Free Medicare Consultation

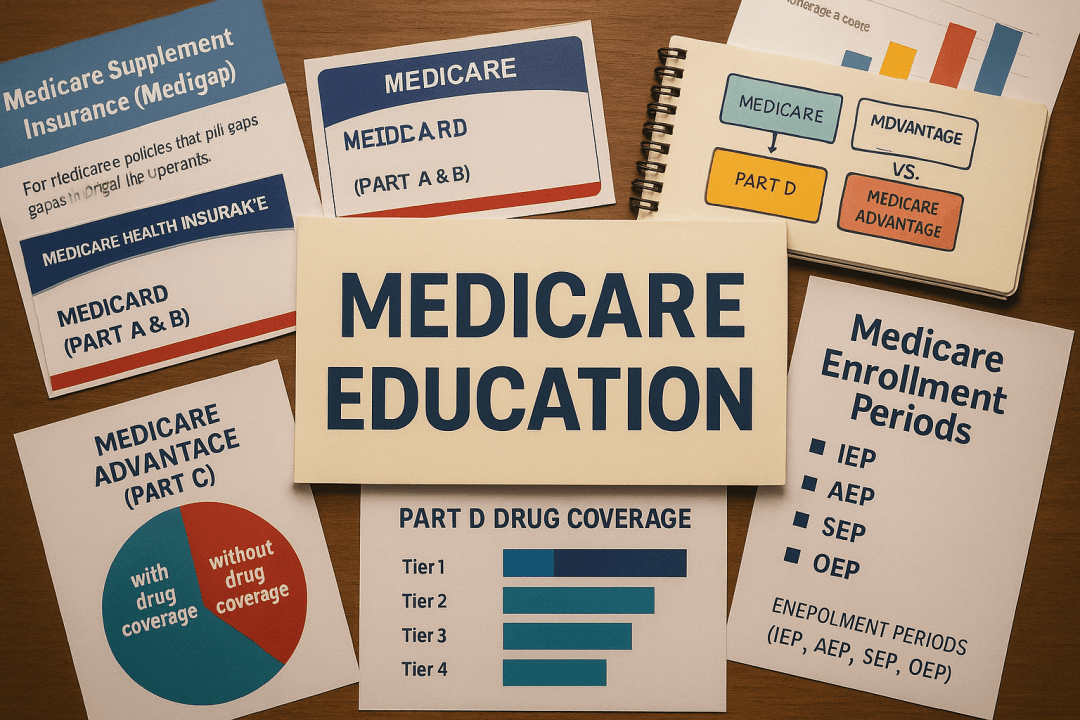

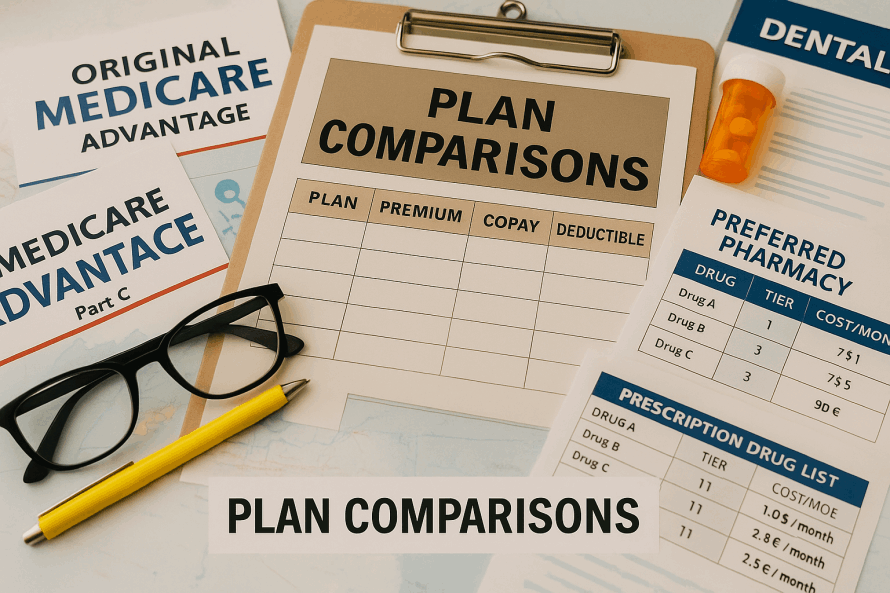

When you request a Free Medicare Consultation, you can expect a one-on-one meeting with a licensed insurance professional who will walk you through your Medicare options in clear, simple terms. During the consultation, we will review your healthcare needs, current coverage (if any), and answer your questions about Medicare Advantage, Medicare Supplement (Medigap), and Prescription Drug Plans. To make the most of your session, please be prepared to share some basic information, including your Medicare card (if already enrolled), a list of your current prescription medications, your preferred doctors or hospitals, and your household ZIP code. Having this information ready allows us to run an accurate plan comparison and ensure you receive the best advice for your situation. Remember, there is no cost and no obligation — just straightforward guidance to help you make an informed Medicare decision.