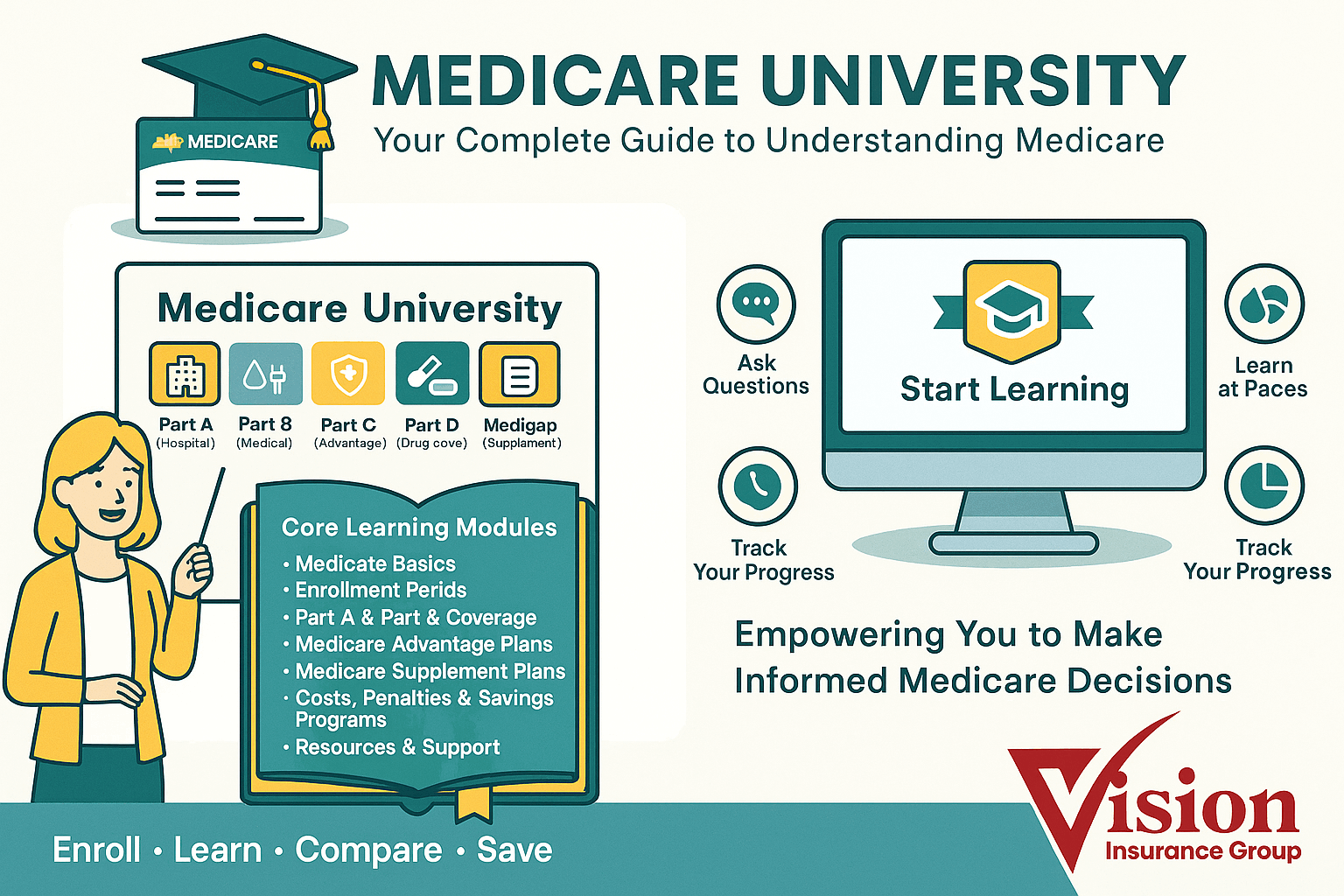

Medicare Enrollment Center

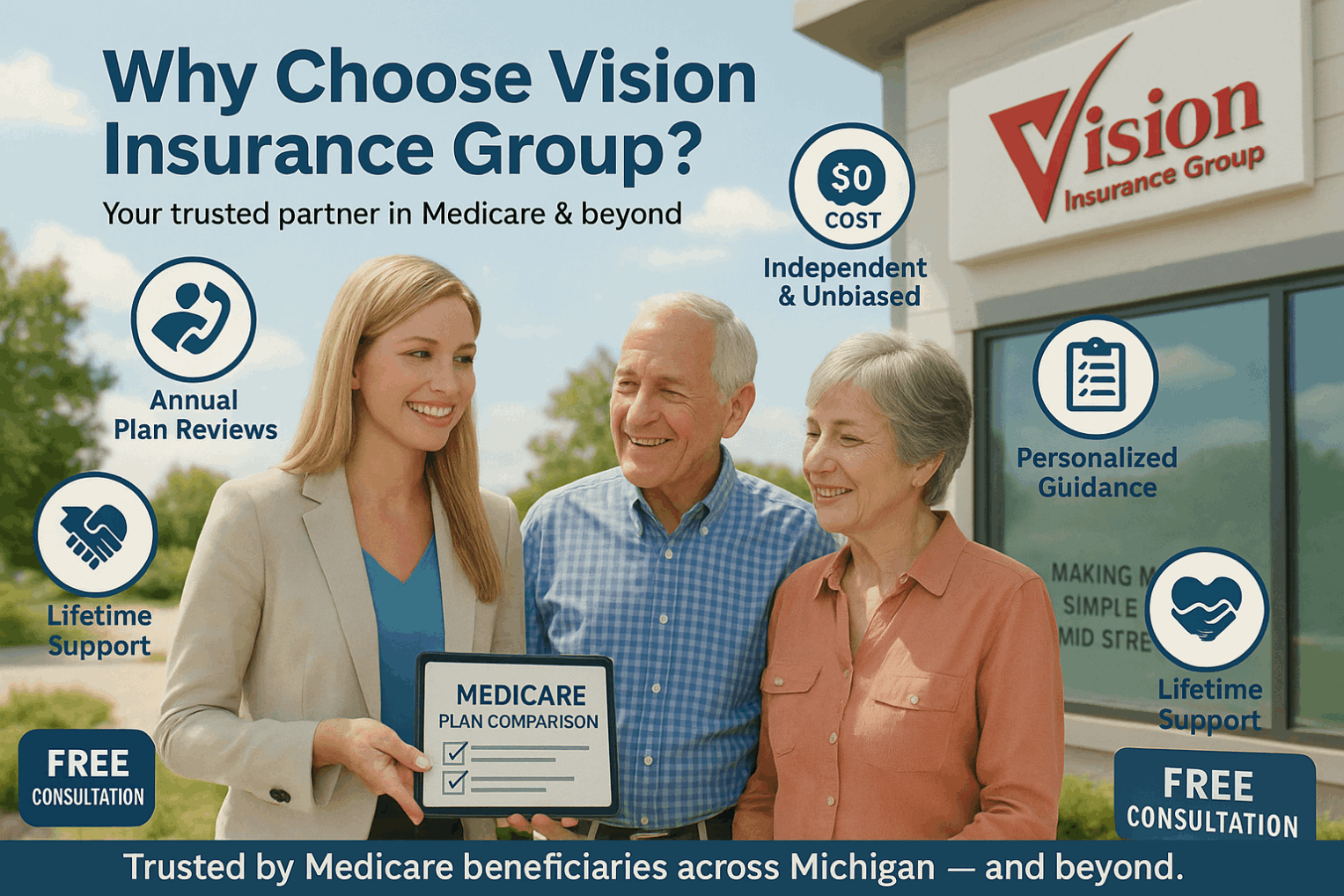

