| Federal government (CMS). | Who runs it | Private insurers contracted with CMS; must cover A & B services and follow Medicare rules. |

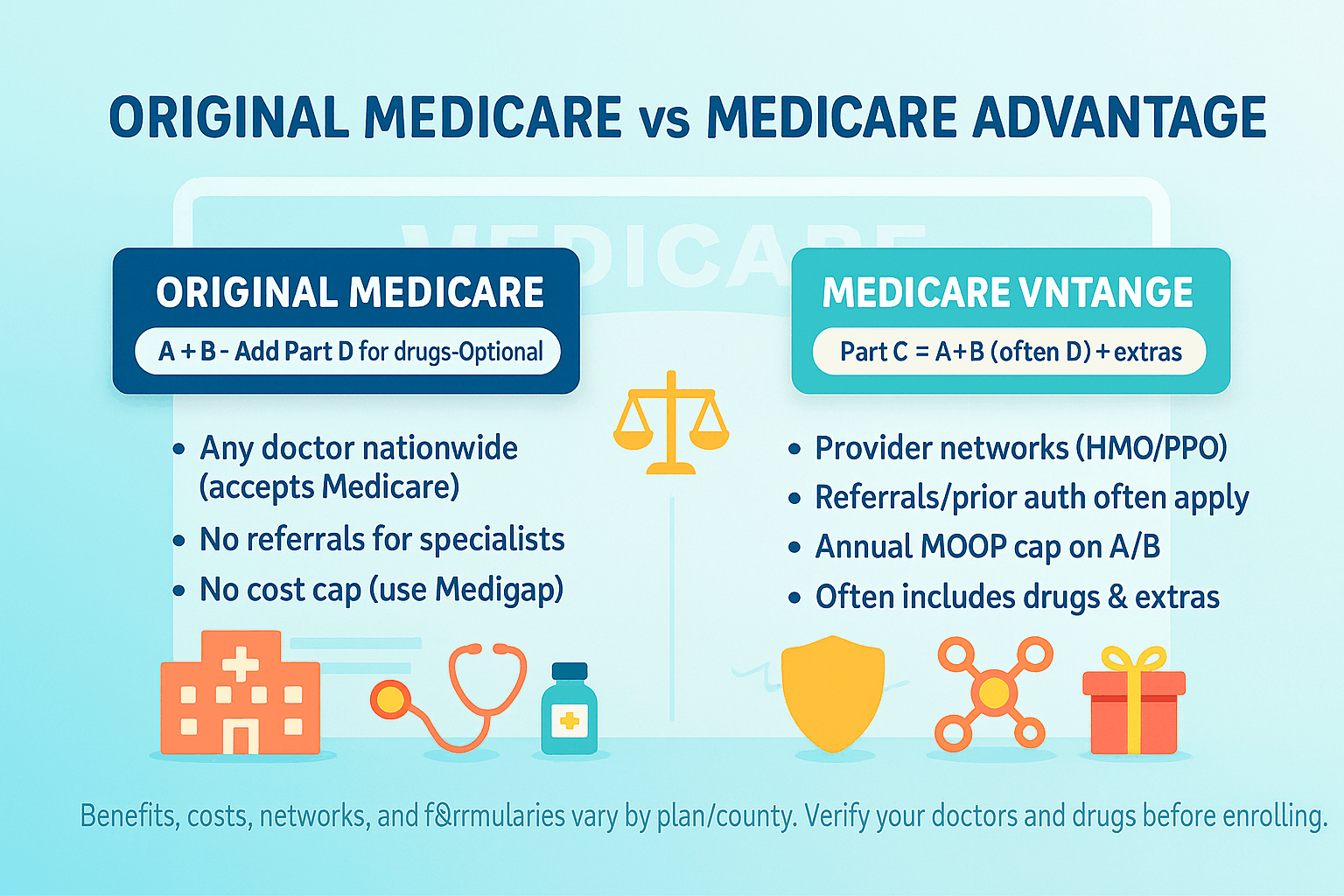

| Part A (Hospital) + Part B (Medical). Add Part D (drug plan) separately if desired. | What it includes | All A & B benefits, and often Part D (MA-PD) in one plan. May include extras (dental, vision, hearing, fitness, OTC). |

