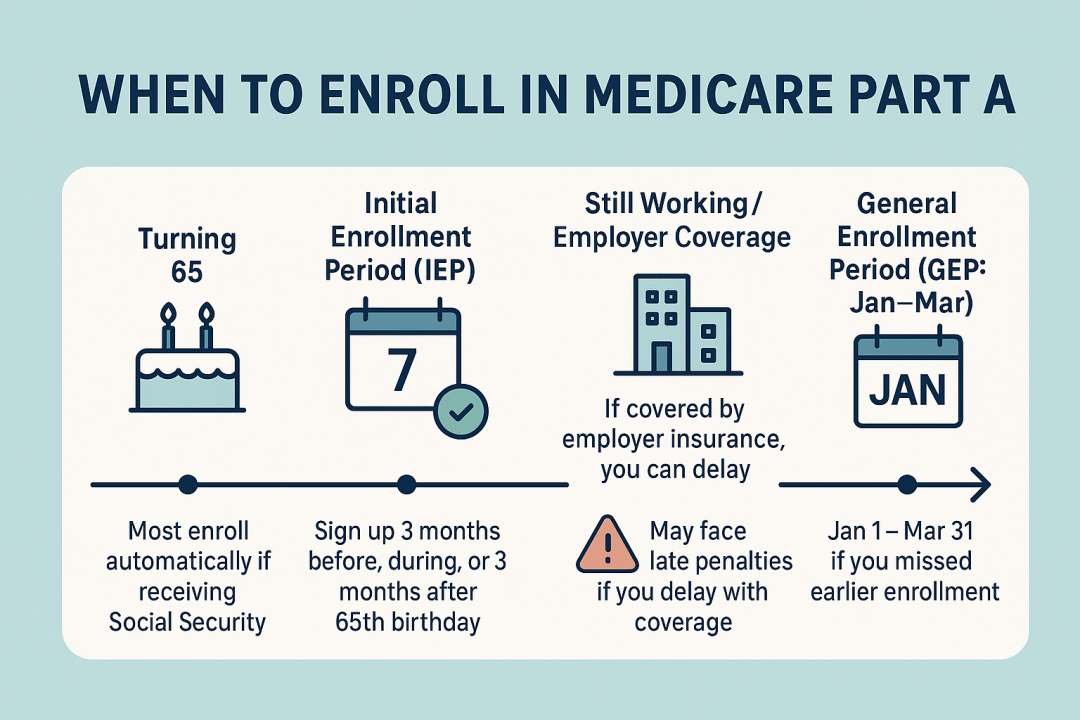

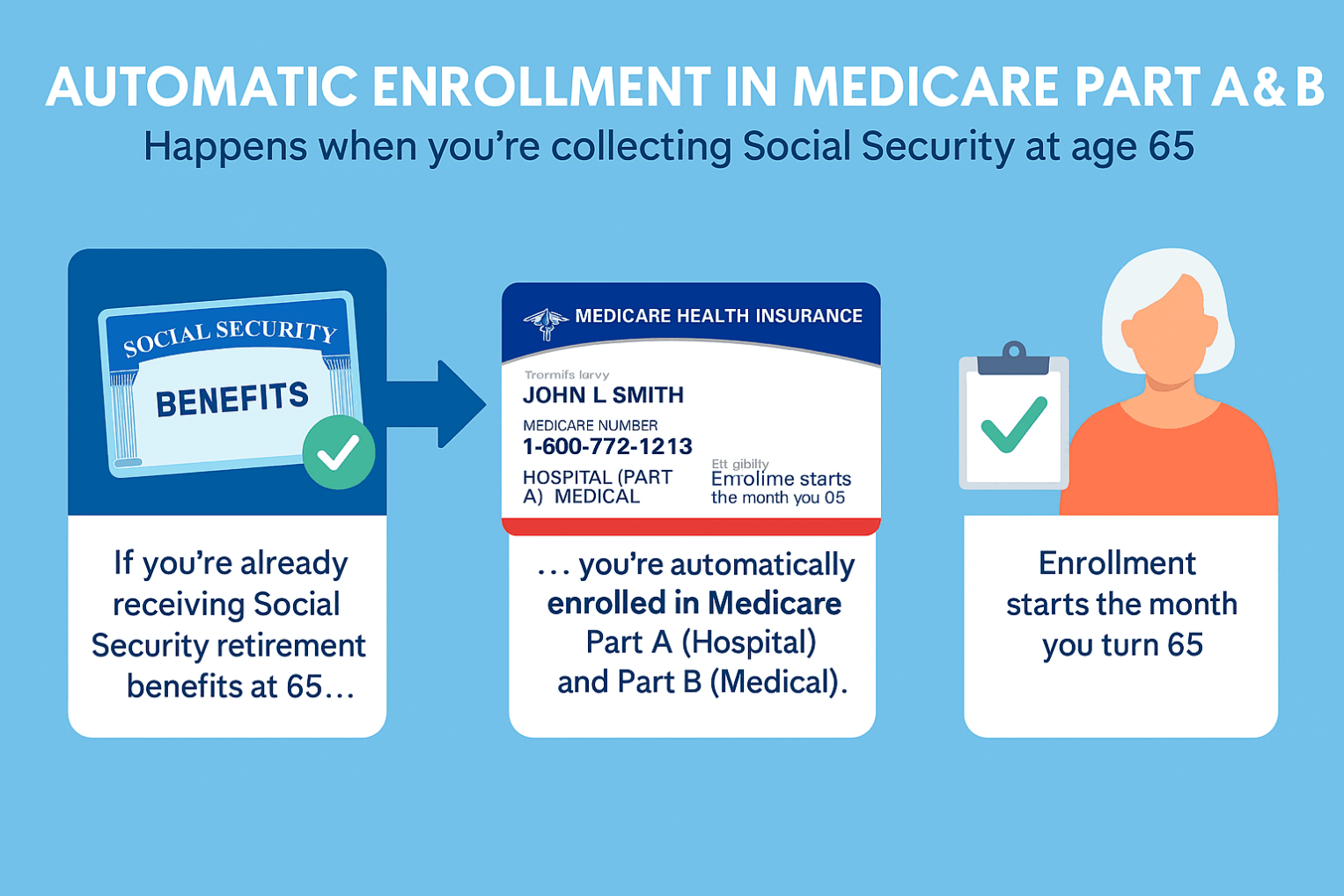

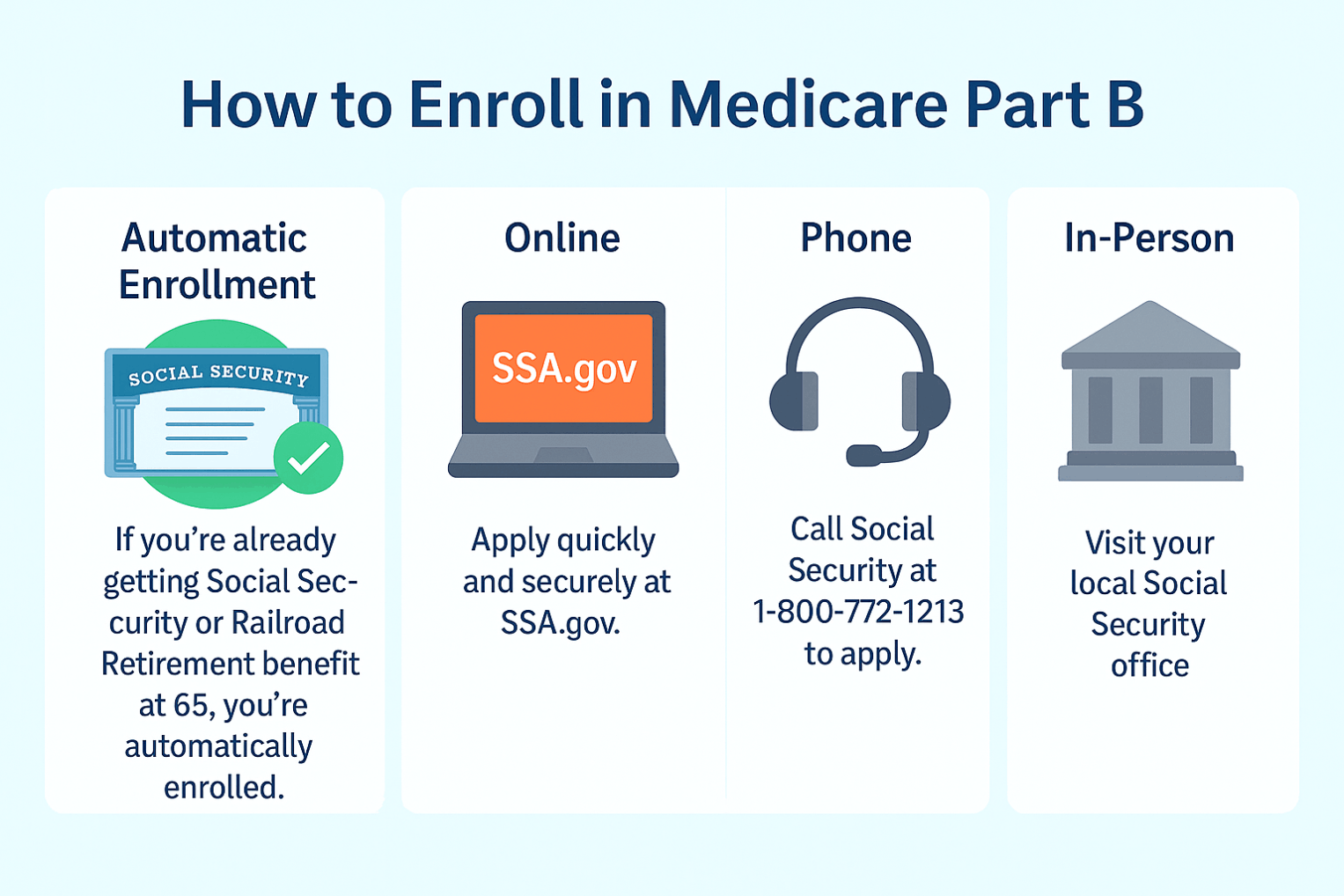

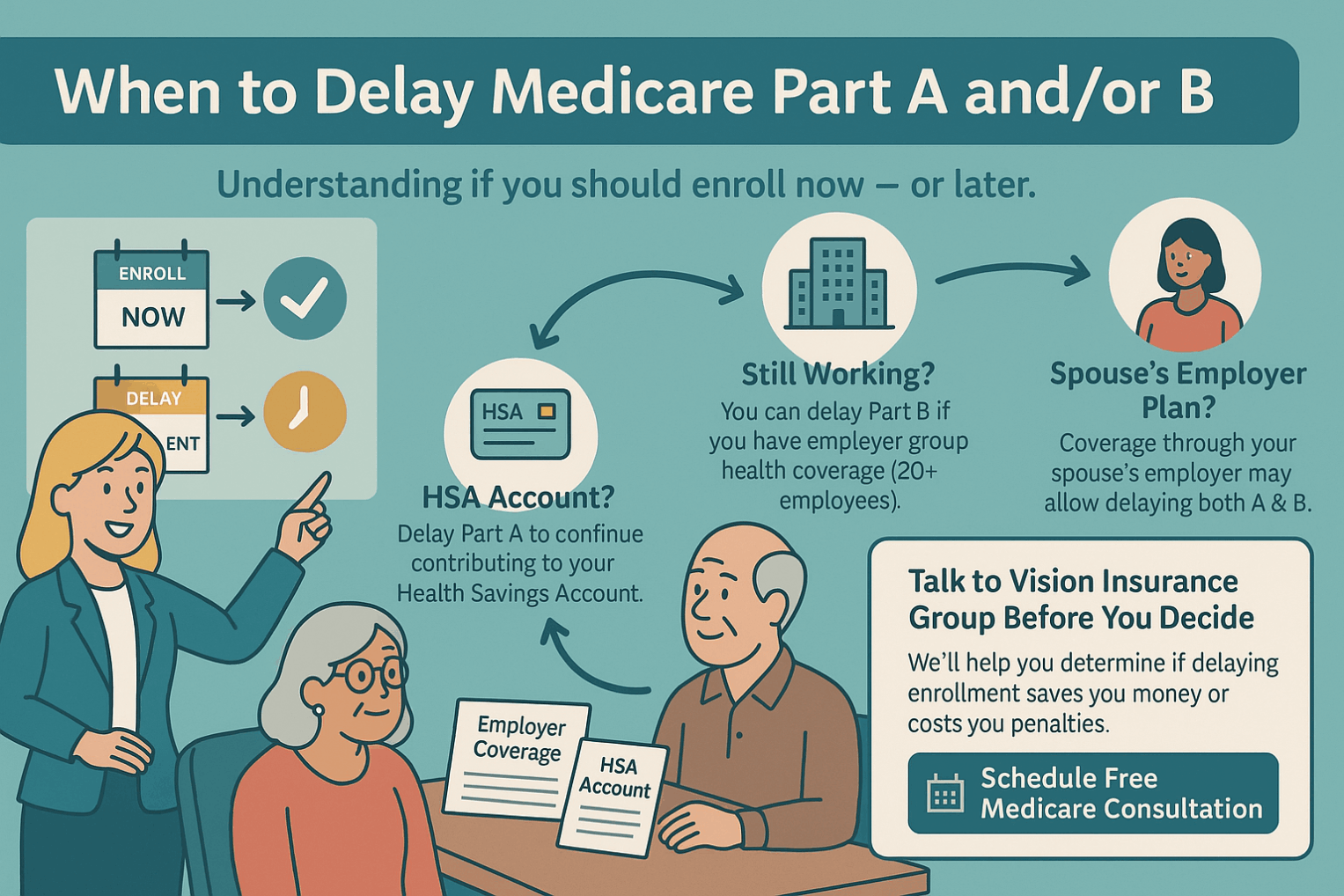

Medicare Part B is the portion of Medicare that covers outpatient medical services. It helps pay for doctor visits, preventive care (like screenings and vaccines), lab tests, outpatient hospital services, durable medical equipment, and some home health and mental health care. After paying a monthly premium and meeting a small annual deductible, beneficiaries usually pay 20% of the Medicare-approved cost for most services, while Medicare pays the rest. Part B does not cover routine dental, vision, or hearing, most prescription drugs, or long-term custodial care. Enrollment is generally at age 65 unless you qualify earlier through disability, and late enrollment can result in a penalty.