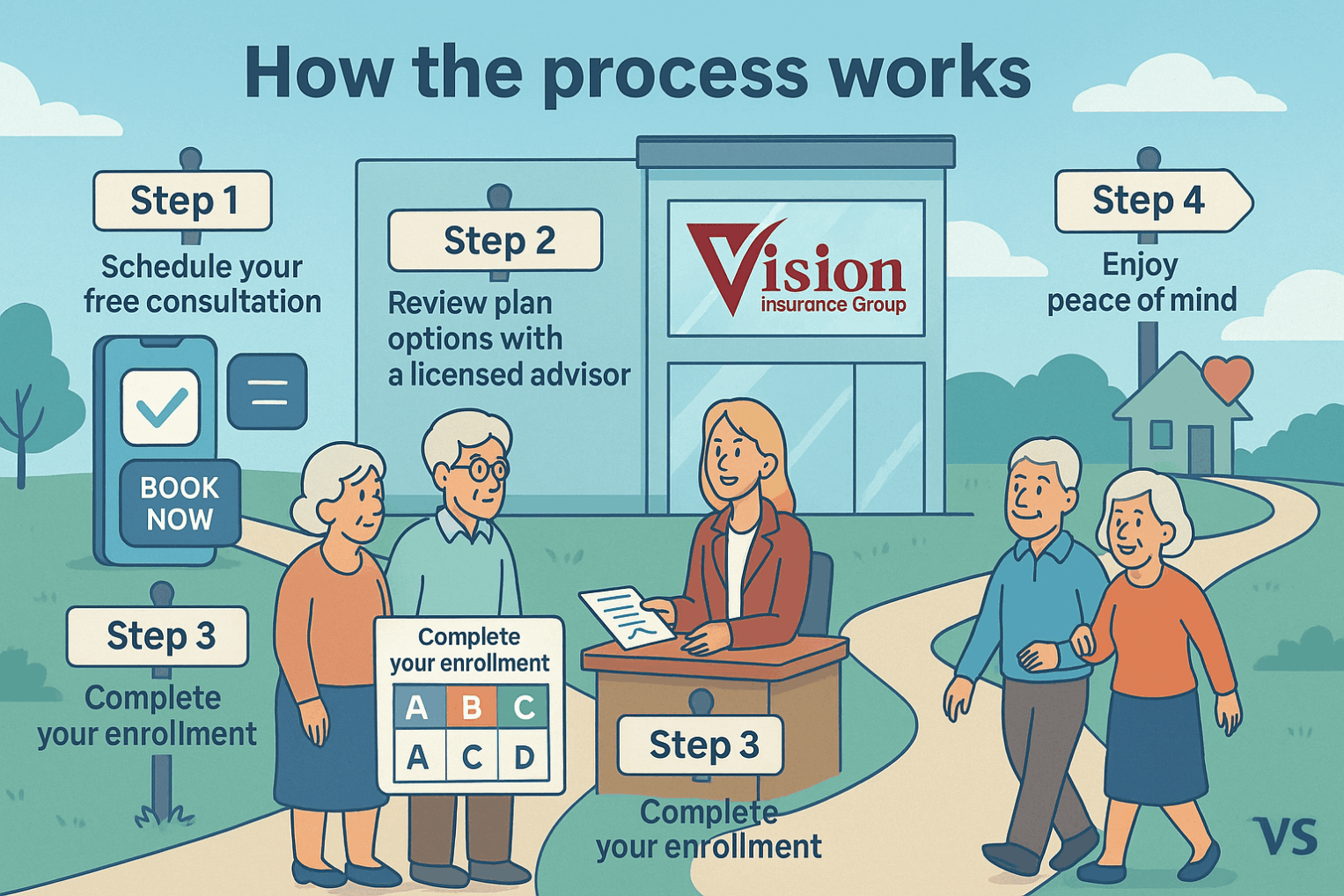

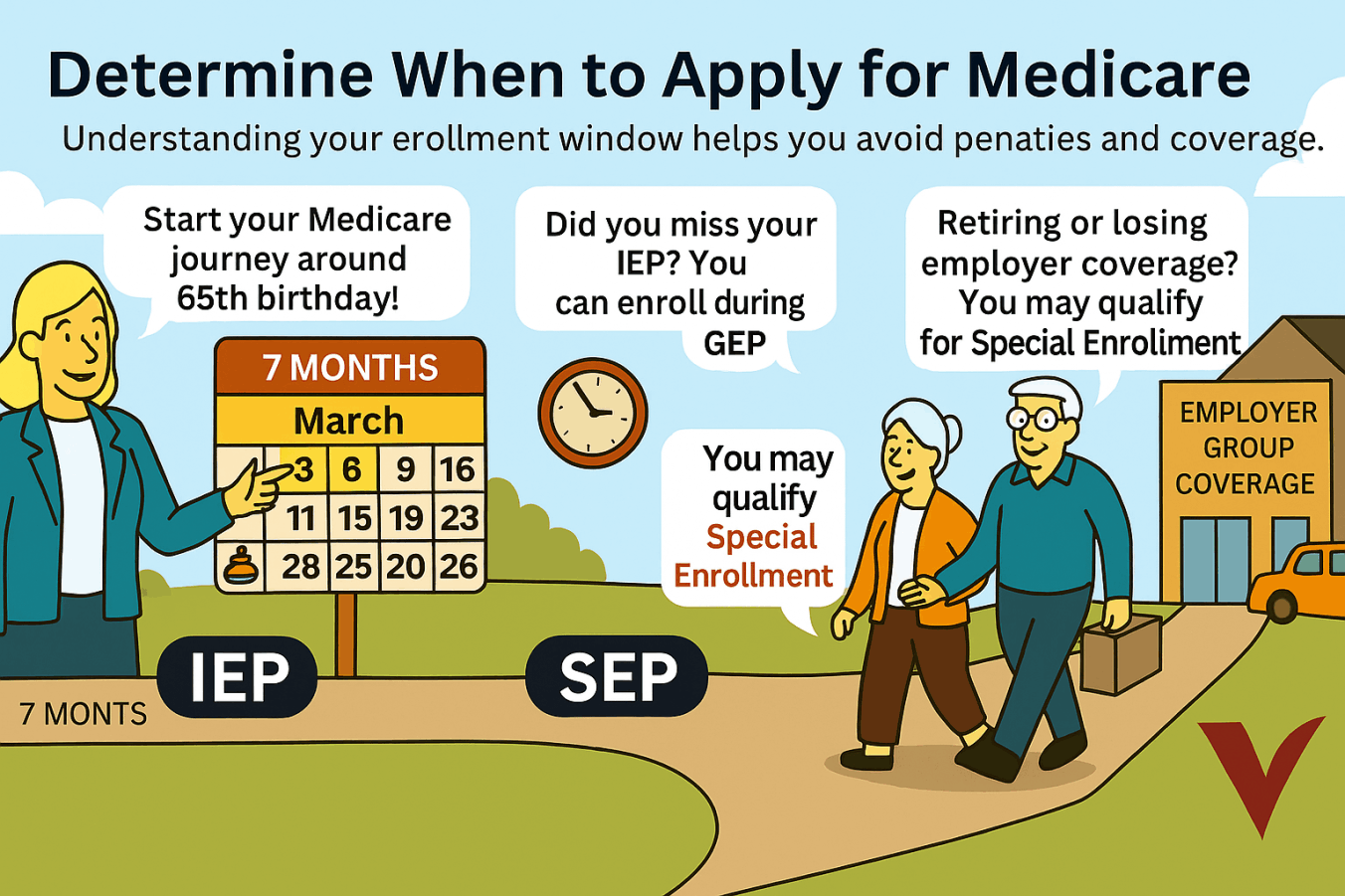

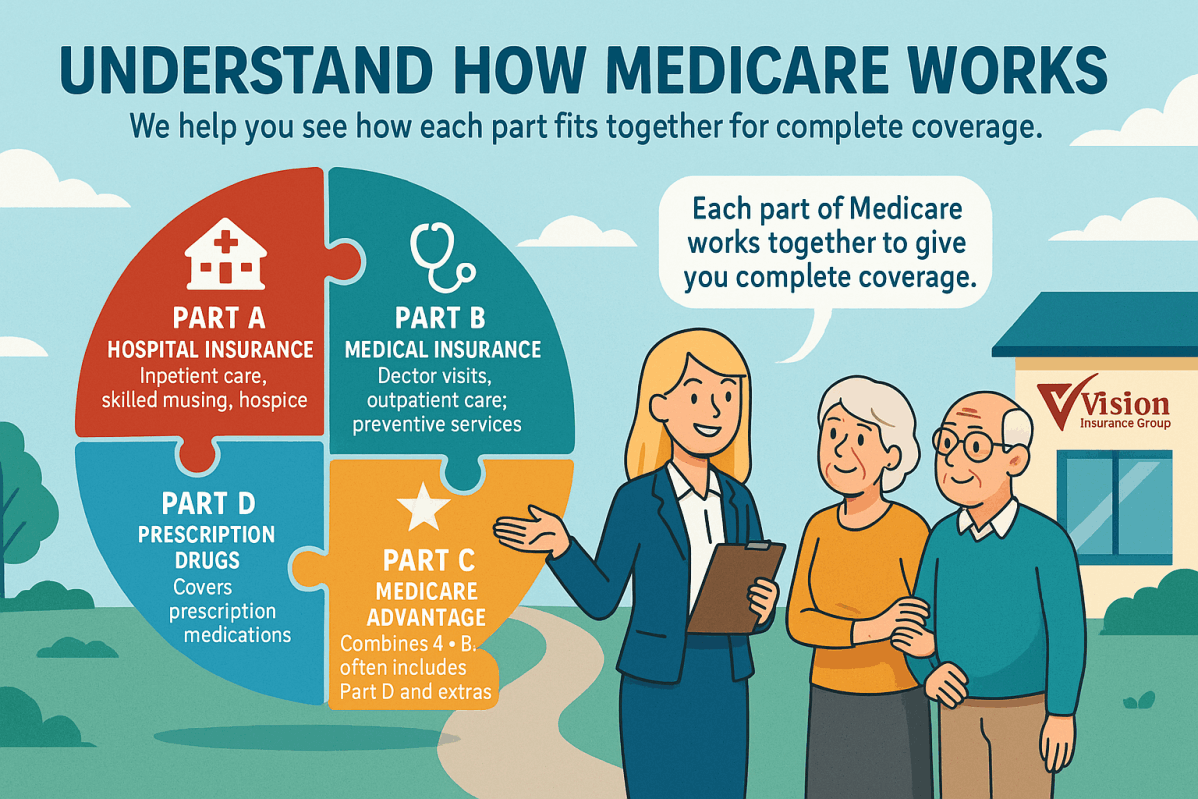