| Any doctor/hospital nationwide that accepts Medicare—no networks or referrals. | Provider access | Networks (HMO, HMO-POS, PPO, PFFS). Out-of-network rules vary by plan; HMOs generally require in-network care (except emergencies/urgent care visits). |

| No referrals for specialists; minimal prior authorization (some DME, home health, etc.). | Referrals / prior authorization | Referrals and prior authorization are common for many services; extent varies by plan/type. |

| Not included. Choose a stand-alone PDP if you want outpatient drug coverage. | Drug coverage (Part D) | Often included (MA-PD). If MA plan lacks Part D, you may or may not be allowed to add a stand-alone PDP (varies by MA type—PPO sometimes yes; HMO generally no). |

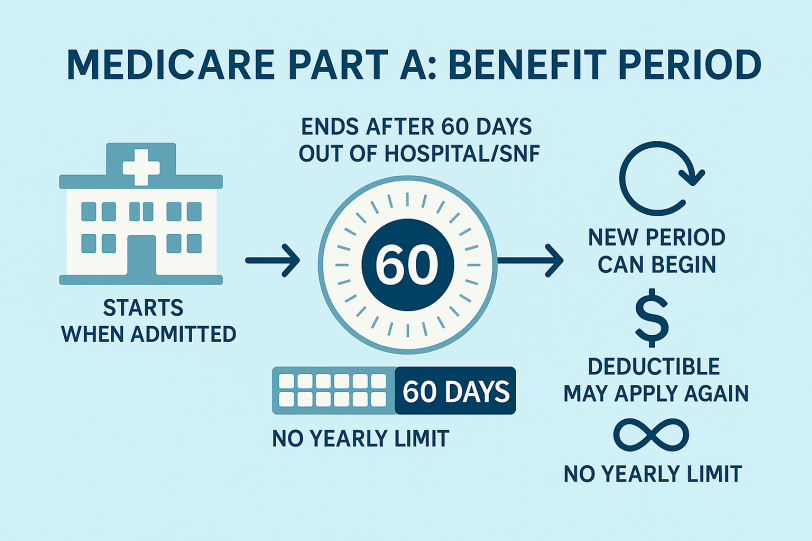

| None (no cap) under OM alone; risk is open-ended unless you add Medigap. | Annual out-of-pocket maximum (MOOP) | Yes. Each MA plan has a MOOP for Part A/B services; once reached, the plan pays 100% for covered A/B care for the rest of the year. |

| Part B premium (and Part A if not free), plus deductibles/20% coinsurance for most B services. With Medigap + PDP, you pay extra premiums but reduce cost variability. | Cost structure | Usually pay Part B premium (some plans reduce Part B via giveback). Plan may have $0–low premiums, set copays/coinsurance, and an annual MOOP; drug copays if MA-PD. |

| National program rules; appeals through Medicare. | Quality oversight | CMS Star Ratings (1–5) influence bonuses and plan quality; plan-level utilization management applies. |

| Generally not included (some employer or Medigap plans may offer limited extras). | Extras (DVH, fitness, OTC, rides, meals) | Often included as supplemental benefits (vary widely by plan and county). |

| Strong for frequent travelers—nationwide access wherever Medicare is accepted. | Travel / snowbirds | Depends on network. PPOs may allow some out-of-network; HMOs typically local/regional. Emergencies/urgent care covered anywhere. Some PPOs better for multi-state living. |

| People who want maximum provider freedom, travel often, or prefer pairing with Medigap for predictable costs. | Best fit (typical) | People who want one card, MOOP protection, predictable copays, and extra benefits, and who are comfortable with networks/prior authorization. |