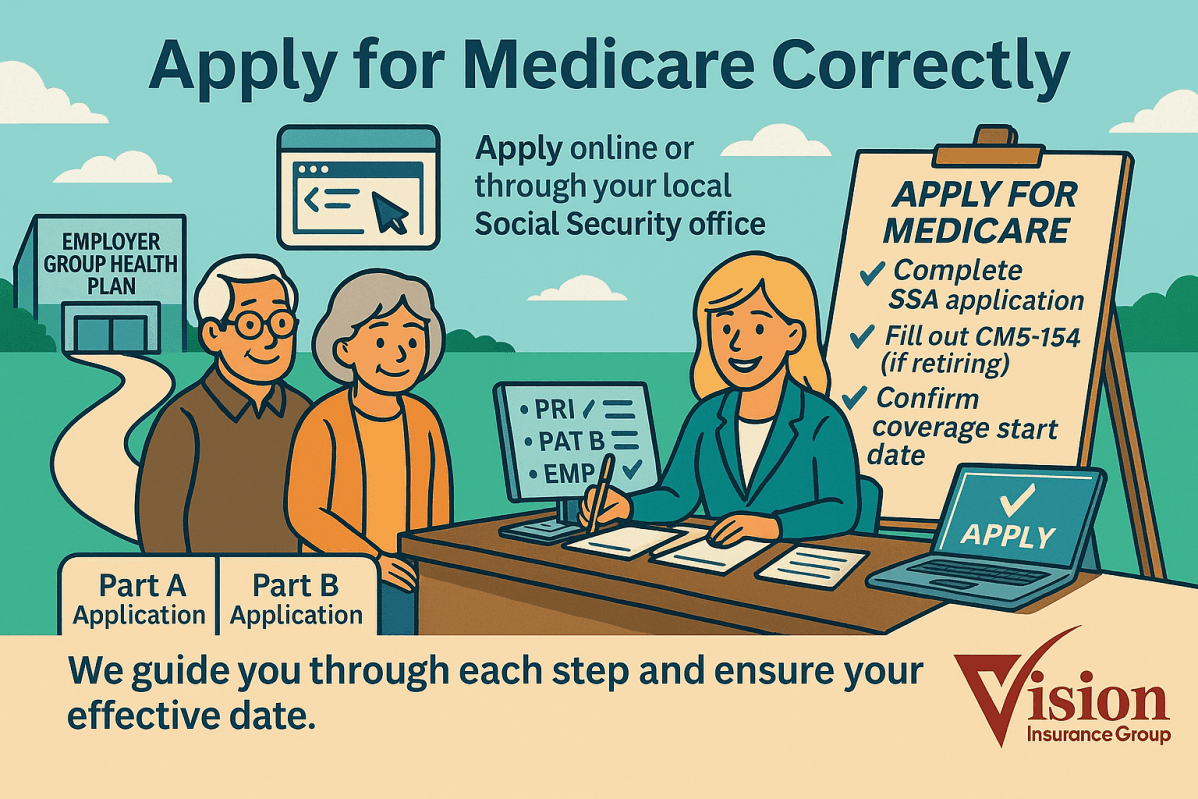

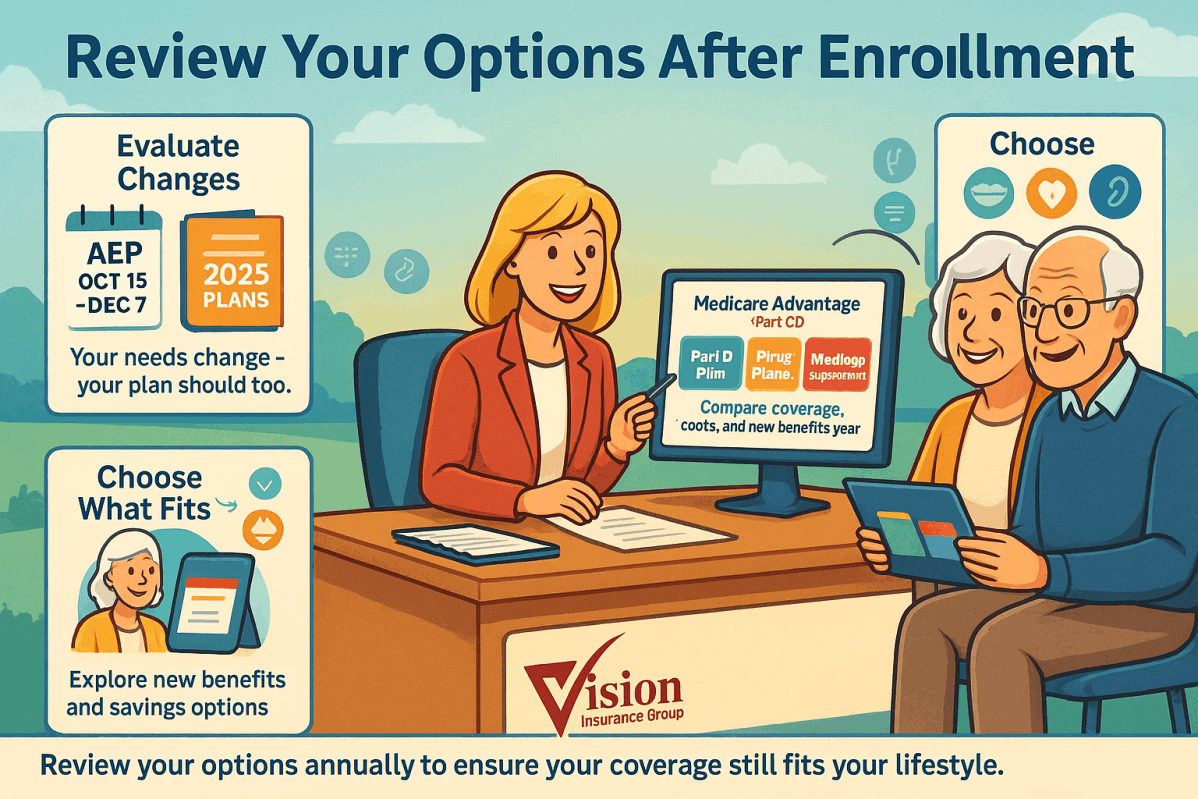

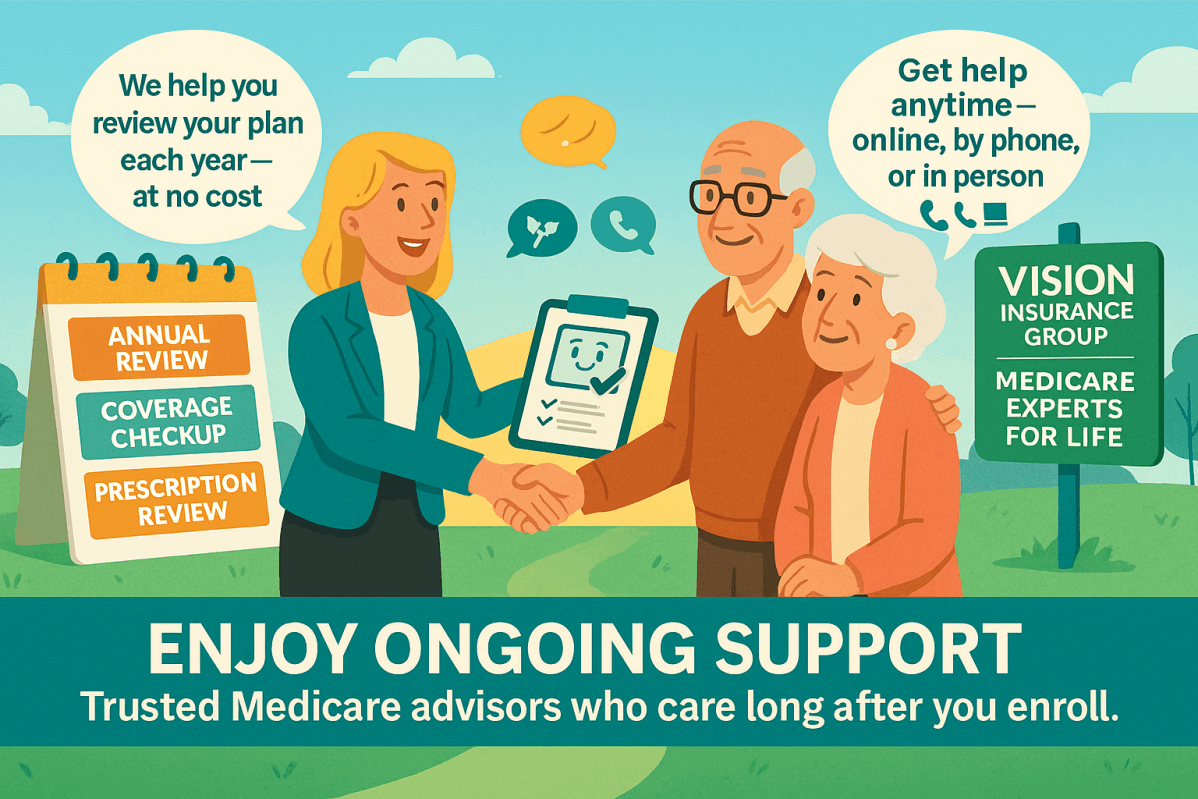

At Vision Insurance Group, we believe Medicare should be simple — not stressful. Our Medicare Enrollment Center was built to help you navigate every step of the process with clarity, confidence, and one-on-one support. Whether you’re applying for Medicare for the first time or reviewing your coverage options, our licensed advisors are here to make it easy — at no cost to you.

From retirement to enrollment — we make Medicare simple, clear, and stress-free.